Slowing US macro and inflation data and a dovish Powell speech led the dollar to its first back-to-back weekly loss since April. Two rate cuts from the Fed by year-end are now fully priced in with the probability for a third on the rise.

Chinese deflation continues to be the main topic in Asia with the yen and yuan having had a bad year so far. A reshuffle of monetary policy is expected from the PboC in the coming months with the focus shifting to the third plenum next week.

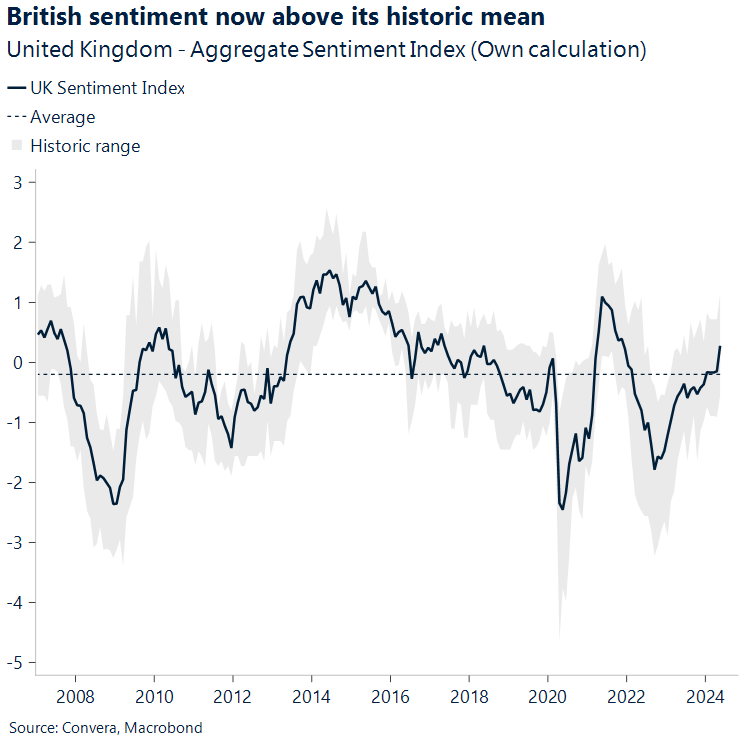

Investors are pricing out political risk in Europe following the French and British elections. The recovery of sentiment seems to have stalled in recent months but should continue in the months ahead.

The UK economy grew at double the expected rate in May, expanding by 0.4% m/m. Such a reading reinforces the idea that the economy is doing well enough that tackling inflation at the last mile becomes trickier, and a BoE cut in August less likely.

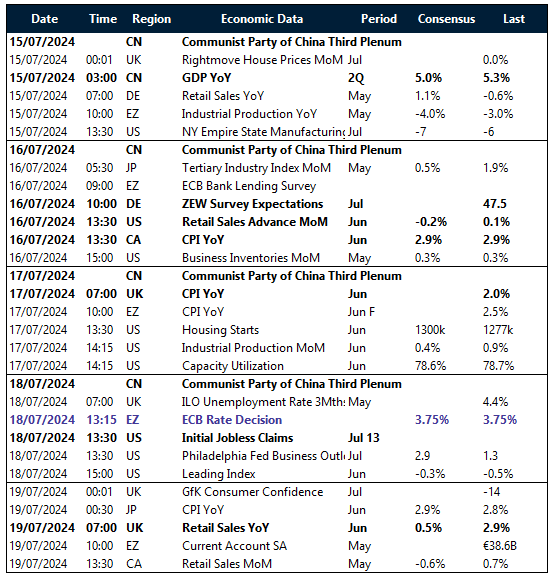

The next batch of economic data will be closely watched against the backdrop of rising bets on a September rate cut by the Fed. Canadian and UK inflation, the ECB’s rate decision and Chinese GDP are up next.

The euro is on track for its third consecutive weekly gain amid growing confidence of a September Federal Reserve cut as EUR/USD tested the $1.09 mark.

Sterling got a shot in the arm after the US inflation report, spiking to the highest level ($1.2955) in a year against the US dollar.

Global Macro

US inflation decline the first since 2020

Nasdaq down on good data? A development that came as a surprise to a lot of investors was the sharp drop of major US equities indices. The Nasdaq shed 2% of its value and recorded its weakest day since mid-April following the CPI release on Thursday. It was the worst reaction to an inflation disappointment since the Fed started hiking rates in early 2022. One plausible explanation would be that markets didn’t discount easier policy from the Fed enough and that inflation has now given the Fed the green light to cut. This has led capital from the overbought tech space into value and small caps, pushing the Russel 2000 to its best week this year so far.

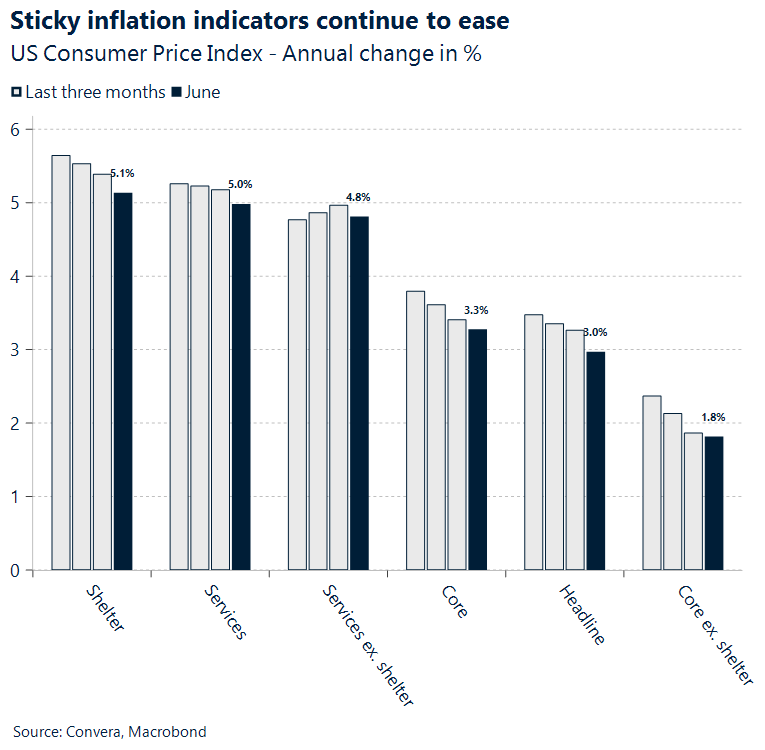

Disinflation continues. The reason for the capital allocation does not matter too much for our macro thesis and the declining US dollar. Inflation declined on a monthly basis for the first time since the pandemic. Sticky indicators like core, shelter and services inflation continued to ease in June as the headline figure fell to 3.0%. There is some room left to go when it comes to the disinflation narrative, which will allow the Fed to cut interest rates in September and December. However, anchoring core inflation to 2% will not be as easy as the market reaction suggests. The risk of inflation settling above target in 2025 remains elevated.

Not as easy as it seems. We have recently proposed two macro theses that are starting to unfold, and which might complicate the picture for the Federal Reserve going into the second half of the year. First, the global inflationary impulse and the goods side of inflation have bottomed and are on the rise again. Second, the US labor market and economic growth are more likely to surprise to the downside. This poses a conundrum for the Fed, that is complicated by the upcoming presidential election in November. Q2 inflation misses and further moderation in job and wage growth might sway policy makers to cut. This might anchor headline inflation above the 2% target.

Regional outlook: United Kingdom

Hawkishness despite inflation on target?

Strong growth. The UK economy grew at double the expected rate in May, expanding by 0.4% on a monthly basis, compared to an estimate of 0.2%. Such a reading reinforces the idea that the economy is doing well enough that tackling inflation at the last mile becomes that much trickier, and a Bank of England (BoE) interest-rate cut in August less likely. The upcoming inflation and wage data will be closely watched in that regard.

Hawkishness prevails. BoE Chief Economist Huw Pill hinted that rates in the UK might not come down from 16-year highs next month, referring to lingering concerns about stubborn price and wage pressures. In particular, the rise in services prices is a sign of uncomfortable strength in underlying inflation. The UK’s annual rate of inflation fell to the BoE’s 2% target in May. However, services inflation came in at 5.7%, easing only a little from the 5.9% rate recorded in April. Pill’s comments suggest he is unlikely to vote for a rate cut at the August meeting.

Slower retail sales, higher pay. Figures from the British Retail Consortium showed retail sales in the UK fell 0.5% on a like-for-like basis in June 2024 from a year ago, reversing from a 0.4% rise in May and missing market expectations for a 0.2% gain as bad weather dampened consumption. A survey of job recruiters also showed companies are boosting pay offers for new jobs at the fastest pace since October, an indication of lingering inflationary pressure that may concern the Bank of England (BoE).

Comments needed. The BoE’s six-week pre-election purdah is now over and upcoming speeches from policymakers will be crucial for market pricing given the recent gap in communication. Inflation is expected to have fallen below the 2% target last month. Will this be enough to push some policy makers over the edge to the dovish side?

Regional outlook: Eurozone

French politics takes the front stage

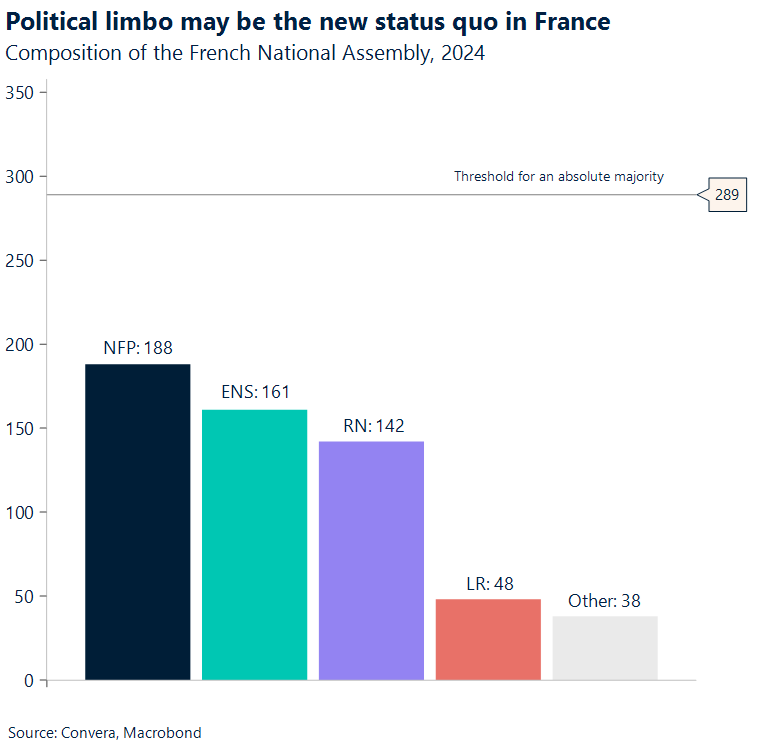

Political deadlock. As expected, the second round of the French snap elections resulted in a hung parliament. More divided than ever, the parliament is currently made up mainly of three blocs (Left – 182 seats, Centre – 168 seats, Extreme Right 143 seats) and several smaller ones, with no bloc able to claim an absolute majority.

Way ahead is very blurry. Outcomes range from a minority left-wing government to a grand coalition of moderate parties, or even a technocratic government, as happened in Italy between 2011 and 2013. The hung Parliament is most likely to result in a status quo, with no large-scale reform expected before new legislative or presidential elections take place.

Political uncertainty to remain. Such a backdrop is not sustainable beyond the short-term, yet there is no end to the current political uncertainty in sight. Consequently, we expect the spreads between the OAT-Bund 10-year bonds to remain structurally elevated, dampening the euro’s potential. Having said that, unless we see more dramatic developments, any further direct impact in the FX spot market is likely to be limited from here on as investors fatigue sets in. We are however likely to see the traces of the French election snafu creep into Eurozone economic indicators in the months to come, particularly in the sentiment indices.

Week ahead

Another interesting week ahead

US disinflation is in full swing and is leading to the first back-to-back weekly loss of the Greenback since the end of April. The next batch of economic data will be closely watched against the backdrop of rising bets on a September rate cut by the Fed. Canadian and UK inflation, the ECBs rate decision and Chinese GDP are up next. On the political front, China’s third plenum could result in some market moving policy decisions that could be announced throughout the week.

Weaker spending ahead. How much is the US consumer still willing to spend? This is the question investors will ask themselves going into the retail sales releases next week. May saw spending increase by just 10 basis points with the inflation adjusted figure falling by 0.2%. The consensus expects retail sales to have fallen by 0.2% in June as leading indicators on consumption continue to weaken. Other noteworthy releases include the industrial production figures and soft data like the NY Empire State-, Philly Fed-, and Leading Indices.

CPI watch. As much as US disinflation is dominating the macro news flow this week, falling price growth has not been prevalent in every part of the world this quarter. Headline CPI most likely stagnated in Canada last month despite falling gasoline prices. The Bank of Canada started cutting interest rates in June in line with the ECB. For the latter, the base effects have made a back-to-back cut in July almost impossible. It’s a different picture in the UK, where consumer inflation is expected to have fallen below the important 2% mark. Optimism over rate cuts could be muted though, given sticky services inflation and wage growth remaining well above the 3% level needed to get inflation back to 2% sustainably.

FX Views

A watershed moment

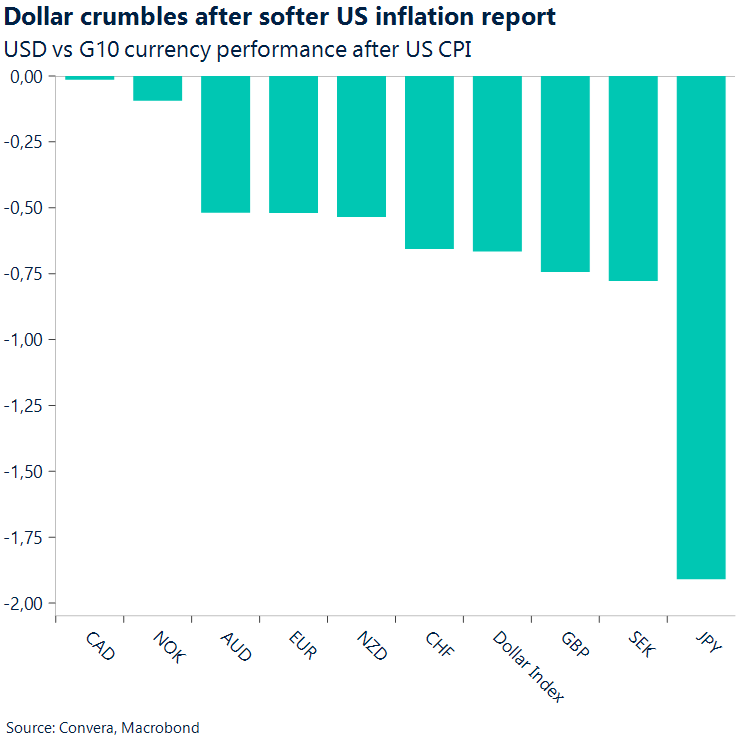

USD Tumbles after soft CPI. Inflation data out of the US represented a watershed moment for markets, especially if that single data point turns into a trend – it was the first print of on-month deflation since May 2020. Two-year US bond yields plunged more than 12 basis points from 4.62% and the US dollar index tumbled to its lowest in five weeks. Earlier in the week, Fed Chair Jerome Powell stated the central bank needed more confidence that inflation was slowing before moving on rates. This print may have given him that. Softer data in recent weeks have further stoked concerns about an abrupt US slowdown as well. Thus, traders are now seeing as much as 60 basis points of rate cuts this year, i.e. definitely two cuts and a slim possibility of a third. The dollar is naturally under pressure with the 104 handle on the DXY a key support level in focus. The standout loss post CPI print was versus the yen, which saw USD/JPY fall up to 2.6% on the day.

EUR Relishes dollar leg driven weakness. The euro is on track for its third consecutive weekly gain amid growing confidence of a September Federal Reserve cut. The broad-based Euro index eked out a mere 0.16% week-on-week gain, weighed down by the outperformance of GBP and JPY. Gains against the US dollar were more pronounced; EUR/USD rallied to a five-week high as rate moves eroded the dollar’s yield advantage over the euro, with DE-US two-year spreads breaking resistance near -170 basis points and hitting their tightest since early March. The pair is now entirely driven by the USD leg, as French political risk has been sidelined while awaiting news on the National Assembly composition (July 18), the first glimpse of the new political equilibrium. Although the attempt to break past the $1.09 barrier was met with fading interest, increased market confidence that the Fed may be growing more comfortable with moving toward rate cuts may soon put $1.10 on the agenda for the euro. The upcoming ECB decision on Thursday is unlikely to be the necessary catalyst.

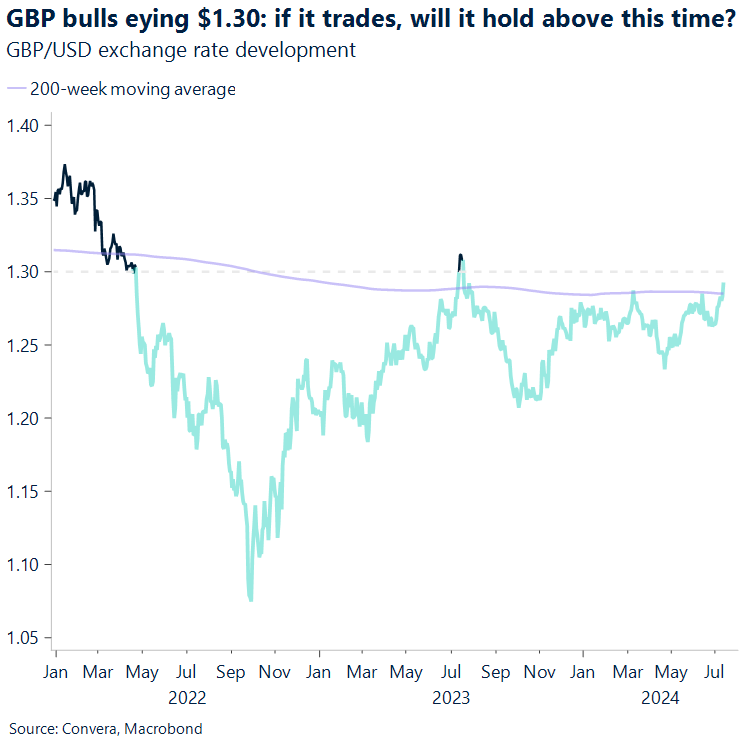

GBP Closing in on $1.30. Sterling got a shot in the arm after the US inflation report, spiking to the highest level ($1.2955) in a year against the US dollar. Hawkish comments from Bank of England (BoE) policymakers set the bullish tone at the start of the week, particularly from Huw Pill. The Chief Economist is seen as a bellwether voter with regards to the internal consensus for the BoE that may define the timing and extent of interest rate cuts. As a result of Pill’s comments, expectations for an August cut were scaled back to around 13 basis points, i.e. almost a coin toss, down from a 65% probability. Thus, GBP/USD broke above its 200-week moving average resistance level, supported by data showing the UK economy grew at double the expected rate in May and permanent wage growth accelerated somewhat last month. All eyes are on the crucial $1.30 handle now, a level sterling has only been above for six days out of the last two years. With bullish short-term cyclical and political dynamics holding, the case for further upside in GBP/USD remains compelling, but the upcoming UK inflation and labour market data will be crucial in shaping the outlook.

CHF Volatility slumps as summer lull takes over. One-month implied volatility in EUR/CHF dropped to its lowest level in a year as French political uncertainty ebbed. EUR/CHF has risen almost 3% in four weeks, just 1.6% away from its 1-year high of 0.993. USD/CHF has fallen about 1.5% in the last two weeks though, driven by broad-based dollar weakness. Looking ahead, fundamentals continue to support the case for more easing by the Swiss National Bank (SNB) given downside risks to inflation from weak demand conditions and bouts of FX strength. June’s inflation print confirmed the recent moderation in price pressures, supporting this outlook. Meanwhile, Q1 intervention data did not reveal much appetite for FX reserves buying during the window of franc strength in January, which casts some doubt on the SNB’s willingness to intervene actively during episodes of excess franc strength. However, it also implies more active use of interest rate policy and deeper rate cuts, which is CHF negative, especially versus pro-cyclical peers and if political uncertainties in France continue to abate.

CNY PBoC refines monetary strategy with liquidity adjustments. The People’s Bank of China has recently introduced changes to its liquidity management approach, announcing reverse repos aimed at enhancing open-market operations and maintaining adequate banking system liquidity. This move potentially signals the establishment of a new interest rate corridor, with the seven-day reverse repo rate serving as a central guide. This adjustment is expected to provide the bank with greater flexibility in managing cash conditions and interest rates, particularly in light of strong bond demand. Chart shows China’s RRR for large FIs influences the CNY/USD rate. Market participants should closely monitor upcoming key economic indicators, including GDP, industrial output, retail sales, and unemployment figures.

JPY Growth forecast adjustment amid inflation target pursuit. The Bank of Japan is reportedly preparing to revise its GDP growth projection for the current fiscal year downward while maintaining its commitment to the 2% inflation target through early 2027. Despite the anticipated growth adjustment, the central bank is expected to largely maintain its GDP outlook for fiscal years 2025 and 2026 at its upcoming meeting. Governor Kazuo Ueda has indicated that interest rate adjustments will be considered once there’s greater confidence in sustained achievement of the 2% inflation target. Elsewhere, the dollar dropped a lot against the yen on Thursday in New York trading. It briefly hit its lowest point in three weeks, around 157.50 yen per dollar. This big move happened after new US CPI data came out. The dollar went from about 161.50 yen to 160 yen very quickly. A Nikkei article suggested that the BoJ conducted a “rate check” for EURJPY on Friday morning, possibly preparing for yen-buying intervention. By signaling its readiness to intervene, even against the euro, the BoJ aims to deter speculative selling of the yen. Market observers should pay attention to the December 2023 channel trend line as a key resistance point, as well as upcoming trade balance and national CPI data releases.

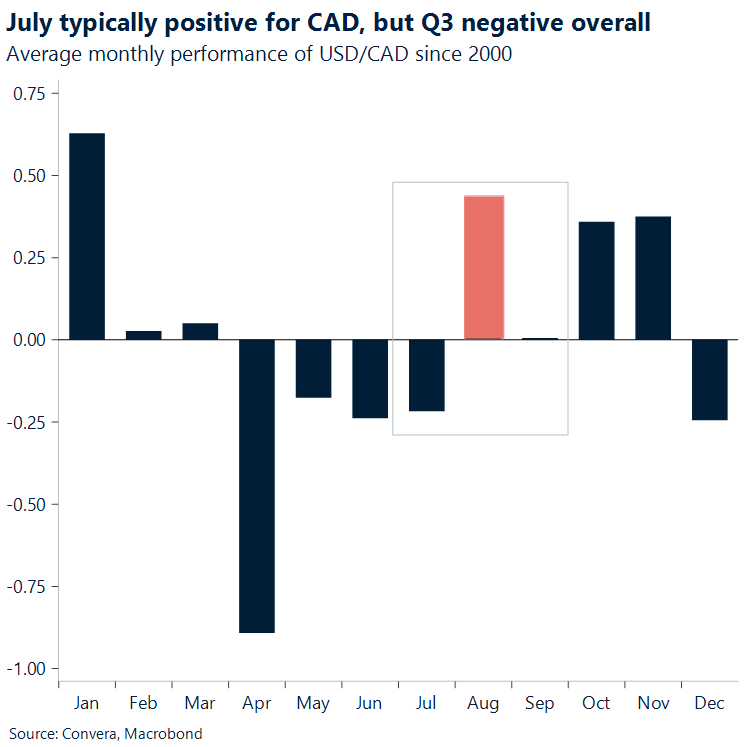

CAD Heading into its own CPI test. The Canadian dollar extended its winning streak to a fifth consecutive gain, marking its best performance in 18 months, due to a weakening US dollar following a softer-than-expected CPI print. CAD briefly breached the C$1.36 barrier for the first time in almost two months before this knee-jerk reaction faded. Despite the week-on-week gain against the US dollar, the Loonie continues to underperform as weak fundamentals and rising BoC rate cut expectations weigh on the currency. Although Canada’s May CPI ticked higher, deteriorating labour market conditions have put the BoC on a timer. The money market implied probability of a July rate cut advanced to 77%, up from 61% at the start of the week. The upcoming Canadian CPI report (July 16) will be crucial in this context. Looking at seasonality trends, historical data suggests that July tends to favour the CAD. Over the past 20 years, the USD/CAD pair has depreciated by an average of 0.56% during July on 13 out of 20 occasions. The trend indicates a recurring pattern that could support the CAD in the near term. However, Q3 typically exhibits an overall strong USD positive trend, particularly due to its outstanding performance in August.

AUD Australia’s business optimism rises as consumer confidence wanes. Recent economic indicators in Australia paint a mixed picture. The business sector experienced a notable uptick in confidence, with a 6-point increase observed across most industries. The construction sector, while still showing improvement, saw a more modest 4-point gain. Overall business conditions enhanced from 6 to 4, as reflected in sales, employment, and profitability metrics. However, there are indications that high inflation is putting pressure on profit margins, with the response rate declining from 3 to 2. In contrast, consumer sentiment took a slight downturn, dropping 1.1% to 82.7 points from June to July. The AUD/USD pair continues to display ambiguous short-term price movement, maintaining its position above a cluster of moving averages. Despite repeated attempts, the pair has struggled to breach the 2024 range highs and the Jan 2023-Dec 2023 trend line. Traders should keep a close eye on upcoming employment data, including the unemployment rate and participation rate.

Theme in focus

European business outlook remains challenging

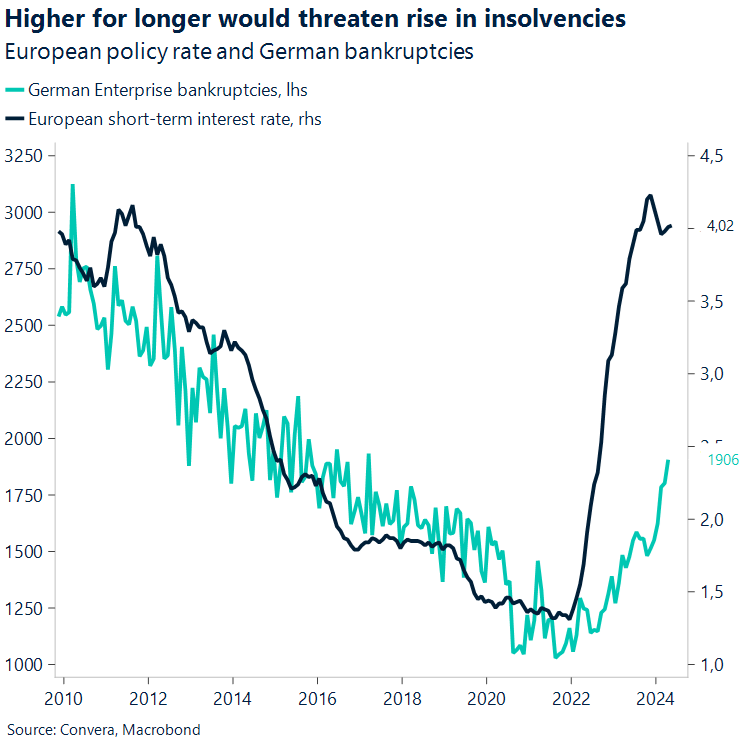

Easier policy ahead. We see it as likely that the structural issues Europe is facing will push the central bank to more aggressive easing over the medium term. Oxford Economics even forecasts a return to the European neutral rate of 1.6% at the beginning of 2026. Both consumers and businesses will be positively affected by this easing of credit conditions. Still, the real economy will have to come to terms with the definite end of the negative interest rate regime that has governed Europe for a decade.

Rates now, other issues later. Despite that, interest rates are not likely to be the most pressing topic for European businesses going into the second half of the 2020s. More than half of companies on the continent still see the lack of qualified workers as their biggest problem, an issue that is more relevant for larger corporates. Regulatory hurdles as it relates to the EU’s bureaucracy, limited access to finance and unfair competition make up the other three top four concerns. These domestic hurdles are paired with global ones such as weak demand from a still recovering China and elevated energy prices and material costs.

Cyclical recovery but construction in doldrums. The overall economic outlook is expected to brighten a bit in the second half of 2024 and first half of 2025. This is due to improving cyclical factors. Global price pressures have receded and are giving way to real wage growth, which should support spending in Europe. Sentiment in the manufacturing and construction sectors is slightly recovering, even though these will be two sectors that will feel the lingering effect of the ECB’s monetary policy the longest. German construction confidence has bottomed but remains near its lowest since 2011. How much relief these industries get depends on inflation and rates going forward.