Written by the Market Insights Team

Tariff fears weigh on peso and loonie

Boris Kovacevic – Global Macro Strategist

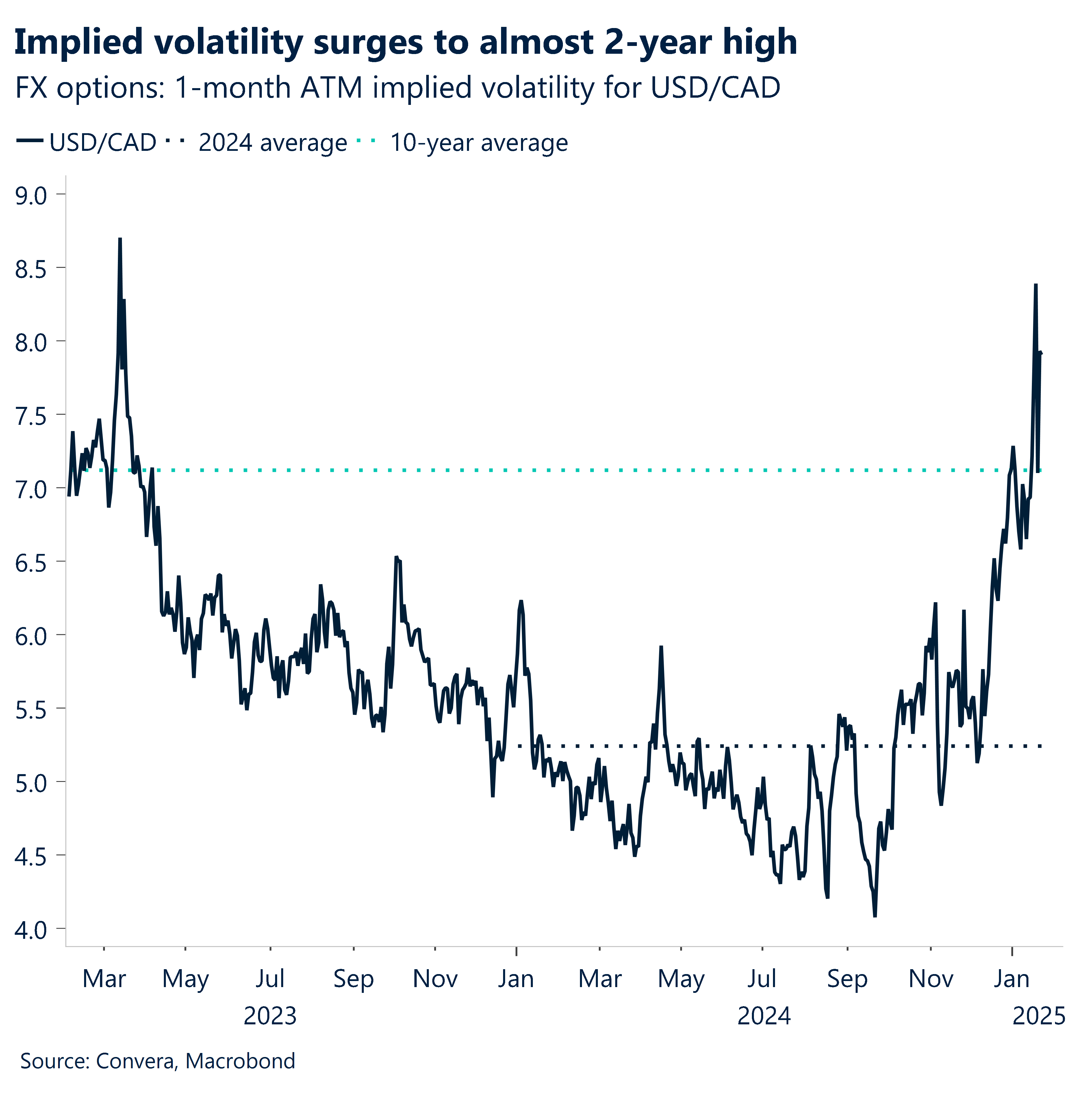

Investors were on edge yesterday as global markets kicked off the week with a mix of both optimism and uncertainty as Donald Trump officially started his second term. Reports ands comments from the president himself that the US is considering steep tariffs on Mexico, Canada, and China have sent ripples through markets, raising questions about how global trade dynamics will shift in the coming months. FX traders quickly reacted with the price of options products which bet on further Canadian dollar weakness rising to the highest in two years.

In Europe, investors found some relief in the fact that no immediate tariffs have been rolled out, but concerns linger about what’s ahead. Meanwhile, in China, officials are trying to reassure markets about economic stability as growth remains fragile. Equity benchmarks across the developed world did manage to push higher despite these uncertainties, with strong corporate earnings helping to offset fears about trade policy. Bond yields on the longer end continue to descend and provided a welcomed relief to the currency market, which has been grappling with a stronger dollar up to last week.

The US Dollar Index is already on track to fall for a second consecutive week, a development that we last saw in September 2024. As we move further into the year, markets are bracing for more volatility. With trade policy, central bank decisions, and geopolitical risks all in play, investors are trying to navigate through the complex macro backdrop where any policy surprise could spark sharp market moves.

Did you read the memo?

Kevin Ford – FX & Macro Strategist

The Trump 2.0 era marks the beginning of another wave of tariffs and protectionism. With February 1st as a new date to see if he follows through or if this is part of his negotiation tactics, we’re reviewing the memo issued on inauguration day. This presidential memorandum, titled “America First Trade Policy,” directs departments to review and report by April 1st, 2025 (note the inconsistency between dates). These reports are expected to be the catalyst for new tariff proposals or adjustments to current tariffs. The timeline allows for the confirmation of Howard Lutnick as Commerce Secretary and Jamieson Greer as US Trade Representative (USTR), which are seen as prerequisites for changes in tariff policy.

Potential announcements regarding tariff changes are expected post-April 1, with tariffs taking effect 30 to 60 days later. Possible tariffs include a universal tariff and specific tariffs on China, Mexico, and Canada. The Commerce Secretary, in consultation with the Treasury Secretary and USTR, will investigate the causes of the US’s trade deficits and recommend remedies, such as a global supplemental tariff.

Preparation for the July 2026 review of the USMCA will begin, assessing the agreement’s performance since July 1, 2020, and determining whether to extend it for another 16 years or make amendments. This joint review, conducted by representatives from the US, Mexico, and Canada, will evaluate the agreement’s effectiveness. The review’s outcome will affect policies on automotive industry rules, labor matters, and trade relations among the three countries, creating a platform for broader initiatives and addressing existing issues.

Meanwhile, still Canadian Prime Minister Trudeau has pledged dollar-for-dollar retaliatory tariffs if Trump imposes a 25% tariff. Even though volatility has spiked over the last few days, the Loonie keeps trading sideways between 1.426 and 1.451.

Animal spirits push the euro beyond $1.04

Boris Kovacevic – Global Macro Strategist

Investor sentiment around the European economy has been overwhelmingly negative, with recession fears, weak growth prospects, and persistent geopolitical risks dominating the narrative. However, much of this pessimism is already reflected in asset prices, creating an environment where the bar for positive surprises is set exceptionally low.

This was highlighted by yesterday’s ZEW investor survey in which zero percent of participants described the Eurozone economy as in a good state. The German sentiment index fell more than expected and remains in depressed territory. This asymmetry in expectations means that any upside surprise in economic data—whether stronger-than-expected growth, resilient consumer spending, or even a slight improvement in business confidence—could trigger a disproportionately strong market reaction this year.

This could have significant implications for the euro in the medium term. For now, however, its rally is being fueled by market sentiment and dollar selling, as investors react to Trump’s decision to hold off on immediate tariff hikes. EUR/USD extended Monday’s gains, pushing beyond the $1.04 mark, with last week’s $1.02 lows already fading from memory. But as the pair climbs higher, selling pressure is likely to build, given that the Eurozone remains vulnerable to potential US tariffs down the line.

Sterling still stuck in downtrend

George Vessey – FX Strategist

The British pound is 2% higher than its recent 1-year low against the US dollar. The recovery from $1.21 stalled before the $1.24 threshold, keeping the downtrend since October intact. Despite capitalising on the broadly weaker USD this week, concerns about UK stagflation (sticky inflation and stagnant economic growth) are an ongoing headwind for the pound.

On Tuesday, data showed that wage growth accelerated to a six-month high in the three months leading up to November, in line with expectations. However, the unemployment rate unexpectedly rose to 4.4%, accompanied by the sharpest drop in payroll numbers since November 2020, indicating potential softening in the labour market. Higher wages caused traders to pare back rate expectations slightly, but the odds of a rate cut at the Bank of England’s (BoE) February meeting are still above 80%. We think sterling is caught between a rock and hard place when it comes to the BoE though. Sterling’s present negative correlation with rates/yields reflects worry about the UK’s economic growth slowdown and the government’s rising debt burdens. Yet, if the BoE sends stronger signals on the need for interest rate cuts, this will also likely weigh on sterling via the yield narrative.

For the pound to recover sustainably against peers, including the euro, UK data needs to improve alongside confidence in fiscal policy. This morning’s data showing the UK government borrowed more than expected in December underlines the challenge facing Chancellor Rachel Reeves.

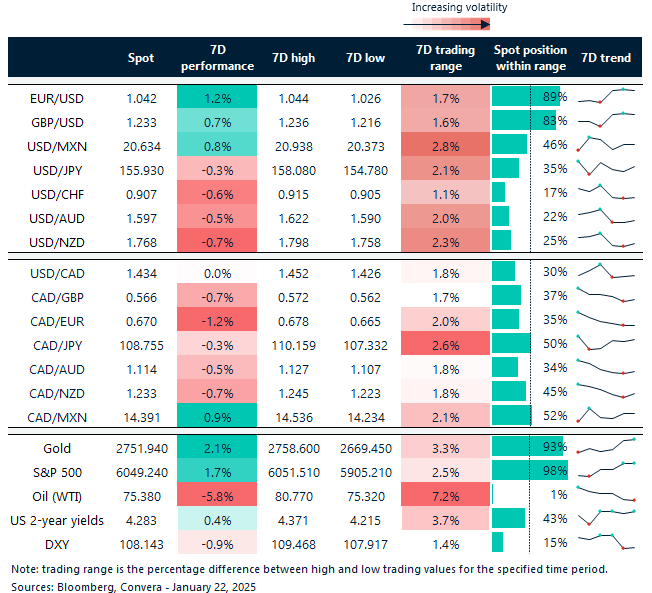

Oil sinks, EUR/USD jumps over 1% in a week

Table: 7-day currency trends and trading ranges

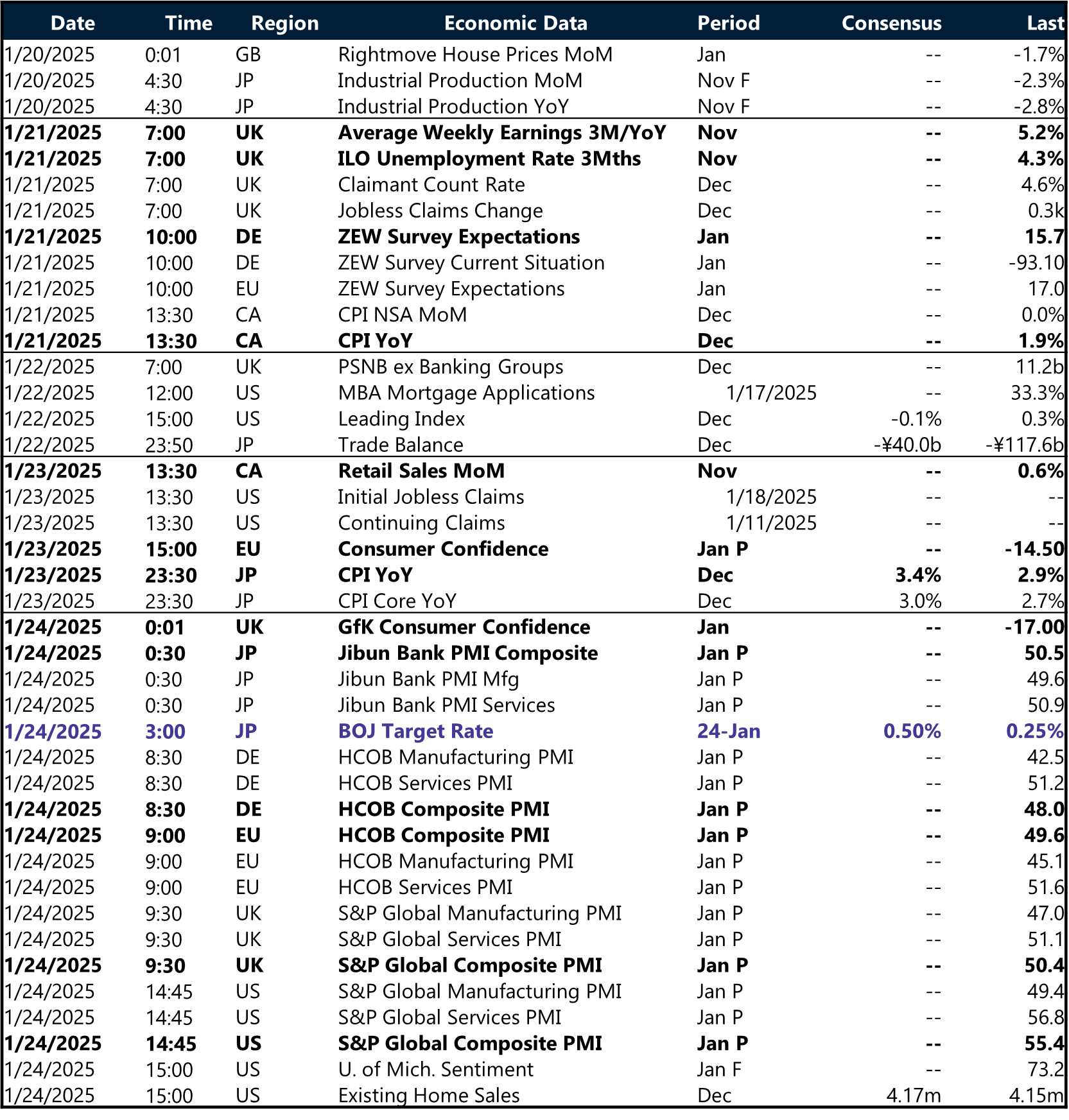

Key global risk events

Calendar: January 20-24

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.