Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD completes five-day winning streak

The US dollar completed a five-day winning streak on Friday to end a perfect week of gains for the dominant US currency.

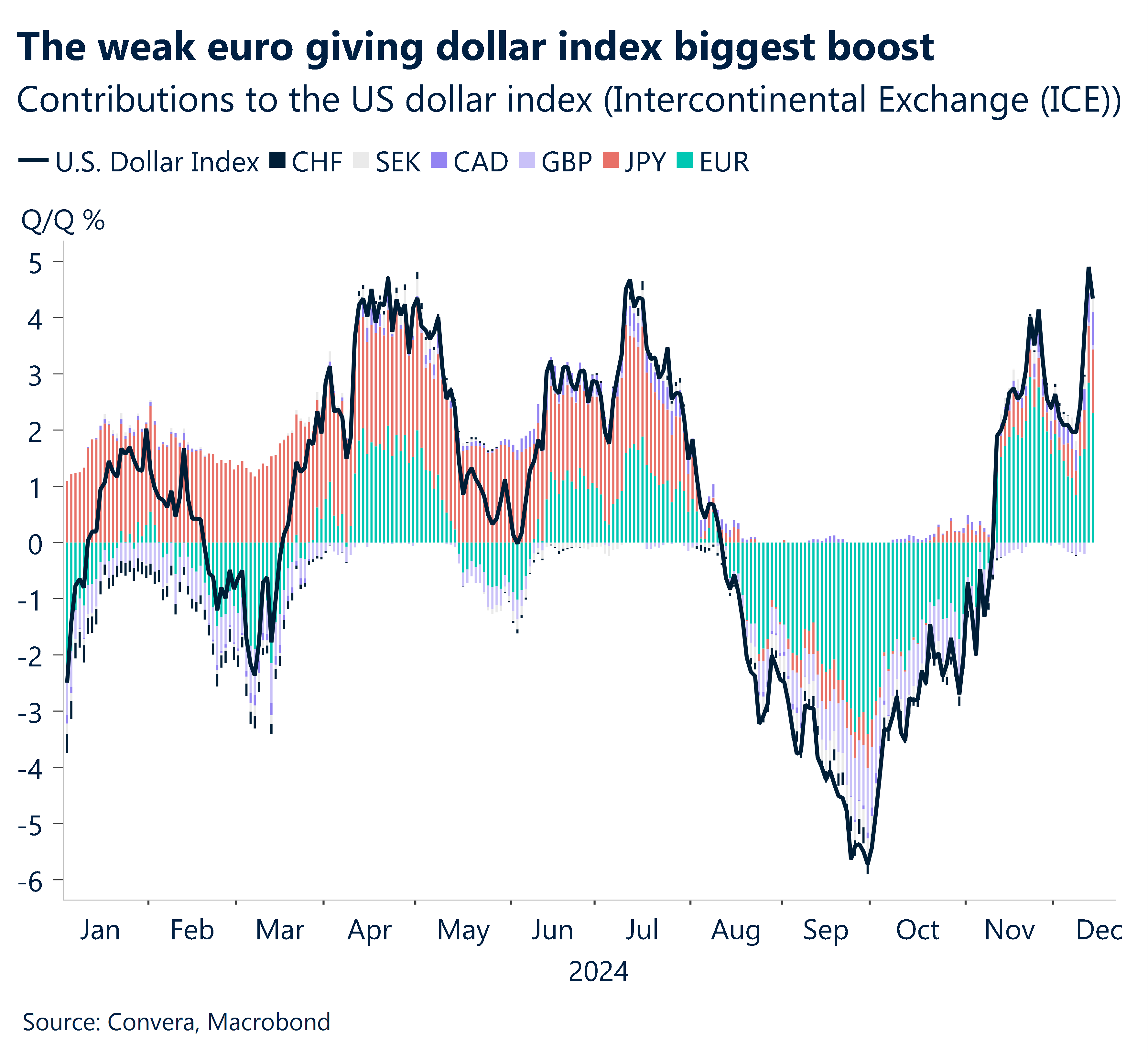

A series of rate cuts from major central banks last week – including the European Central Bank (25bps), the Swiss National Bank (50bps) and Bank of Canada (50bps) – helped the US dollar gain last week.

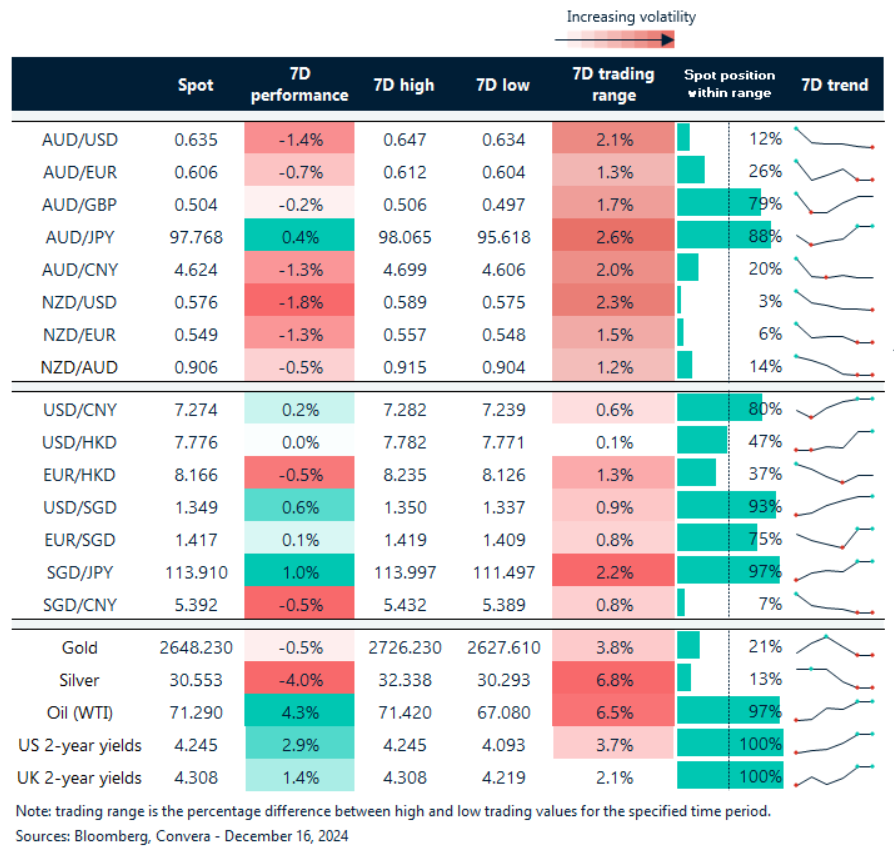

The USD’s strength saw more losses across regional markets with the Aussie and kiwi both pressured.

The AUD/USD closed at the lowest level for the year on Friday with next support seen at 0.6270 and then 0.6170. Any rebound might target 0.6400 and then 0.6455 with more speculative targets to 0.6600.

The NZD/USD closed at the lowest level in two years with topside targets to 0.5795 and then 0.5850 with more speculative targets to 0.6000.

USD/SGD and USD/CNH both returned to recent highs.

Fed cut in focus, but might not cool greenback

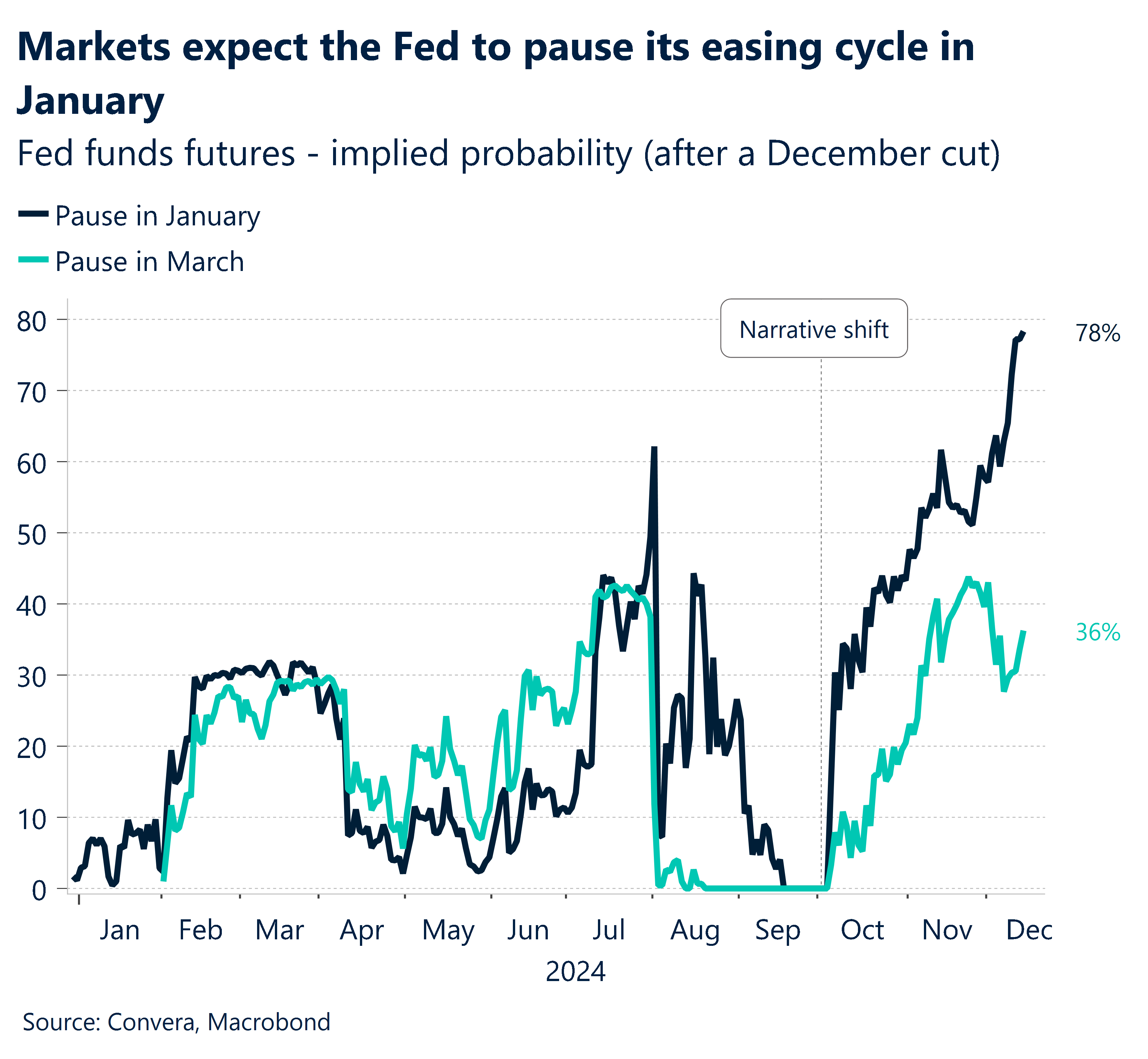

FX markets will focus on several central bank decisions this week with Thursday morning’s Federal Reserve decision the clear highlight.

The Federal Reserve, Bank of Japan (BoJ), and Bank of England (BoE) are scheduled to announce their monetary policy decisions this week. Markets will closely monitor their policy directions to assess any shifts in interest rate expectations.

The Bank of Japan’s decision on Thursday will be especially pivotal for the Japanese yen. With Japan’s CPI data showing a YoY consensus of 2.9% for November (up from 2.3% prior), any signs of policy adjustments could drive volatility in the JPY. The yen recently weakened against the dollar, but the BoJ’s decision could change the trend depending on their stance toward inflation targets and monetary expansion.

Meanwhile, the Federal Reserve’s rate decision on Wednesday evening will be a key driver for the US dollar (USD). Markets are pricing in 25bps cut, but any hawkish commentary could further support the USD after the DXY gained momentum in recent weeks.

The Bank of England’s rate decision on Thursday could also impact the GBP, especially as UK CPI data for November is expected to show a slight uptick in the YoY rate to 2.6% (from 2.3% prior). If inflation surprises on the upside, the BoE may maintain a hawkish tone, lending support to the GBP.

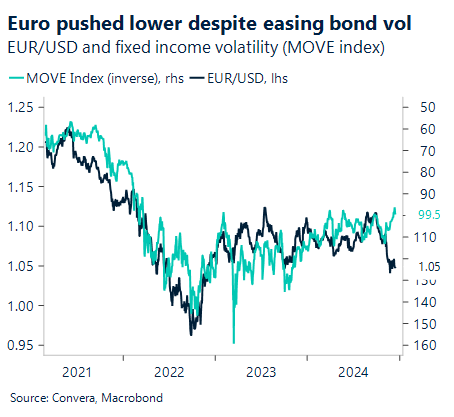

Weak data likely to weigh on EUR

While the euro has fallen versus the US dollar and British pound this month, the EUR has outperformed versus most other G10 currencies, notably stronger versus the Aussie, kiwi and Japanese yen.

In Europe, German and French flash PMIs will be released today. We anticipate another negative flash PMI data in December as the Sentix continues its downward trend.

The euro area composite number is predicted to drop 0.3 points to 48, the lowest level since the beginning of 2024.

We anticipate that decline will be driven by German services on a national and sector level. Regarding manufacturing, we anticipate that the euro area index will print at the lower end of its most recent range of 45 to 46.

On EUR/USD, short-term resistance is at 1.0600 with support at 1.0330.

Across the region, the AUD/EUR has fallen to the lower end of the 0.6000 to 0.6250 trading range, while the NZD/EUR is near the lower part of the 0.5450 and 0.5700 range.

USD at highs ahead of Fed decision this week

Table: seven-day rolling currency trends and trading ranges

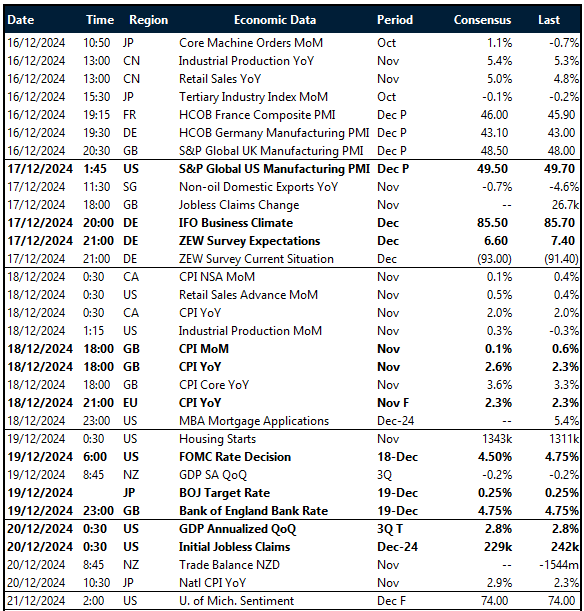

Key global risk events

Calendar: 16 – 21 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.