Written by Convera’s Market Insights team

Strong data, dovish comments

Boris Kovacevic – Global Macro Strategist

The US dollar continues to build on its gains from Monday in early European trading today despite Fed officials keeping the door for a rate cut in December open. Macro data has once again acted as a tailwind for the Greenback as the manufacturing sector contracted less than expected in November. The US 10-year yield stabilized at around 4.2% and helped the S&P 500 reach its 54th record high this year. The index has now closed five days above the important 6,000 points threshold.

The ISM manufacturing PMI increased to 48.4 in November, rising from the lowest level so far this year. New orders finally expanded after having been in contractionary territory for seven consecutive months. The overall picture remains one of weakness as the barometer for the US manufacturing sector has been below 50 since the end of 2022. However, signs are emerging that the tide is starting to turn. The Atlanta Fed GDP Nowcast now estimates economic growth for the quarter at 3.2%.

New York Fed President Williams acknowledged the recent string of better-than-expected data in an interview and doesn’t see a recession on the horizon. However, further gradual rate cuts remain his base case for the coming quarters. Fed Governor Waller added to the dovish sentiment yesterday but stated that policy remains significantly restrictive. These two comments pushed the probability of a cut in December to 75%. The incoming data this week could solidify or put into question such an easing of policy before year end. The release of US job openings is the main risk event for today.

Euro below $1.05 – three risks to watch

Boris Kovacevic – Global Macro Strategist

The likely dissolution of the French government is pushing bond spreads and implied euro volatility to yearly highs. Uncertainty over the French budget and the upcoming election in Germany in February mean that Europe’s two largest economies now don’t have majority governments able to push through legislation. This makes the continent inflexible and the euro unattractive for foreign investors.

European equities have been able to profit from the positive sentiment out of Asia as investors cheered less than expected punitive US curbs on Chinese chips and AI component access. However, the common currency continues to be the collateral damage of diverging growth outlooks and expected tariff increases. EUR/USD has opened the day below the $1.05 mark, signalling minimal appetite to push the currency higher for now.

Three uncertainties are keeping the implied euro volatility high and spot rate below $1.05 for now. 1) Investors are expected a large data patch from the US over the coming days, including the ISM services PMI and non-farm payrolls report. These two have the potential to move Fed easing bets in one or the other direction. 2) Uncertainty about Chinese stimulus. The start of the annual Central Economic Work Conference will take place next Wednesday. The two-day meeting is attended by the high-profile officials and investors are hoping for some clarity on how Beijing wants to guarantee 5% growth next year. 3) Uncertainty about the French government. Prime Minister Michel Barnier and the opposition are currently going back and forth on the social security funding law that could lead to a collapse of the administration and the appointment of a new cabinet. At 85 basis points, the premium the French government pays to finance new debt versus Germany is already the highest since 2012.

Sterling’s downside bias below key moving average

George Vessey – Lead FX Strategist

The British pound is starting what is typically one of its strongest months of the year firmly on the back foot. GBP/USD slumped almost 1% on Monday after a relief rally last week saw the pair climb 2% back towards the $1.28 mark. Now, nearer $1.26 again, it’s testing its 100-week moving average for support.

Fresh tariff threats from US President-elect Donald Trump over the weekend gave the dollar a renewed boost in a further sign that the next few years could be more volatile in the FX space. The impact of Trump’s comments are likely to be anything but linear though, with more erratic price action in the short term potentially smoothing out to a different long-term trend. The only thing that’s certain is heightened uncertainty. It’s not just the US election result and Trump’s tariff threats rocking the pound’s boat though. GBP/USD’s over 5% slide quarter-to-date hasn’t been helped by softening UK economic data either. Citi’s UK economic surprise index has slumped to minus 47 from plus 8 in mid-October.

Observing the technical set up from a wider lens, the overall trend remains to the downside given the exchange rate is below its 200-day moving average, which is located around $1.28. A weekly close above this level will call this trend into question. Although the international backdrop could still evolve in many different ways, the return of a more-bullish pound outlook will require improved UK economic data prints. We didn’t get that this morning though, as retail sales figures from the British Retail Consortium saw a 3.3% y/y drop in November.

JPY top performer as Japan rate hike beckons this month

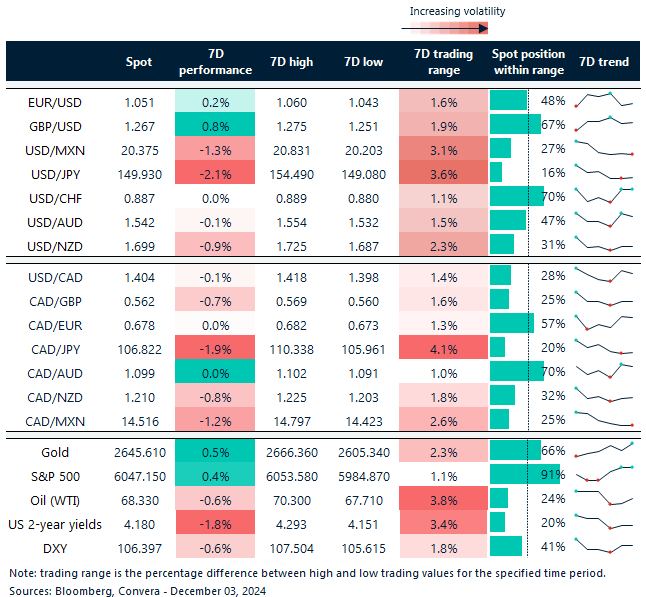

Table: 7-day currency trends and trading ranges

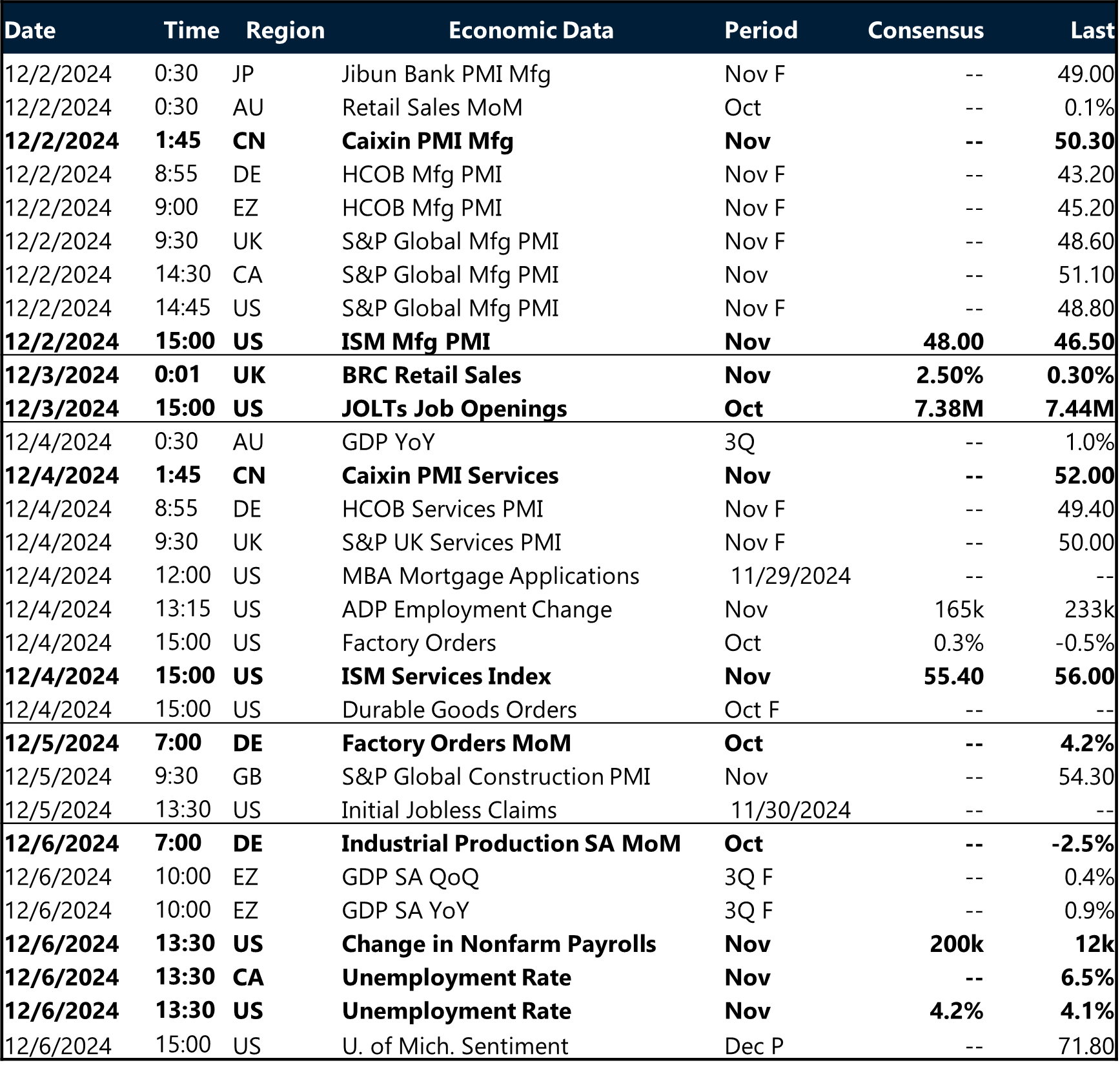

Key global risk events

Calendar: December 2-6

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.