Written by Convera’s Market Insights team

Wild swings a taste of things to come

George Vessey – Lead FX Strategist

It’s already been a rollercoaster of a week in the FX space stemming from international news, namely in the US. First, the market mood was lifted after the nomination of Scott Bessent as Treasury Secretary, leading traders to dial back on their “Trump trades.” Then, the Trump trade reawakened as the president-elect renewed his tariff threat. The overbought US dollar is taking a breather, but its peers are staging some sizable swings.

An additional 10% levy on goods from China and 25% tariffs on all products from Mexico and Canada took markets by surprise – especially for the Canadian dollar, which sank to a fresh 4-year low versus its US counterpart. CAD hedging costs rallied by the most in more than two years and one-month risk-reversal options, a measure of the cost of buying rather than selling a currency and a gauge of market sentiment, are now the most bearish for the Canadian dollar in two years. A tariff of 25% on all imports from Canada could lead to a 19% CAD depreciation versus the USD, according to Barclay’s import substitution model. Perhaps the threat is overblown, but the wild swings in FX markets following Trump’s announcements were a reminder of how much volatility his comments can cause, and how far it can spread.

On the macro front, the US Conference Board’s consumer confidence was pretty much in line with estimates, rising to 111.7, the highest reading since July of last year. The probability of a Federal Reserve rate cut next month remains a coin toss and investors are likely to keep rates rangebound until they get confirmation October’s core PCE deflator signals disinflation progress is ongoing or has stalled. That data is due today.

Yearning the yen

George Vessey – Lead FX Strategist

The Japanese yen is in high demand today despite improved investor sentiment thanks to the cease fire agreement between Israel and Hezbollah. This suggests that FX traders are buying the yen in anticipation of an interest-rate hike from the Bank of Japan (BoJ) next month.

The Japanese currency has strengthened almost 2% versus the US dollar this week and has also gaining near 1% versus EUR, AUD and GBP. Overall this month, then yen is up against 86% of its global peers we’re tracking. The last time the yen was rising on a multi-pronged basis was back in the summer when carry trades were being rapidly unwound.

Rates traders are pricing a higher than 65% probability for a BoJ rate hike in three weeks as investors are await Tokyo’s inflation data later this week, which could offer further clues on the outlook for monetary policy.

Pound’s not so sterling Q4

George Vessey – Lead FX Strategist

Even before the US election, the pound’s bullish path narrowed. GBP/USD has declined over 5% quarter-to-date, a far cry from its average return of a 1% rise in Q4 since 1971. The currency pair has broken below key moving average support levels to trade at or near oversold territory on daily and weekly timeframes. Aside from external pressures, the UK economy is also faltering and its debt dynamics are catching attention again.

Following the poor retail sales and PMI figures last week, a further softening in UK data would likely trigger broad sterling weakness, given that this year’s rally relied mainly on an upturn in the UK economic cycle. This also gave sterling an edge due to its “carry” position as UK interest rates remained elevated compared to elsewhere. Although this is still the case and is expected to be through 2025, the international news flow – geopolitics and the impact of US election result has been adding to sterling’s downside momentum via the strong-US dollar channel.

The new Republican administration is likely to focus on countries that enjoy large trade surpluses with the US and impose large tariffs on imports from the US. As such, the UK is likely to be well down the list of priorities for Trump. Nevertheless, this positive dollar context could persevere into next year, with a break of $1.25 feasible if EUR/USD slides closer to parity.

US stocks near all-time highs

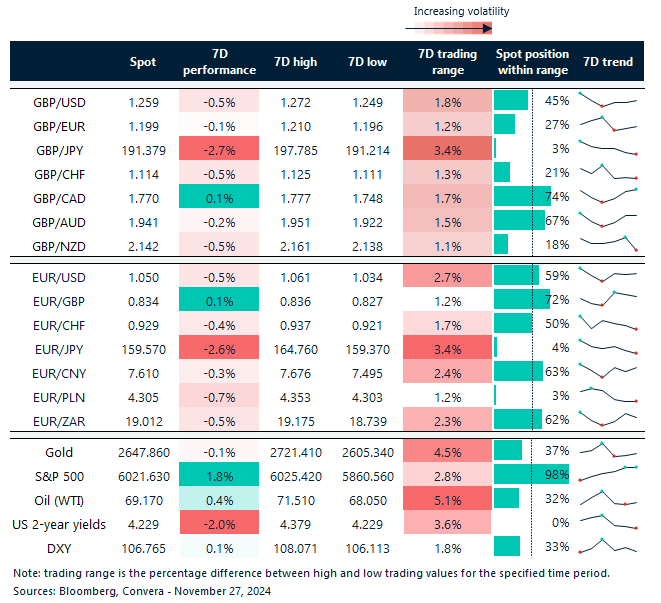

Table: 7-day currency trends and trading ranges

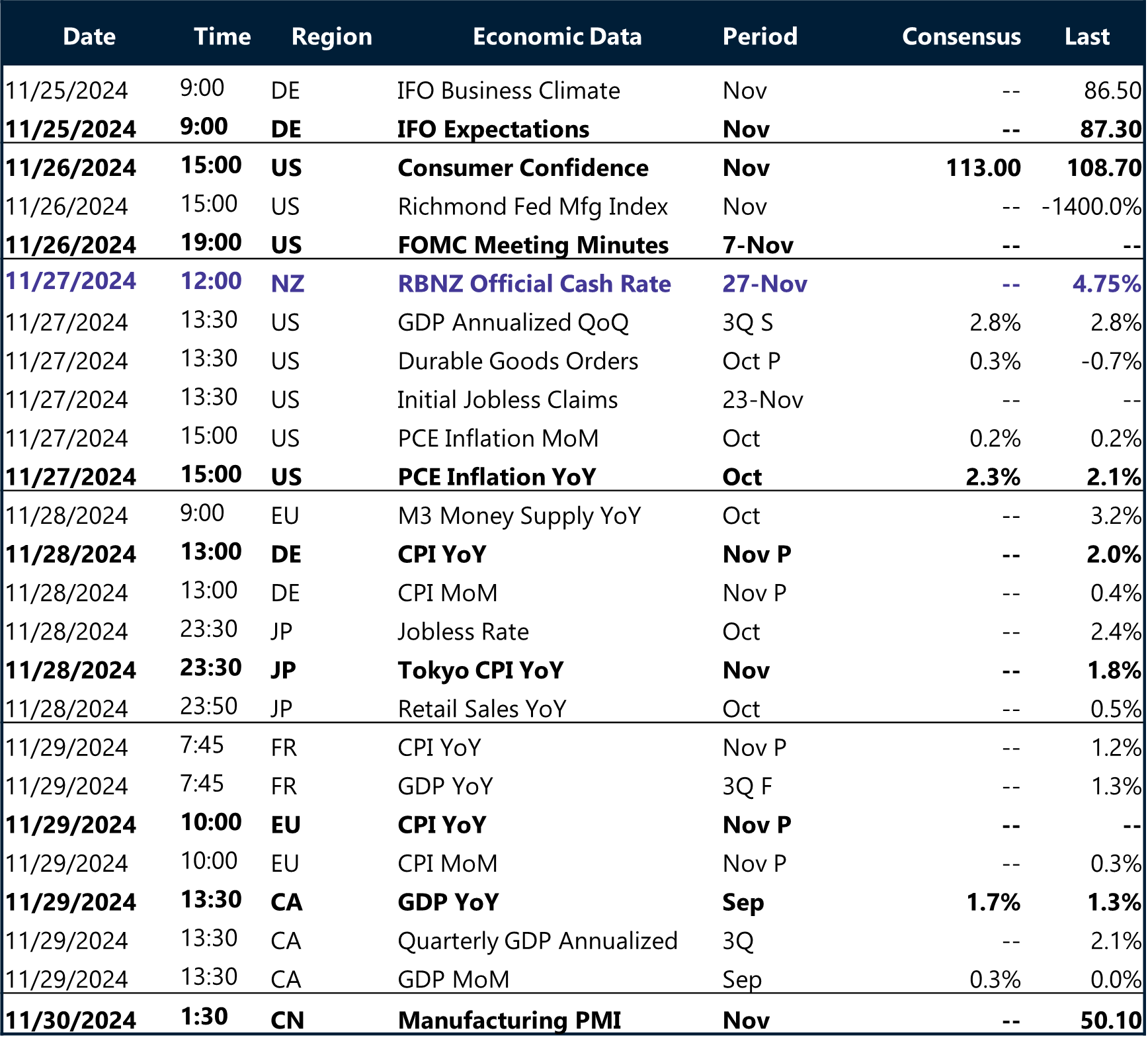

Key global risk events

Calendar: November 25-29

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.