Written by Convera’s Market Insights team

Dollar bounces before Powell speech

Boris Kovacevic – Global Macro Strategist

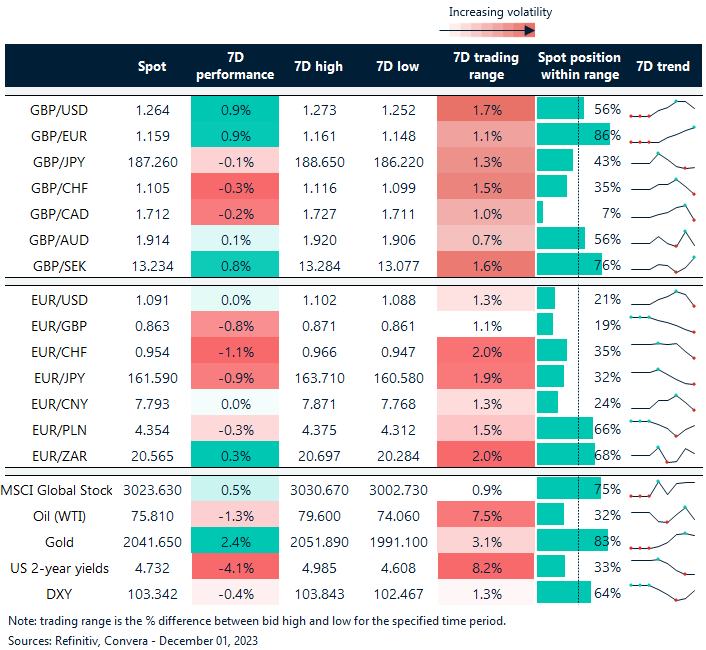

Global equities and government bond yields pared back some of their recent gains amidst what appears to be buyers’ fatigue and profit taking. Especially given that the incoming data continued to support the narrative of a more dovish Federal Reserve (Fed) going forward. The US 10-year yield recorded its first daily rise this week. This supported the Greenback, with the dollar pushing into slightly positive territory on the week. However, yesterday’s slight pullback in stocks and rebound in the dollar and yields did not dent the overall trend of the month with the S&P 500 recording one of its best Novembers on record (+8.9%).

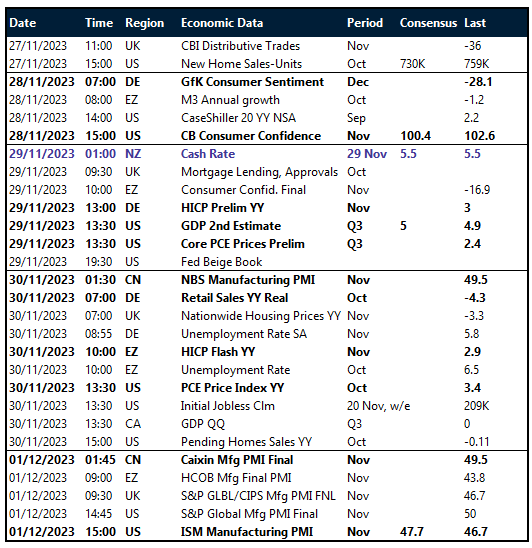

The US economy slowed in recent weeks with inflation cooling and signs emerging that the labour market tightness is easing. Real (inflation adjusted) consumer spending and core inflation both grew by 0.2% in October, less than in the previous month. This comes as good news for the Fed, which has recently paused its tightening cycle. The Fed’s Beige Book (Summary of Commentary on Current Economic Conditions) showed some economic weakness amidst a consumer pullback with the Oxford Economics Beige Book Index falling below zero for the first time since 2020. Markets are convinced that the Fed will start cutting interest rates early next year as the fall of inflation to its lowest since March 2021 (3%) would be enough reason for easing policy. Option traders currently price in five rate cuts for the entirety of 2024.

The first day of December and the end of this week will conclude with the release of the ISM purchasing manager index for the manufacturing sector and Fed Chair Jerome Powell concluding this week’s plethora of central bank speak. Markets seem warry about Powell not confirming the pre-existing dovish bias that had been notable in the speeches of other Fed officials this week. There are still some data releases left before the next FOMC meeting with next Friday’s jobs report being the most important one.

2nd best G10 currency this week

George Vessey – Lead FX Strategist

As expected, given overbought conditions, the British pound retreated to the $1.26 mark against the US dollar, stepping back from its recent three-month high above $1.27 this week following a decline in the US dollar on rising Fed rate cut bets. Despite this pullback, sterling posted a 4% monthly gain in November, its best performance in a year.

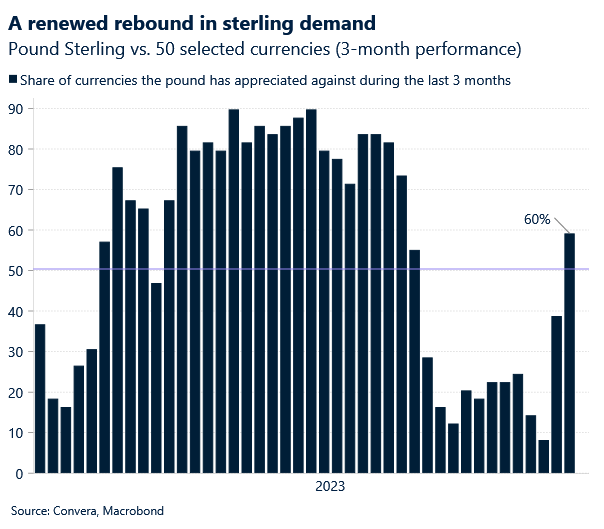

Growing expectations that the Bank of England (BoE) would implement its first rate cut by June, contrasts with the Fed’s anticipated timeline of May. Simultaneously, BoE policymakers have maintained a hawkish stance this week, stating monetary policy might require a “restrictive” approach for an extended period to guide inflation back to the central bank’s targeted 2%. The UK’s 10-year Gilt yield rebounded to the 4.2% mark, rising from a recent six-month low just above 4%, supporting a modest uplift in many UK-G10 yield differentials and therefore the pound. Only two weeks ago the pound was trading higher on a 3-month basis against just 8% of 50 global currencies we’re tracking, but this week, that share has increased to 60% in a sign of renewed demand for the higher yielding pound and hopes the UK might avert a recession next year. Further demonstrating this optimism about the overall economy was Lloyds Business Barometer yesterday showing business confidence in November increased for a second straight month by 3 points to 42% – a 21-month high.

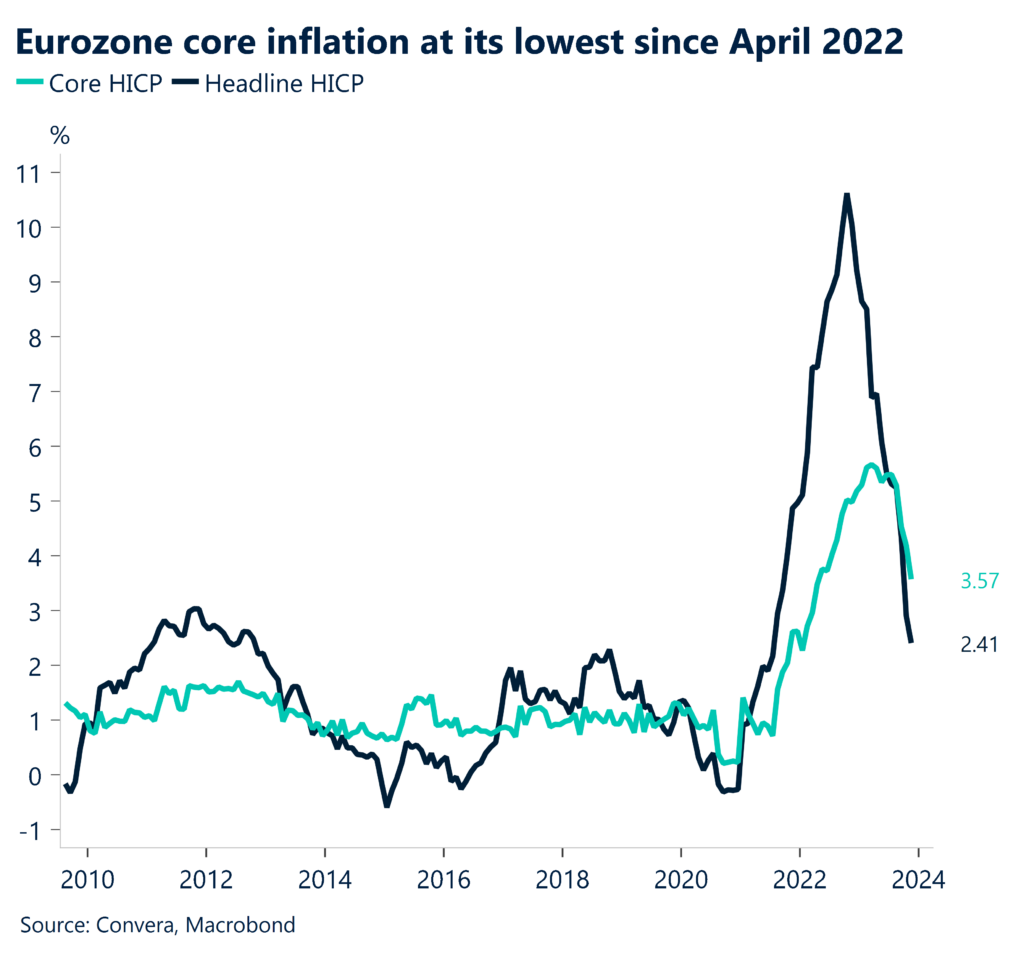

Over the past five days, the pound has been the second best performing G10 currency, reaching its highest level in over a month against the euro above €1.16. The rise in 2-year UK-German yield spreads after cooling Eurozone inflation helped support the uplift and we see room for further upside given the pair has broken out of its descending trend channel and is above all of its key long-term daily and weekly moving averages.

Dovish ECB repricing hurts euro

Ruta Prieskienyte – FX Strategist

The euro stumbled on the last trading day of the month, falling close to 0.8% on the day in what was the 10th largest daily depreciation of the year. As Eurozone inflation continued to fall sharply, EUR/USD slipped below $1.09, and EUR/GBP touched mid-October lows amid heightened European Central Bank (ECB) rate cut expectations.

Flash HICP data showed a more substantial-than-expected deceleration in inflation across the Eurozone, including Germany, Italy, and Spain. The headline rate declined to 2.4% y/y in November, reaching its lowest level since July 2021, and the core rate, which excludes volatile food and energy prices, cooled to 3.6% y/y, marking its lowest point since April 2022. The decline was seen across the board, most notably in energy and food inflation. Goods and services inflation also both fell significantly, to 2.9% and 4% y/y, respectively. In fact, on a monthly basis, core inflation was negative – the largest monthly decline since January 2020. What does this mean for interest rates going forward? In the immediate term, the ECB is almost certainly going to hold the deposit facility rates at 4% in the rate decision meeting in two weeks’ time while it awaits for new staff projections to communicate the trajectory of policy rates from then onwards. Having said that, evidence is mounting that the inflation fight is nearing an end, thus making it rather hard to convincingly hold onto the hawkish narrative. But the wind is turning. ECB’s Panetta has highlighted growing “material downside risks” to economic growth.

On the back of yesterday’s preliminary inflation print, markets increased their ECB policy easing wagers, pricing in a further 3bps cuts for March from yesterday (currently at 13bps) and betting on cumulative 110bps cuts for the whole of 2024 (up from 100bps yesterday). Despite the dovish repricing, EUR/USD closed out the month up by 2.9%, which was the biggest monthly gain since November 2022.

Swissy leads G10 FX this week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: November 27-December 1

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.