Pound edges up after inflation

After the strong UK wage growth figures yesterday, peak rate expectations for the Bank of England (BoE) base rate were hoisted back to 6% by March next year. The market fully priced a quarter-point increase next month and the pound extended gains after the data release. Then came UK inflation this morning, and it was a mixed set of results.

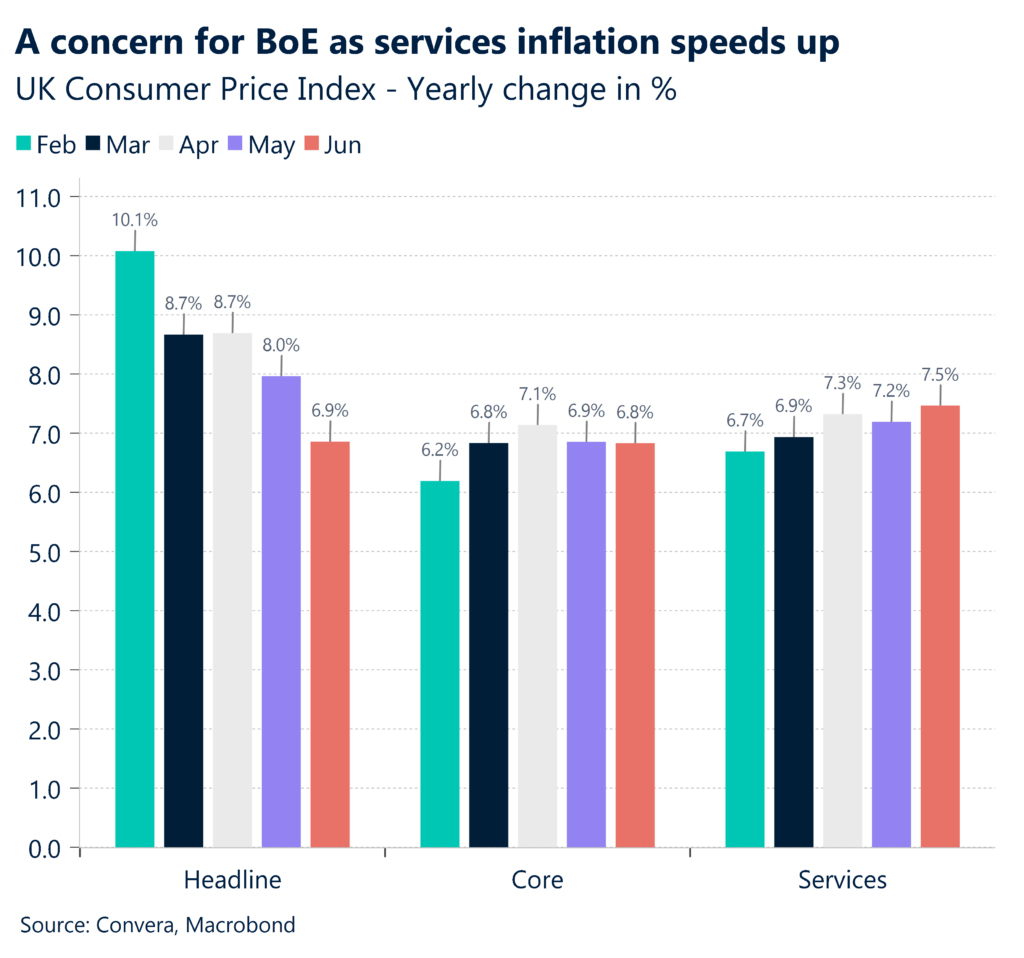

As widely expected, lower gas and electricity prices drove a sharp drop in UK inflation to 6.8% in July from 7.9% the previous month, the lowest rate of price increases since February last year. However, although the headline inflation rate declined, there was no improvement in underlying price pressures with core inflation still rising at an annual rate of 6.9%. Moreover, the rate of price growth in the services sector rose to 7.4% from 7.2%, underscoring the BoE’s concerns that it hasn’t yet broken the wage-price spiral feeding inflation across the economy. Does this mean the BoE may yet be forced to engineer a recession in order to finally get inflation under control? It’s worth noting we get another set of both price and wage data before the September policy meeting.

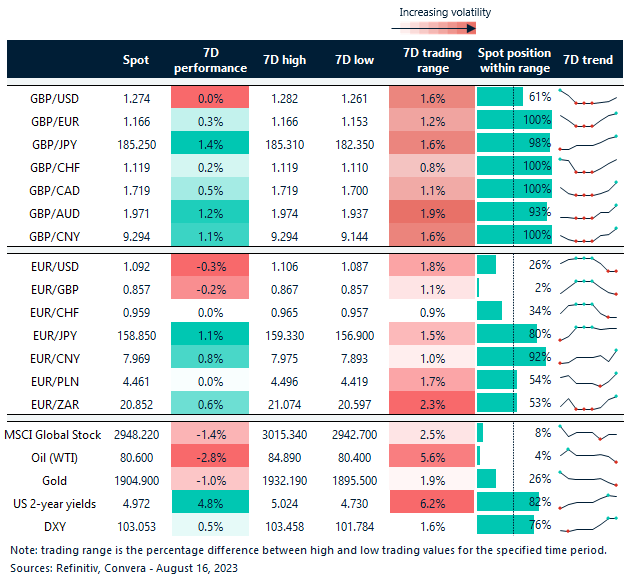

Widening yield spreads in favour of the pound as a result of increasing interest rate expectations have helped GBP/USD rebound from lows last witnessed in late June. Nevertheless, the odds of an economic slowdown will continue to increase if the BoE keeps raising interest rates and therefore GBP upside may be limited.

Euro steady despite weak China data

After a raft of disappointing economic data from China yesterday and a surprise interest rate cut, data for July showed China’s new home prices fell for the first time this year. Asian stock markets are sliding, and the Chinese yuan remains on the defensive. As the health of the Eurozone economy is heavily dependent on China for growth, the euro’s recent resilience is likely to be tested.

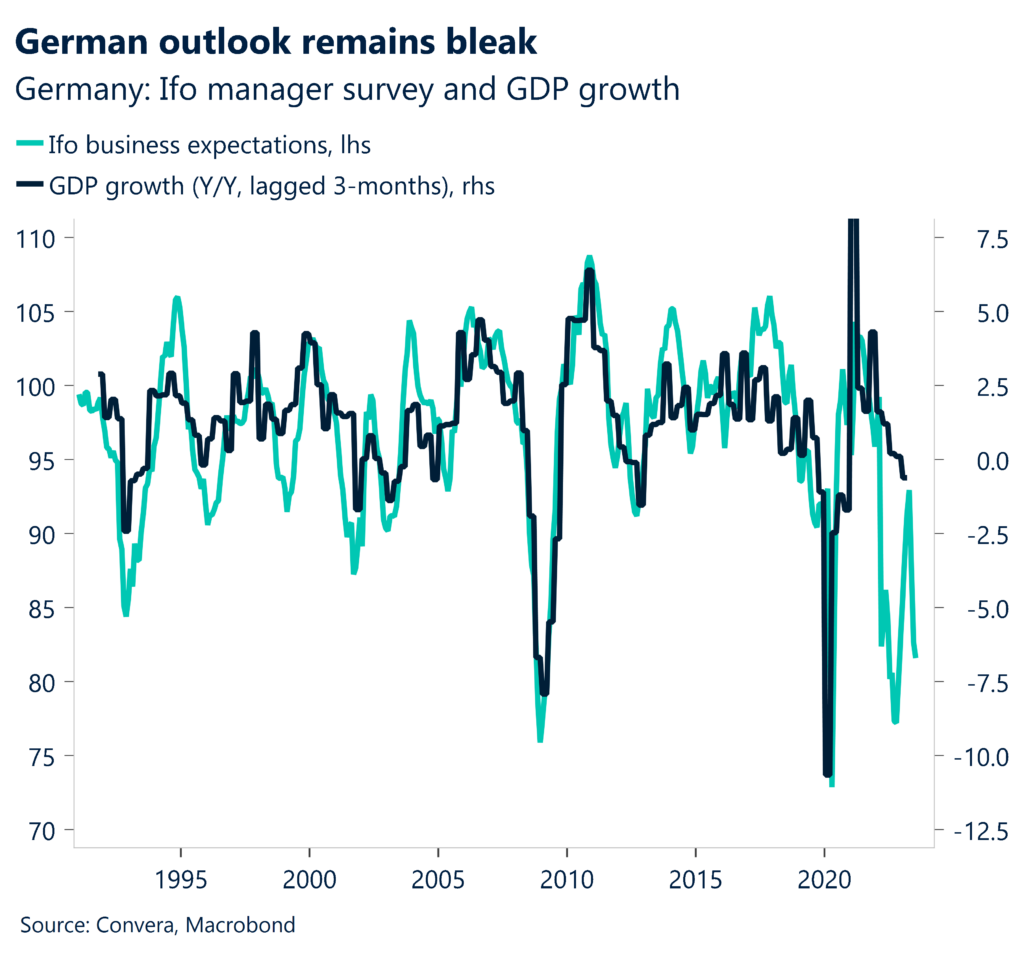

In terms of the latest macro developments from the Eurozone, yesterday, the ZEW Indicator of Economic Sentiment for Germany increased to -12.3 in August from -14.7 in July. An index of current conditions fell substantially, however, to its lowest since October 2022. Most respondents do not expect any further interest rate hikes in the Eurozone although money markets are pricing a 52% chance of one more 25-basis point hike next month. The recent surge in European natural gas futures to their highest since June has prompted investors to brace for a hawkish pivot from the European Central Bank as officials look to stop long-term inflation expectations drifting ever higher.

Overall, although European equity markets are sliding into the opening bell, the euro remains afloat the $1.09 handle versus the US dollar this morning. Attention turns to the second quarter GDP estimate from the bloc today and whether EUR/USD can resist breaking $1.09.

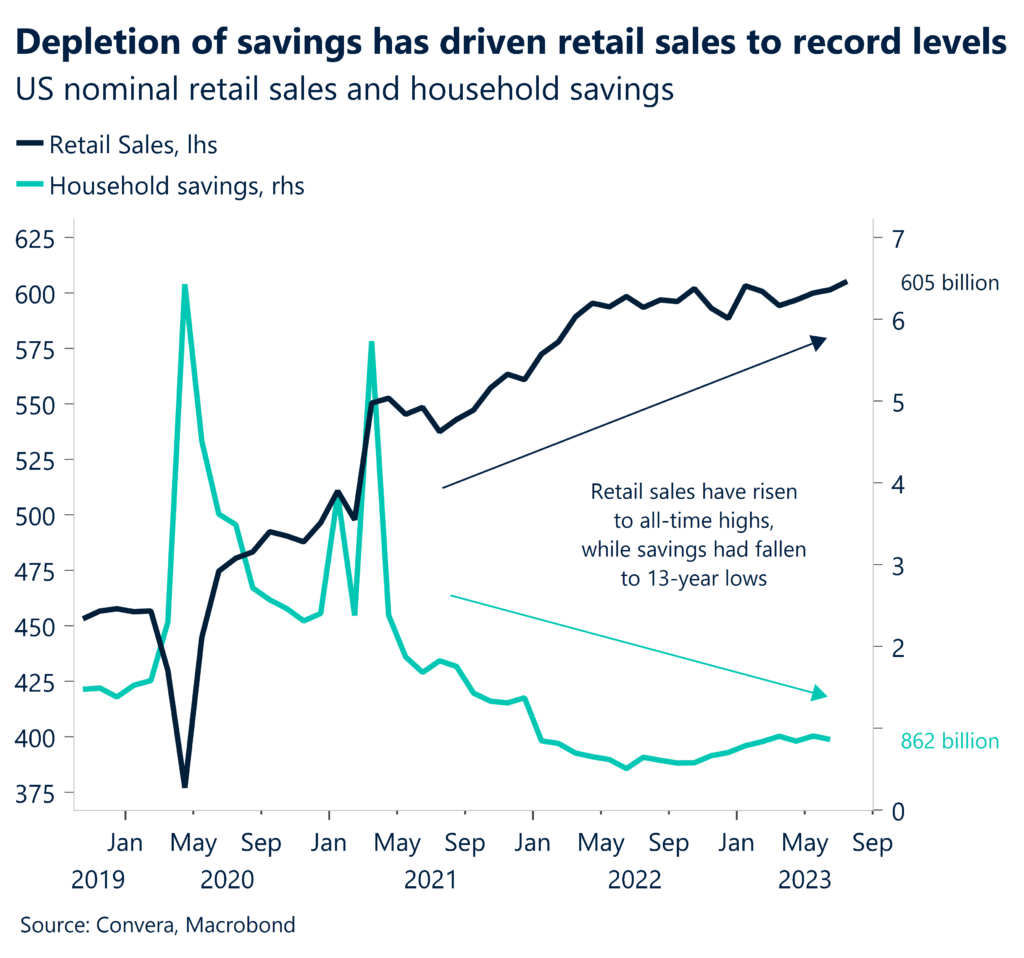

Strong US consumer helps dollar

US retail sales provided another upside data surprise and indicates a 2.2%-3% annualised GDP growth rate is possible for the third quarter according to several investment banks. The upgraded forecasts also suggest investors may anticipate the Federal Reserve (Fed) keeping interest rates elevated, which should keep the US dollar in high demand.

US retail sales rose 0.7% month-on-month in July versus the 0.4% consensus. June’s growth was also revised up 0.1 percentage point to 0.3% month-on-month. Next up, industrial production today, and we could see another positive surprise, reaffirming the resilience of the US economy, which would be more positive news for the US dollar. We also have the Fed’s minutes from its July policy meeting published later this evening. They should reflect the hawkish efforts to combat dovish expectations – i.e., trying to convince market participants that interest rates will stay higher for longer and rate cuts are not on the agenda in the near term.

The US dollar index, which tracks the dollar against a basket of currencies, briefly breached its 200-day moving average on Monday. However, since then, the US currency has struggled to hold above it in a sign that the upside potential may be waning.

Risk aversion hurts commodity currencies

Table: 7-day currency trends and trading ranges

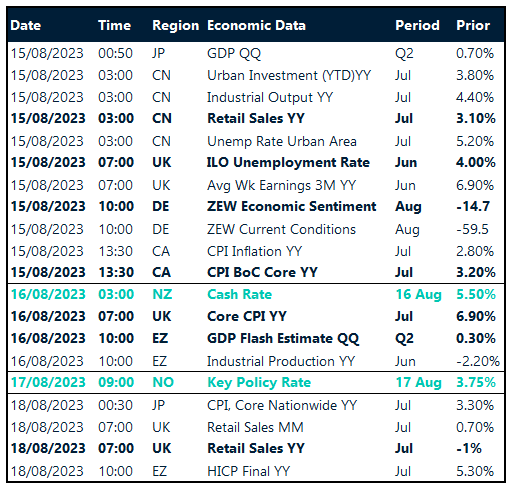

Key global risk events

Calendar: August 14-18

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.