Written by Convera’s Market Insights team

Pound mixed as UK inflation cools

George Vessey – FX Strategist

Headline consumer prices in the UK rose 2.5% in December from a year earlier, missing the consensus forecast and previous print of 2.6%. Moreover, both core (3.2%) and services inflation (4.4%) slowed more than anticipated, which will be welcomed by Bank of England (BoE) policymakers and market participants hoping for some respite from the turmoil in the UK gilts market that pushed benchmark government bond yields to a 17-year high.

To what extent the softer set of numbers will alleviate traders’ concerns about inflation remains unclear given two-year breakeven rates surging a remarkable 90bps since Chancellor Rachel Reeves unveiled her autumn budget. Ahead of the data, markets saw the odds of a third interest-rate cut at the next BoE meeting on Feb. 6 at around 65%, with only one quarter-point reduction fully priced in for this year. Now, markets see an 85% chance of a Feb cut and are pricing in two quarter-point cuts by the end of the year.

As for the pound, we warned this week that the asymmetry remains skewed lower, meaning an upside or downside surprise in inflation could see the pound drop lower. An upside surprise would have put extra strain on gilts and due to sterling’s current indirect correlation with rates, we would’ve expected a weaker pound. But the downside surprise that we’ve witnessed instead, although alleviates pressure on gilts and reduces the costs of government debt repayments, has increased BoE easing bets, which initially dragged sterling lower. However, it’s already reversed those losses at time of writing as it appears more sensitive to long-term borrowing costs than the short-term central bank outlook.

GBP/USD trades around the $1.22 handle for now, down over 2% since the start of the year, and almost 10% from its October high, although the daily and weekly charts are flashing oversold conditions. US inflation data today will be pivotal for the pair. GBP/EUR has fallen 2% in 2025 as well, but the currency pair continues to avoid sizeable daily moves. In fact, GBP/EUR has not recorded a daily rise or fall of 1% or more for over 500 trading days. Still, the pound enjoyed a healthy uptrend in 2024, finishing the year almost 5% higher and recording its highest year-end close since 2016 and remains over two cents above its 5-year average at present.

Greenback wavers on tariff uncertainty

Boris Kovacevic – Global Macro Strategist

The US dollar struggled to maintain its weekly gains, slipping about 0.8% from its Monday peak. Recent headlines suggest that the Trump administration may adopt a more measured and gradual approach to implementing tariffs. While uncertainty persists around the evolving news, this aligns with our initial thoughts shared in July during our first presidential preview. Although there are no clear catalysts to significantly move away from the Greenback, there are signs of potential exhaustion as both Trump’s tariff policies and the Federal Reserve’s (Fed) pause appear to be priced in.

The dollar faced additional pressure from weaker-than-expected producer price data released yesterday, casting some doubt on the narrative that inflation is reaccelerating rapidly. December’s factory gate prices rose by 0.2%, bringing the annual increase to 3.3%. While this marks the largest advance since February 2023, it fell slightly below the forecast of 3.4%. The annual core PPI figure surprised even more, coming in at 3.5% versus the 3.8% consensus. We advise caution in interpreting these figures too heavily. The upcoming Consumer Price Index (CPI) report will be the key piece of the puzzle in assessing inflationary risks and the Fed’s policy trajectory. This context explains why the dollar reacted more strongly to reports of a measured tariff approach than to the PPI miss.

Investors largely downplayed the strong National Federation of Independent Business (NFIB) report. The Small Business Optimism Index rose for the fourth consecutive month in December, reaching its highest level since October 2018. Optimism is building around pro-growth policies, such as broad deregulation and favorable tax reforms, which could help smaller companies outperform. Notably, about half of surveyed business owners expect economic conditions to improve—the highest share since 1983. However, we caution against overemphasizing the report. Small business owners often lean Republican, especially favoring Trump. This bias is reflected in the spike of participants citing the political climate as a reason to expand, a trend observed after both of Donald Trump’s elections, as shown in the chart below. The data from the second half of the year will be critical for assessing whether these expectations are met and if the economy shifts upward.

Euro can’t escape the US shadow

Boris Kovacevic – Global Macro Strategist

The euro continues to be stuck in the shadow of developments in the United States, being hardly able to form an impetus on its own. For now, this means that EUR/USD has advanced back above the $1.03 mark as the US PPI figure and tariff news disappointed the dollar bulls. We don’t expect any major change in this dynamic as no heavy hitting economic data will be released for the Eurozone or Germany this week. However, this gives us an opportunity to talk about the big news out of China.

The country closed 2024 on a high note, with its trade surplus reaching a record level in December. This achievement certainty highlights the country’s dominant role in global trade but also raises questions about its sustainability in an increasingly complex economic landscape under Donald Trump. China has been heavily criticized for its subsidy- and industrial policies in recent years. However, by emphasizing openness and organizing initiatives like the China International Import Expo, China seeks to counter accusations of economic nationalism.

This approach also aligns with its aim to position itself as a defender of globalization amidst rising protectionist trends elsewhere. By criticizing protectionist policies while expanding its imports and openness, China strategically shifts the narrative, portraying itself as a victim of restrictive trade practices. This stance could win favor among developing countries as the West under the wing of the US move towards protectionism.

Oil prices surge over 6% in a week

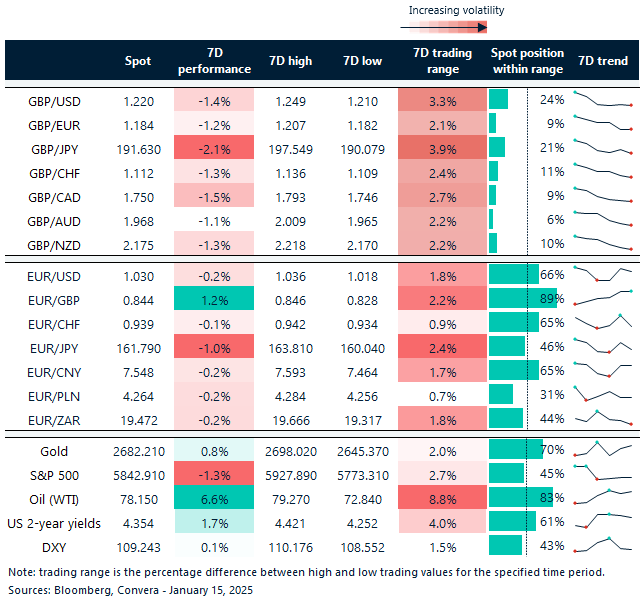

Table: 7-day currency trends and trading ranges

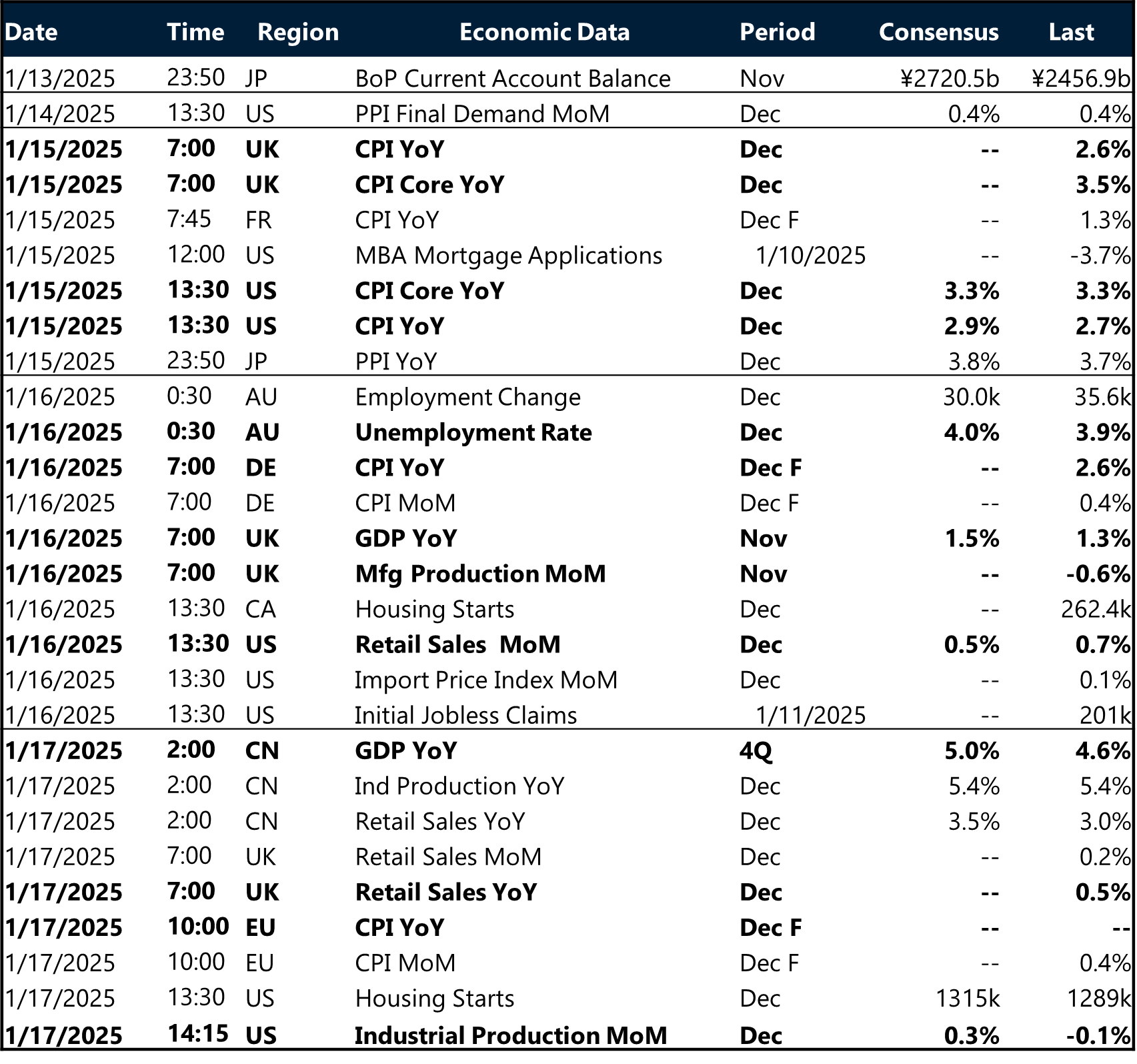

Key global risk events

Calendar: January 13-17

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.