Written by Convera’s Market Insights team

CAD tumbles after Trump tariff talk

George Vessey – Lead FX Strategist

President-elect Donald Trump has pledged to levy tariffs of 25% on all US imports from Canada and Mexico as soon as he takes office. An extra 10% tariff is aimed squarely at China. The announcements serve as opening shots in Trump’s confrontational new trade policy and FX markets are on edge. The Canadian dollar weakened as much as 1.5% in just two hours following the remarks in sign of the market volatility we should expect during a second Trump presidency.

Dollar-yuan’s initial reaction to the tariff threat headlines has so far been limited but the Mexican peso has also been rocked liked the Canadian dollar, shedding 1.5% today already. USD/CAD has surged to its highest level in more than four years and given these developments on trade tariffs, we would not be surprised to see an extension higher to C$1.45. Both GBP and EUR are also capitalising on the weaker Loonie, up around 0.7% this morning with the former finding firm support at its 200-day moving average. There are still a lot of unknowns with regards to how countries will retaliate but the lingering risk for fresh headlines will likely keep volatility elevated.

The main takeaway from this morning’s reaction to Trump’s comments, and given what we witnessed under his first presidential term, suggests FX traders will remain on edge over the next four years. Options markets have trimmed their bets on a stronger US dollar, after the announcement of Scott Bessent Treasury Secretary choice, but the buck is back on the offensive across the board today after the tariff talk turbulence.

Short-term reprieve for euro

George Vessey – Lead FX Strategist

The first major economic release of the week confirms things aren’t getting better for Europe’s biggest economy. Germany’s most prominent leading indicator, the Ifo index, took another nosedive. Yet EUR/USD staged a decent bounce from the brief plunge to $1.0335 on Friday, lingering beneath $1.05. But the path of least resistance remains to the downside amid concerns over Europe’s stagflation risks and we are wary of more extended EUR/USD losses into year-end despite supportive seasonal patterns.

After the first rebound in almost half a year in October, the Ifo index dropped to 85.7 in November from 86.5. The current assessment component declined more significantly than the expectations component suggesting that the weaker Ifo index was mainly the result of negative headlines related to the war in Ukraine and still-weak industrial order books. With no immediate tailwinds in sight, the euro looks primed for more losses, and parity appears increasingly likely over the next year. In fact, the options-implied probability of parity trading within the next six months is now around 30%, up from 20% at the start of this month according to Bloomberg data.

Although the euro is heading for its worst two-month run since January 2015, net short positioning in the euro versus the dollar implies more downside risk for the common currency potentially looms. Speculators, according to COT data, recently went net short EUR, but the current level of such bets is far below peaks seen during past crises.

Pound struggling to gain traction

George Vessey – Lead FX Strategist

GBP/USD is struggling to regain control of the $1.26 handle and its 100-week moving average, despite the US dollar’s softer start to the week. The UK-US yield spread remains largely unchanged with yields falling in both regions, whilst the risk-sensitive pound failed to capitalise on improving global sentiment evidenced by the rally in global stocks on Monday.

The pound also lost its grip on €1.20 versus the euro, sliding around 0.5% on Monday – its worst day of the month. Money markets are still pricing in less than a 20% chance of Bank of England (BoE) rate cut in December and three cuts are fully priced in by the end of 2025. The recent uplift in inflation alongside the announced fiscal expansion implies a slower cutting cycle by the BoE, at least initially. However, stagflation fears are on the up, limiting sterling’s gains from this hawkish outlook. Looking ahead, the UK is likely less exposed to direct tariff risks given its trade deficit in goods with the US, which we think supports the case for sustained UK economic outperformance versus an already ailing Eurozone – allowing GBP/EUR to remain in an upward trajectory.

Against the dollar though, despite weak seasonal trends for the buck and month-end flows pointing towards USD selling this week, the downtrend remains intact so long as GBP/USD stays below $1.28 and its 200-day and 200-week moving averages (located around the same level).

CAD under the cosh after tariff chatter

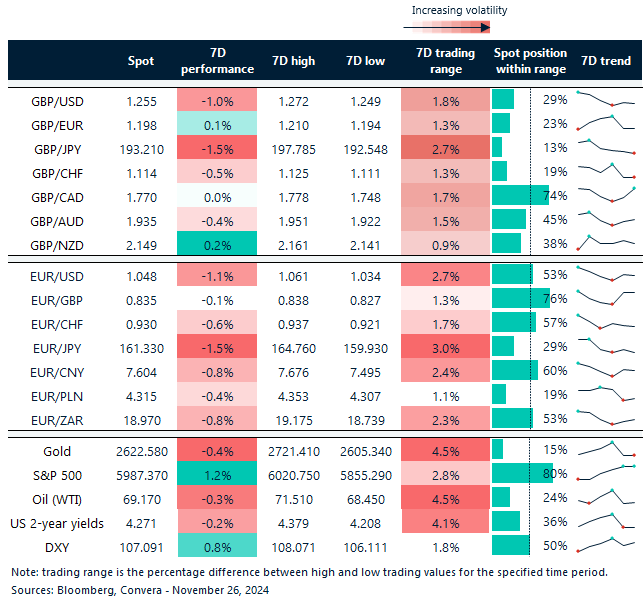

Table: 7-day currency trends and trading ranges

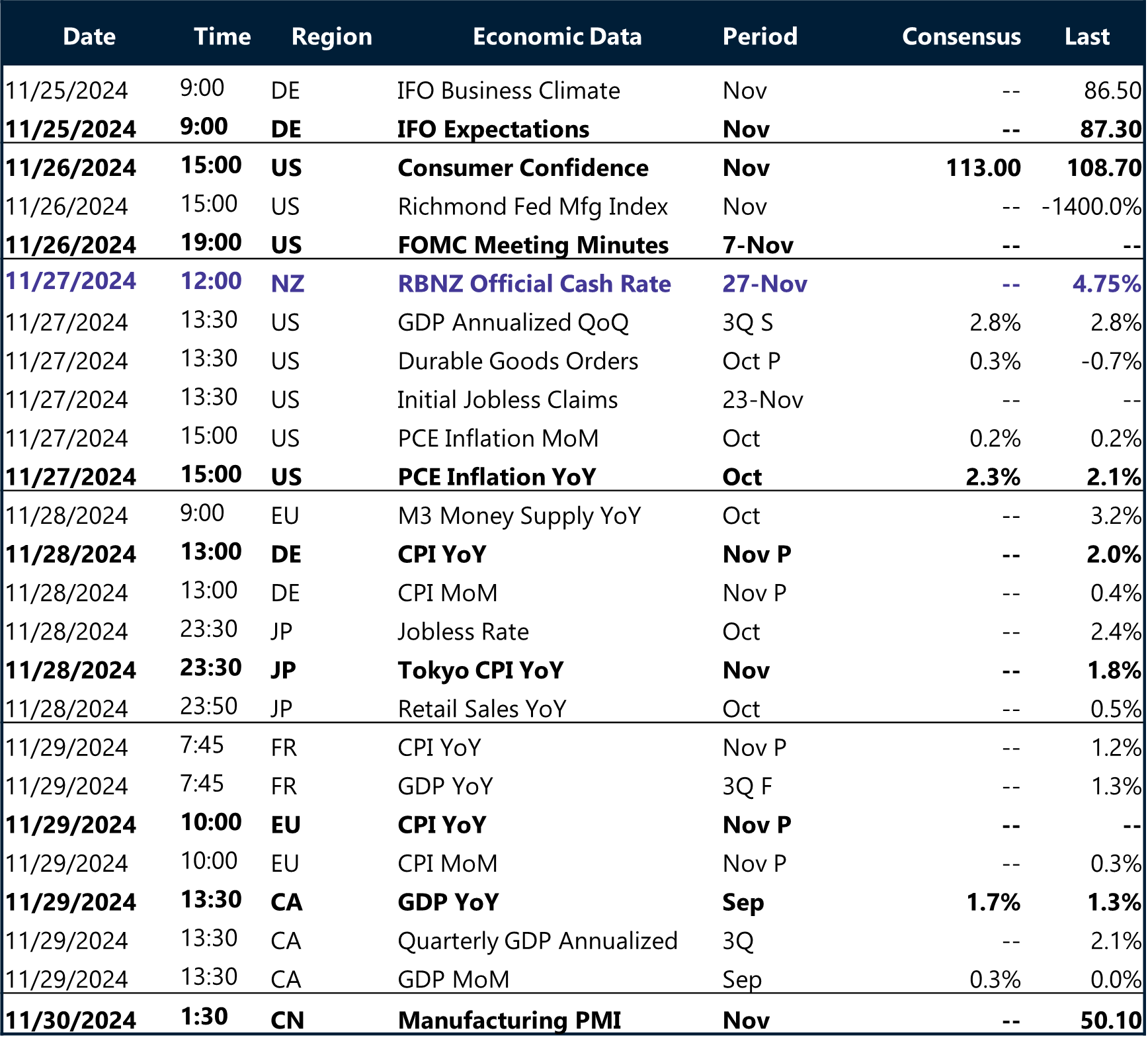

Key global risk events

Calendar: November 25-29

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.