Written by the Market Insights Team

Tariff reset rally

Kevin Ford – FX & Macro Strategist

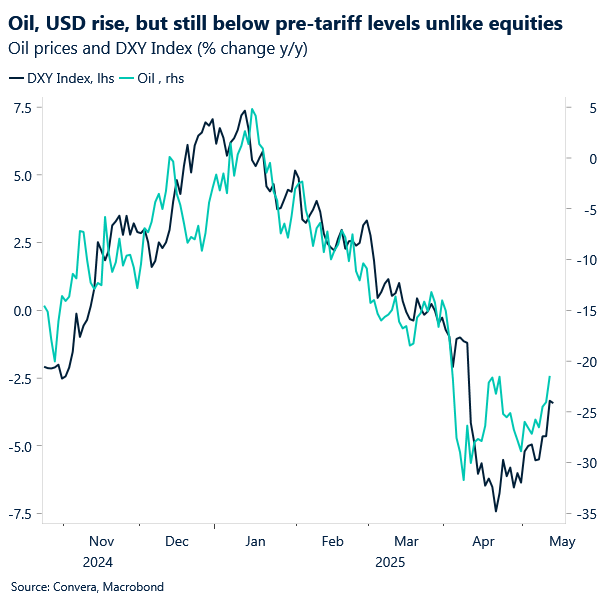

Just a few months ago, a 30% tariff rate on China would have seemed extreme. Now, those levels are fueling one of the biggest equity market rallies in recent history, with the S&P posting its strongest 22-day surge since 2020. Before COVID, a rally of this magnitude had only occurred during the global financial crisis and the dot-com bubble. Sentiment has shifted, and investors are responding with renewed optimism as the US and China roll back tariffs. The US dollar is also making a comeback, up almost 4% from its 2-year low printed last month.

The US-China tariff deal includes a 115%-point reduction in tariffs, lowering US tariffs on Chinese imports from 145% to 30% and Chinese tariffs on US imports from 125% to 10%. China will suspend or remove non-tariff countermeasures imposed since April 2, 2025, such as export restrictions on critical minerals, though the agreement does not explicitly mention rare earth elements or sanctions on US defense and tech companies. Meanwhile, the US will maintain all pre-April 2 tariffs, including those related to intellectual property, steel, aluminum, and fentanyl trade. The de minimis exemption, which allowed duty-free entry for small parcels, remains terminated, meaning low-value packages under $800 from China and Hong Kong will still face tariffs. Additionally, Chinese electric vehicles, steel, and aluminum remain subject to existing tariffs, along with certain pre-April 2 non-tariff measures, though blacklisting US companies was not explicitly confirmed in the final agreement. While this deal marks a major step in trade de-escalation, key areas of uncertainty remain, and further negotiations could determine whether these tariff adjustments become permanent.

Over the past month, while the Nasdaq is up 11%, the S&P 8%, the US dollar index remains 6% lower year-to-date. Clearly, markets don’t need the greenback to recover, for now. But for the dollar to rally further, it will require stronger international demand. Confidence remains fragile amid these shifting trade dynamics, contributing to the disconnect in market reactions.

As mentioned last week, the worst appears to be behind us. Trump blinked, and the US administration has stepped back. Could they have set a 10% base tariff from the start instead of the extreme levels seen on Liberation Day to avoid this turbulence? Perhaps. The challenge now is managing the uncertainty of this 90-day window. We’ve already seen aggressive front-running over the past two months, which could distort data further, something the Fed, already cautious, will need to navigate carefully.

Euro down almost 5% from recent peaks

George Vessey – Lead FX & Macro Strategist

The euro continues to extend losses as trade de-escalation fuels a reversal in the “sell America” trade, boosting US equities while oil prices surge. The inverse correlation between the euro and US stocks and crude remains strong, with fading volatility adding to downside pressure on the common currency, which is now almost 5% down from recent peaks.

Crude’s rally of late, driven by signs that the global trade fallout may be less severe than feared, is lifting commodity prices. As a net importer of oil, Europe faces higher energy costs, weighing further on the euro if the rally continues. EUR/USD dropped 1.4% on Monday, marking its biggest daily decline since the post-US election slump, as it battles to hold above the $1.11 handle. A short-term move toward $1.10 is possible, especially if the pair closes below its 50-day moving average at $1.1084. Today’s German ZEW surveys will be closely monitored to assess whether the euro’s slide extends further or stabilizes near current levels.

Market focus may now shift back to yield differentials too. The Fed’s cautious stance favours dollar bulls, contrasting with expectations of more ECB rate cuts ahead, meaning EUR/USD may fall further in line with euro-US yield spreads. That said, US core data remains uncertain and any cyclical softening could trigger fresh dollar depreciation, particularly if Fed rate expectations adjust dovishly.

Loonie weakens on changing mood

Kevin Ford – FX & Macro Strategist

President Trump made it clear that no country would get the same treatment as the UK. This doesn’t bode well for Canada, as broad-based tariffs persist, keeping the outlook for the Canadian economy uncertain and under pressure. What we’re now seeing played out in trade deals, with both the US-UK and US-China agreements, is that baseline tariffs between 10% and 30% are now a mainstay.

USD/CAD extended last week’s rebound, briefly pausing at 1.394 before resuming its climb, driven by renewed trade optimism as the U.S. and China agreed to slash tariffs by 115% for 90 days. Some resistance is expected near 1.401, where the 200-day SMA sits. Meanwhile, widening US-Canada yield spreads and shifting Fed expectations suggest the Canadian dollar will likely stay above 1.39 in the short term. Broader US dollar strength against the Euro, Pound, and Yen should continue to support USD/CAD’s upward momentum in the coming sessions.

Looking ahead, U.S.-Japan trade negotiations remain stuck, as Japan refuses to accept any deal that lacks sector-specific exemptions. In South Korea, the prospect of a trade agreement before the country’s presidential election on June 3 has been completely abandoned. Meanwhile in the Eurozone, officials are assembling a package of retaliatory tariffs targeting $100 billion worth of U.S. industrial goods. So, this may be as good as trade policy gets, at least for now.

Sterling outpaces euro, but dollar dominates

George Vessey – Lead FX & Macro Strategist

The pound suffered its biggest daily decline in a month on Monday as the US dollar came out on top after the positive US-China trade developments. GBP/USD is grappling with the $1.32 handle today, over two cents from its 2025 peak, but still circa 3% above its 5-year average. A drop towards the 50-day moving average at $1.3091 looks feasible in the short term, but FX traders are still optimistic about the pound’s outlook over a longer time horizon.

Meanwhile, the positive GBP/EUR bias gained momentum following the tariff news, with three key drivers supporting further sterling upside. First, while the UK economic outlook isn’t particularly bullish, recession risks are easing, and the BoE remains cautious without ramping up its dovish stance. Second, as FX markets shift focus back to yields, the sterling-euro yield differential remains firmly bullish, reinforcing the currency’s relative strength. Third, the UK’s advantage in tariff management – a core bullish factor identified earlier this year – was validated by last week’s US-UK trade deal, further bolstering sentiment. One missing piece in the GBP/EUR rally has been risk appetite, but with market optimism returning, sterling’s high-beta status could help extend the pair beyond €1.19, should momentum persist.

On the data front, this morning’s UK labour market report revealed the unemployment rate edged higher to 4.5% as expected – its highest level since 2021. Moreover, the number of workers on payrolls dropped 33,000 in the wake of a sharp increase in employment costs announced in the October budget and the clouded global economic outlook. Separate figures showed wage growth slowing — another sign of a cooling labor market. Private-sector wage growth, the gauge most closely watched by the BoE to gauge underlying pay excluding bonuses, slowed to 5.6% from 5.9%. It was lower than the consensus forecast but above the 3% consistent with keeping inflation sustainably at the 2% target, which is why the BoE maintains a cautious approach to policy easing.

Dollar index climbs over 2% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: May 12-16

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quothave a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.