Written by Convera’s Market Insights team

USD/JPY tumbles 2%

Ruta Prieskienyte – FX Strategist

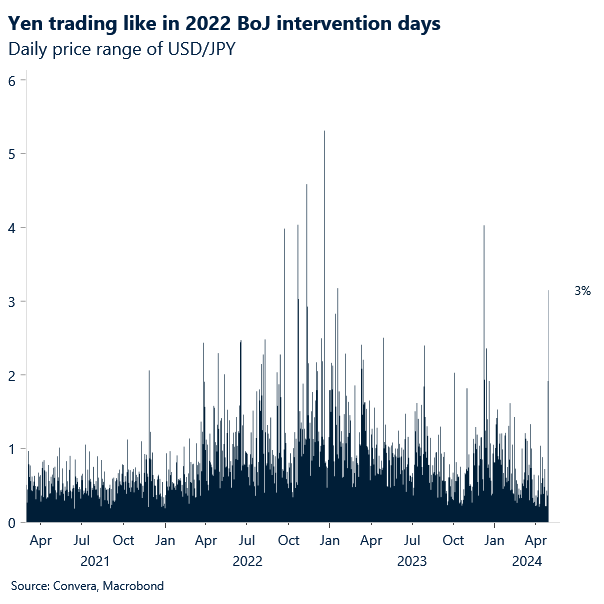

The Japanese Yen rallies around 500 pips against the US dollar – a 2% move – having earlier breached the psychological 160 barrier, with trading volume low in Japan due to a public holiday. The sharp intraday bounce could be attributed to BoJ authorities to bolster the domestic currency, although no official announcement has been made so far. Japan’s top currency official Masato Kanda says “no comment for now,” when asked by reporters whether or not he intervened in currency market.

Uptick of US GDP in Q2?

Boris Kovacevic – Global Macro Strategist

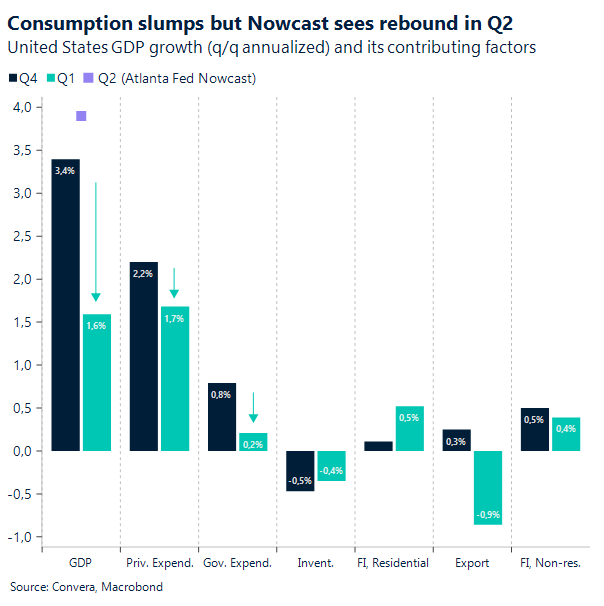

The conclusion of the week has been that US inflation remains sticky while US exceptionalism on the growth side is waning. The upside surprises on retail sales, industrial production, inflation, and durable goods did not culminate into a strong GDP print closing out Q1. US activity expanded by an annualized 1.6% in the three months ending in March. However, the price component (PCE) came in much hotter than expected, beating the 3.4% estimate with a 3.7% growth rate.

The monthly equivalent of the inflation indicator published on Friday confirmed the annual acceleration in March as the PCE price index grew from 2.5% to 2.7%. However, the month-on-month number for both headline and core inflation failed to surprise the consensus at 0.3%. Investors therefore got spared the worst case scenario of a higher print, even though Fed pricing for 2024 remained unchanged at just one rate cut being priced in.

The US dollar has recently suffered a further softening in its momentum due to a calmer risk setting, falling oil prices and weaker-than-expected US economic data. Diverging PMIs were the catalyst to send the US dollar index to 2-week lows, despite US yields consolidating at 5-month highs. The Greenback (DXY) ended the second week in a row unchanged, trading around the 106.00 level.

Going into the new week, the plethora of market moving releases includes the Employment Cost Index, ISM manufacturing and services PMI, job openings, factory orders and the nonfarm payrolls report closing out the week on Friday. The incoming data will be important to gauge where the US is headed as the Atlanta Fed started its Nowcast for Q2 US GDP at a high level of 3.9%. Markets are expecting Jerome Powell to reiterate the neutral stance the central bank has recently adopted in response to higher-than-expected inflation in Q1 at its meeting on Wednesday. However, given the broad expectations of unchanged policy, attention will fall on the Treasuries Quarterly Refunding Announcement (QRA) preceding the FOMC meeting.

Pound at mercy of external events

George Vessey – Lead FX Strategist

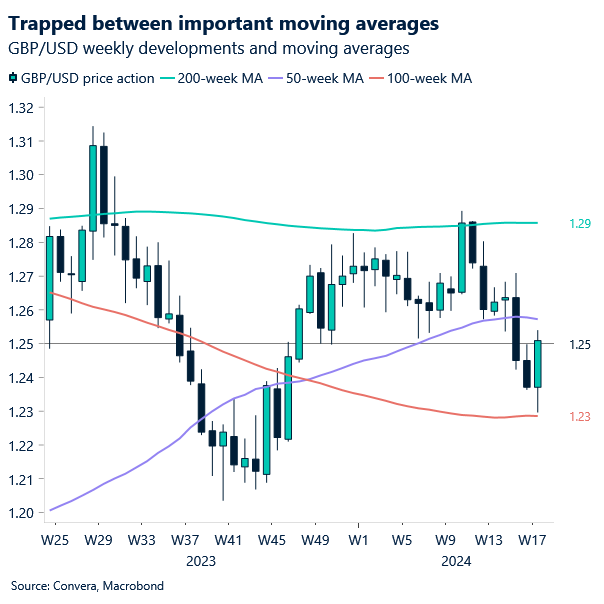

GBP/USD recovered over two cents in a week after finding support at its 100-week moving average near $1.23 this time last week. The pair remains over 3% below its 2024 high near $1.29 though and has been caught in a steep downtrend since March. We need to see a close above its 200-day and 50-week moving averages, in the higher realms of $1.25 and into $1.26 to give us more confidence in a recovery towards $1.30 later this year.

Improving risk sentiment, better-than-expected UK economic data and relatively hawkish comments from some Bank of England (BoE) policymakers last week, diluting some dovish remarks from the week prior, supported the UK currency. Money markets modestly reduced bets on the scope for BoE rate cuts as a result and August is no longer fully priced in as the starting point. The UK 10-year government bond yield surged towards 5-month peaks, supporting sterling’s strength across the board, with GBP/JPY hitting highs last seen in 2008 and GBP/EUR jumping over 1% back above key long-term moving averages. The lack of top tier UK data this week means the pound’s direction will likely be steered by external developments this week, especially amid the plethora of US data and the Fed’s policy decision.

Although US data and the US rates outlook is the main driven of FX trends right now, the risk of a further dovish repricing of the BoE policy outlook, given UK inflation dynamics, is clouding the pound’s short-term recovery prospects more broadly. The rosier economic outlook for the UK though, as reflected with last week’s upside data surprises, bodes well for the pound over the longer term.

Will Euro withstand US gravitational pull?

Ruta Prieskienyte – FX Strategist

The euro was on track for the best weekly performance in 6 weeks’, thanks to improving domestic growth backdrop. Bearish euro pressures renewed as investors digested a wealth of US economic data on Friday, with EUR/USD unable to hold above the key support level at $1.07 ahead of the weekend.

April has seen a broad-based sector wide improvement in the German growth outlook, confirmed by all major surveys. The forward looking Gfk consumer confidence index rose to its highest level since May 2022, while business sentiment improved to its highest level in a year. Meanwhile, the preliminary S&P Global Composite PMIs report for the bloc climbed to 51.4, well clear of the 50 threshold, as German private-sector activity grew for the first time in 10 months. As Eurozone economic outlook turns more neutral, upbeat domestic macro data now plays a supporting act to the common currency, rather than hindering its performance.

This week’s economic calendar is dotted with potential volatility mines. German and European inflation numbers due later today will be key as both investors and policy makers are gearing up for a likely start of the easing cycle in June. Tuesday’s flash Eurozone GDP print could reinforce a narrowing in growth differentials between the US and the common bloc, possibly making a dent in US dollar’s Q2 performance. However, the key events will yet again be US centric, with FOMC rate decision on Wednesday. On a typical FOMC day we tend to observe EUR/USD appreciate by an average of 0.14% d/d on close-close basis, but this time could be different. If we see a downward revision in the Fed dot plot given ample of evidence of persistent inflation pressures, it could further support the dollar. If euro sellers drag the spot below $1.07 threshold, that would pave the way toward the 100-week SMA at $1.0630, with immediate support at $1.0601 (YTD low). For now, 50-week SMA at $1.0820 sets a possible top, capping near-term upside.

Strong bearish signals emerge in JPY

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: April 29 – May 3

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.