Safe haven demand swells

The US dollar and Japanese yen strengthened yesterday on the back of a flight to safety as concerns about the banking system resurfaced. Shares of First Republic Bank plunged nearly 50% after it reported a run on deposits of more than $100bln in the quarter, battered by lost confidence in the banking sector. EUR/USD is grappling with $1.10 this morning, whilst GBP/USD recovers after a brief dip below $1.24.

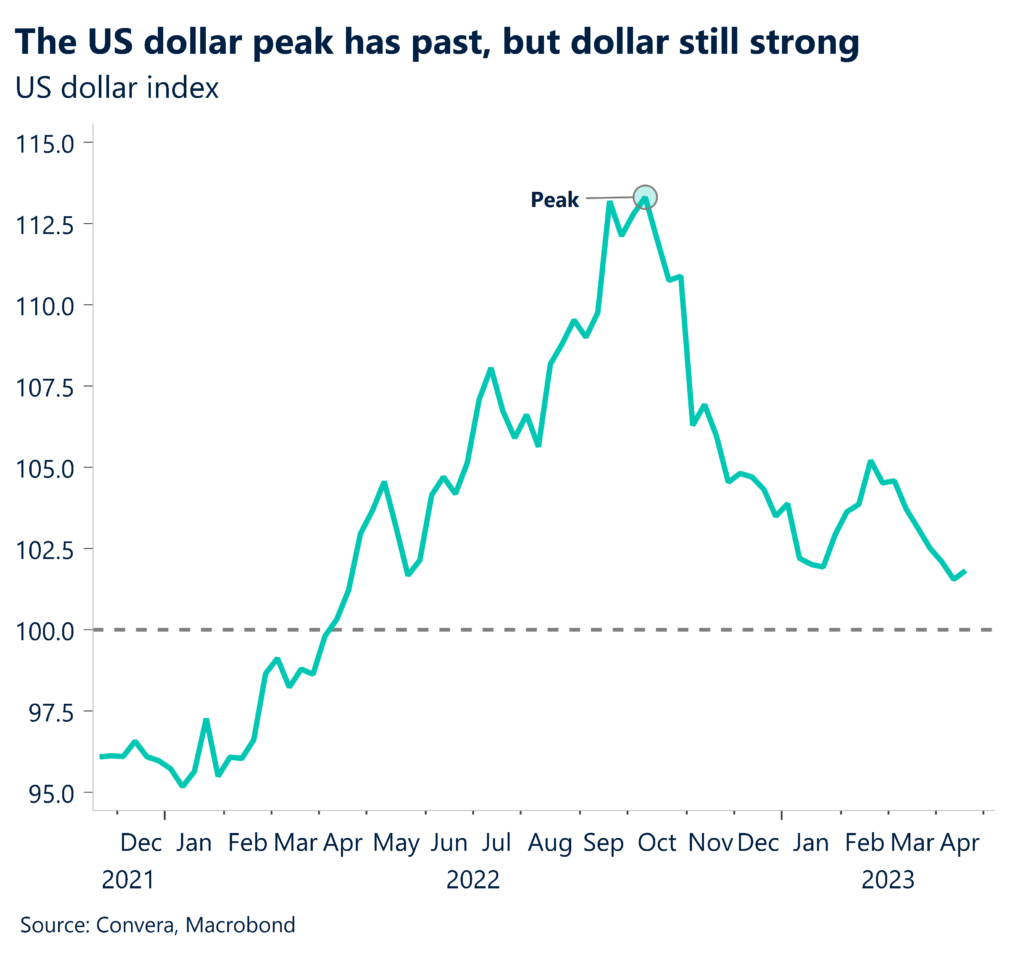

As central banks continue hiking interest rates, the risk of further turmoil in the banking sector remains high. The flight to safety sent 2-year US Treasury yields lower and whilst 5-year US sovereign credit default swaps surged to their highest since 2011 due to the debt ceiling standoff, the safe haven US dollar appreciated across the board. Has the dollar index bottomed out? Also weighing on sentiment was economic data showing US consumer confidence dropped to a nine-month low in April underpinning fears of a recession this year. Meanwhile, our Regional Fed Price Index fell for the first time in three months despite the sub-component for prices paid in the Richmond Fed index surging higher. The overall manufacturing activity index in the Richmond area sank too, as higher interest rates continue to pressure business activity. Markets are now pricing in a 76% chance of a 25-basis point hike when the Fed meets next week, down from a 90% chance at the start of the week. The peak for US interest rates is expected around June and then a decline to end the year below 4.5%.

As well as more earnings reports, investors will look to US durable goods data this afternoon and to first-quarter GDP data and April consumer sentiment data later this week for more clues on the state of the economy.

Pound proving resilient

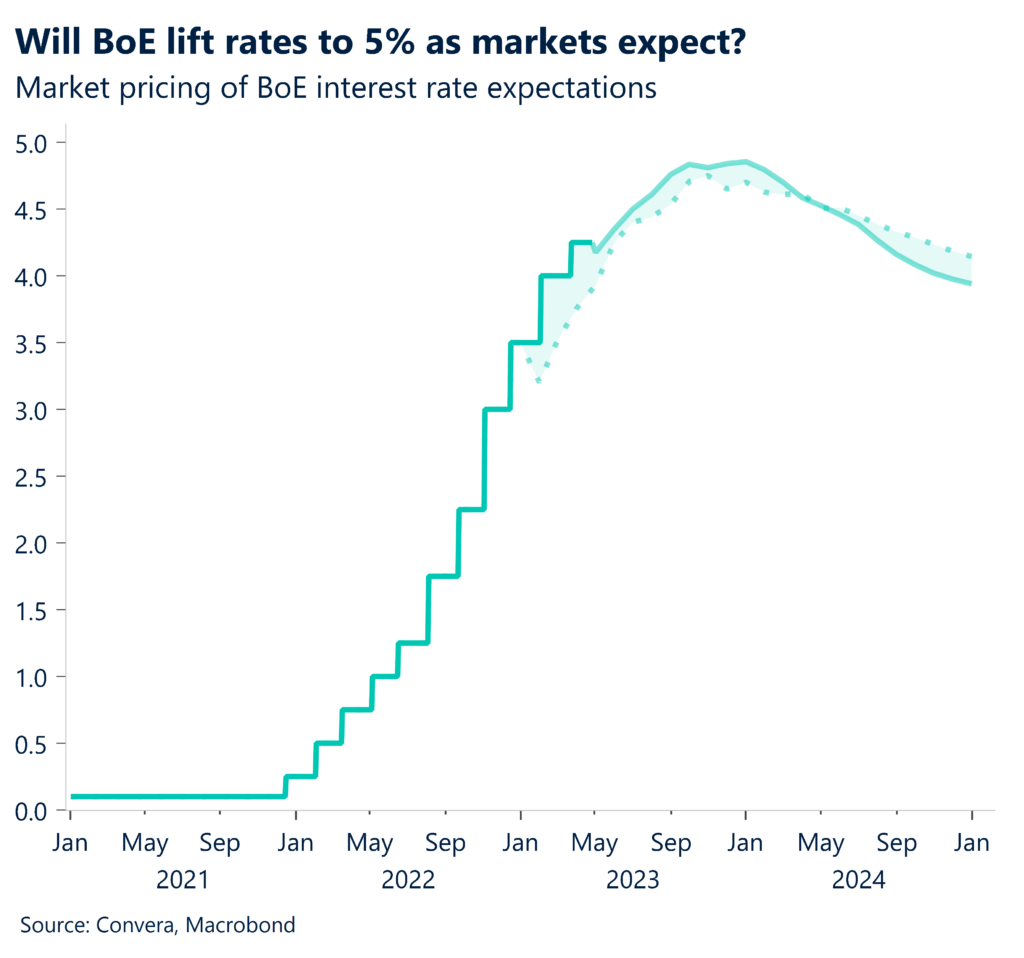

Despite souring risk sentiment, the pound has rebounded back above the $1.24 handle versus the US dollar and continues to trade sideways against the euro, hugging the €1.13 level. With inflation still running above 10.1% in March and evidence of solid service sector demand, expectations of more Bank of England (BoE) rate hikes are proving supportive for sterling.

The BoE meets in the second week of May and markets are pricing a 90% probability of another 25-basis point rate rise, but will the central bank push back against the pricing of another two more hikes before year-end? This is a big risk to the pound, which continues to benefit from narrowing UK-US rate differentials, though BoE Chief Economist Huw Pill called for higher rates to arrest persistently high inflation. In addition, Mr Pill made a controversial comment stating British people need to accept they are poorer instead of seeking to claw back a historic drop in living standards after a jump in inflation. Economic data from the UK is sparse this week, but a bigger-than-expected budget deficit for March capped off the fourth-highest borrowing for a financial year since records began.

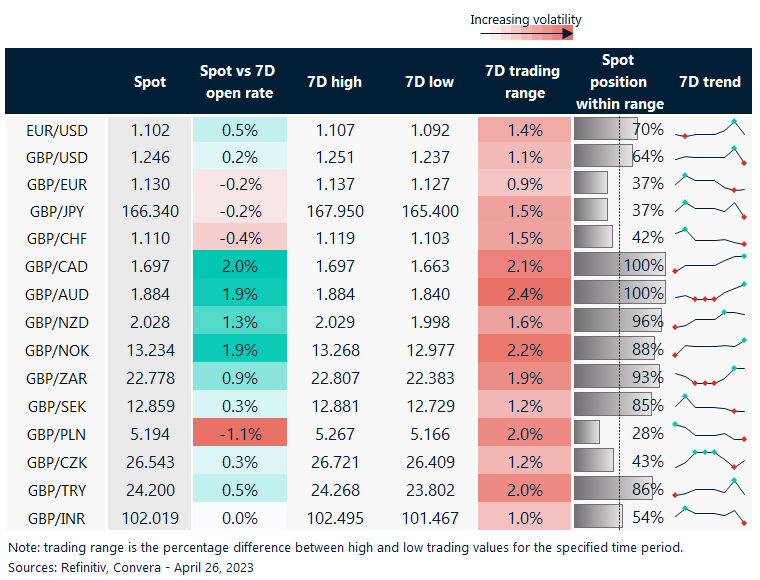

Whilst GBP/USD remains over 3% above its one-year average rate, GBP/EUR is 2% below its one-year average. Scouring the long-term positioning of GBP currency pairs though, it’s the yen which is still of great value to British importers – currently GBP/JPY is trading 13% above its fiver-year average.

Euro upside risk despite slump in equities

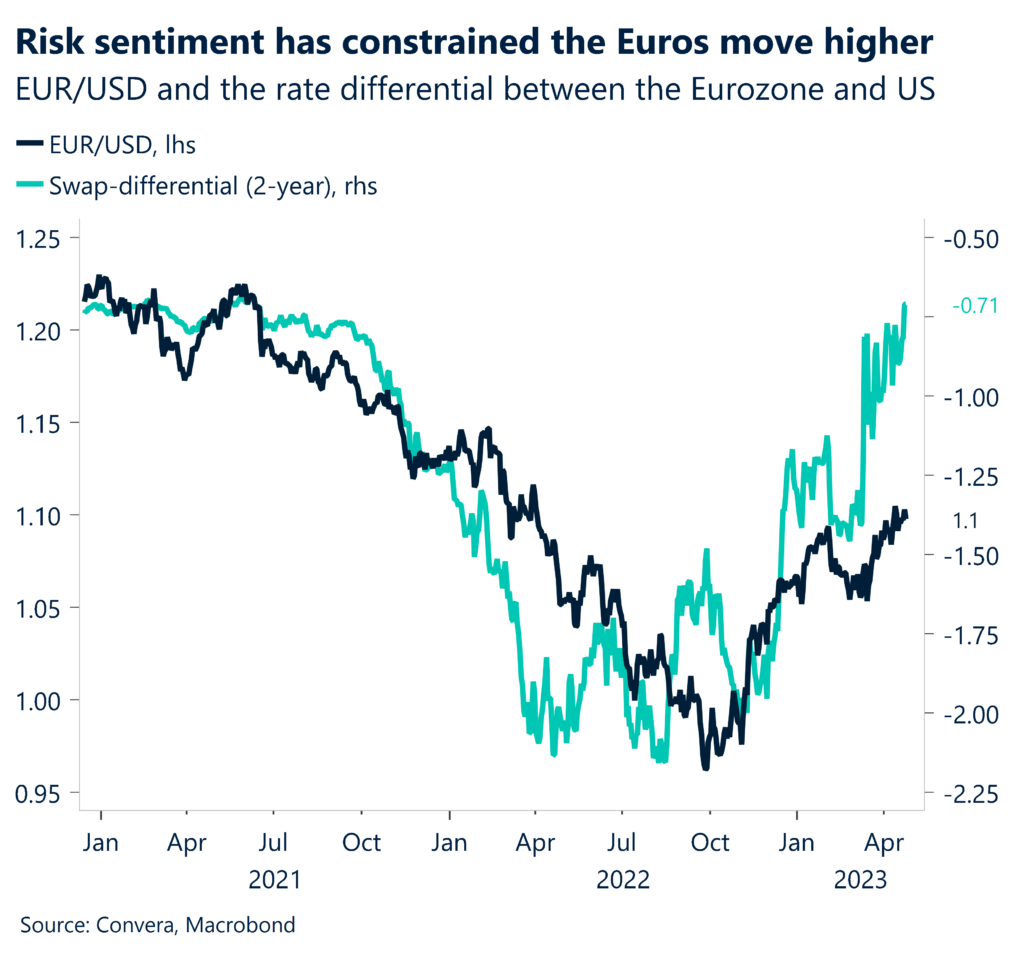

European equity markets were headed for a lower open on Wednesday after European financials dragged their domestic equity indices down yesterday and provoked a further move to safe havens amid renewed concerns about a wider impact from the recent banking crisis. The euro remains relatively stable though amidst market pricing of at least three more rate hikes by the European Central Bank (ECB) this year.

Data so far this week has been mixed for the euro. The Ifo business climate indicator for Germany rose for the sixth consecutive period and Germany’s GfK consumer climate indicator increased for a seventh straight month to -25.7 – the highest since April 2022. However, the value still remains below the pre-pandemic level of about three years ago. Spanish producer prices turning negative on both a monthly and annual basis, which caught markets off guard, just after several ECB policymakers signalled a 50-basis point hike is on the table next week. The two-year EUR-USD swap rate differential is now at -71bp, the narrowest since August 2020 which remains a key factor supporting the bullish narrative for EUR/USD.

Banking worries puts investors on alert for a repeat of the bond rally that took place after the Silicon Valley Bank failure in March, but absent further contagion in the banking sector, the euro should continue grinding higher until more clarity emerges on the monetary policy front by the Fed and ECB meetings next week.

Risk aversion triggers volatility

Table: 7-day currency trends and trading ranges

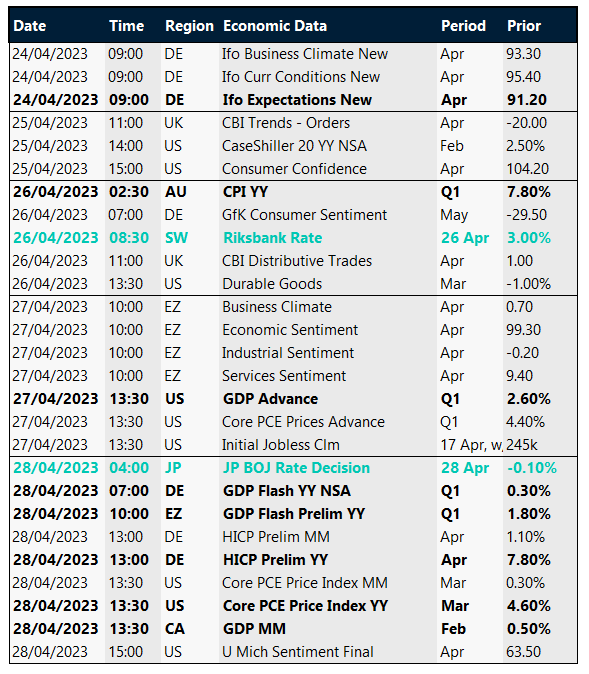

Key global risk events

Calendar: Apr 24-28

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.