Written by Convera’s Market Insights Team

US data closes out a stellar week

Boris Kovacevic – Global Macro Strategist

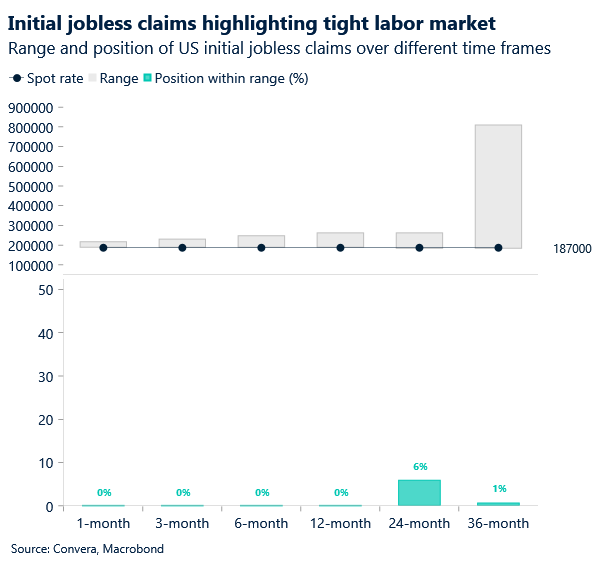

Global investors are in the process of paring back their expectations of rate cuts for the major central banks against the backdrop of better than expected US data and hawkish speeches from policy makers on both sides of the Atlantic. Labor market data concluded this week of macro surprises from the US economy with initial jobless claims showing that the number of Americans filling for unemployment benefits fell to 187 thousand last week, the lowest since October 2023.

The positive data followed upside surprises of retail sales, industrial production, and housing sentiment earlier this week. US two-year Treasury yields reversed last week’s fall and continued to support the Greenback, which is on track to rise for a third consecutive week versus the Australian dollar, the Japanese yen and Canadian dollar. The global reserve currency shows less strength against the euro and pound, as the future policy path pricing for the Fed, ECB and BoE have almost completely converged.

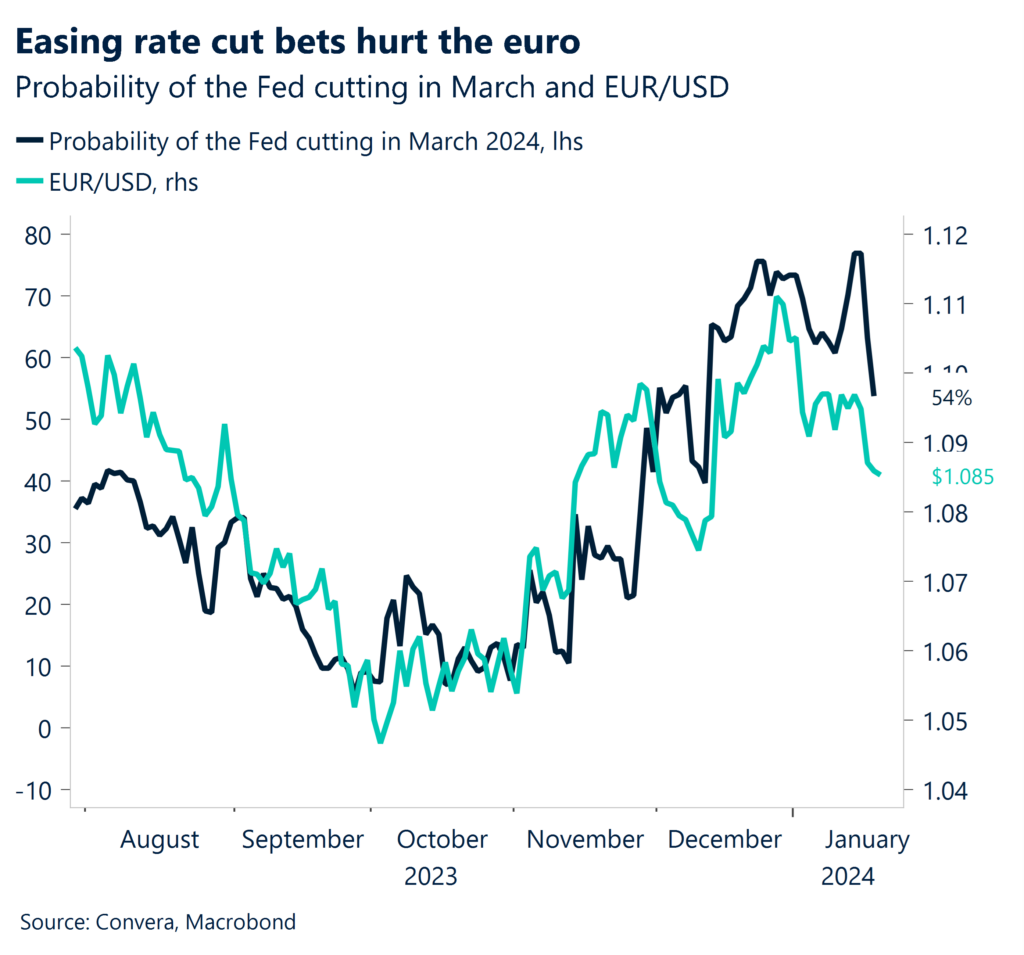

Global sentiment shook-off its recent gloom after a sequence of better US economic data boosted optimism across markets. The MSCI World Index rose in yesterday’s trading but remains flat on the week as US stock markets outperformed its global peers. This comes despite investors having reduced the probability of a Fed rate cut in March from 80% last week to 52% as of now. Markets are not so sure about the timing of the first policy easing. However, they are still pricing in six cuts for 2024 as a whole. This is the reason for the muted price action in FX markets this week.

EUR catches a breath

Ruta Prieskienyte – FX Strategist

European markets steadied as investors paused for breath following a recent sell-off that sent major equity indexes to multi-week lows. Germany’s DAX rose for the first time in four days, while the benchmark 10-year German edged to 2.3% for the first time since December 4th. Meanwhile, EUR/USD added to losses and closed marginally lower as hawkish Fed’s Bostic comments sent German-US 2-year yield spreads wider in the US dollar’s favour.

The euro depreciated earlier during the Thursday session when data revealed that passenger car registrations in the European Union fell by 3.3% y/y, marking the first decline in 17 months. Germany posted a double-digit contraction, plunging 23% from a year earlier. To add salt to the wound, construction output in the bloc declined by 2.2% from the previous year in November of 2023, the sharpest decline since February of 2021, and accelerating from the 0.7% drop in the previous month. The data underscored the impact of the ECB’s aggressive monetary tightening campaign on countries in the currency bloc as appetite for large purchases and projects waned.

On the ECB front, the key takeaway from the December minutes was that while policymakers agree that inflation would be brought back towards the 2% target in 2025, there is a need for the maintenance of a restrictive stance for some time. The minutes did not reveal anything materially new nor different from the recent slur of ECB communication, but further cemented that the fact it is simply too soon to discuss rate cuts given that one cannot be too confident that the task of combating inflation had been accomplished.

Broad weakness saw euro close lower against most G10 peers. EUR/USD is on track to a second weekly depreciation this year and is already down 1.6% YTD. The pair rebounded from its key support level at 200-day SMA during today’s Asia trading hours, but further downside risk cannot be ruled out with preliminary US Michigan Consumer report due later today as well as a whole host of central bank speeches scheduled from both Fed and the ECB. Meanwhile, EUR/GBP fell to a fresh 1-month low and is looking to close out the week lower for the fourth consecutive time, marketing the worst weekly performance in over 8 months.

Weak data, muted GBP/USD, strong pound

Boris Kovacevic – Global Macro Strategist

British investors had their eyes on the retail sales report this morning, as the downside surprise of the nominal wage growth print and upside beat of the inflation number left us with opposing data points up for interpretation. The anticipated macro week ended with the release of the report from the Office for National Statistics showing retail sales tumbling 3.2% in December and falling the most since January 2021. Economists had expected a 0.5% contraction. The fall was broad based at the end of last year with food stores performing poorly and department stores and goods retailers complaining about sluggish demand. The number rounds off 2023 with an annual growth rate of -2.8%, the lowest sales number since 2018.

Where does this leave the pound? We have been right in anticipating both 1) some disappointments across the data this week and 2) the pounds insensitivity to the data. While GBP/USD has reacted mildly to the three macro releases this week, the correlation between sterling and the global risk sentiment and Fed pricing has been more important than regional data. The data misses, or in the case of UK CPI, the upside surprise, will not be enough to push the Bank of England into one or the other direction. This explains the muted price action of the currency pair, which traded in a tight range of 1.8% over the course of the last five weeks, staying between $1.26 and $1.2870.

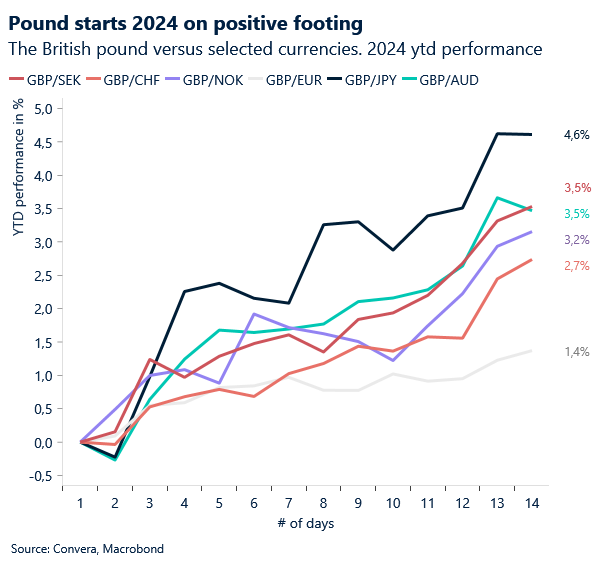

Apart from the US dollar and euro, the pound has been strengthening versus other currencies, showing how high inflation, and rising short-term yields continue to offer the pound some support. GBP is expected to appreciate for a fourth consecutive week versus the Swedish krona, Australian dollar and Canadian dollar and will end the third week in a row on stronger footing against the Japanese yen, Swiss franc, and Norwegian krone.

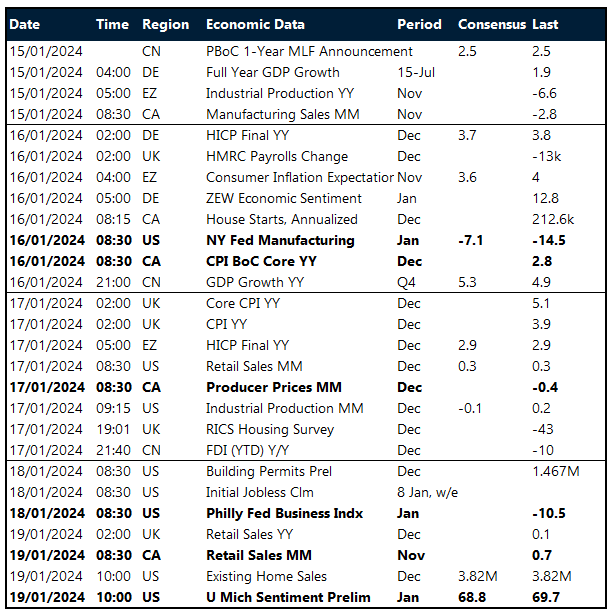

Key global risk events

Calendar: January 15 – 22

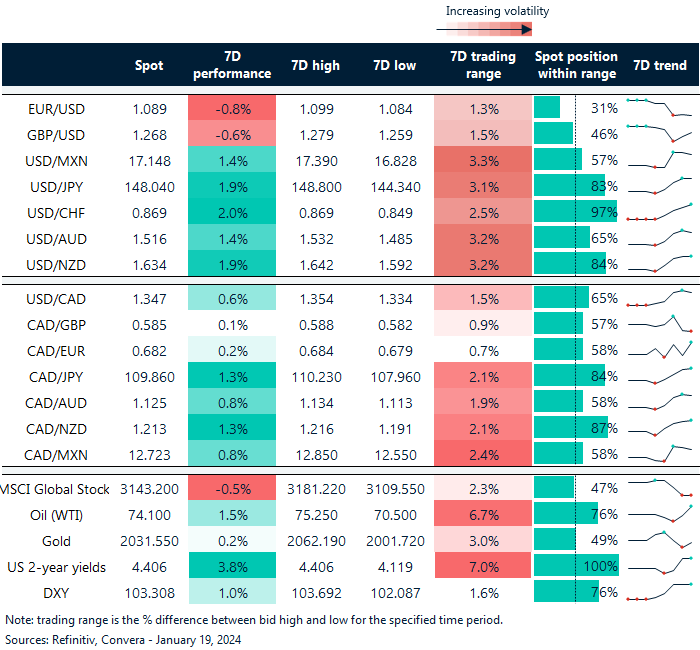

Dollar pushes higher on rising yields

Table: 7-day currency trends and trading ranges

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.