Written by Convera’s Market Insights team

Stocks fall, US yields and dollar rise

Boris Kovacevic – Global Macro Strategist

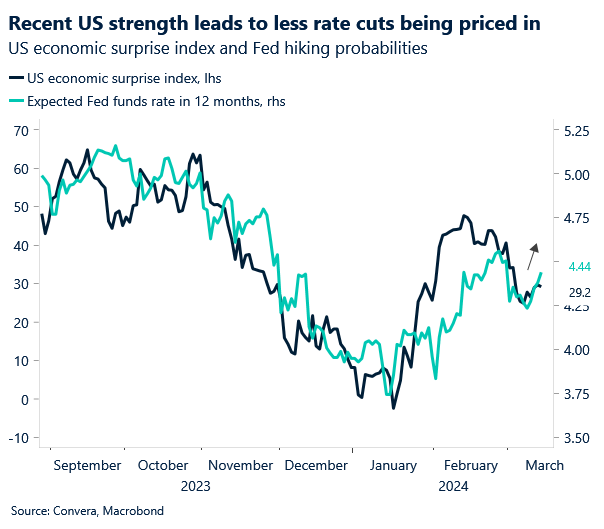

Global stocks slipped after a raft of US economic data cast doubt on the timing and size of rate cuts from the Federal Reserve (Fed) this year. After falling to a 1-month low last week, US yields have marched higher with the 10-year yield on track for its biggest weekly rise since October last year. Accordingly, the US dollar has appreciated, with the dollar index scoring its best daily performance in a month.

The latest inflation data continues to point in the wrong direction from the Fed’s perspective, as the fifth relevant inflation print came in hotter than expected. January had been about by CPI, PPI and PCE inflation beating expectations and pushing the expected easing bets for 2024 down. February is shaping up to repeat the hot numbers from the prior month with consumer- and producer prices once again coming in above consensus this week. The latter rose by 0.6% on the month, raising the annualized growth rate from 1.0% to 1.6%. A separate report showed initial jobless claims remaining at historically low levels (209k), supporting the thesis that the easing of the labour markets tightness seen via other indicators is happening at a moderate pace. Retail sales did rise less than expected in February (0.6% vs. 0.8% expected), with the January print being revised down from -0.8% to -1.1%. However, after a brief back and forth on pricing, markets did settle on trusting the inflation beat more than the sales disappointment, sending the dollar higher.

Market pricing is now finally back in line with the FOMC’s own rates projections, published via the dot plot back in December, showing three rate cuts for 2024. With government bond yields rising for the fourth day in a row against the backdrop of the inflation surprises, discussions have emerged about the upcoming dot plot next week showing only two rate cuts for this year. This remains a threat for risk sensitive assets hoping for a quick pivot from the Fed.

Pound drops as risk appetite ebbs

George Vessey – Lead FX Strategist

The British pound has fallen around 1.3% from its 7-month high of $1.2893 recorded last week. Yesterday saw GBP/USD accelerate lower after US data triggered a reduction of 2024 US easing prospects, sending the UK-US 2-year yield spread lower and thus weakening the pound. Wavering global risk sentiment, as a result of diminishing rate cut bets, has also weighed on the pro-cyclical pound.

In the UK this week, data indicated that Britain’s economy had resumed growth in January after experiencing a shallow recession in the second half of 2023. However, the GDP report hasn’t significantly altered the outlook for UK rate cuts this year, particularly after Tuesday’s jobs report revealed a slowdown in wage growth rates. We expect a majority of the Monetary Policy Committee to vote to keep Bank Rate at 5.25% next Thursday. But sticky pay growth in the private sector, and recent comments by MPC members point to another three-way split in the vote. Implied volatility (IV), a gauge of expected price fluctuations over a specific time frame, is at multi year lows, and 1-week IV haven’t spiked much since capturing the key central bank meetings next week. Meanwhile, 3-month GBP/USD IV is more than one standard deviation below its historical mean.

We’ve only witnessed such a sustained period of low volatility a handful of time over the past three decades. A helping hand here is the convergence of policy easing expectations of the G3 central banks. If the pace and timing of easing this year starts to diverge off the back varying economic data, this could kick-start a fresh period of volatility, especially once one of these central banks pulls the trigger.

ECB signals readiness to cut rates in June

Ruta Prieskienyte – FX Strategist

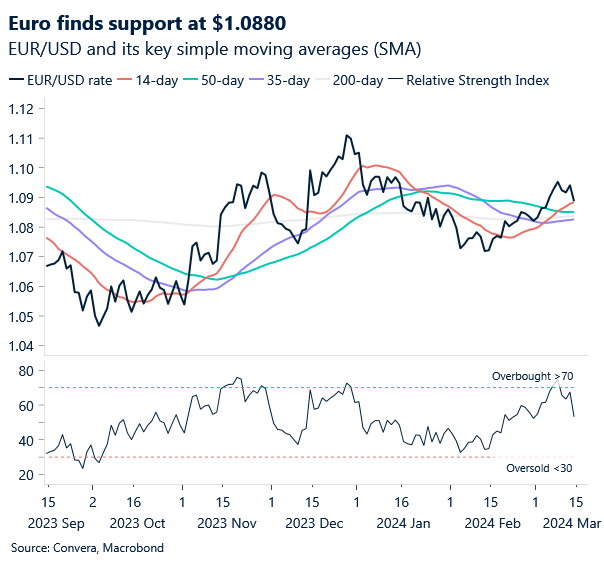

As has been the case since Q2 2022, EUR/USD was unable to hold near the $1.0950 handle after hot US PPI and lower than expected initial jobless claims cast doubt on the timing and size of Fed rate cuts reignited demand for the Greenback. German-US 2-year bond spread widened to a near 2-week low at -180bps, halting the euro’s recent bullish streak.

Both the Fed and the ECB have signalled interest rate cuts could come soon and investors are speculating for the first reduction in June. Most ECB officials now appear aligned on the June timing as well. While one of the hawks, ECB’s Knot, urged investors against declaring victory over inflation too early, markets chose to pay attention to ECB’s Stournaras who provided the most specific and detailed rate cut schedule to date. The Governor of Bank of Greece argued that the ECB must lower borrowing costs twice before its August summer break and another two times before the end of the year, signalling a cumulative of 100bps rate cuts are on the cards by year-end. The policymaker highlighted that keeping rates at historic highs could foster a monetary policy environment that is too restrictive, hindering an already difficult economic recovery across the bloc. He also downplayed still strong nominal pay increases by stressing that real wages will reach the pre-pandemic level only in 2025. Consequentially, market participants moved to price in additional monetary easing, expecting over 90bps of rate cuts by end of 2024.

The euro is on track to close the week stronger than most of its G10 peers, eyeing largest gains against the Scandi pair of NOK and SEK amid downside surprises in inflation. Meanwhile, EUR/USD is looking to shed close to 0.6% value when compared on weekly basis – the first w/w loss in since mid-February. EUR/USD is currently licking wounds at a support level near $1.0880 (14-day SMA). With market sentiment souring overnight after the PBOC disappointed investors hoping for more stimulus steps, we’re likely to enter the important central bank meeting week with softer momentum across risk assets.

CAD battered by renewed USD buying

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: March 11-15

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Join us for Convera Live! A series of in-person events discussing the future of global payments.