Written by Convera’s Market Insights team

Payrolls to power dollar’s dominance

George Vessey – FX Strategist

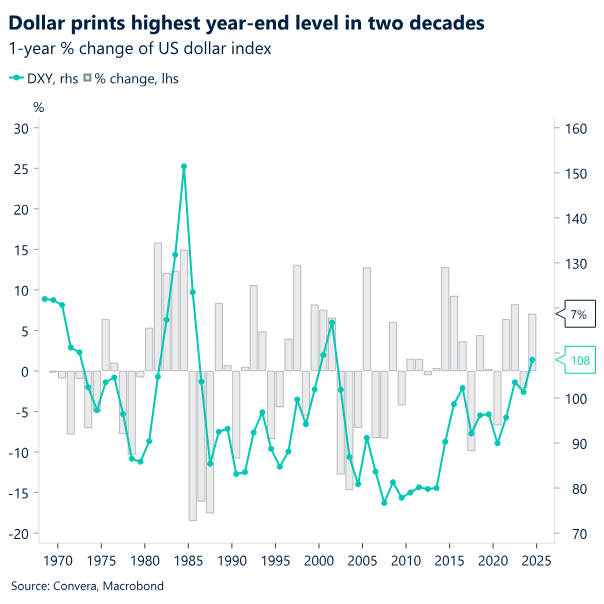

The US dollar defied consensus expectations of weakening last year with a solid appreciation, powered by US economic outperformance, a hawkish repricing of Federal Reserve (Fed) rate expectations, and the Republican’s election victory. The US dollar index has climbed over 20% in the last four years. It rose 7% in 2024, and recorded its highest year-end level in two decades. It started 2025 in the same fashion, extending to its highest level since October 2022 last week following strong US data and thin market liquidity. However, today, a report that US President-elect Donald Trump’s aides are exploring a “universal” tariff plan only covering critical imports has sparked a circa 1% decline in the greenback versus many peers.

The US economy was outperforming international peers before the election, forcing traders to scale back Fed easing bets, sending US yields and the US dollar higher. President-elect Donald Trump’s win and the associated policies added to the bullish dollar case. Thus, at this stage, the dollar’s strength should hold into early 2025 thanks to a supportive economic and fiscal backdrop as well as potential tariffs. This week, investors will analyse the minutes from the Fed’s December policy meeting for clues on if and when interest rates will be lowered again. On the data docket, factory orders, job openings and the ISM services figures will be watched closely, but Friday’s jobs report will be the main attraction.

For now, we are not expecting any rapid deterioration in the US labour market. Instead, it might be a more gradual one that is consistent with the Fed staying cautious on easing, especially amidst inflation concerns fuelled more by tariff risks. Fundamentally speaking, there’s little reason to bet against further dollar strength, but it won’t be a linear upward trend in 2025.

CAD claps Trudeau news

George Vessey – FX Strategist

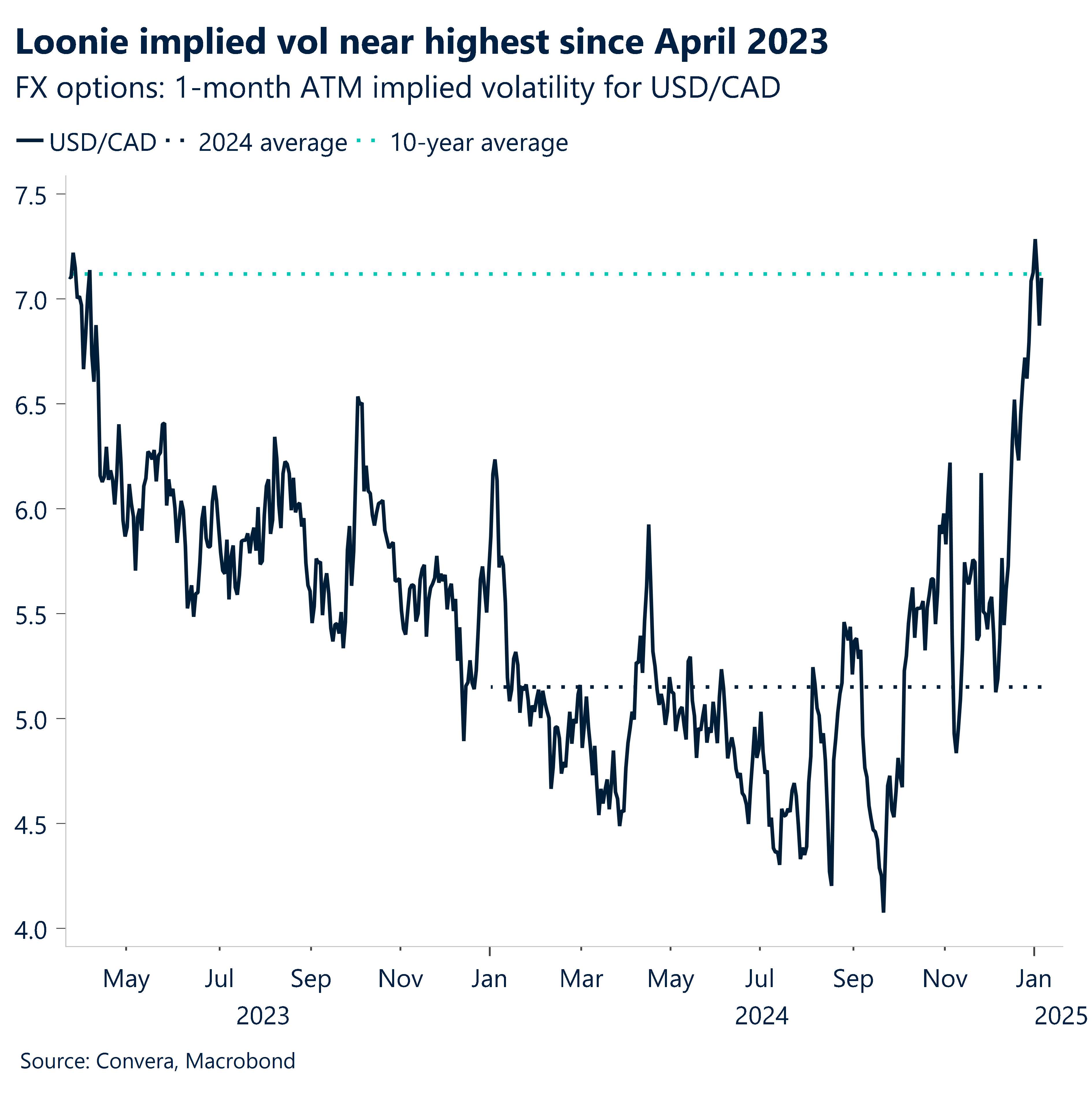

The Canadian dollar is enjoying the news that Canada’s prime minister Justin Trudeau will resign as leader of the Liberal Party this week. The Loonie raced to the top of the G10 FX leaderboard, rising almost 1% against the US dollar, though traders are pricing more intense USD/CAD fluctuations over the coming month, amidst a string of key event risks that could weigh on the currency.

Trudeau has been facing pressure from elected lawmakers in his party to quit for several months, and that intensified when his finance minister stepped down in mid- December due to concerns around policy. No final decision on the resignation has been made, however, sources expect an announcement to happen before an emergency meeting of Liberal politicians on Wednesday.

Despite the Canadian dollar reacting positively to the report and USD/CAD more than reversing Friday’s rally, the currency pair is still hovering near its highest level in four years. Diverging policy rate expectations between the US and Canada and the risk of Canada being hit by US tariffs remain overwhelming negative drivers at this stage.

Negative pressures pile up on euro

George Vessey – FX Strategist

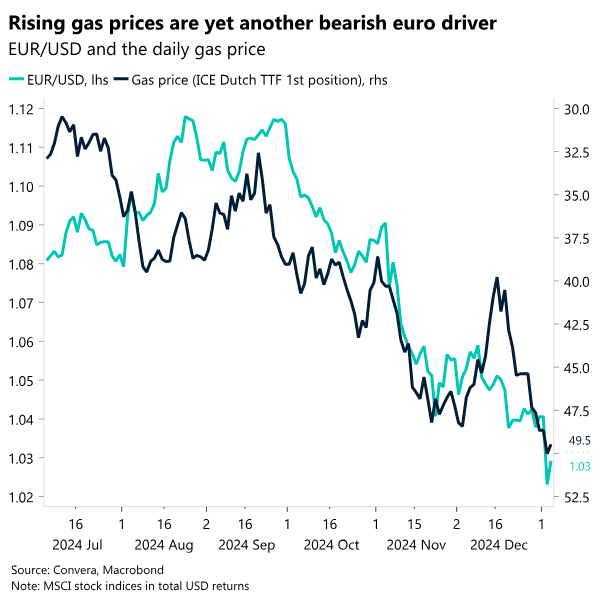

The euro remains plagued by a plethora of negative factors, and is already suffering from the so-called January Blues. EUR/USD kick-started 2025 by falling to its lowest level since November 2022, taking out the $1.03 handle, and hedge funds are raising bets on an extended slide toward parity in the coming months.

Though excess euro pessimism is already near, the euro domestic context, both cyclical and political, remains convincingly euro-negative at this stage. Feeble Eurozone economic growth remains a key concern relative to major peers, even compared to the UK, whilst the looming danger of US tariffs and another energy crisis only exacerbates the fragile situation. The last time EUR/USD hit parity was just after Russia’s full-scale invasion of Ukraine. A big driver of this move was the surge in gas prices and a weakening of the bloc’s terms of trade. Now, gas inventories across the continent are already falling at the fastest pace since 2021, and with the cold weather forecast for northern Europe likely compounding demand for heating fuel, the potential for another energy crisis is back on the radar.

Diverging policy expectations between the Fed and ECB are also helping to drive the euro’s slide, via the widening in the short-dated swap rate differential. The focus this week will be on December’s inflation figures, with a rebound expected in the Eurozone. Any significant upside surprise might curb markets confidence on four ECB rate cuts this year, which in turn, should help the euro stabilise.

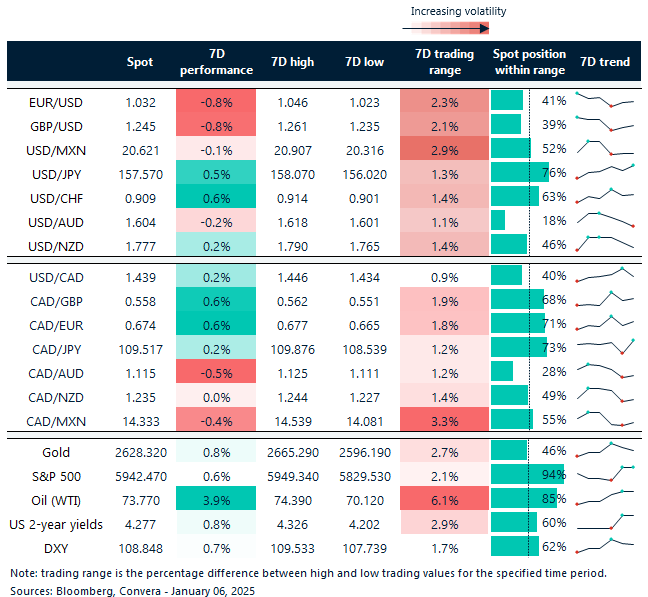

European FX off to a weak start in 2025

Table: 7-day currency trends and trading ranges

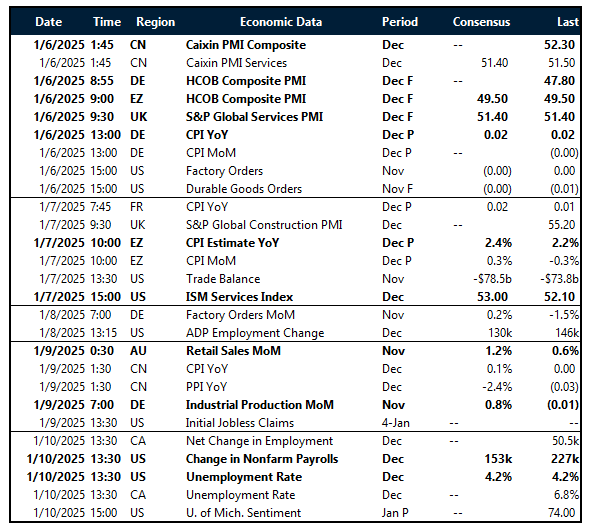

Key global risk events

Calendar: January 6-10

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.