Written by Convera’s Market Insights team

FX in Trump’s shadow in 2025

Boris Kovacevic – Global Macro Strategist

The US economy seemingly ended last year on a stronger than expected footing as yesterday’s labor market and services data surprised to the upside. This adds fuel to continue cutting the already heavily scaled back expectations of Fed rate cuts for this year and has pushed both the US dollar and longer dated bond yields higher once again. If not for the brief periods in Q2 ’24 and Q4 ’22, the 10-year yield at 4.7% would be the highest level it traded since 2007. Zooming in on the data, the US services sector expanded more than anticipated in December as the purchasing manager index rose from 52.1 to 54.1. It was the 10th time the barometer had expanded (above the 50 mark) last year. At the same time, job openings increased by 259k to 8.098 million in November and well above the expected 7.7 million. This marked the highest level in six months and the third increase in a row.

Stepping back from the short-term view, it is important to lay out our broader macro strategy going into the year. In 2024, the global macro picture was dominated by the exceptional resilience of the US economy, which was powered on by the spending power of its consumers and tight labor market. The Fed was still given the opportunity to cut interest rates by 100 basis points due to the rapid fall of inflation in the previous 12 months. However, adding the prospects of higher tariffs under president-elect Donald Trump to the already worrisome spike in inflation and macro resilience now means that policy makers will tread carefully in easing monetary conditions any further. We are therefore starting the year with markets expecting only a single rate cut for 2025. This could not be more different to last January exactly twelve month ago, when market pricing set expectations for more than six rate cuts over the year. We think that markets will be slightly caught wrongfooted once again, but in the opposite direction. Despite the macro resilience, the US labor market is likely to weaken further and the probability of Trump using tariffs more rationally and sensibly has increased since the Washington Post report. This could give way to 2-3 cuts if inflation remains anchored.

What does this mean for the US dollar? Well, it will continue to be hard betting against the Greenback. Politics across the globe will be shaped by last years election results, that shifted broadly to the right. New elections in Germany in February and the resignation of Justin Trudeau in Canada bring uncertainty, from which the dollar can profit. However, we remain cautious of the extent to which the currency can appreciate from here on. Trump’s tariff rhetoric will matter more than regional politics and we expect less drastic increases than the consensus.

No prospect for bullish change

Boris Kovacevic – Global Macro Strategist

The euro failed to build on its two-day winning streak that started on Friday and is back below the $1.04 mark. Stronger US macro data has raised inflation concerns and pushed longer dated Treasury yields higher, pressing the common currency down in the process. Price pressures have recently started building in Europe as well, putting a lid on ECB cutting expectations. However, the weak growth outlook means that stagflationary risks loom large, making it difficult for euro bulls to keep up with the selling pressure.

European inflation increased for a fourth consecutive month in December, ending the year on a five month high of 2.4%. The increase was stronger than expected but can be explained by base effects, lessening the case for the ECB to turn hawkish. Today’s release of German factory orders adds to the bleak picture as they tumbled by 5.4% on the month, making November the second weakest month in about a year. European economic sentiment, retail sales, and German industrial production is coming up this week. However, the main focus will be on the US labor market report coming out on Friday.

UK making headlines in fixed-income market

George Vessey – FX Strategist

Sterling remains trapped in a downtrend against the US dollar, one that’s been in place since the start of October 2024. It was at that juncture when polling for US President-elect Donald Trump started improving, the US data surprise index turned positive and Fed easing bets began scaling back. Meanwhile, the UK’s autumn budget was poorly received and economic data started to disappoint.

During this circa 3-month period, GBP/USD sunk around 8%, from $1.34 to less than $1.24 last week – a 9-month low. The rebound witnessed this week was largely a result of a weaker dollar amidst tariff related news flow, but strong UK retail sales figures gave the pound an extra boost. However, GBP/USD failed to break above its 3-month-long downtrend line. A close above $1.26 would do the job, but the pair has pulled back under $1.25 after a slew of strong US data. Moreover, the UK was making headlines in the fixed-income market yesterday too. A poor 30-year auction drove yields above 5.22%, their highest level since 1998, and piling the pressure on the Chancellor to maintain market stability. The Labour government plans to sell £297 billion of bonds this fiscal year – the second-highest on record – is keeping gilts anchored and yields high.

As is the prospect of fewer interest rate cuts by the Bank of England (BoE). Traders are betting the UK central bank will deliver only two quarter-point reductions this year, compared to bets on more than three at the start of last month. Although this dynamic should support the pound through the rates channel, a high-for-longer rate narrative in a weakening economic backdrop may not be all that pound bullish if stagflation chatter resurfaces.

Oil up 4% in a week

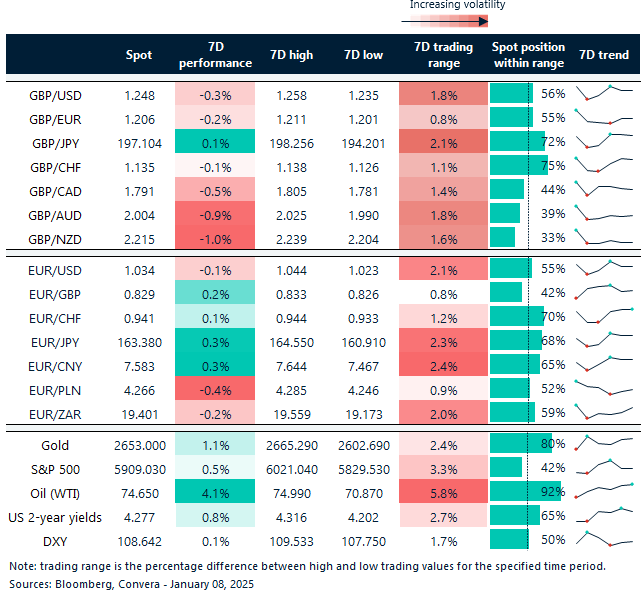

Table: 7-day currency trends and trading ranges

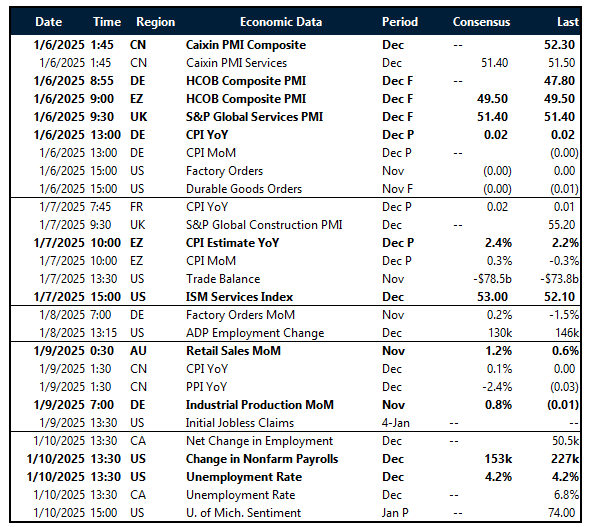

Key global risk events

Calendar: January 6-10

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.