Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Korean won falls to four-year lows

Asian FX markets were dominated by the sharp move lower in the Korean won overnight after South Korean president Yoon Suk-Yeol threated to introduce martial law before the move was rejected by the South Korean parliament.

The Korean won tumbled with the USD/KRW at the highest level since the Covid pandemic.

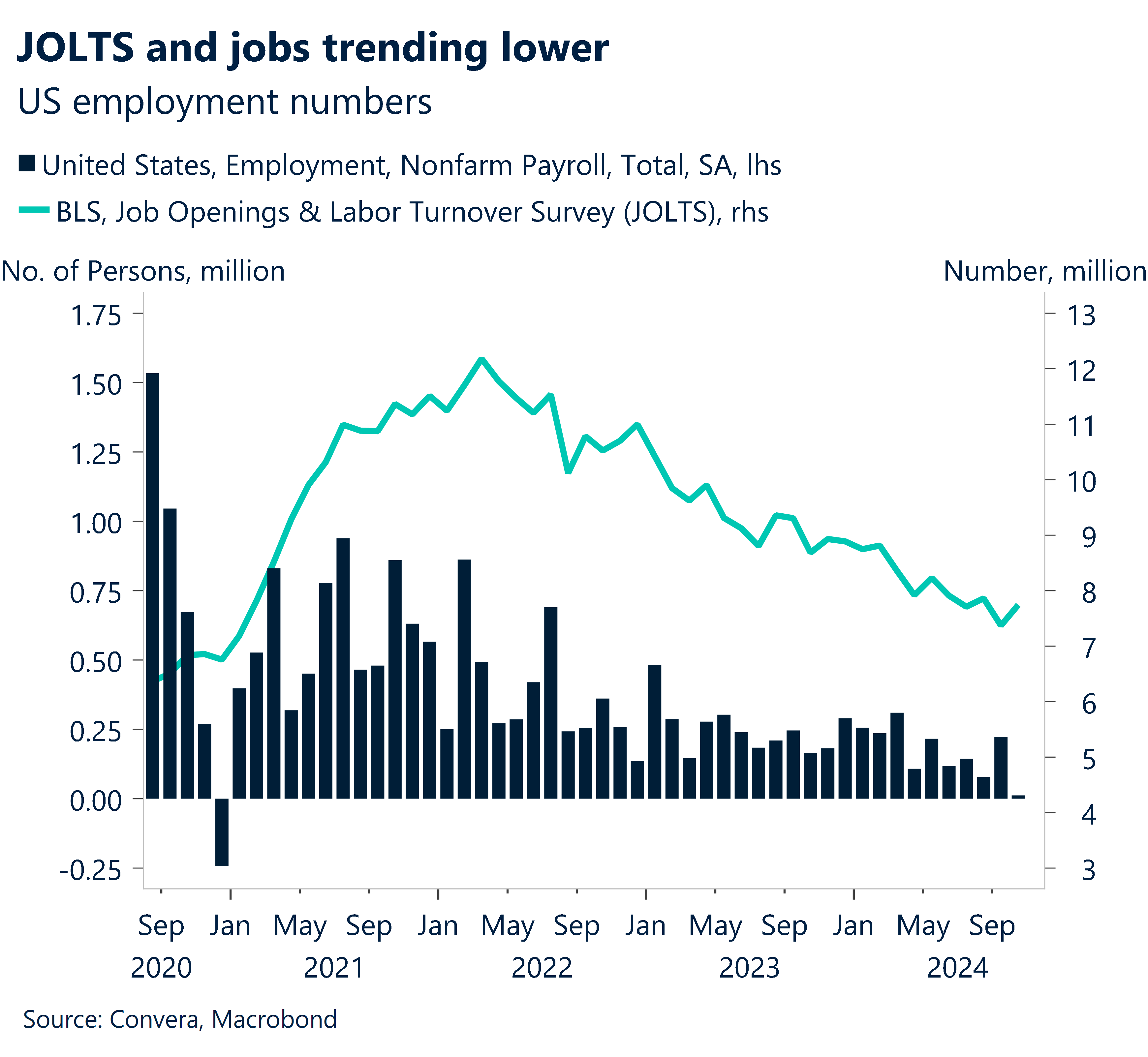

The USD dollar was moderately lower in other markets as investors awaited Friday night’s all-important jobs report. Overnight, the Job Openings and Labor Turnover Series (JOLTS) was better than expected at 7.74m versus the 7.51m forecast.

The AUD/USD gained 0.1% while NZD/USD fell 0.1%.

The USD/SGD was flat but USD/CNH gained 0.2% ahead of more key PMI numbers – the Caixin services PMI is due at 12.45pm AEDT.

Australian Q3 GDP seen as moderate amid mixed signals

Looking forward, Australian GDP is due at 11.30am today (AEDT).

We see Q3 GDP tracking at 1.5% year-over-year and 0.7% quarter-over-quarter.

We anticipate moderate increase in private consumption but robust growth in government expenditure and investment in homes and businesses.

With export volume growth surpassing import growth, net exports also seem to have played a role in growth.

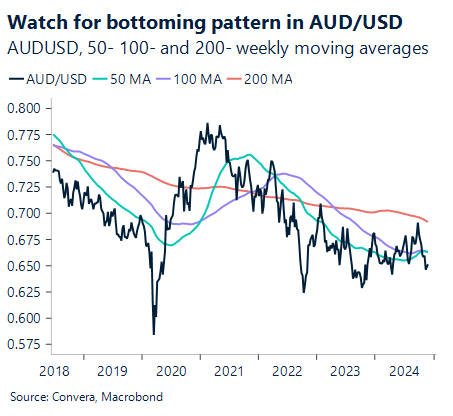

For now, it seems the AUD/USD exchange rate will remain sideways inside the lower end of the 2H22-2024 trading range.

The AUD has been one of the better performers following the US election, As such, we will watch for indications of a bottom pattern in the low-60s. The 0.66 handles provide the next key resistance.

Steady prices point to policy pause in Philippines

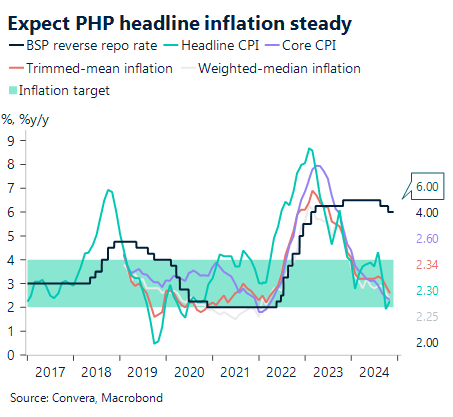

This Thursday will see the announcement of the Philippines’ CPI.

Given that decreased retail gasoline prices balance increased power rates, we anticipate headline inflation to stay steady at 2.3% year over year in November, as it did in October.

Due to weather-related interruptions in supply, rice prices also eased further, although other food commodities saw slight increases.

Our projection predicts 0.0% m-o-m seasonally adjusted inflation on a sequential basis (October: 0.1%). We anticipate that core inflation will stay constant at 2.4% year over year.

Technically speaking, USD/PHP has corrected slightly from 59.09 YTD highs but the pair remains in a longer term uptrend with the 50-day EMA bullish crossover above the 200-day EMA.

CNY weaker across Asia

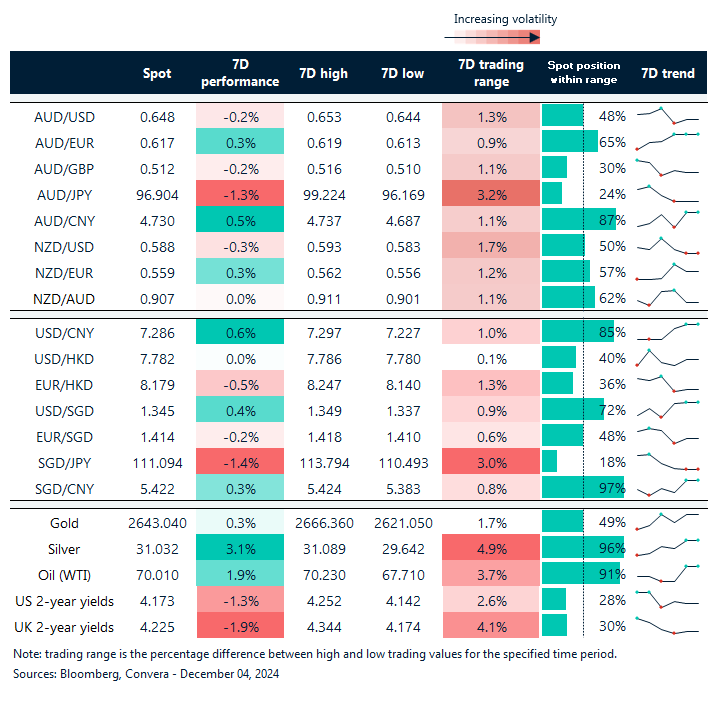

Table: seven-day rolling currency trends and trading ranges

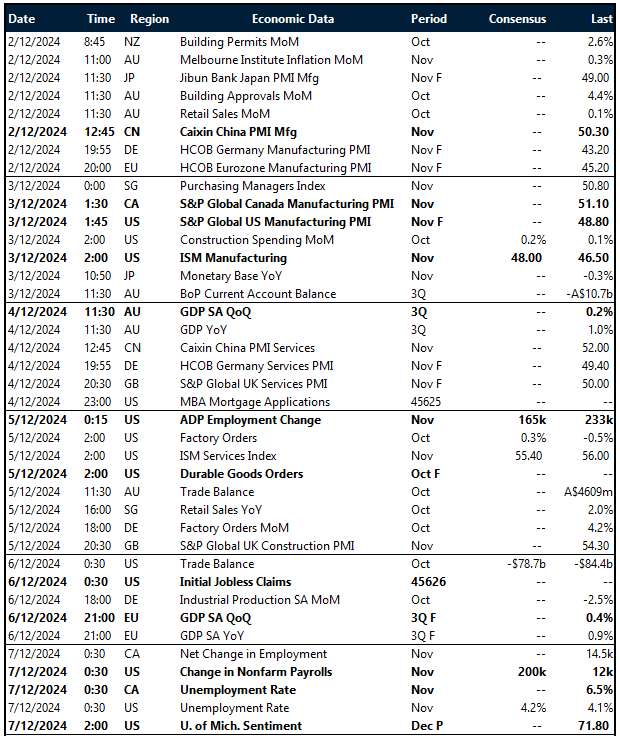

Key global risk events

Calendar: 2 – 7 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.