Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US PPI drop sparks stockmarket rally

The US dollar was down sharply overnight as a weaker than expected producer price index (PPI) reading suggested tonight’s key CPI number might also be lower and opened the path to a September rate cut.

Annual headline PPI fell from 2.6% to 2.2% while the annual core reading dropped from 3.0% to 2.4% in a sign of rapidly falling price pressures.

US shares surged on the news with the S&P 500 up 1.7% and the Nasdaq up 2.4%.

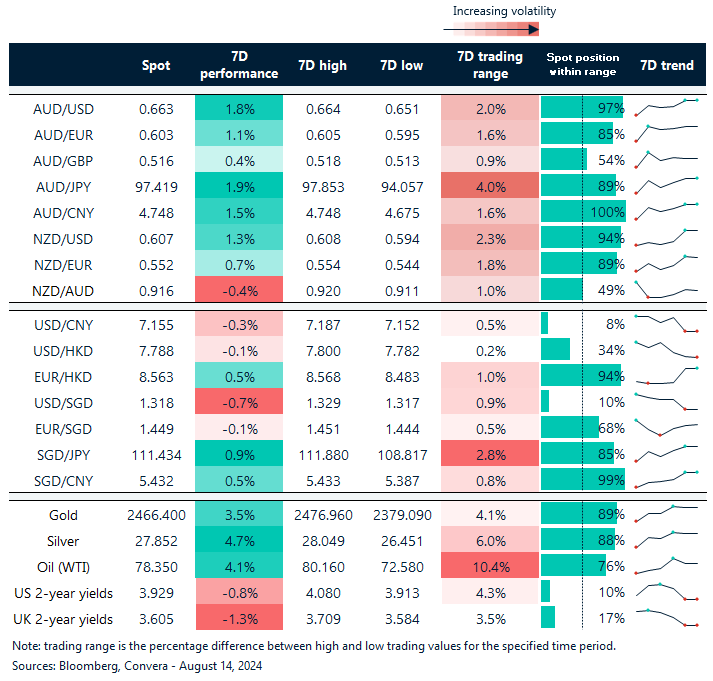

The greenback tumbled with the USD index closing at the lowest level since 16 January.

The USD/SGD fell to the lowest level since March 2023.

The USD/CNH was also sharply lower but the USD/JPY was broadly steady. The AUD/USD gained 0.7% but the NZD/USD outperformed with a 0.9% gain ahead of today’s RBNZ decision.

RBNZ could spark NZD volatility

At today’s Reserve Bank of New Zealand meeting, the RBNZ looks likely to start an easing cycle with a 25bp rate cut to 5.25%.

A slight majority of economists expect the RBNZ to remain on hold on Wednesday – 12 out of 21 according to Bloomberg – but financial markets are looking for a reduction with a 67% chance of cut priced in (source: Bloomberg).

However, with the NZ economy pressured, the rate of unemployment grown dramatically, and the rate of inflation, at 3.3% year-over-year, lower than the RBNZ’s projection and near top of its 1-3% target zone, the RBNZ might be likely to take action.

Since policy is fairly stringent and adjustments take time to take effect, we believe the RBNZ needs to move quickly. We would not rule out a significant rate cut of 50 basis points at this meeting.

Considering the volatility of other asset classes and the changing global cyclical outlook, the NZD/USD exchange rate has remained remarkably steady, recently climbing to a one-month highs.

The NZD faces risks of losses as we head into the end of the year because of the country’s extremely poor growth and the likelihood of further central bank rate cuts.

USD risks with CPI expected to fall

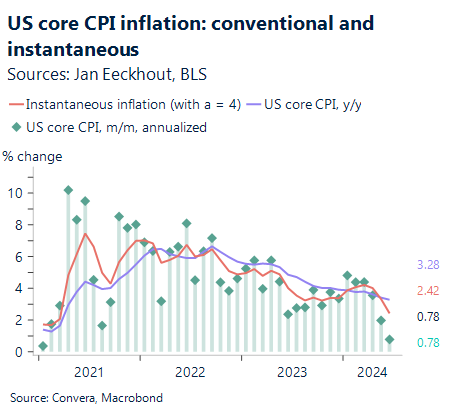

Tonight, US CPI is the key reading and it is probable that core CPI inflation stayed low in July. However, with markets looking for a fall, a higher number could unsettle sentiment and see the USD higher.

We anticipate an m-o-m increase of just 0.077%, which is comparable to the 0.065% reading from June. The underlying inflation rate is still slowly declining, and volatile elements in July are probably going to make this deceleration more pronounced. Prices for essential products and services connected to travel are predicted to decline for a fourth straight month.

After a significant slowdown in June, we anticipate a small recovery in rent and OER inflation. Lead indications indicate that the underlying disinflation trend in housing should persist until the end of the year, notwithstanding this little reversal.

The Fed will continue to prioritize labor markets if disinflation persists leading to rate cuts as soon as September.

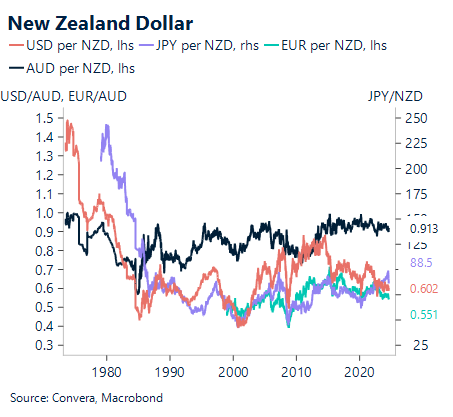

Kiwi at highs ahead of RBNZ

Table: seven-day rolling currency trends and trading ranges

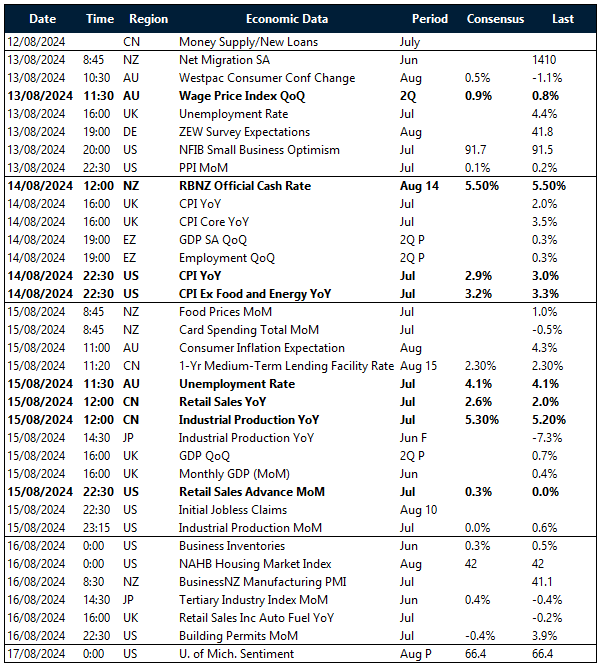

Key global risk events

Calendar: 12 – 17 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]