Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD/JPY fall pressures greenback

The US dollar was mostly weaker across Asia on Friday as the Thanksgiving holiday-thinned trade kept the focus on the APAC region.

A hot reading from Tokyo’s October CPI, at 2.2% versus 2.0% forecast in annual terms, saw markets look towards another Bank of Japan rate hike on 19 December.

The Japanese yen jumped and USD/JPY fell below 150.00 for the first time in six weeks.

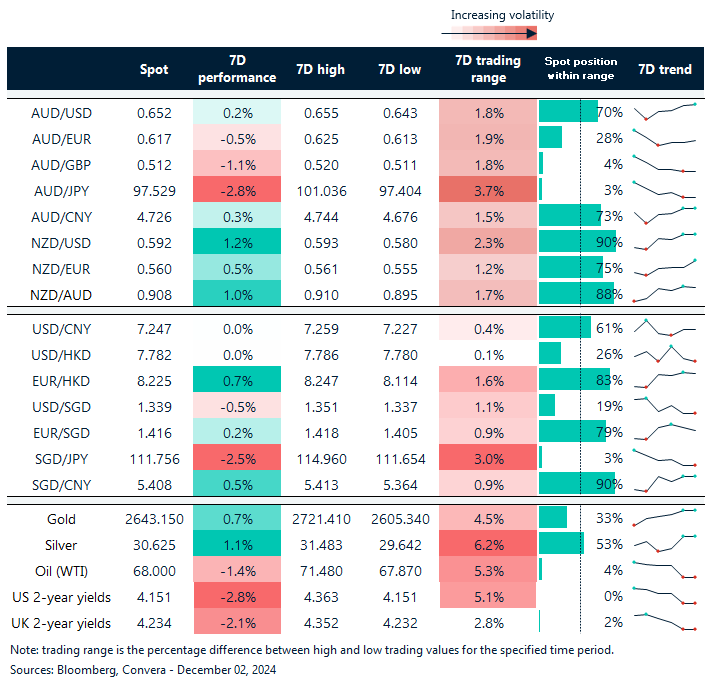

The greenback was mostly weaker through APAC with the AUD/USD up 0.2% and NZD/USD up 0.3%.

In Asia, the USD/SGD fell 0.2% while USD/CNH was flat.

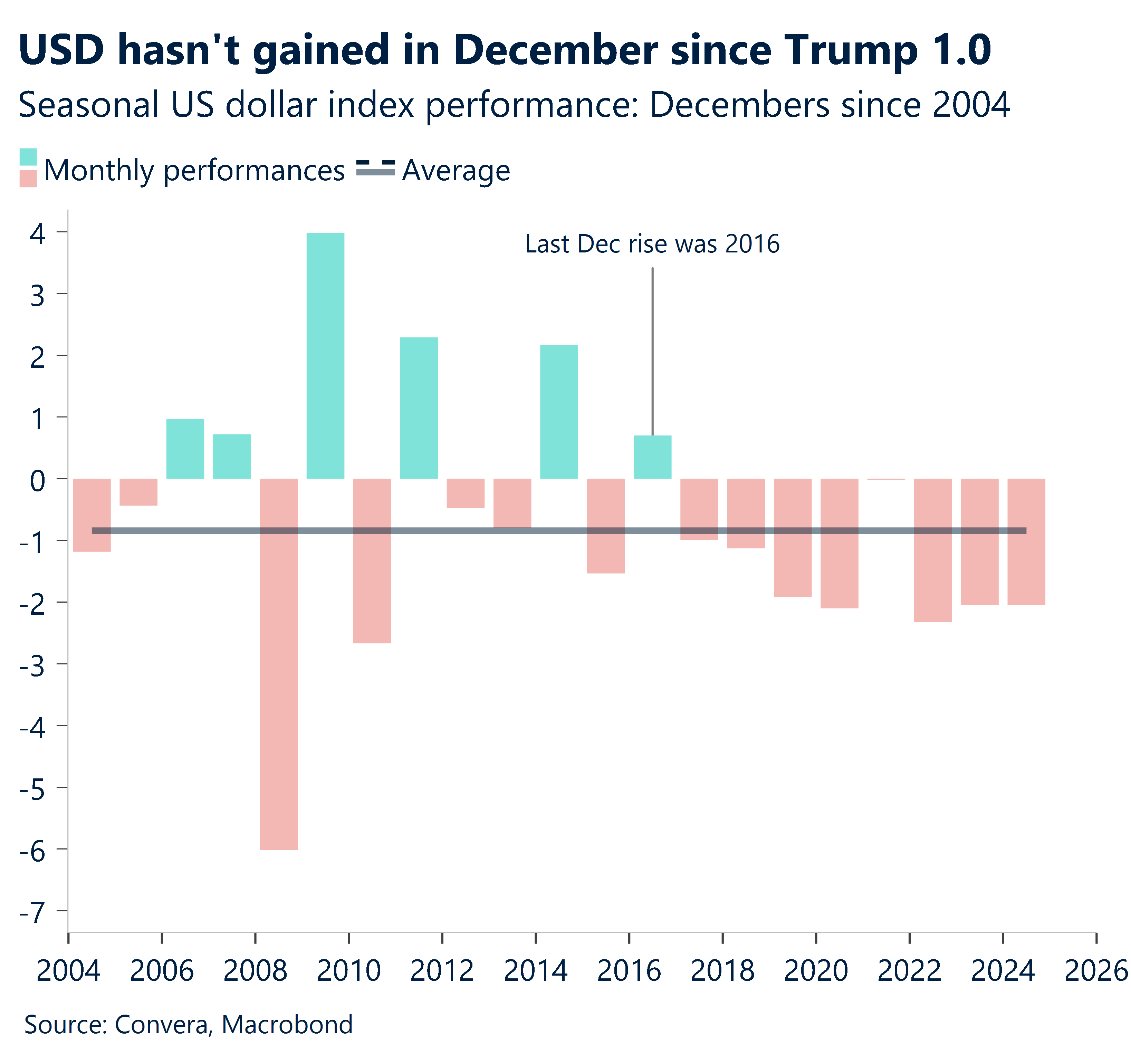

The US dollar’s losses capped a poor week for the greenback after an almost non-stop run of weekly gains since October. The USD index suffered its worst week since August.

US employment and global PMIs in focus this week

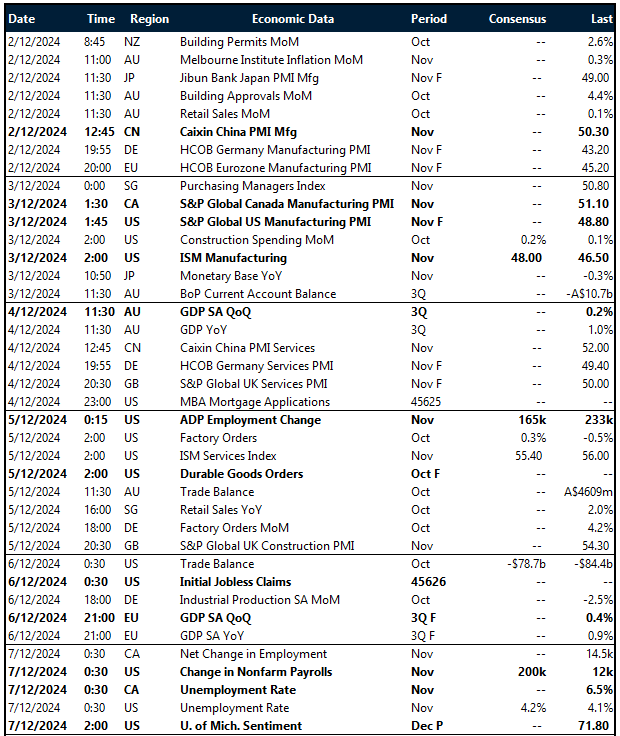

FX markets will be closely watching the US employment report for November, along with a series of global PMI readings and central bank speakers throughout the week.

The US jobs report will be a key highlight, with forecasts pointing to 200,000 new jobs and the unemployment rate ticking up to 4.2%.

Manufacturing and services PMIs from major economies will set the tone early in the week. China’s Manufacturing PMI is expected to show mild expansion, while the US ISM Manufacturing is forecast to remain in contractionary territory at 48.

In the Asia-Pacific region, the Reserve Bank of Australia will receive key inputs for its 12 December meeting with Q3 GDP data and October trade balance.

Export strength hopes for Chinese manufacturing

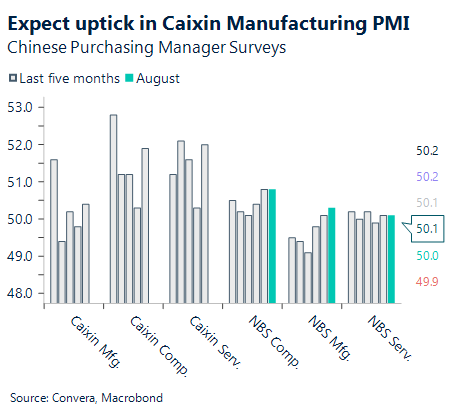

In the near term, Chinese PMI will be in focus, with Caixin China PMI due at 12:45p, AEDT on Monday.

Since export growth is expected to continue to be strong and is further bolstered by the recent reductions in the export tax rebate, which should bring some short-term front-loading in the second half of November, we anticipate that the Caixin manufacturing PMI, which surveys more SMEs and exporters in the eastern coastal region of China, will rise from 50.3 in October to 50.5 in November.

Technically speaking, USD/CNY looks set for bullish momentum upside, with 50-day EMA crossing above the 200-day EMA from the bottom. The next key resistance level is seen at 7.2773 (YTD high).

USD lower in Asia

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 2 – 7 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.