Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Greenback stages comeback

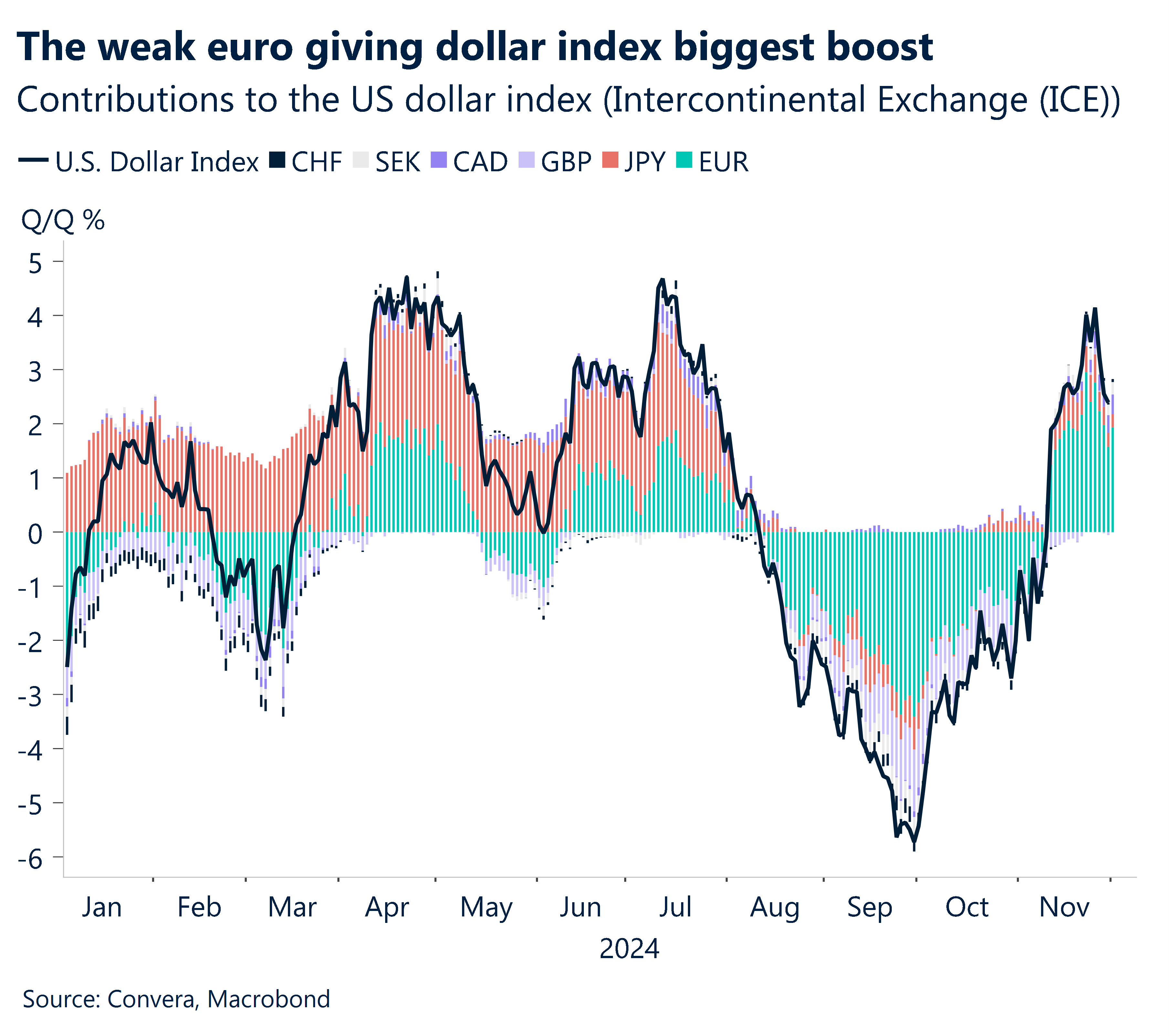

The US dollar shook-off its Thanksgiving hangover with a strong performance for the first trading day of December with the USD index rebounding from three-week lows as it gained 0.6%.

The greenback was helped by a better ISM manufacturing number with, notably, new orders jumping higher but prices paid easing – a perfect mix of growth as inflation slows.

US shares continued to gain with the S&P 500 up 0.3% and the Nasdaq up 1.0%.

The greenback’s best gains were against the euro as political worries in France hit the single currency. The EUR/USD fell 0.8%.

The Aussie was also lower after a weaker-than-expected reading from early GDP numbers signalling the potential for a miss when the September-quarter GDP numbers are released on Wednesday.

Company operating profits fell 4.6% over the last quarter while inventories look likely to detract from growth with a 0.9% fall over the quarter. Net export numbers are due at 11.30am AEDT today.

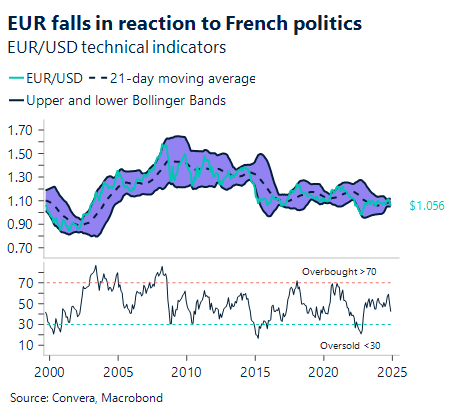

EUR weaker on French political noise

The euro was weaker overnight thanks to French political noise around the social security budget, with far-right leader Marine Le Pen warning on a “no-confidence” vote.

A successful no-confidence vote would likely drive meaningful EUR downside beyond current ranges.

For now, the EUR/USD appears pressured after the market turned significantly at longer-term trend line resistance in the 1.12 handle that drove the EUR/USD’s negative momentum.

We see further decline into 2025, with the next support around 1.0252, and 1.0202. The market might find a bottom in the first few months of next year, however.

In other markets, the euro was also lower, with the AUD/EUR back near recent higher around 0.6200, and EUR/SGD nearing the 1.4000 long-term support.

US’s steady expansion signals dollar support

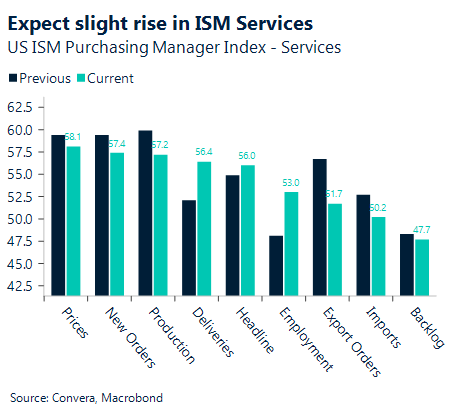

Overnight, the US’s ISM manufacturing number came out stronger than expected, at 48.4 versus the 47.7 expected, helping the USD higher.

US ISM Services is scheduled for Wednesday night and might continue the theme of a stronger US economy.

In November, we anticipate that ISM services will slightly increase from 56.0 to 56.4. The month saw a significant improvement in both national and regional service surveys.

We anticipate that the employment index will stay in expansionary territory in November after rebounding last month.

Technically speaking, the USD index continues to show strong price action with 50-day EMA still above 200-day EMA with next key support at 104.70.

USD in comeback

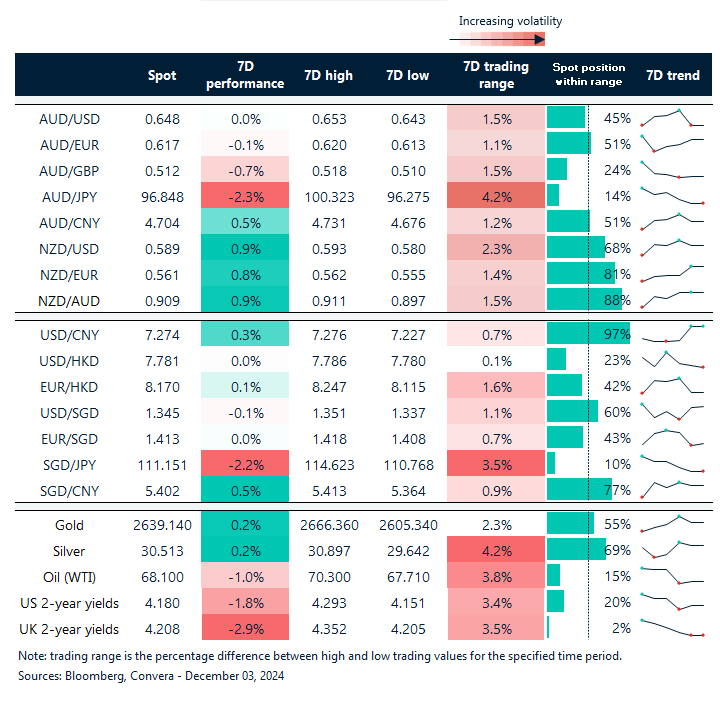

Table: seven-day rolling currency trends and trading ranges

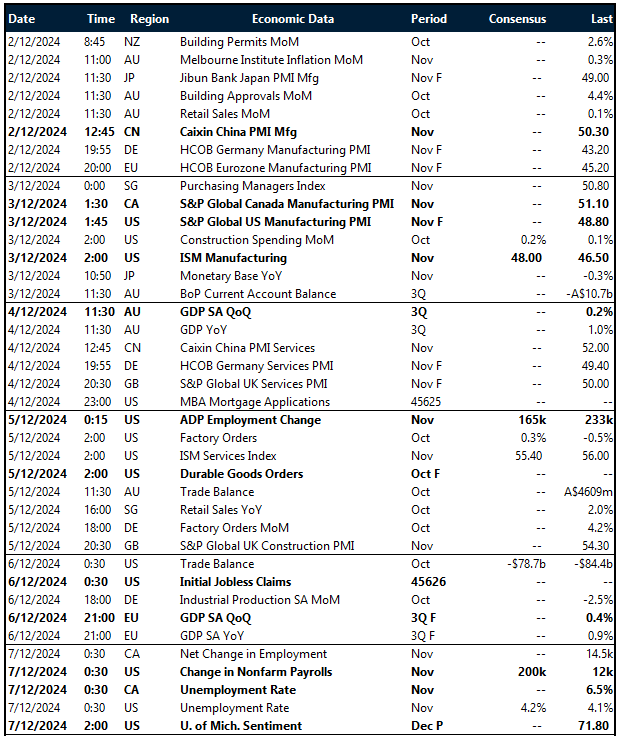

Key global risk events

Calendar: 2 – 7 December

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.