US data drives reversal

Global sentiment shook-off its recent gloom after a sequence of better US economic data boosted optimism across markets.

Most notably, US weekly unemployment claims fell to 187k – the lowest level in almost a year. Housing starts numbers were also stronger.

US shares climbed for the first session in four overnight with the S&P 500 up 0.9% and the tech-focused Nasdaq up 1.5%.

In FX markets, the US dollar was flat, pausing at a recent move to one-month highs as measured by the USD index.

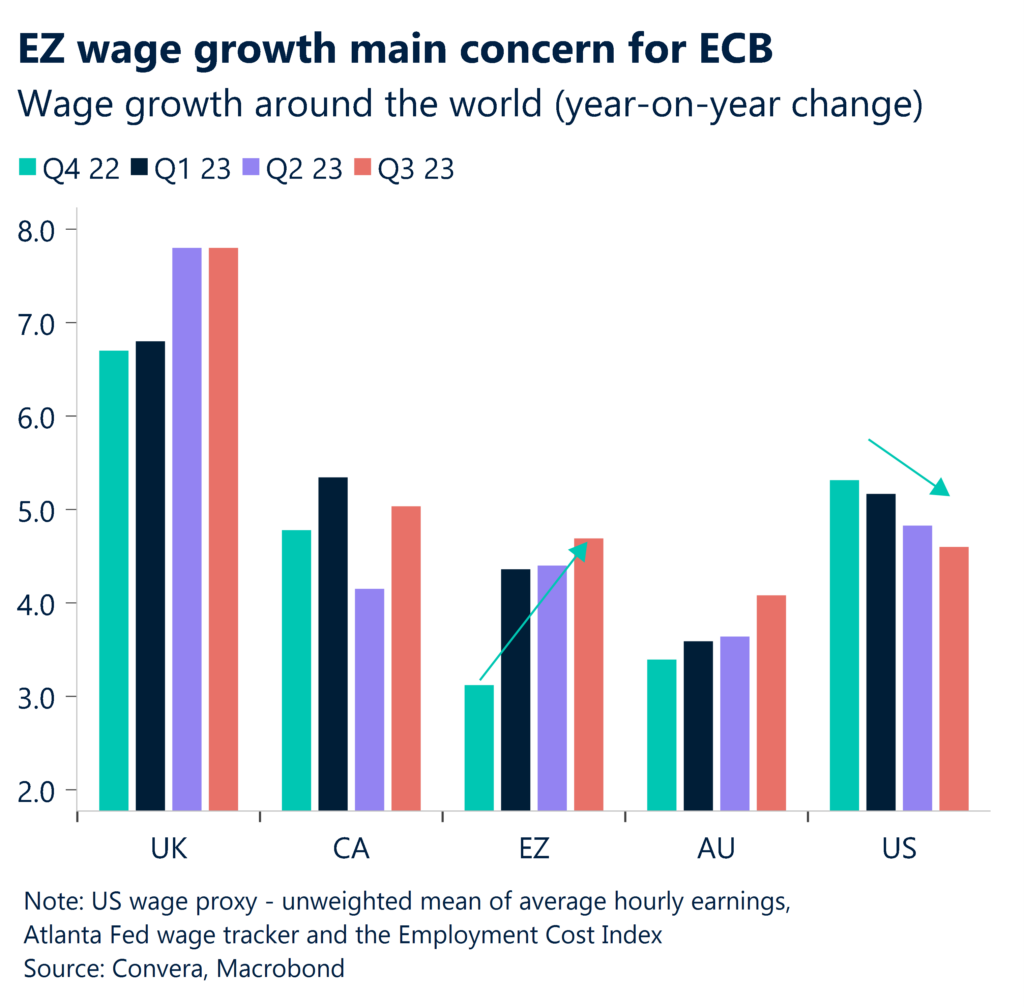

Other markets were mixed, with the EUR flat after last night’s European Central Bank minutes while the British pound gained following this week’s hot inflation reading.

The Australian dollar was higher despite a shock drop in employment reported yesterday – 65.1k jobs were lost in December versus the 18k gain expected. However, local economists mostly suggested the big drop was due to statistical noise as other data points don’t align with this number.

Japan CPI in focus

Today, December 2023 all-Japan core CPI is due. We expect 2.3% year-over-year inflation in the core CPI (all items less fresh food) for December in Japan, down 0.2 percentage points from 2.5% in November. The BOJ’s measure of core-core CPI inflation, which includes all goods but excludes fresh food and energy, looks likely to decline from 3.8% in November to 3.7% year over year.

For dollar-yen, US macro is the biggest danger. If growth is below expectations, the USD/JPY correction will get worse. In the meanwhile, USD/JPY may rise more strongly if a dovish Fed ignites inflation once again.

The USD/JPY’s recent gains have pushed it back toward the key 150.00 level that has seen reversals in this market.

Although we believe that the breadth of the BoJ’s policy adjustments would be restricted until compelled by the considerable depreciation of the yen, the normalization of BoJ policy might potentially lead to volatility.

MYR weakness to be short lived?

A weakening Malaysian ringgit might face short-term further losses ahead of today’s advanced GDP growth report. GDP looks likely to decline to 3.1% yo-y in Q4 from 3.3% in Q3, which reflects the manufacturing output growth that was less rapid than anticipated, the tourist sector’s loss of recovery momentum, and relatively modest export growth.

The goods trade surplus is predicted to decrease somewhat from MYR 12.4 billion in November to MYR 12.1 billion in December. Export growth is predicted to slow down slightly to -6.3% year over year from -5.9% in November as a result of dropping commodity prices, particularly those of palm oil, and weakening external demand, particularly from China. In the meantime, import growth most likely increased as a result of ongoing investment since Q3.

In Asian FX in 2023, MYR has been the largest underperformer but the ringgit could see a reversal and head higher this year. The current account may gain more from tourism-related policies than from net exports, which are constrained by the amount of foreign exchange earnings converted.

Aussie off lows thanks to improving risk sentiment

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 15 – 20 January

All times AEDT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.