“Core” inflation creates headaches

FX markets were mostly cautious overnight with traders nervous ahead of a week of key inflation releases around the world.

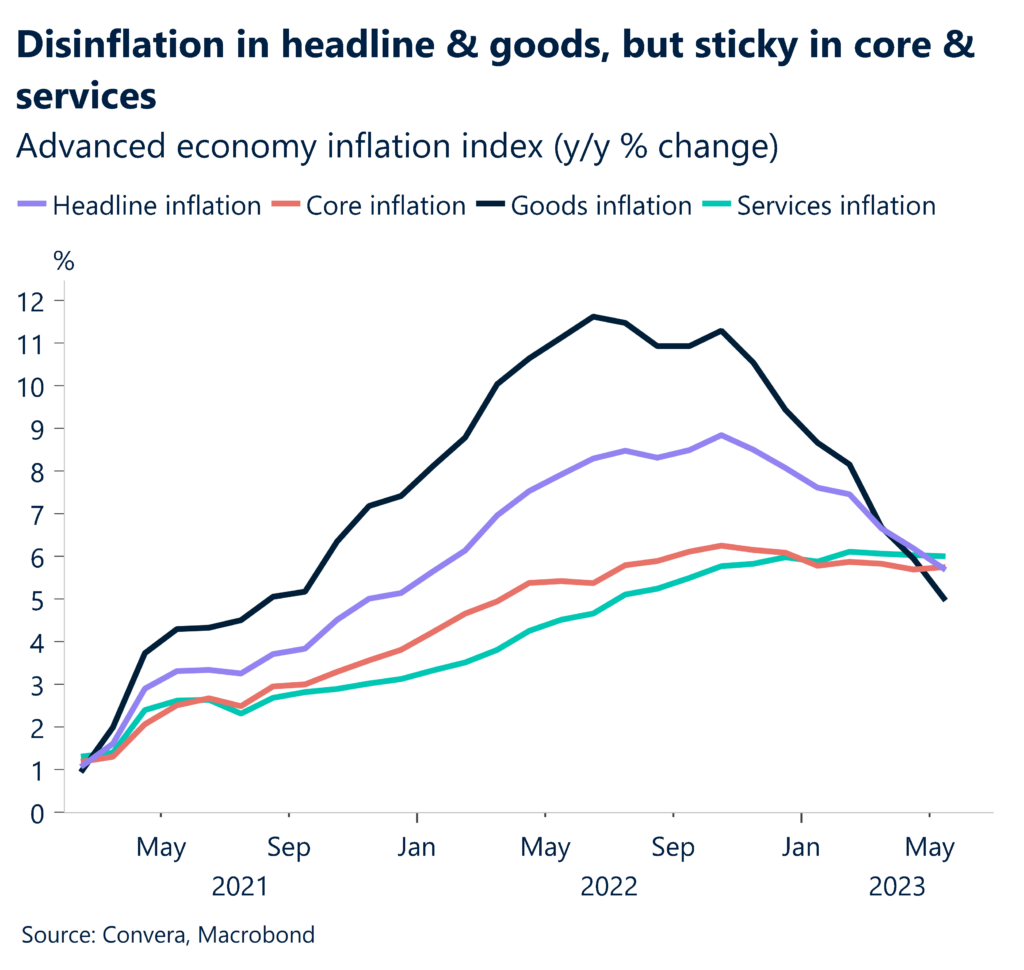

While headline inflation – which includes all measured components – has fallen sharply over the last 12 months, the core measures of inflation, which typically remove more volatile items like food and energy, has remained stuck at highs.

As per the chart below, using an average of advanced economies, while headline inflation has fallen from near 9.0% to under 6.0% over the last year, core inflation has been stuck between 5.5% and 6.0% for most of the last 18 months.

This “stickiness” in core inflation is the major reason why central banks have been forced to keep hiking rates even after many – including in Canada and Australia – signaled they were near an end to policy tightening earlier in the year.

CNY collapse continues

Across FX markets, with traders on edge ahead of this week’s inflation readings, we saw only moderate moves.

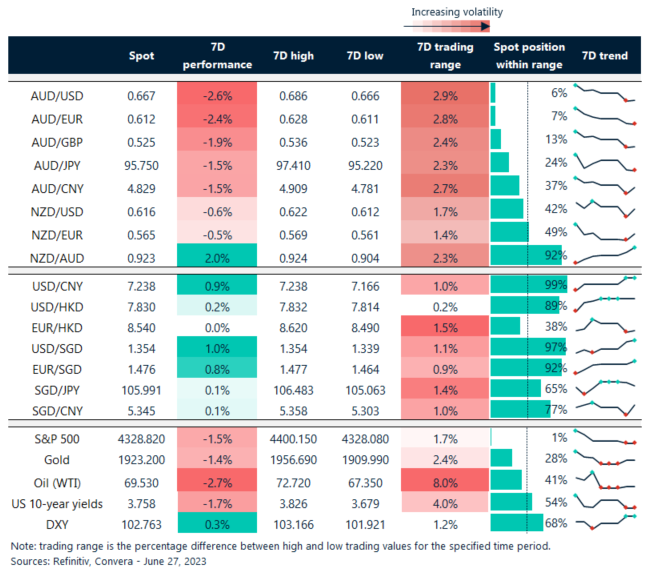

The AUD/USD fell 0.1% with the Aussie weaker in most other markets.

The kiwi was the best performer overnight with the NZD/USD up 0.4%.

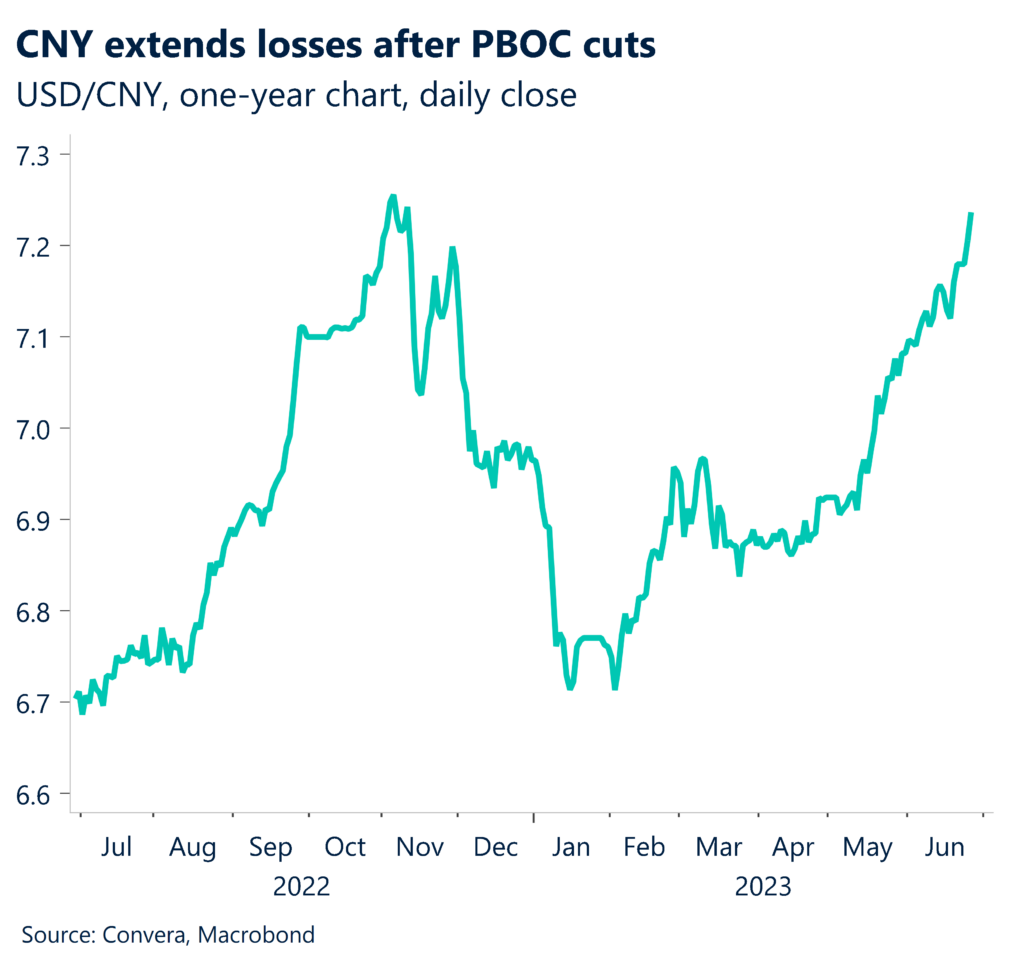

However, the Chinese yuan continued to see big moves lower, with the USD/CNY up another 0.4% as the Chinese currency was pressured by recent rate cuts by the People’s Bank of China.

CAD kicks-off key week for inflation

The week’s sequence of inflation readings from Canada, Australia, Europe and the US kicks-off tonight with Canadian price data due.

As seen in other major markets, while a big drop is expected in annual headline inflation, forecast to drop from 4.4% to 3.4%, core inflation is expected to only inch lower, down from 4.1% to 3.9%.

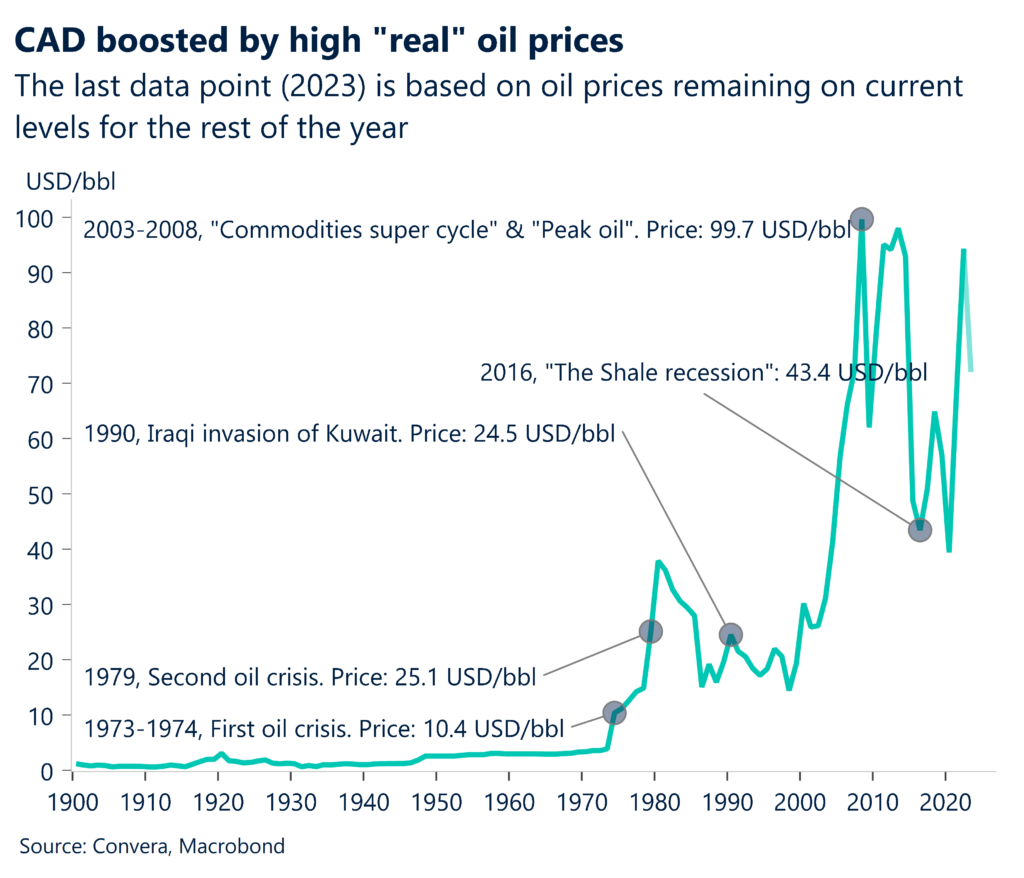

The surprise rate hike from the Bank of Canada in early June, lifting rates from 4.50% to 4.75%, has driven a strong move higher in the Canadian dollar this month, with the CAD at nine-month highs versus the US dollar and eight-month highs versus the Aussie.

FX markets pause ahead of CPI numbers

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 26 – 30 June

All times AEST

Have a question?[email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.