Dollar slips to 1-year low on slowing inflation

The US dollar has dropped to a one-year low against a basket of currencies as investors digest a slew of data this week pointing to slowing US inflation. After a fall in the headline consumer price index revealed on Wednesday, yesterday we saw a significant downside surprise in the producer price index.

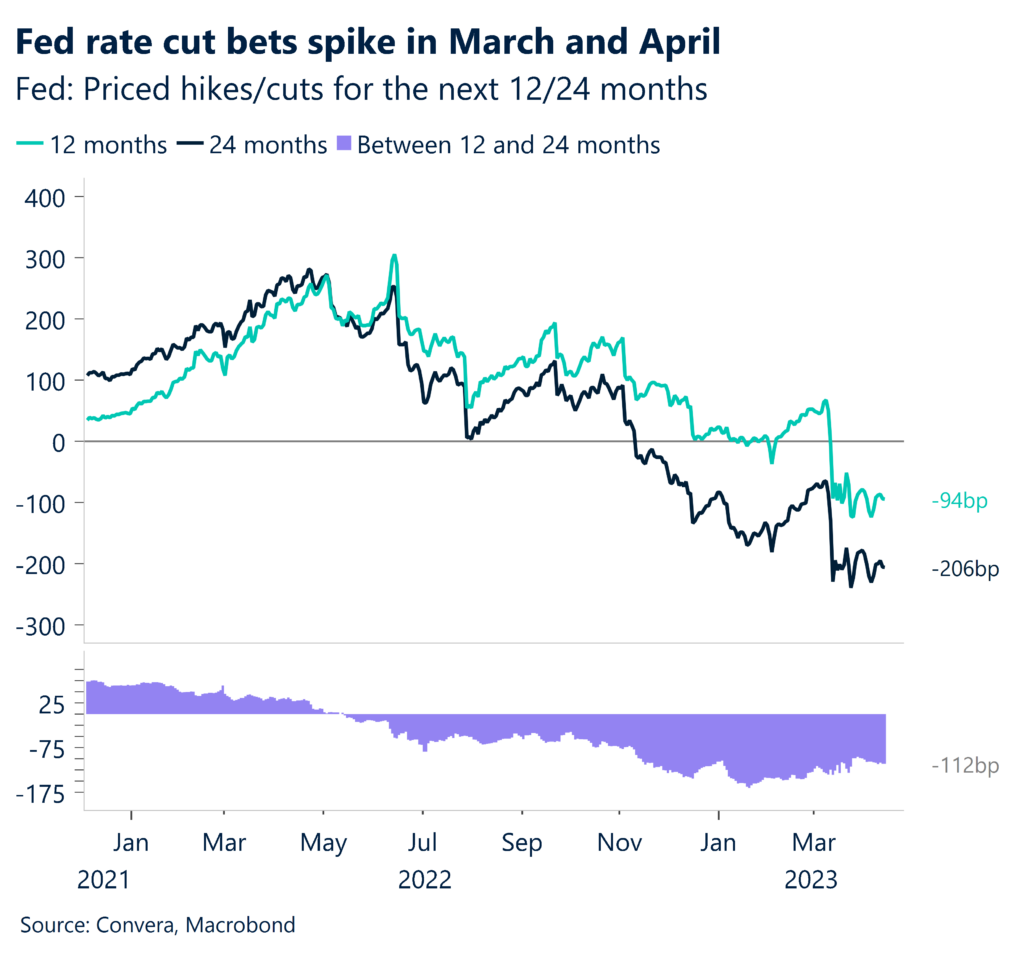

Headline consumer prices have come down significantly since peaking in June last year, falling from 9.1% to 5%, but core inflation (excluding energy and food prices) remains highly elevated and is viewed as the better indicator of underlying inflation, up 5.6% from a year ago. It’s the first time in over two years that the core came in above the overall measure. This is keeping bets of a Federal Reserve (Fed) rate hike on the table for May; however, producer prices unexpectedly fell 0.5% month-on-month in March – the biggest decline in nearly three years. Core producer prices also decreased for the first time since 2020, raising hopes that lower core consumer inflation could follow. As a result, money markets are increasing bets on the Fed resorting to rate cuts after May’s hike, with over 50 basis points of cuts before year-end and over 200 basis points of cuts over the next 24 months currently priced in. Meanwhile, the March Fed minutes disclosed that the collapse of two regional banks could tip the economy into a recession later this year, further supporting demand for US government bonds, sending yields lower.

The yield on the 10-year Treasury note fell to under 3.4% yesterday, towards a seven-month low of 3.28%, which weighed heavily on the dollar’s yield appeal. With the Fed still being driven by data, attention today will be on US retail sales, industrial production and the University of Michigan consumer sentiment survey.

Sterling spikes to fresh 10-month high

The British pound extended gains to above $1.25 yesterday, and this morning has touched its strongest level since June 2022. The catalyst is positive global risk sentiment and broad-based dollar weakness as markets position for a Fed pause, narrowing US-UK yield differentials as the Bank of England (BoE) is still expected to hike and hold rates steady through the rest of the year.

BoE Chief Economist Huw Pill said last week the central bank still could not be sure that it has raised interest rates enough to tame inflation, but yesterday stated that the latest UK GDP data was disappointing even though it was better than forecast by the BoE late last year. Britain’s GDP stagnated in February due to strikes by public workers, but January’s growth was revised higher, suggesting the economy might avoid a recession in early 2023. Meanwhile, adding to the BoE’s conundrum, UK lenders recorded a rise in households defaulting on loans over the past three months, according to new data from the UK central bank. The BoE’s Credit Conditions Survey found that default rates on secured loans to households, such as mortgages, increased in the last quarter, and were expected to increase further this quarter. Tightening of lending standards should prove disinflationary, perhaps taking the pressure off the BoE to hike rates further.

Money markets are pricing in a 63% chance of a BoE rate hike next month, but a surprise pause could hinder further gains for the pound. Still, if the Fed cuts rates and market pricing of US rates falling below UK rates by November comes to fruition, GBP/USD could extend towards $1.30 before year-end.

Euro rallies through key resistance level

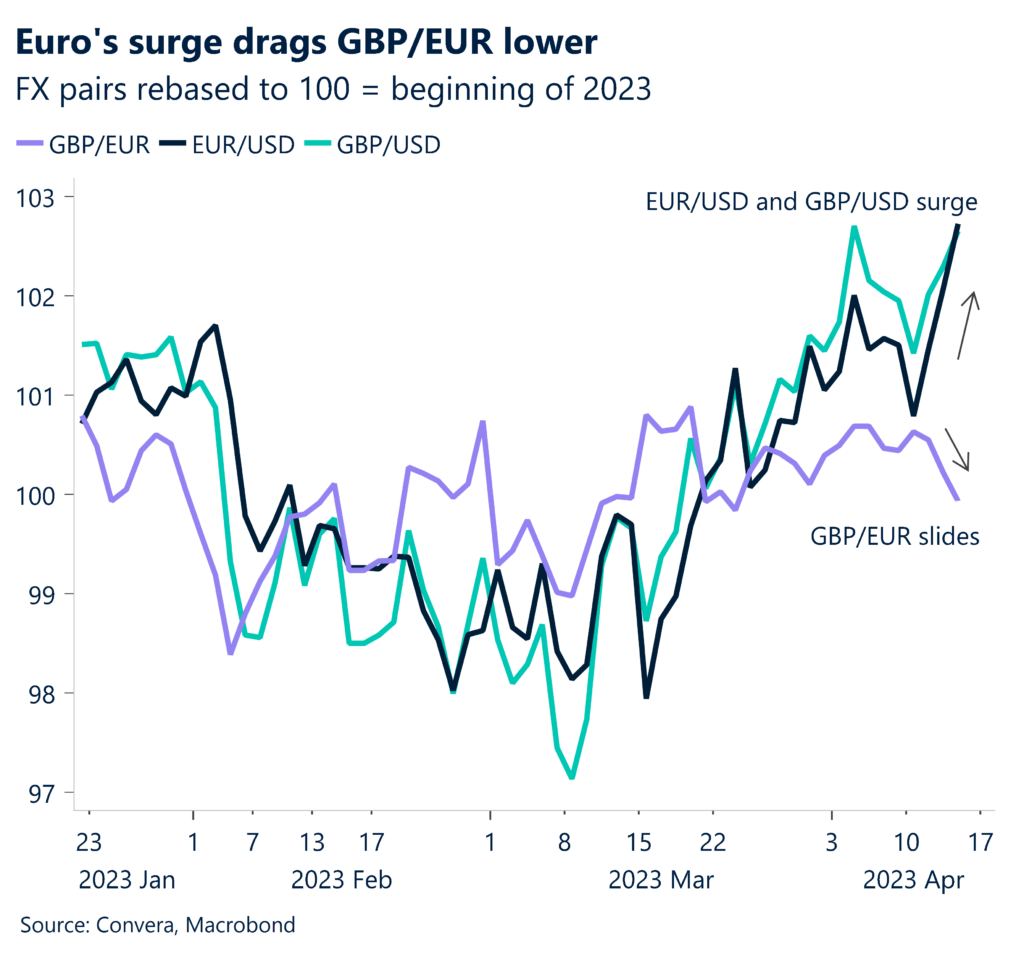

The euro has extended gains above the $1.10 mark versus the US dollar, touching its highest level since April 2022, and is now closer to the $1.11 threshold. With EUR/USD on track for its seventh weekly rise in a row, up 1.5% so far this week, this has dragged GBP/EUR back towards €1.13. Remember, EUR/USD is the most traded currency pair in the world, so with such flows out of the dollar and into the euro, this has ramifications for other currency pairs like GBP/EUR.

The European Central Bank (ECB) is set to deliver two more 25-basis point rate hikes by mid-year to combat inflation. While headline inflation in the Eurozone was the lowest in 13 months in March, both core and food inflation hit a fresh record high. Meanwhile, data yesterday showed Eurozone industry roared back in the first quarter of this year, with factory output rising at its fastest pace for six months in February, increasing by a faster-than-expected 1.5% and beating the consensus forecast of a 1% rise. Resilient economic activity across Europe, combined with sticky core inflation, especially in the services sector, has given the May ECB meeting a hawkish tilt. Several policymakers are debating whether a 50-basis point hike is necessary, though markets are only placing a 20% probability of a such a move right now.

An indirect transmission mechanism of raising interest rates is the exchange rate. Short-term FX movements are volatile, but the underlying trend of the EUR/USD is still well captured by rate differentials and current account imbalances. As such, the longer-term view is one that EUR/USD reaches $1.15 this year, which should also help alleviate imported inflationary pressures.

EUR/USD up 1.3% this week

Table: 7-day currency trends and trading ranges

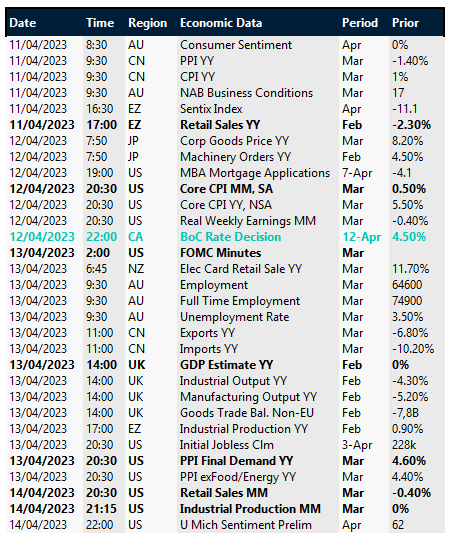

Key global risk events

Calendar: Apr 10-14

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.