Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Euro recovers from recent lows

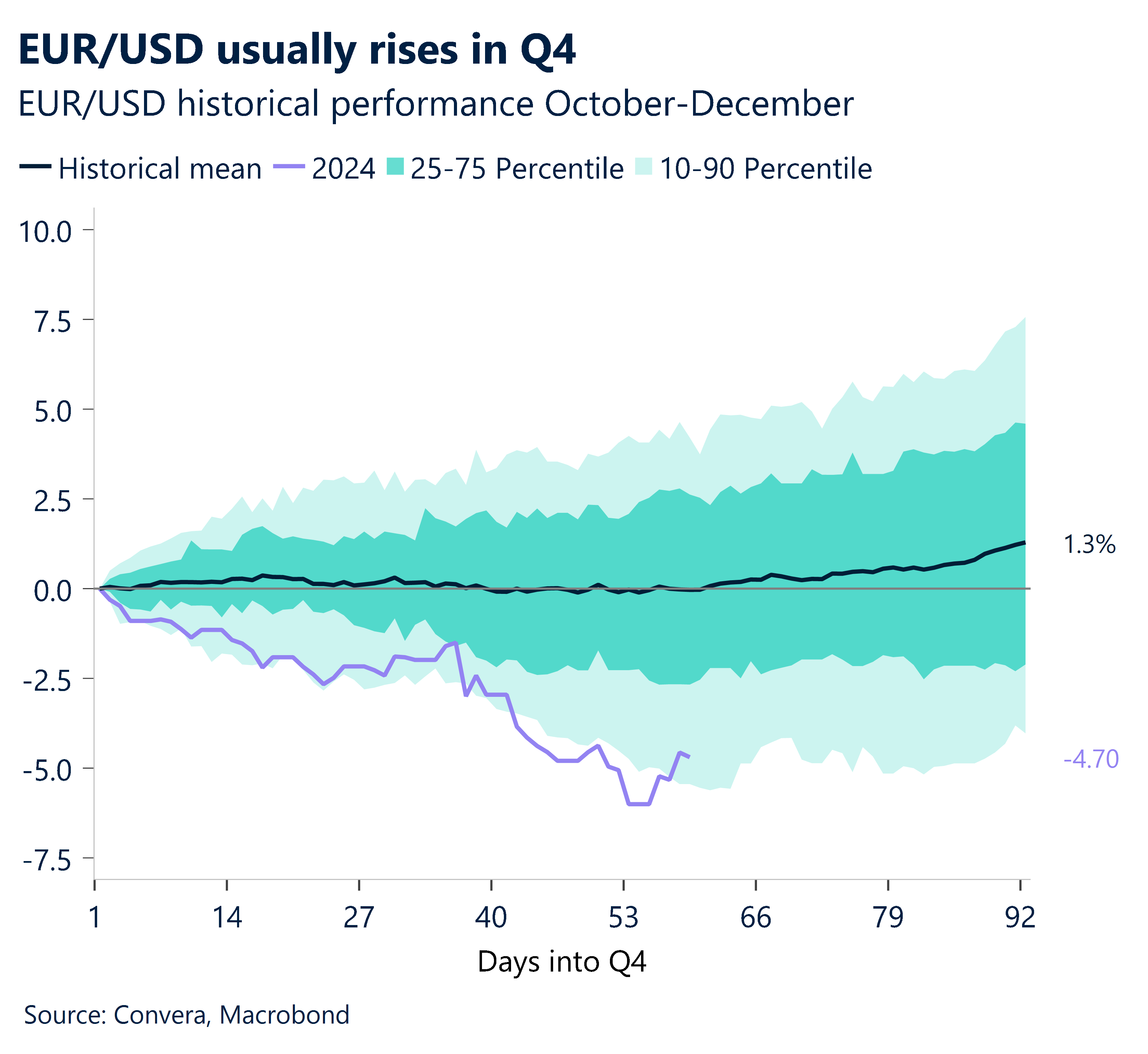

With US markets closed overnight for the Thanksgiving holiday, the euro took centre-stage with a continuation of the recent rebound that has seen the EUR/USD bounce nearly 2.0% from last Friday’s lows.

The EUR/USD’s post-election losses had been extreme up until last week with the euro the most deeply oversold since November 2022, according to the relative strength index, a widely-used momentum indicator.

The euro has been helped higher by an increase in inflation measures this week, notably in some German states and Spain.

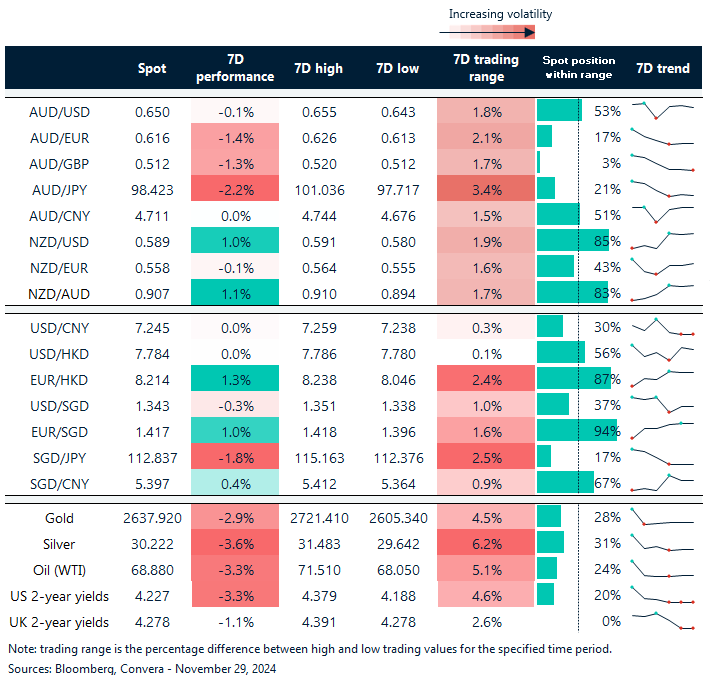

The euro’s gains translated into the APAC region with the AUD/EUR down 1.8% from, but still close to, 18-month highs, and EUR/SGD up 1.5% from, but still close to, two-year lows.

Other markets were more muted due to the Thanksgiving holiday, with AUD/USD flat, NZD/USD down 0.1%, USD/SGD down 0.1% and USD/CNH down 0.2%.

Slower easing likely after February, says RBNZ’s Silk

With an expected third-consecutive 50bp rate cut in February 2025 from the Reserve Bank of New Zealand, Assistant Governor Karen Silk of the RBNZ stated Thursday that the central bank’s most recent projections suggest it would moderate the pace of easing, with probable pauses in the cycle.

Silk told Bloomberg that monetary policy should continue to be somewhat restrictive in order to “keep some pressure” on price setting, since inflation might increase to 2.5% in the upcoming year.

Although the RBNZ sees small upside inflationary risks from US tariffs, we note that it is dovish on global growth and may become much more so in 2025 if lower revisions to the CPI persist.

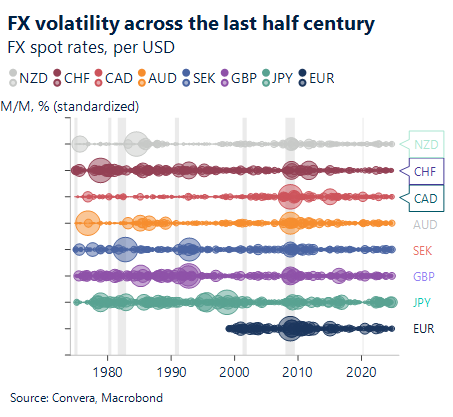

Based on historical patterns, the NZD tends to exhibit heightened volatility during RBNZ policy shifts (see chart on historical FX volatility), particularly when dovish signals follow hawkish periods – expect similar choppiness ahead as RBNZ navigates this careful policy transition against global economic uncertainties.

China PMI expected to rise; USD/CNH eyes 7.3100

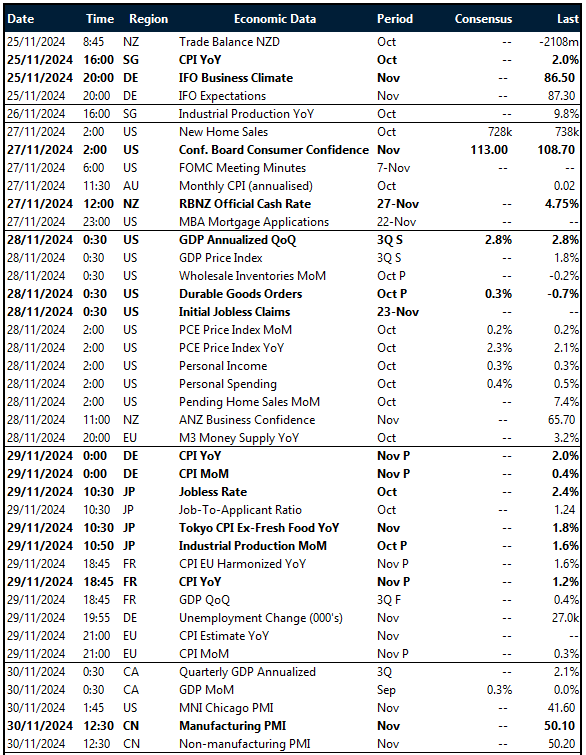

Over the weekend, Chinese manufacturing PMI will be revealed.

We anticipate that the official manufacturing PMI will rise even further to 50.6 in November from 50.1 in October, given the ongoing improvement in data in the month-to-date November.

Taking direction from i) the completion of an inverted head and shoulders (positive pattern), the USD/CNH has the potential to gain further.

The corrective phase of the bullish pattern looks to have started because of the price action’s ii) divergence from the upper Bollinger and iii) waning upward momentum.

The textbook objective for the inverted head and shoulders bottom is 7.3114. However, following these types of pattern completions, corrections are possible.

Euro strength seen in APAC

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 25 – 30 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.