Written by Convera’s Market Insights team

Check out our latest Converge Market Update Podcast where our Global Macro Strategist, Boris Kovacevic, breaks down this week’s most notable macroeconomic news.

Dollar slides as Fed stays on course

George Vessey – Lead FX Strategist

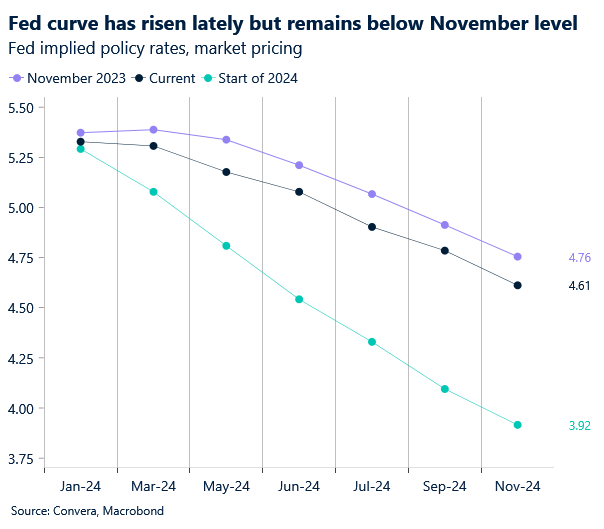

As widely expected, the Federal Reserve (Fed) left its main policy rate target unchanged at a 23-year high between 5.25% and 5.5%. The Fed’s updated economic projections were the main focus though, and the Dot Plot revealed officials still expect to make three lots of 0.25 percentage point rate cuts this year, signalling confidence that inflation is cooling sufficiently to reduce borrowing costs. The US dollar index fell to 1-week lows in line with US yields, whilst US equity markets closed at record highs and pro-cyclical currencies marched higher.

Policymakers’ revised rate forecasts showed a median interest rate of 4.625% for the end of this year, unchanged from December, while forecasts for the next two years and the long-run were higher than last quarter with just three reductions in 2025, down from four forecast in December. The dispersion of the Dot Plot is overall more hawkish despite the median sticking with three cuts for this year, but officials said that any future adjustment in rates will depend on the data, the outlook, and the balance of risks. Fed Chair Jerome Powell made some dovish remarks such as sticky early year inflation may have been something of an anomaly due to ‘seasonal problems’. As these data prints were the key driver of a scaling back of Fed rate cut bets, naturally investors reacted positively to these comments, with the S&P 500 breaking above 5,230 and the Dow Jones reaching all-time highs.

Meanwhile, the reaffirmation of three rate cuts this year means we are now at 83 basis points of cuts priced for the year versus 74 basis points just before the announcements. We truly are in a meeting-to-meeting, data-dependent holding pattern. Attention shifts back to the data with flash PMIs, existing home sales and the Philly Fed index due later today.

BoE to sit tight today

George Vessey – Lead FX Strategist

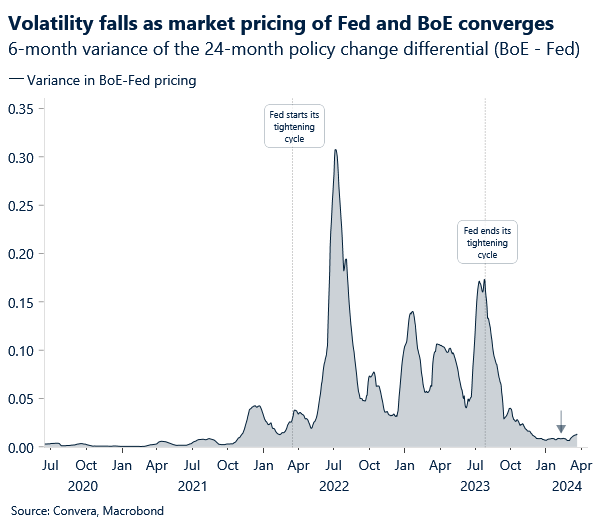

The Fed’s meeting was the main event yesterday, which saw GBP/USD snap a four-day losing streak and stretch back towards $1.28, but focus turns to the Bank of England’s (BoE) monetary policy decision today. The Bank Rate is expected to stay at 5.25%, but the bigger-than-expected fall in the UK inflation rate may nudge BoE officials to lean more dovish. This could wound the pound, which is currently 0.7% below its 7-month high reached against the USD two weeks back.

The BoE’s last meeting in February was the first three-way vote split, including a rate hike and cut, since August 2008 and only the sixth time in the BoE’s 295-meeting history. Historically, after such a voting pattern, the central bank’s next move has mostly been to cut rates, but this is highly unlikely today. Although headline UK inflation slipped further than expected to 3.4% in February, from 4.0% a month earlier, with core inflation at 4.5% and service inflation still above 6%, we’re not expecting any overtly dovish signals from the BoE today. Money markets are still pricing in less than three 25bps rate cuts by the BoE this year, but since the inflation surprises tilting lower and softer labour market indicators of late, market pricing shows a roughly 55% chance of an earlier cut coming in June as opposed to August.

It could be argued that risks to sterling lean asymmetrically to the downside in the short term given stretched positioning. Speculators are holding the highest amount of net long GBP (bets on GBP appreciating) since 2007. This suggests the British currency could be increasingly vulnerable to any dovish signals by the BoE as well as softer data surprises. Flash PMI data ahead of the BoE’s meeting today is thus something to keep an eye on too.

ECB hints at June cuts, but there are conditions

Ruta Prieskienyte – FX Strategist

In Europe, policy rate cuts appear to be on the horizon, but the ECB remains hesitant to pull the trigger first. Speaking at a conference in Frankfurt, ECB’s President Lagarde laid out three tests that the central bank will apply to judge the optimal time to cut interest rates, cautioning, however, that the ECB would not commit to a predetermined rate cut path and will continue to depend on incoming data:

(1) Wage growth. The ECB is looking for “data to confirm whether wages are indeed growing in a way that is compatible with inflation reaching our target sustainably by mid-2025.”

(2) Corporate profit margins. The condition required for a compression, allowing inflation to come down without spillover into the labor market.

(3) Productivity growth. The factor would allow the bloc to recover more rapidly even as inflation dissipates.

Earlier this week, Vice President Luis de Guindos echoed the sentiments of several colleagues by stating that the central bank would be willing to discuss an interest rate cut in June, underscoring the importance of policymakers gathering additional information before making any policy adjustments. Notably, among the 26 members of the Governing Council, 5 central bank governors have all publicly supported acting in June. Money markets are now pricing in 87 basis points of ECB cuts this year.

On the back of a dovish interpreted FOMC decision, EUR/USD bounced back above $1.0900, from a 3-week low touched earlier in the Wednesday session. As the dollar is stumbling across the board, the near-term bias for EUR/USD now turns more bullish, with the next resistance level at $1.09500. Today’s calendar offers preliminary March PMI data, but may be largely ignored as investors have bigger news to chew on. In other EUR-crosses, EUR/CHF climbed to the highest level in four months, but the rally may soon come to a halt if the Swiss National Bank fails to deliver the interest rate cut that some investors are expecting.

DXY pares gains as Powell’s message interpreted as dovish

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: March 18-22

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.