Written by Convera’s Market Insights team

Watching the dots…

Boris Kovacevic – Global Macro Strategist

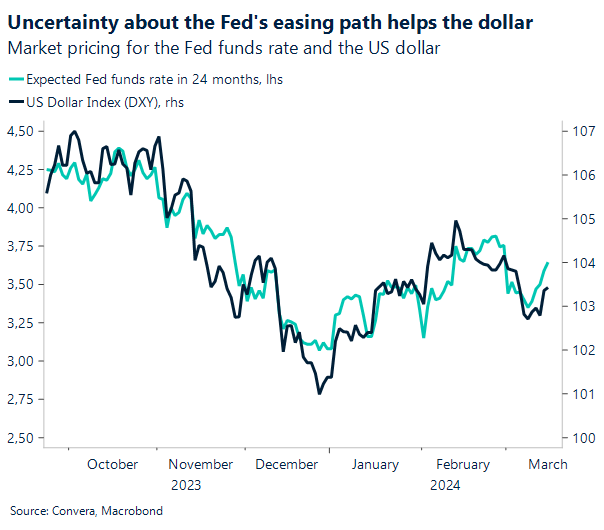

Something interesting happened last week. For the first time this year, market pricing has fully converged to the FOMC’s own rates projections, published via the dot plot back in December. Both investors and policy makers now see three interest rate cuts as the base case for 2024. The main culprit of falling easing bets has been the slowdown of the disinflation process in the developed world. Core inflation rates continue to fall in the US, UK, and Eurozone, albeit at a slower pace. While the consensus and central bank forecasts expect the disinflationary trend to reinstate itself in the following months, more confidence on inflation returning to 2% is needed amid the ambiguous data to start the monetary easing cycle.

This uncertainty has pushed US 10-year Treasury yields higher in every single trading session last week and in what has become the strongest increase in yields so far this year. Discussions have even emerged about the upcoming FOMC’s dot plot next week showing only two rate cuts for this year. While not the most likely scenario for us, it remains a threat for investors holding risk sensitive assets hoping for a quick and aggressive pivot from the Fed. So far, the pullback in easing expectations that has shaped Q1 has been orderly. The rise in bond yields did limit the Greenback’s depreciation but have failed to meaningfully impact equity markets in a negative way.

The US dollar has risen against over 60% of its global peers this week, a huge contrast to the mere 2% it rose against last week. The dollar index snapped a 3-week losing streak after hotter-than-expected US producer and consumer price data led to markets pricing three cuts as opposed to four (last week) by the Fed in 2024. The Greenback therefore continues to follow Fed pricing quite tightly and will be sensitive to the incoming data and the FOMC decision this week.

BoE needs to see more progress

George Vessey – Lead FX Strategist

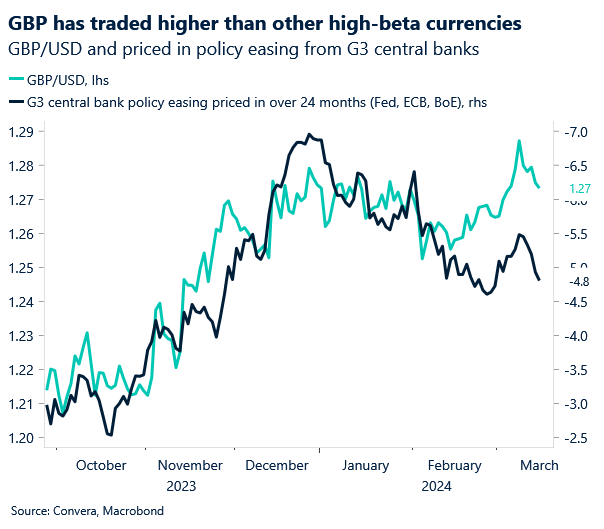

The British pound has fallen around 1.3% from its 7-month high of $1.2893 versus the US dollar. Hot US inflation data was the main driver of FX trends last week, but we also saw UK wage growth pressures continue to ease but remain elevated, whilst UK GDP rebounded in January. The Bank of England’s (BoE) is likely to keep interest rates unchanged at 5.25% until clearer signs that pay growth and services inflation are cooling sufficiently.

Ahead of the BoE’s decision this Thursday, the latest UK inflation data drops in and services inflation, which rose 6.5% in January, is key to the timing of the first rate cut by the BoE. Unless we witness a meaningful downside surprise in inflation, we expect the BoE to reiterate its previous forward guidance that rates need to stay sufficiently restrictive for an extended period. Markets are currently pricing in just 60 basis points of easing for 2024, with the first cut expected in August. This week features the world’s biggest collection of central bank decisions for 2024 to date, and whilst the global tightening cycle was largely synchronised, the timing and scale of monetary easing might diverge enough to ramp up FX volatility.

As it stands though, the expected path of monetary policy isn’t too dissimilar amongst the G3 central banks, so we think the overall extent of monetary easing that’s expected is more important right now. The more rate cuts are being priced in, the better the growth prospects for high beta currencies, like the British pound, versus the US dollar. Thus, despite a hawkish repricing of UK rates seen last week, the overall hawkish repricing of G3 policy hurt the pound.

Euro enters FOMC week with softer momentum

Ruta Prieskienyte – FX Strategist

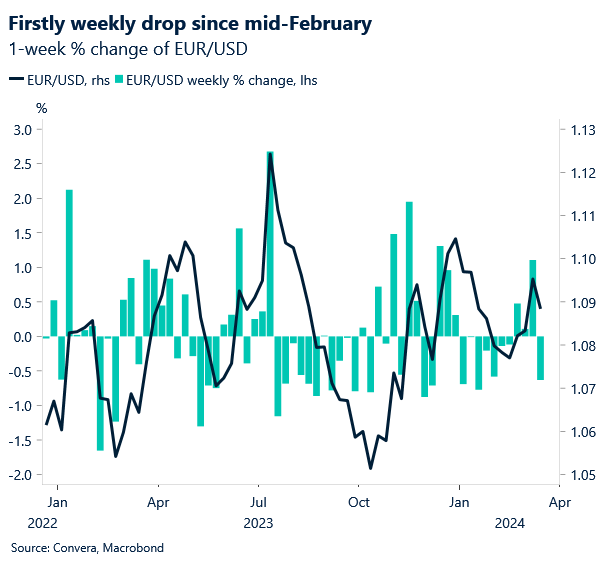

Last week the euro retreated from its 7-week high with European Central Bank policymakers maintaining a dovish stance, while investors shifted focus to the US dollar following hotter-than-expected inflation figures from the US, which dampened expectations for a June rate cut by the Federal Reserve.

A consensus appears to be forming among Governing Council members on the timing of the ECB rate cuts with June emerging as the most likely contender to kickstart policy easing cycle. ECB council member Olli Rehn remarked on Friday that the central bank had initiated discussions about rate reductions at the March meeting, echoing sentiments from other officials suggesting the possibility of a rate cut by early summer. Austria’s Holzman supported that a rate cut is more likely in June, than April, while Greek Governor Stournaras signalled a cumulative of 100bps rate cuts are on the cards for the European Central Bank by year-end. While the ECB remains optimistic about the inflation progress thus far, “there are some residual doubt” about the convergence to 2% in 2025 as per latest ECB staff projections, specifically wage growth pressures.

Across its G10 peers, the euro closed the week on a positive note, gaining over 1.1% against the Norwegian Krona amid Norway’s cooler than expected inflation print for February. With Norges Bank rate decision due on Thursday (Mar 21), EUR/NOK could surrender the recent gains if the central bank stands firm and signals the possibility of further rate hikes. Across other pairs, EUR/USD posted its first weekly decline since mid-February (-0.47% w/w). If this week’s inflation and wage report surprise to the downside, markets would price in more rate cuts and EUR/USD could erase March gains, testing $1.0850 level. For now, EUR/USD is licking its wounds at a support level near $1.0880 (14-day SMA) and is looking to enter the FOMC week with softer momentum.

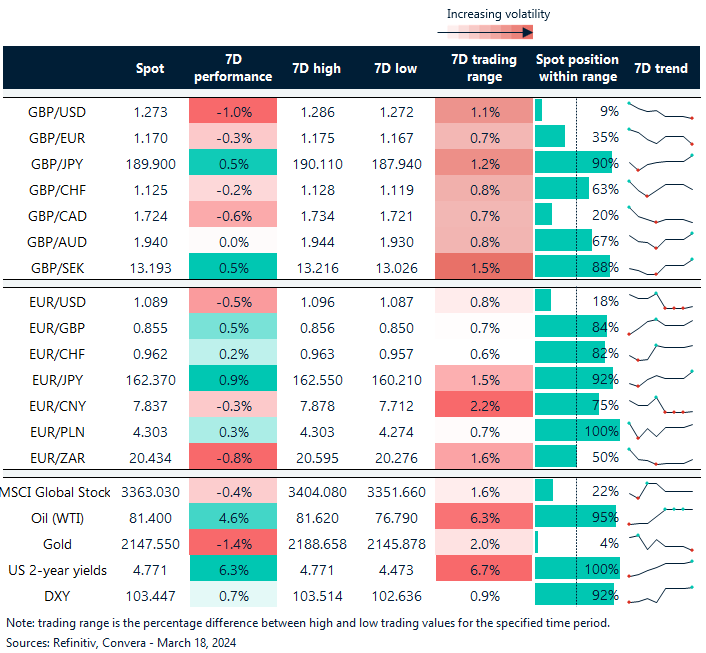

DXY near a 2-week high ahead of FOMC week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: March 18-22

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Join us for Convera Live! A series of in-person events discussing the future of global payments.