Global overview

Expectations for the Federal Reserve to delay its next rate hike tapped a brake on the U.S. dollar’s monthlong rally to mid-March highs. While the dollar kept to narrow trading ranges, it softened against the euro and sterling, and neared a four-week bottom versus the Canadian dollar. The dollar has steadied within its ranges with upside capped after data aggravated concerns about the world’s biggest economy tipping into recession. A key pillar of U.S. economic durability, the service sector, nearly stalled in May. The data suggested the U.S. economy’s resilience may be starting to fade. Signs of a slowing economy, meanwhile, added traction to the view that the Fed may delay its next rate increase. The Fed is a week away from issuing its next decision with markets coalescing around the central bank holding rates at a range between 5% to 5.25%. The market mood Wednesday was cautious ahead of a Bank of Canada rate decision and after China released disappointing trade figures that showed exports contracted for the first time in months in May. Markets are also in a bit of a holding pattern ahead of new U.S. inflation data on June 13, the eve of the next Fed announcement.

Euro firms as ECB meeting draws closer

The euro firmed Wednesday but favored a tight range with upside capped by ongoing concerns about weakening European growth. While German industrial output rebounded with a gain of 0.3% in April, the recovery from a more than 2% tumble in March fell short of forecasts of a 0.5% increase and highlighted the weak state of the bloc’s largest economy. Downside for the euro has found support from expectations for the Fed to hold off on a rate hike next week which contrasts forecasts for the ECB on June 15 to raise by 25 basis points from 3.25%.

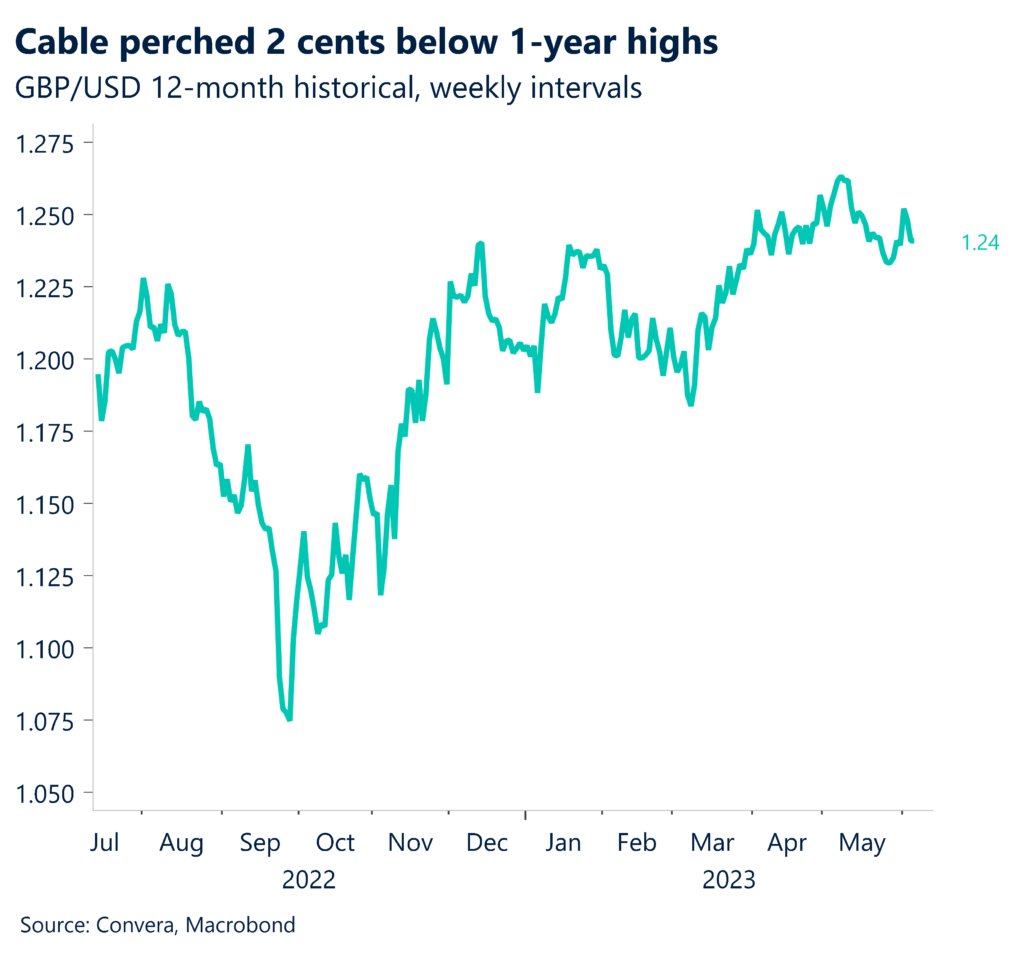

Sterling rises vs weaker dollar

A focus on global lending rates Wednesday put some wind in sterling’s sails. The pound edged into positive territory for the week amid expectations for the Fed to delay its next rate increase, while the Bank of England on June 22 is all but certain to raise UK borrowing rates for the 13th consecutive time from 4.50%. The specter of a smaller yield advantage for dollar-based assets has left recent greenback gains vulnerable.

C$ flirts with 4-week high as BOC looms

Canada’s dollar neared one-month highs on expectations for the Bank of Canada today to at least sound hawkish on the policy outlook. Markets are split over whether Ottawa will resume rate increases from 4.50%, following a streak of better-than-expected domestic data and unemployment hovering around all-time lows. A quarter percentage point rate hike to 4.75% could potentially put levels below 1.33 in play for USD/CAD that have been out of the market since mid-February. No policy changes today, on the other hand, could see the pair reclaim the upper end of its 1.33 to 1.36 range. Central bankers are due to render their decision at 10 a.m. ET.

Dollar adheres to narrow ranges

Table: rolling 7-day currency trends and trading ranges

Key global risk events

Calendar: Jun 5-9

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.