Written by George Vessey & Boris Kovacevic

Yield increase rolling over equities

The plethora of global interest rate decisions last week has revealed that the forward guidance of a central bank can be as or even more important than the actual decision itself. This mantra can explain why both the US Dollar Index has recorded the tenth consecutive weekly appreciation and why the US 10-year government bond yield reached a 15-year high in the same week that the Federal Reserve (Fed) stopped raising interest rates. Markets did not care about the rate pause and have solely focused on the FOMC’s projection of another hike this year, strengthening the thesis of a higher for longer rates regime going into 2024.

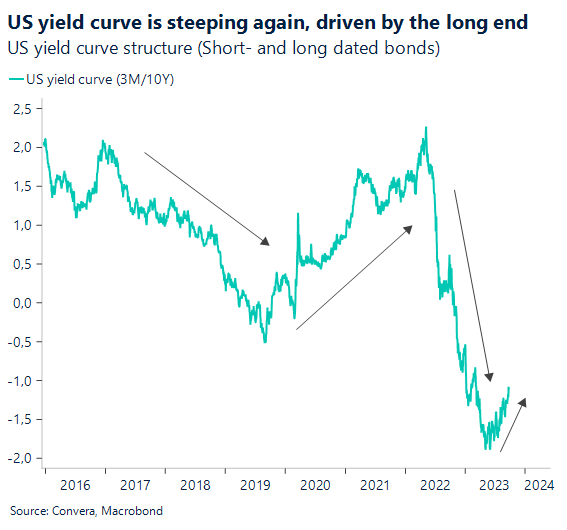

Yields on the front end (6-12-24 month bonds) of the curve have outpaced their longer dated (+10-year bonds) peers from May 2022 to May 2023 with the central bank interest rate increases driving this flattening of the yield curve. However, with investors seeing the light at the end of the tightening tunnel, and inflation remaining higher than expected, yields on the long end have started rising again, pushing the yield curve up.

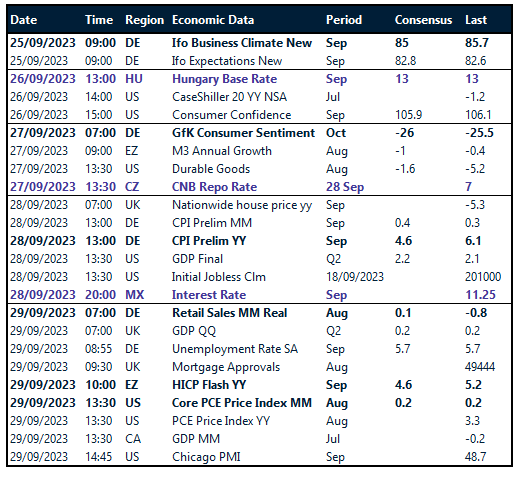

The upcoming week will mainly be dominated by European macro and inflation data. In the US, secondary releases like consumer confidence, home prices and the Chicago PMI will be watched as well. However, the main event across the pond will be the PCE Index, the Fed’s preferred inflation gauge. Inflation has picked up in recent weeks and economic data has remained resilient, supporting the yield move higher. We do think that the effect of tighter policy on the real economy will start becoming more visible in Q4 this year and Q1 2024. Still, the dollar probably has some more room to run higher in the short term given the lack of alternatives.

European central banks have had enough

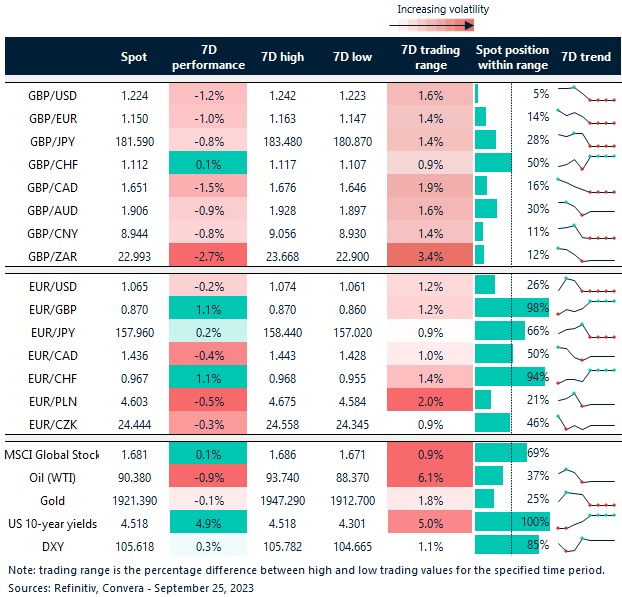

European central banks have collectively decided that monetary policy is tight enough for the moment. The ECB communicated a likely pause to its tightening cycle, while the British and Swiss central banks did not hike at all at their meetings in September. The difference in the forward guidance between the European banks and the US Fed is stark and is explained by the vastly different positions of their respective economies. Investors have recognised that and are currently selling the euro, franc, and pound against the dollar.

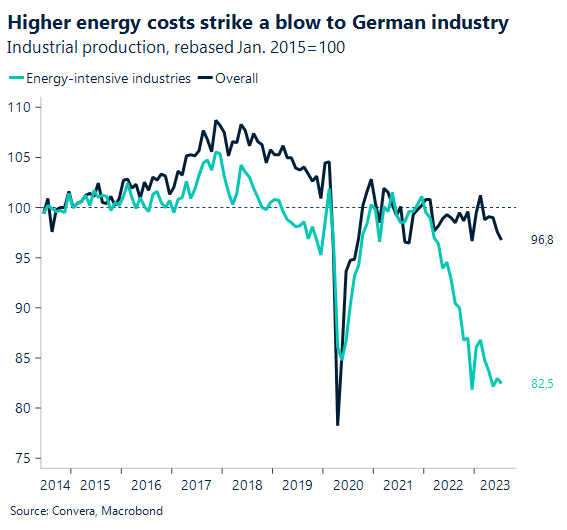

As we have mentioned in our daily market update during the last week, most of the pessimism towards Europe seems to be priced in. However, we are still in the phase where every week is accompanied by another macro disappointment on the old continent. Against this background, it has been hard for investors to stop selling risk assets like the euro. The latest Purchasing Manager Indices (PMI) didn’t do anything to support a bottoming of the European business cycle. There has been some improvement like in the German services sector, but overall private activity, especially in the manufacturing sector, remains weak, supporting the thesis that the Eurozone is in contraction right now.

We are expecting German and Eurozone inflation to show significant improvements in September, giving the ECB some breathing space. The consensus expects CPI growth (y/y) to print 4.6% compared to 6.1% in August. However, the focus before Friday will fall on German macro data, of which we are expecting nearly one print a day. The Ifo business expectations index on Monday will start the week and is followed by GfK consumer confidence and German retail sales on Wednesday and Friday, respectively.

Pound oversold, but downside bias intact

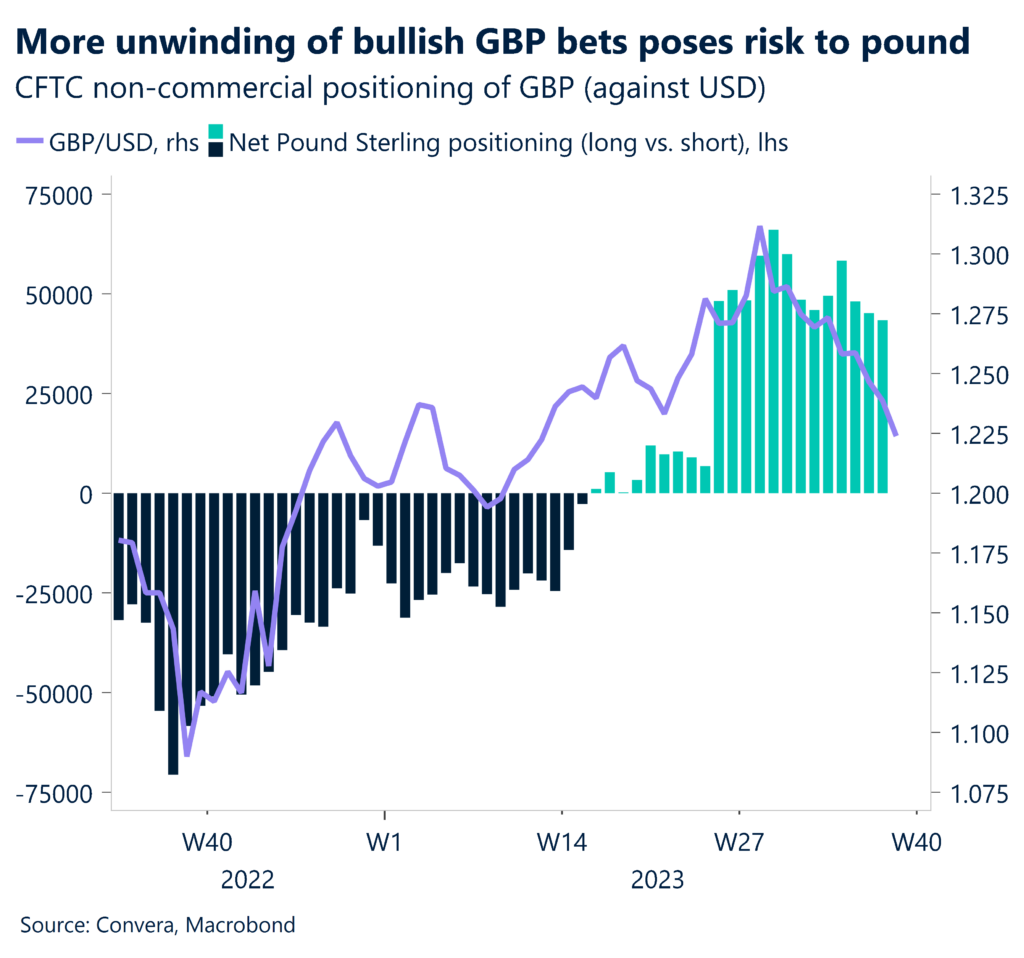

The British pound remains on the defensive following the dismal flash PMI data increasing UK recession fears. GBP/USD hit a fresh 6-month low just shy of $1.22 and GBP/EUR hit a 2-month low below €1.15, though the former dipped into oversold territory suggesting it may consolidate or rebound slightly from here.

The weaker-than-expected UK PMIs saw the composite number suffer its sharpest decline since January 2021 when the UK was in lockdown. In addition, private sector companies shed workers at the fastest pace since the pandemic and the depths of the financial crisis, adding to a growing list of indicators that point to a lacklustre second half of the year for the UK economy. This bleak outlook is weighing on the pound and spurring a rally in gilts (fall in yields), with 10-year bonds on track for their longest streak of weekly gains in two years. There is room for UK yields to continue falling given that the market is still pricing in around a 65% chance of another UK rate hike, but there is greater uncertainty because of the tight 5-4 vote by the Bank of England to hold its key interest rate at 5.25% last week.

Meanwhile, although GBP speculative long positioning has fallen from 16-year peaks (when GBP/USD was trading above $1.31), they are still elevated compared to levels that prevailed for most of the last five years. Therefore, despite the oversold conditions according to the daily relative strength index, if traders continue exiting these long positions, sterling risks sliding further, especially against the US dollar. The $1.20 handle could be a short-term downside target.

EUR/GBP up over 1% in a week

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: September 25-29

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.