Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

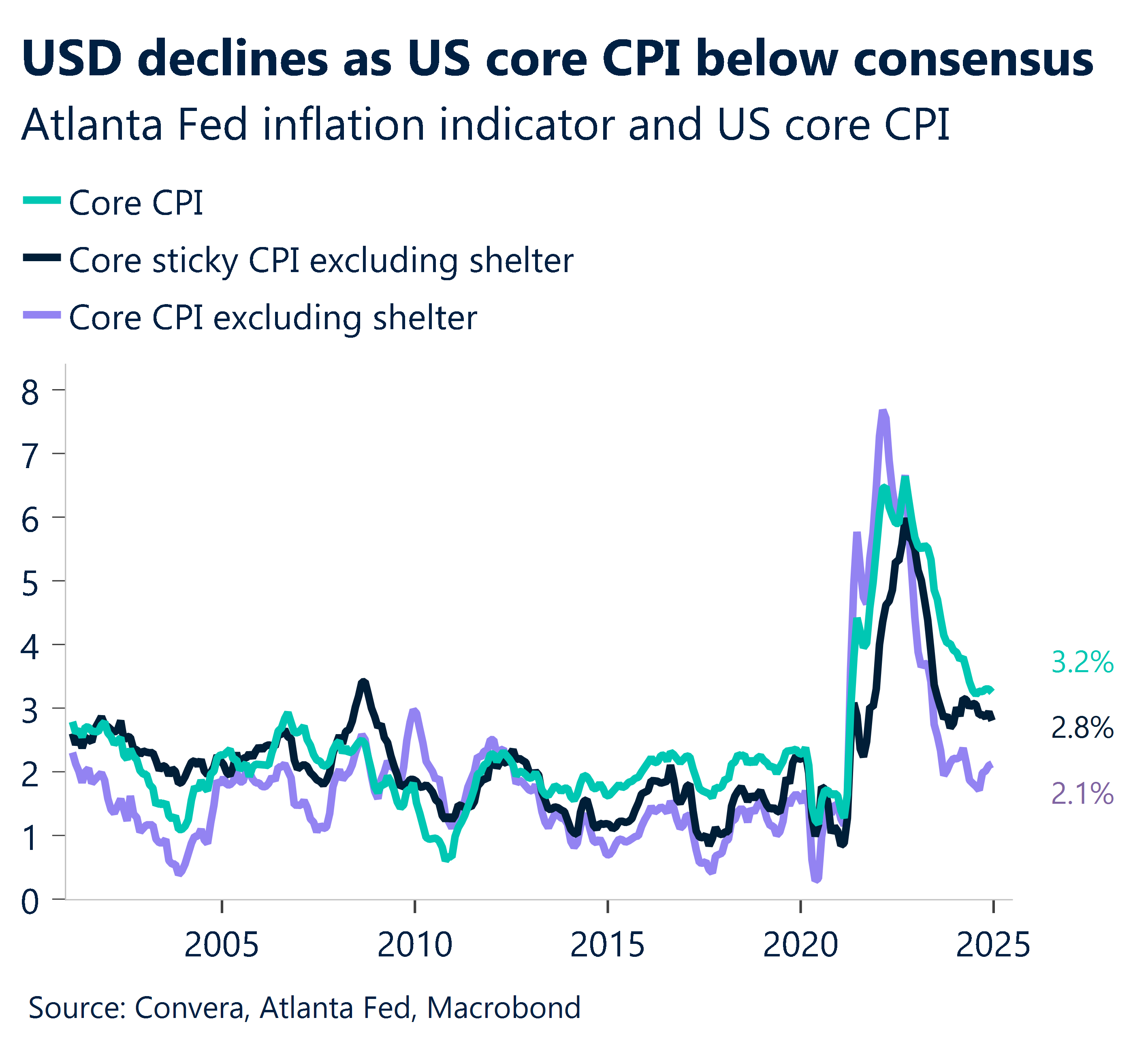

Greenback retreats on softer inflation print

The greenback declined as US core CPI came in below consensus at 0.2% MoM for December.

The USD index fell 0.2% with profit-taking emerging after the recent rally to two-year highs.

The euro was the main underperformer, failing to break above 1.0320 resistance and settling near 1.0295.

The yen saw significant moves with USD/JPY dropping through 157.00 to 156.00 before steadying at 156.50.

In Asia, USD/CNH edged up to 7.3480.

Key focus turns to Australian jobs data, and Bank of Korea’s rate decision today.

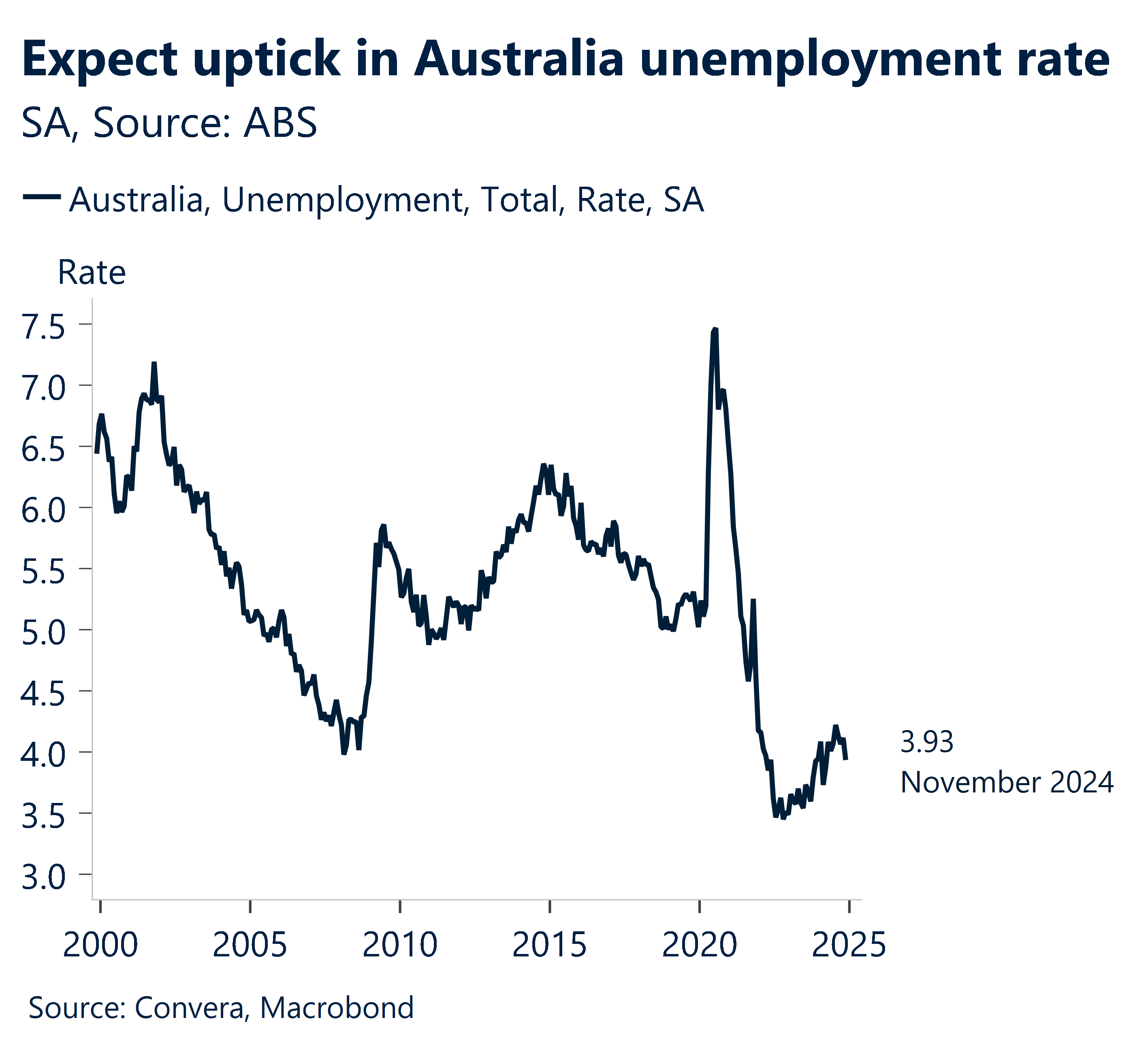

Australian jobs growth to slow, unemployment to tick up

Today, the unemployment rate for Australia will be announced.

We anticipate that after a better showing in November, job growth will be about 10,000 in December.

December typically sees slower employment growth than November, and the ABS seasonal adjustment procedure may have lagged behind the trend toward earlier year-end sales activity, such as the increasingly well-liked Black Friday sales in November.

After a sharp decline to 3.9% in November, we anticipate that the unemployment rate will rise back to about 4.1% in December.

In general, we anticipate that trend employment growth will continue to progressively slow down, reflecting decreasing net immigration and previous subtrend GDP growth.

AUD/USD has rebounded past 3 trading sessions and the 0.6349–0.6396 range should now serve as a crucial resistance area.

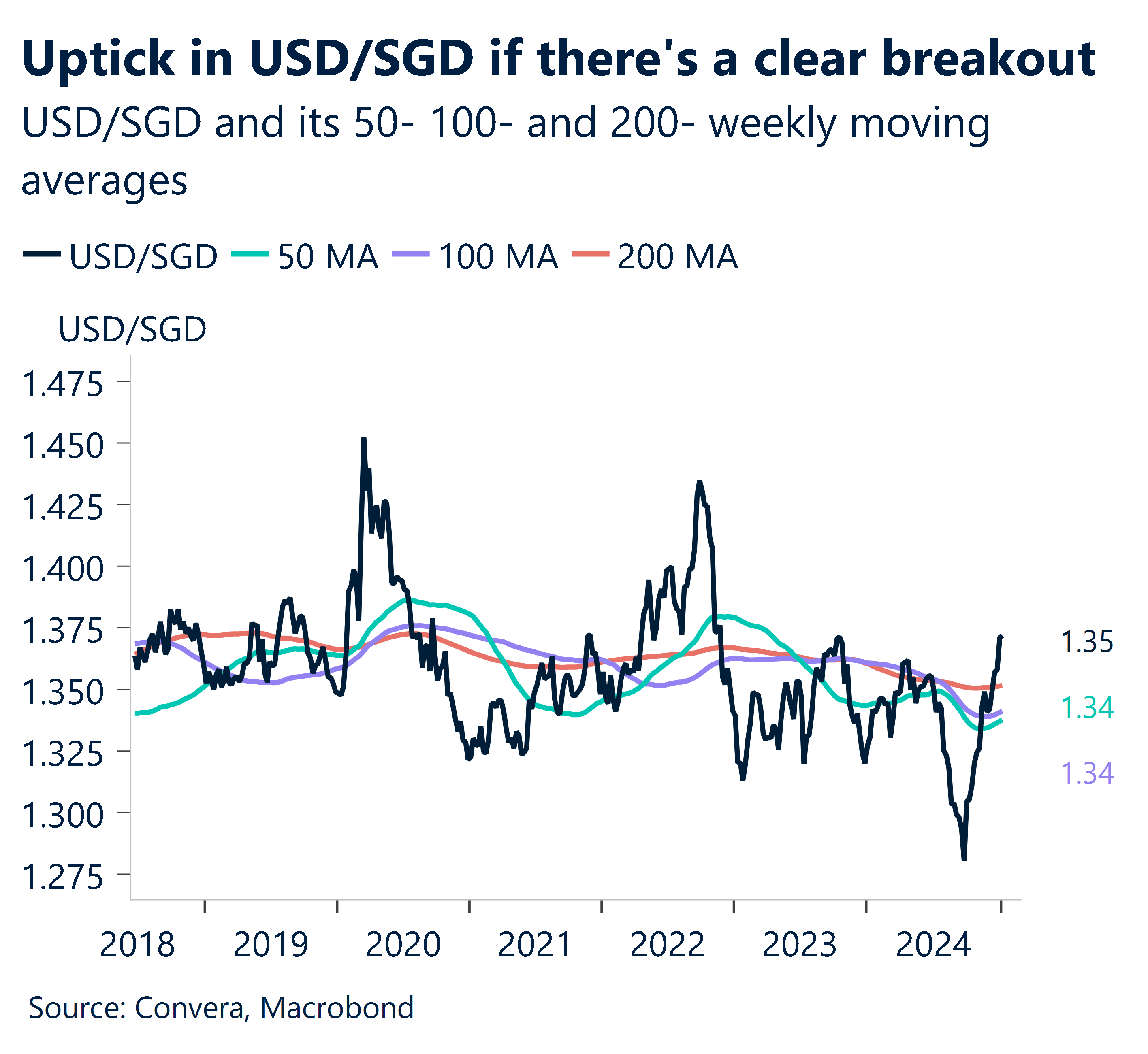

Singapore NODX growth to accelerate on base effects

Singapore NODX will be out tomorrow.

Due in part to the low base effects from pharmaceutical exports, we anticipate that non-oil domestic export (NODX) growth will rise from 3.4% in November to 4.9% year-over-year in December.

Even though it will slow following the November spike, electronics export growth should still be in the double digits.

Accordingly, after a steep 14.7% increase the month before, NODX growth dropped to -1.5% m-o-m.

There will be positive momentum in USD/SGD only until there is a clear break above 1.3660, with a target of 1.3755, followed by 1.4045.

Aussie rebounded back from lows

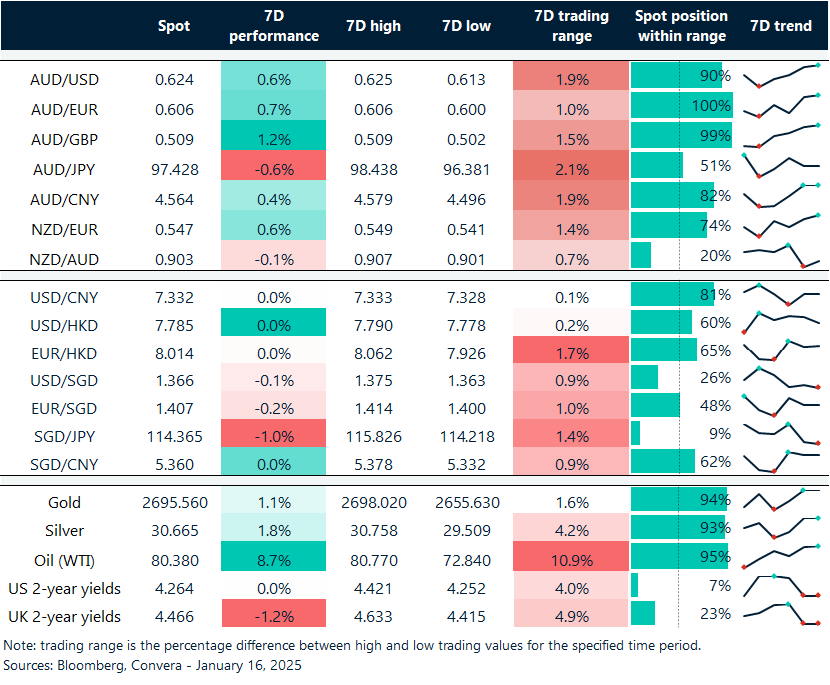

Table: seven-day rolling currency trends and trading ranges

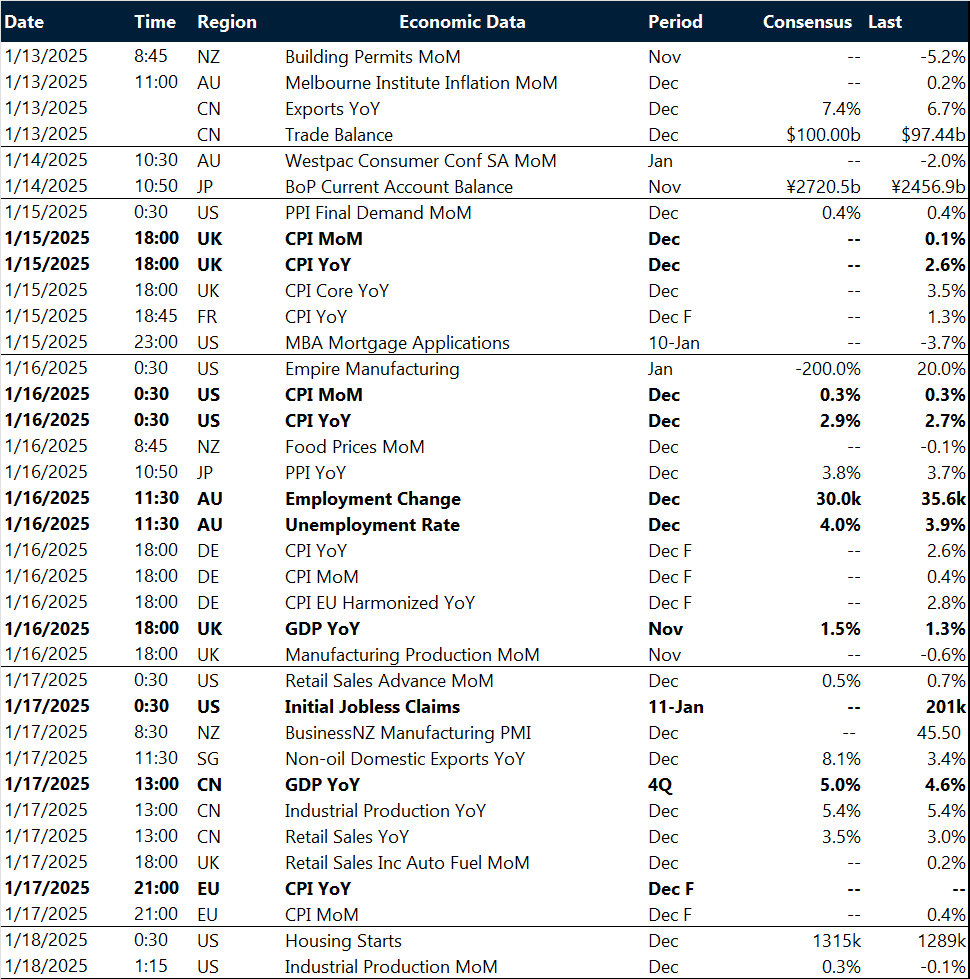

Key global risk events

Calendar: 13 – 18 January

All times AEDT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.