Written by Convera’s Market Insights team

Strong dollar advance

Boris Kovacevic – Global Macro Strategist

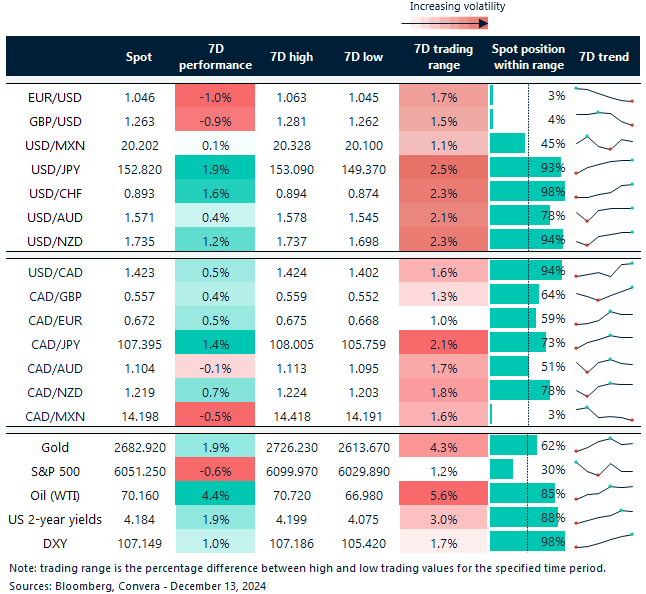

Chinese equity markets fell in yesterday’s session as policy makers disappointed expectations with a lack of details from the economic conference that began on Wednesday. The interest rate cut in Europe and stronger rise in producer prices added to the US dollar’s appeal and led the currency to its fifth consecutive daily rise. The Greenback is on track to gain another week, which would be the 10th gain in the last 11 weeks.

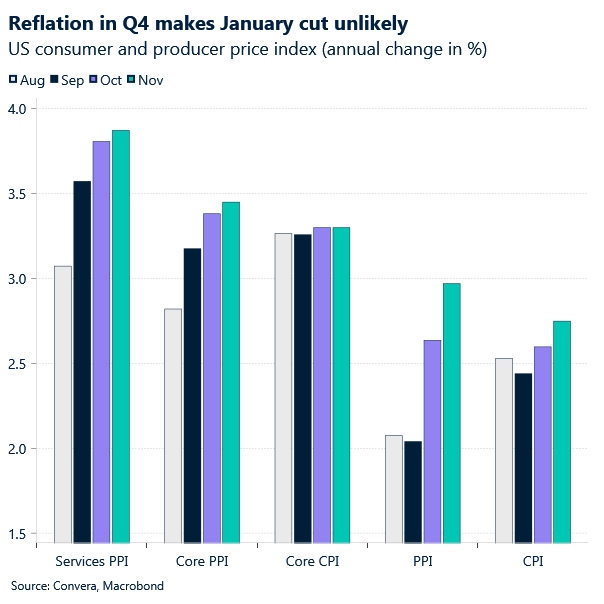

Bond yields will go into the weekend with a strong bounce as inflationary data seems to suggest limited room for the Fed to cut next year. Earlier this week, core consumer prices were confirmed to have risen by 30 basis points for a fourth consecutive month. While the advance didn’t change the annual increase, it adds to the feeling that inflation is yet to be beaten by the Federal Reserve (Fed). Producer prices did little to nothing to dispel these fears. A monthly gain of 0.4% was the largest advance since June and pushed the annual figure to 3%. While the December cut is set in stone, investors see a 75% probability that the Fed will not ease policy in January.

This stands in stark contrast to other central banks, which continue to advance their easing cycle. Central banks in Europe, Switzerland and Canada cut interest rates this week. The Swiss National Bank by 50 basis points. Markets are also considering the consequences of Donald Trump fuelling global trade tensions next year. The risk sentiment adds to bullish calls for the dollar. We think a lot is already priced in and the Greenback will find it hard to climb to new highs. However, resilience due to the trade and rates outlook is warranted.

Euro mixed after ECB dust settles

George Vessey – Lead FX Strategist

As widely expected, the European Central Bank (ECB) cut rates by 25 basis points yesterday, bringing the deposit rate to 3%, its lowest level since March 2023, and bringing the cumulative reduction in this cutting cycle to 100 basis point. EUR/USD is trading back below $1.05, though GBP/EUR has slipped from 2-year highs below €1.21 as traders assessed the messaging around policy trajectory.

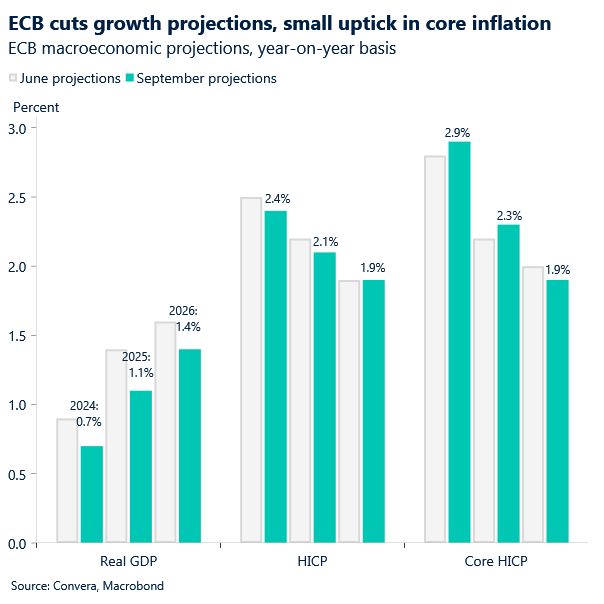

The ECB’s forecasts include a lower growth and inflation rate for the Eurozone. Consistently, the central bank downwardly revised its GDP growth projections, including a 0.1 percentage point drop in the current year to 0.7%, and a 0.2 percentage point drop in the next year to 1.1%, significantly underperforming forecasts for the US. Inflation is expected to gradually decrease, with forecasts of 2.4% in 2024, 2.1% in 2025, and 1.9% in 2026. Future ECB rates being priced into the overnight index swaps market have been volatile since the meeting, but the net result is that traders now expect a lower rate at the end of January than they have since November. However, further out, markets are pricing in marginally less ECB easing with swaps implying about 122 basis points of rate cuts in 2025, compared to about 133 basis points earlier Thursday.

Judging from ECB officials’ comments, the bank is now looking to bring interest rates to neutral levels, with President Lagarde suggesting that ECB staff saw the level of the neutral rate between 1.75% and 2.5%.

Pound extends decline after UK economy contracts

George Vessey – Lead FX Strategist

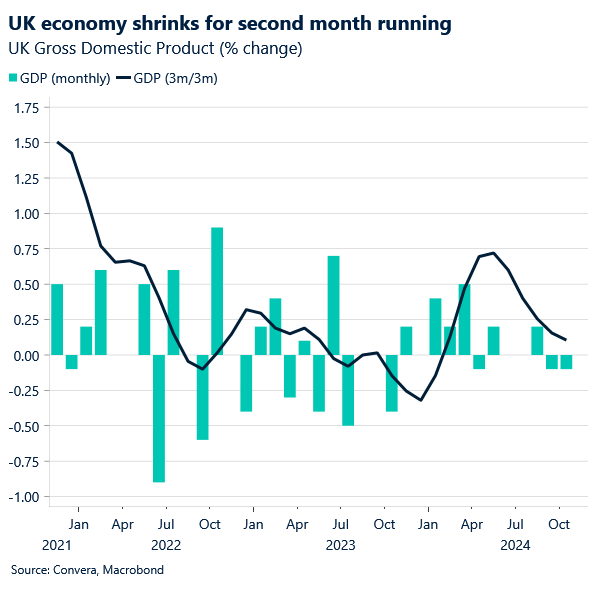

Data this morning revealed the UK economy shrank 0.1% in October on a monthly basis compared with estimated growth of 0.1%. The unexpected fall was driven by construction and production, while the dominant services sector stagnated. Sterling is weaker across the board.

GBP/USD has extended its decline from $1.28 towards $1.26, whilst GBP/EUR is pulling back after closing at its strongest level in eight years against the euro earlier this week. This weakness could run further in the short term, especially if Bank of England (BoE) easing bets increase. The UK economy, which had been the fastest-growing in the G7 between January and June, grew by 0.1% during the third quarter of the year. On a monthly basis, the figures showed zero growth in the powerhouse services sector, with manufacturing and construction declining at a pace of 0.6% and 0.4% respectively. It adds to the picture of a far more jittery economy during the second half of the year, in the wake of the general election, with consumer and business confidence also waning.

Thus, the three 25bp rate cuts by the BoE currently priced in by financial markets appears to be too conservative. We’ve warned a dovish recalibration of these rate expectations are a significant risk to the pound, and given today’s economic data, this risk is only rising.

Sterling sharply reverses course

Table: 7-day currency trends and trading ranges

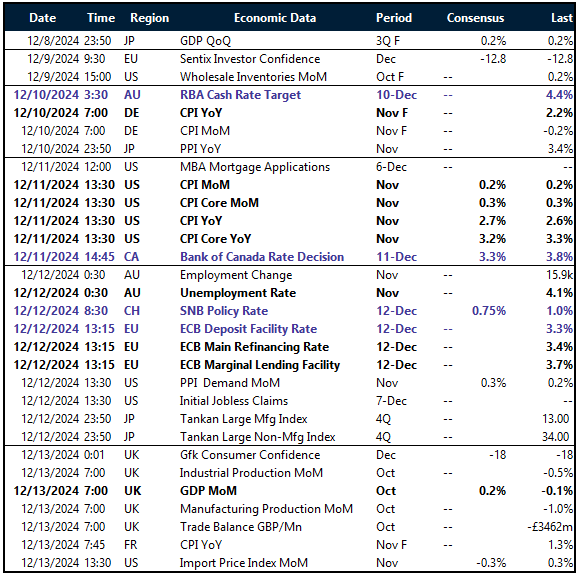

Key global risk events

Calendar: December 9-13

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.