US debt deal supports holiday-thinned markets

FX markets were mostly quiet overnight with the US and much of Europe closed for public holidays.

More broadly, markets also took a sigh of relief after the weekend’s in-principle deal on the US debt ceiling.

US President Joe Biden and Republican leader Kevin McCarthy have struck an agreement for a two-year extension of the debt ceiling with some spending cuts but the deal still needs the approval of a volatile US Congress.

The size of the US bond market means that markets might remain volatile until the deal is passed by the US Congress.

Aussie higher, but NZD still underperforms

The markets that were open were mostly higher, boosted by optimum around the US debt deal, with S&P 500 futures up about 0.3% and Nasdaq futures up 0.4%.

The Australian and New Zealand dollars both benefited from the improved sentiment.

The AUD/USD gained 0.3% as it continued to rebound from six-month lows. The AUD/EUR gained 0.5% while the AUD/JPY gained 0.2%.

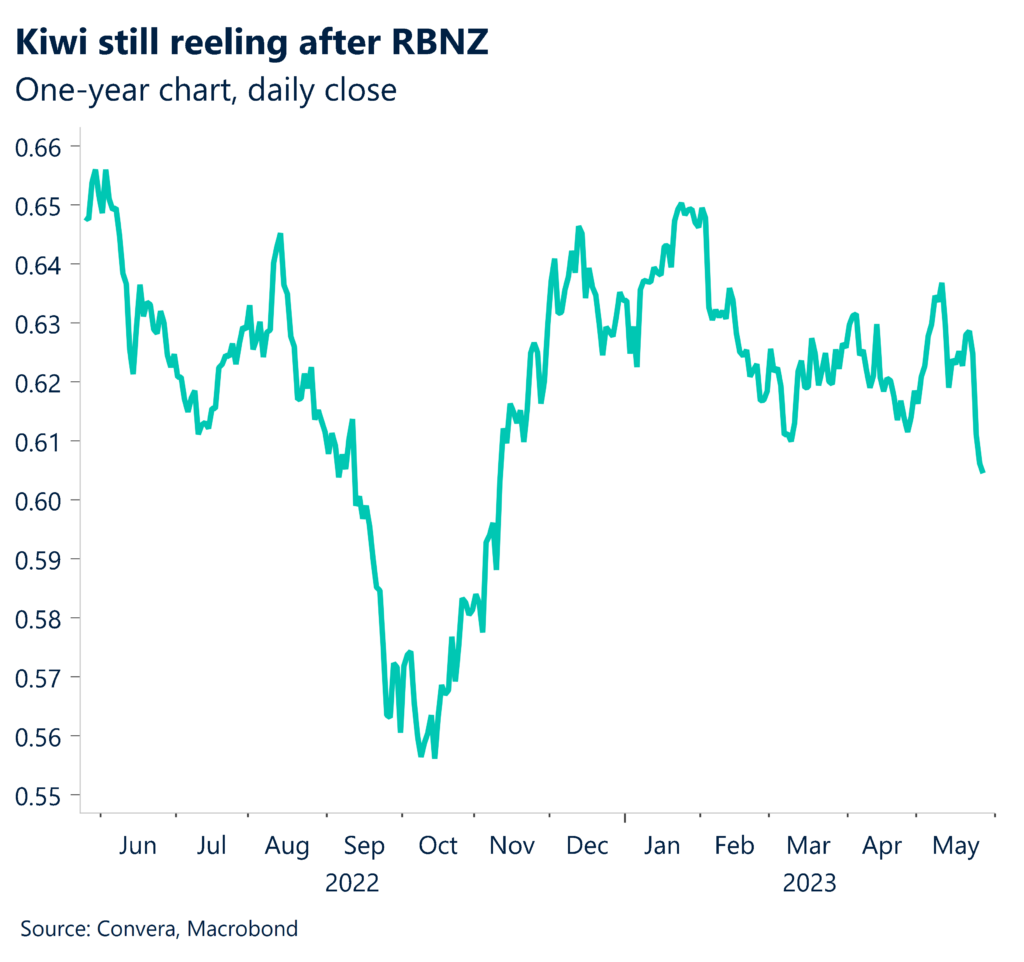

The kiwi saw only small gains as it continued to struggle after last week’s Reserve Bank of New Zealand decision signaled a likely end to rate hikes.

The NZD/USD gained less than 0.1% with the NZ dollar mixed in other markets.

Chinese PMIs, especially around new orders, to be key

While global markets mostly gained, Chinese shares weakened, with Hong Kong’s H-Shares index now nearing a 20% fall from the highs – one definition of a bear market.

All eyes are on today’s official National Bureau of Statistics manufacturing PMI out of China with the private-sector Caixin manufacturing PMI due on Wednesday.

The NBS PMI dropped sharply last month – down from 51.9 in March to 49.2 in April. The market is looking for a small rebound to 49.4.

Importantly, a big move lower in new orders impacted as global demand for manufacturing goods waned. The new orders component will be closely watched today.

USD mostly lower overnight but USD/SGD, USD/CNY still at highs

Table: seven-day rolling currency trends and trading ranges

Key global risk events

Calendar: 29 May – 2 June

All times AEST

Have a question?[email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.