Written by Convera’s Market Insights team

Yen reverses and stocks rebound

George Vessey – Lead FX Strategist

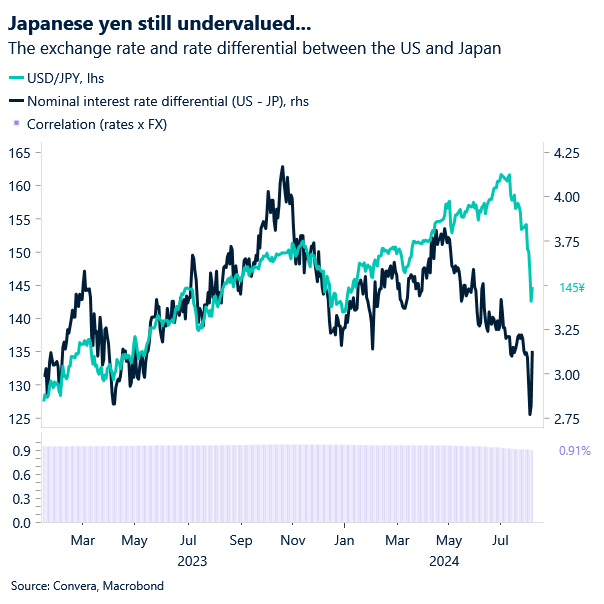

Asian stocks have rebounded overnight, and the Japanese yen has weakened more than 2% against major peers like the US dollar and British pound after the Bank of Japan’s (BoJ) Uchida raised concerns about the volatile markets moves of late and calmed rate-hike anxiety with dovish comments. The yen’s slump is being welcomed as it reduces the potential for fresh, rapid carry trade unwinds and the deleveraging impulse that generates across the broader financial system.

Nevertheless, the recent unwinding in carry trades could have more room to run as the yen remains one of the most undervalued currencies. The trade has been pummelled over the past month, but particularly this past week, leading to the yen’s realized volatility spiking to its highest since the pandemic. The huge shift in trading activity was exacerbated by the BoJ’s rate hike last week and then swelling fears of a looming US recession. However, helping soothe those latter woes was the Federal Reserve (Fed) Bank of San Francisco President Mary Daly, who stopped short of concluding the labour market has begun seriously weakening. Other Fed officials, who’ve spoken since the release of the dismal US jobs data from July, have also cautioned against reading too much into one employment report.

Global risk appetite has since improved, with the Nikkei rebounding 2.8% and almost back where it started before Monday’s 13% crash. Euro Stoxx 50 futures have advanced 1.3%, alongside gains in US futures. Treasuries have fallen alongside safe haven currencies like the Japanese yen and Swiss franc. The US dollar index has bounced from 6-month lows thanks to the gains against the yen, but it is softer against pro-cyclical FX – a pattern that may persist now that the dollar’s rate advantage has been trimmed with four Fed cuts priced in for 2024.

Seasonals and rate differentials weigh on pound

George Vessey – Lead FX Strategist

After trading near €1.20 just a few weeks back, the British pound is now just above €1.16 versus the euro and below key daily moving averages, having unravelled much of its year-to-date rally in tandem with a decline in expectations for UK interest rates and the unwinding of carry trades hurting global risk sentiment.

Despite the somewhat hawkish Bank of England (BoE) rate cut last week and Governor Andrew Bailey and chief economist Huw Pill both saying that further rate cuts are likely to be some months away, markets are pricing another 42 basis points worth of easing before year-end. Rate differentials were already pointing to an overstretched sterling, especially against the euro, so we’re not surprised to see GBP/EUR close the gap lower. The UK’s July inflation data out next Wednesday will only go so far in determining the timing of the next cut because the BoE expects inflation to rise again to 2.75% by year-end and says that it won’t respond to any singular month of data surprises. That likely rules out a September cut which markets are currently pricing a 47% chance of.

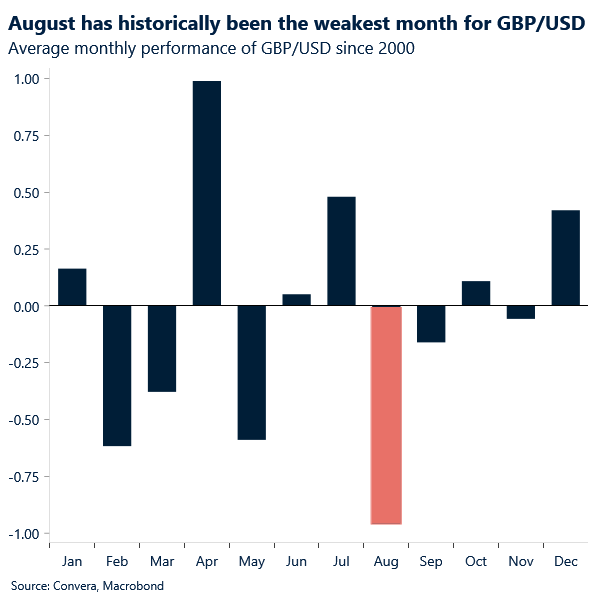

Heightened global growth concerns and the sharp global equity market sell-off has certainly muddied the picture though, and if the BoE does lean more dovish over the coming months, sterling’s upside potential could be limited before year-end. In the shorter-term, looking at GBP/USD, August has historically been the pair’s weakest month of the year, with average returns of around -0.80% since 2000.

Euro pares back some gains, trades structurally higher

Ruta Prieskienyte – Lead FX Strategist

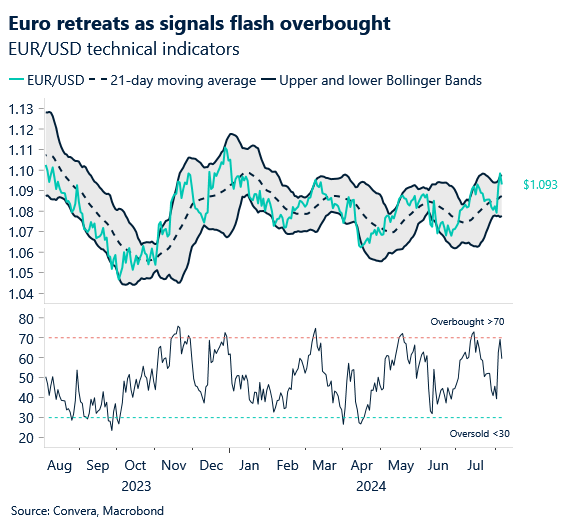

German bond yields moved mostly higher across the curve, lagging US Treasuries, as risk appetite returned following a sharp selloff at the start of the week. European stocks, apart from the French CAC 40, climbed as dip buyers emerged. Consequently, EUR/USD surrendered a portion of its recent gains amid soft mean-reverting behavior. While volatility is noticeably lower, further flare-ups, especially around US labor market reports, cannot be ruled out.

Investors have aggressively priced in an increased risk of a US recession following last Friday’s labor market report, whereas the outlook in Europe remains less clear. Eurozone retail sales fell 0.3% MoM in June, more than the expected 0.1% decrease, driven by a marked decline in sales of food, drinks, and tobacco products. The HCOB construction PMI edged down to a six-month low in July, with activity and output declining significantly, particularly in housing. New business also fell amid weak demand, sparking further job shedding. However, German factory orders rose by 3.9% MoM in June, surpassing market forecasts of 0.8%, marking the first increase since last December. Foreign orders gained 0.4%, with orders from outside the Eurozone rising 0.9%, while orders from within the bloc fell 0.3%.

The ECB officials must balance the growth picture in Spain and Italy, which are proving more resilient than Germany. Money markets are betting on the ECB cutting rates by 24bps in September and pricing in ~72bps by year-end. With relatively stable ECB rate expectations, recent volatility stemmed from the aggregate repricing of Fed easing. As the US rate moves appear exaggerated and are already correcting, scaling back Fed easing expectations suggests some upside risks for the greenback, albeit at a structurally lower level compared to last week.

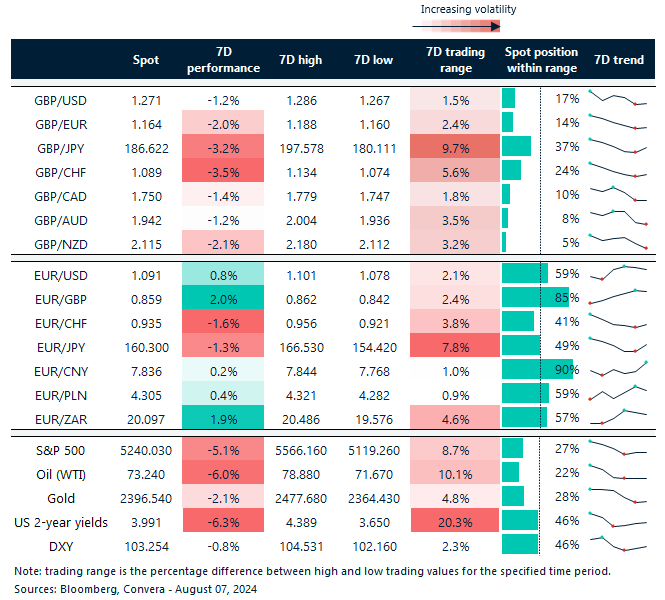

GBP/EUR down 2% in a week; bottom quarter of 7-day range

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 05-09

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.