UoM inflation expectations shock markets

The Australian and New Zealand dollar both turned sharply from recent highs on Friday after an unexpected jump in US consumer inflation expectations spooked markets.

The University of Michigan inflation expectations gauge jumped from 3.6% to 4.6% over the month in a sign that US consumers are becoming increasingly pessimistic about inflation. This can have a flow-on effect as consumers demand higher pay rises and drive inflation up.

The survey shocked markets after consumer and producer prices were both reported much lower last week.

The news sent US shares lower – the S&P 500 fell 0.3% – while US bond yields jumped. The benchmark two-year bond yield climbed from 3.97% to 4.10%.

US markets were also pressured by a poor retail sales reading on Friday. US retail sales fell by 1.0% over March below the 0.4% fall expected.

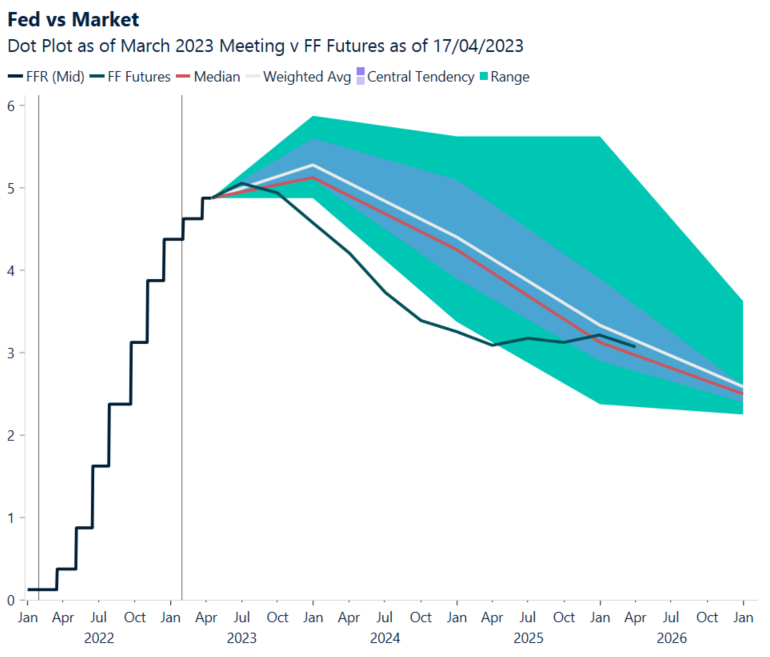

The poor data illustrates the current uncertainty in markets over the US Federal Reserve’s next move. While the US Federal Reserve expect interest rates will stay high until mid-2024, as shown by the Fed’s “dot plot” forecasts, market pricing sees the Fed as likely to start cutting by the end of this year.

Aussie, kiwi turn from highs

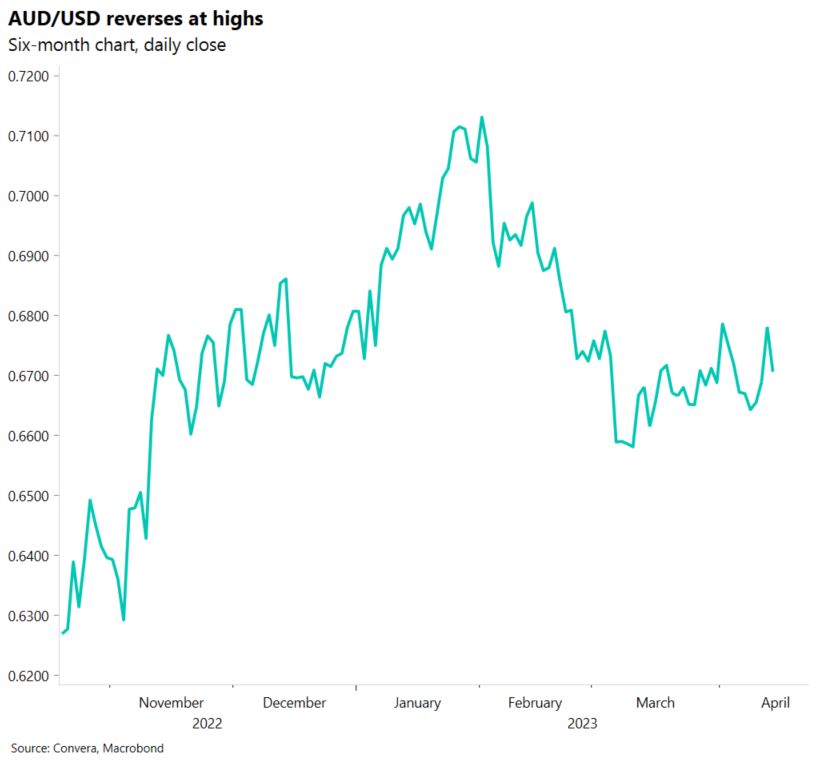

The AUD/USD turned sharply lower after reaching the top of its recent trading range at the seven-week highs.

The Aussie was weaker in most other markets with the AUD continuing to underperform in Europe. The AUD/EUR fell 0.7% while the AUD/GBP lost 0.2%.

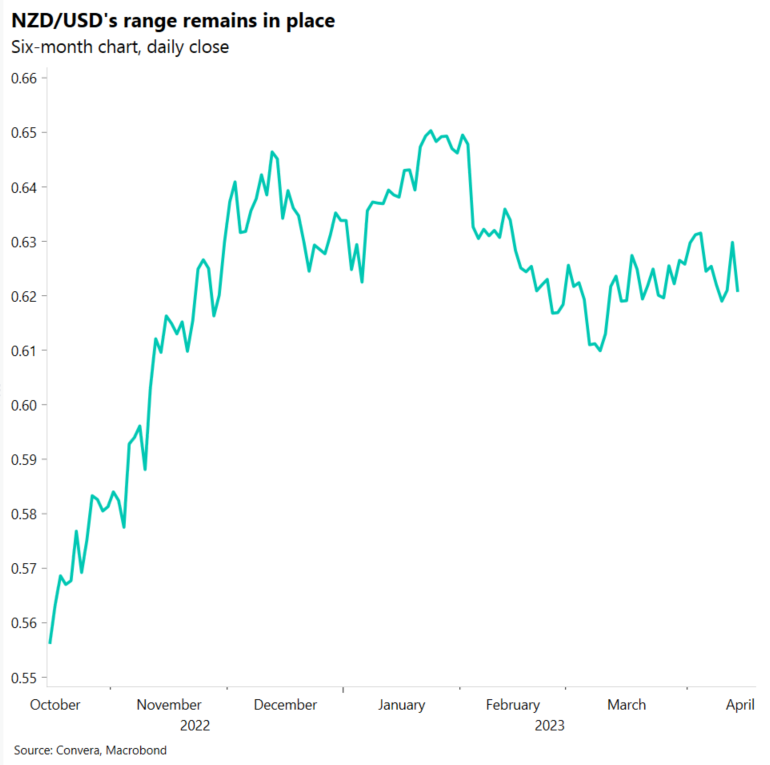

The NZD/USD also reversed from major recent highs as it remained in its two-month long trading range.

China GDP, NZ inflation in focus this week

Chinese GDP numbers, due on Tuesday, will be the major release early in the week, with markets hoping for a significant bump as the world’s second-largest economy emerges from last year’s COVID-driven lockdowns.

Later, on Thursday, NZ inflation numbers will be closely watched, after the Reserve Bank of New Zealand surprised markets with a larger-than-expected 50-basis point hike in the week before Easter.

Market forecasts expect NZ inflation to remain hot – with a quarterly result of 1.8% up from 1.4% previously and the annual rate expected to hold steady at 7.2%.

Aussie, kiwi reverse from multi-week highs

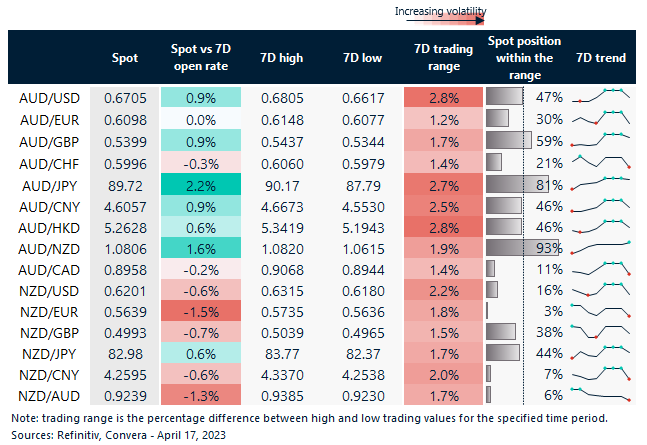

Table: seven-day rolling currency trends and trading ranges

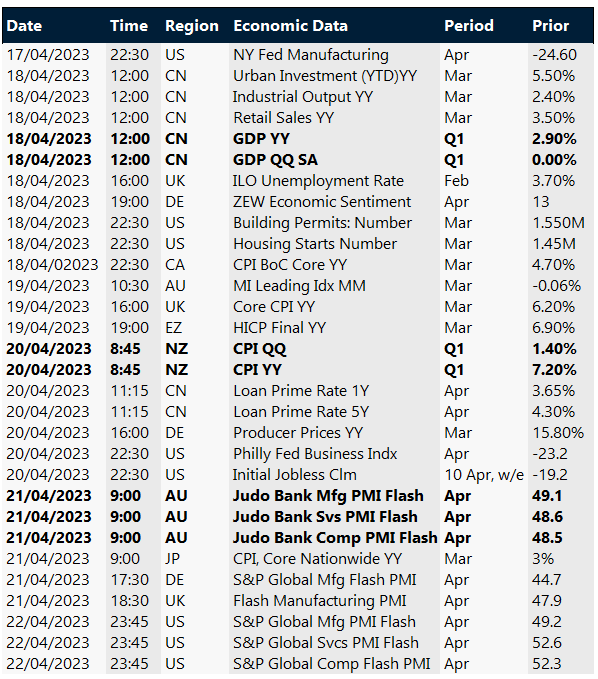

Key global risk events

Calendar: 17 – 22 April

All times AEST

Have a question? [email protected]