Trusted by tens of thousands of customers of all sizes

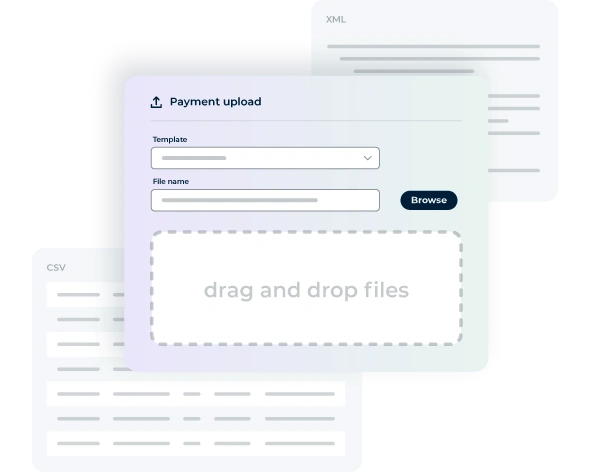

Online payments increase efficiency for Strathclyde Pension Fund

Find out how Convera helped Strathclyde Pension Fund streamline international payments processes and improve its service to members.

1 Excluding Switzerland which has a 60-day limit.

2 Available payment method may vary by country and industry.

Hotel Barge Luciole reduces costs for its business and clients

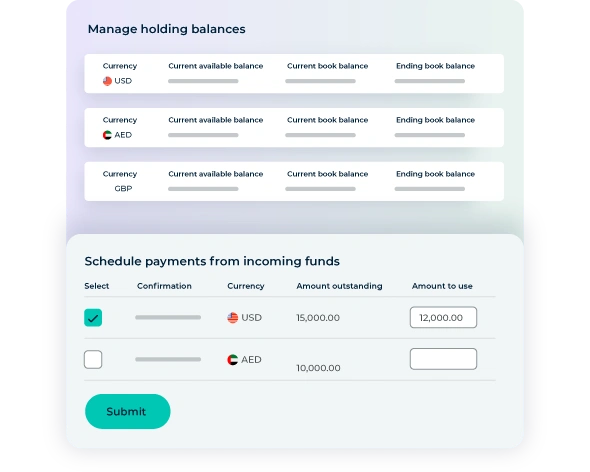

Discover how a European travel provider has leveraged Convera’s holding balances to lower the cost of incoming payments.

Use our currency converter to get real-time exchange rates

Currency converter

Payment solutions news and updates

Browse all

Scott Johnson on fraud, FX, and 2026 cross-border payment challenges

Convera’s VP of Program Management, Scott Johnson, discusses key cross-border payment challenges and risks for 2026, including AI fraud, regulatory complexity, and FX hedging in volatile times.

FX trends for March 2026: Tariffs, central bank risk, and oil on edge

Dive into the Global FX Outlook for March including heightened political pressure on central banks, escalating geopolitical risks, and the impact on your business.

What is a budget rate, and how does it guide small business FX planning?

Learn what a budget rate is, how to set one, and why it’s essential for small businesses planning FX strategies and hedging currency risk.

Receive daily currency market updates direct to your inbox

No signs of de-escalation

Strong dollar, shaky foundations. Hawkish repricing ignites as inflation risks rise. Stagflation fears are back on the agenda.

Dollar gains as tensions rise, oil spikes

US Dollar strengthens on war jitters. Fed Miran flags neutral rate, warns on jobs. Inflation and US labor market data in focus

War rages on, markets reel

The Middle East conflict has sparked a global market shock, driving energy prices higher, freezing shipping routes, and lifting risk levels as investors brace for more volatility.

Ready to get started?

Find out why business leaders choose Convera for their commercial payment needs.

Contact sales