The 2024 US election is shaping up to be one of the most closely watched political events of the year. As the world’s largest economy heads to the polls on November 5th to decide its 47th President and 50th Vice President, businesses and financial markets around the globe are bracing for volatility.

The stakes are high. With control of the White House, Senate, and House of Representatives hanging in the balance, the election outcome will have profound implications for domestic policy, international trade, and critically, global FX markets. Is your business ready to weather this storm?

Download our US Election Guide for FX Markets now.

Written by Convera’s Market Insights team, the US Election Guide is designed to help businesses understand and prepare for potential currency market fluctuations arising from this pivotal moment. It breaks down likely scenarios and identifies key risks to help your business navigate the uncertainty that lies ahead.

The political landscape: Tight race and unclear policy direction

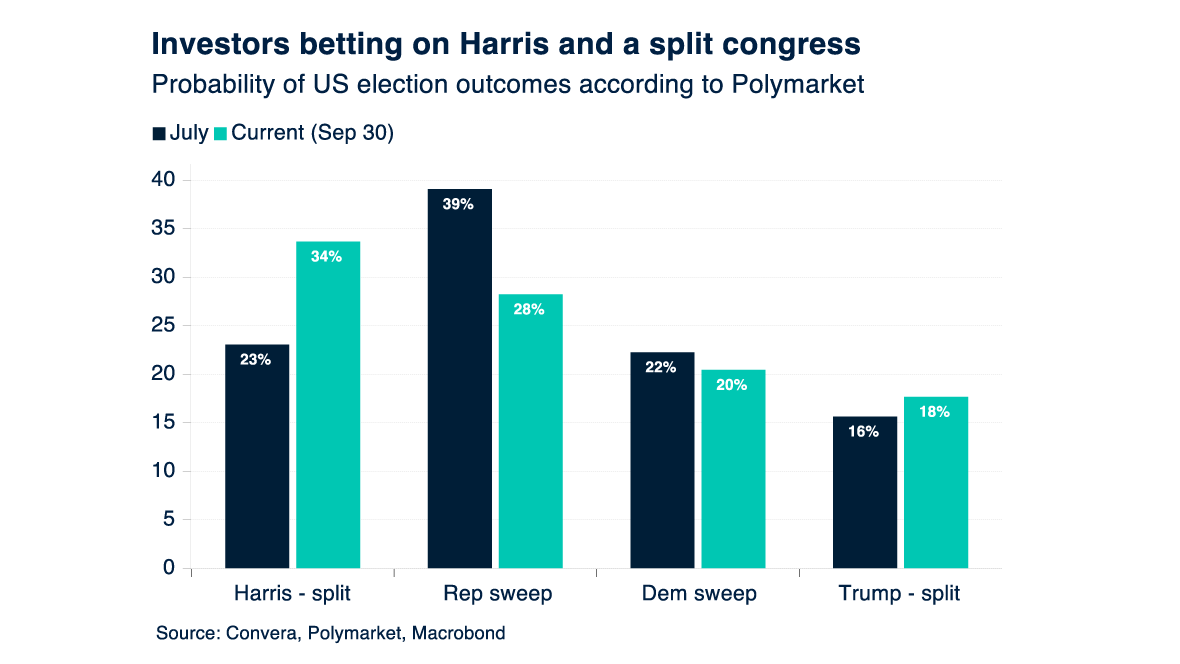

The race to the White House is incredibly tight, with opinion polls showing a slight edge for the Democrats. Vice President Kamala Harris has emerged as the frontrunner to succeed President Biden, who has withdrawn from the race. However, the battle for control of Congress adds another layer of complexity. The Senate appears to favor the Republicans, while the House of Representatives remains a toss-up, with no clear indication of which party will dominate.

According to Boris Kovacevic, Convera’s FX & Macro Strategist, Central Europe, “This divided political landscape creates a scenario where policy direction is unclear and the potential for a Trump win or a Harris victory brings different implications for market movements and currency volatility. Financial markets are already reacting to shifting probabilities, and investor sentiment remains on edge.”

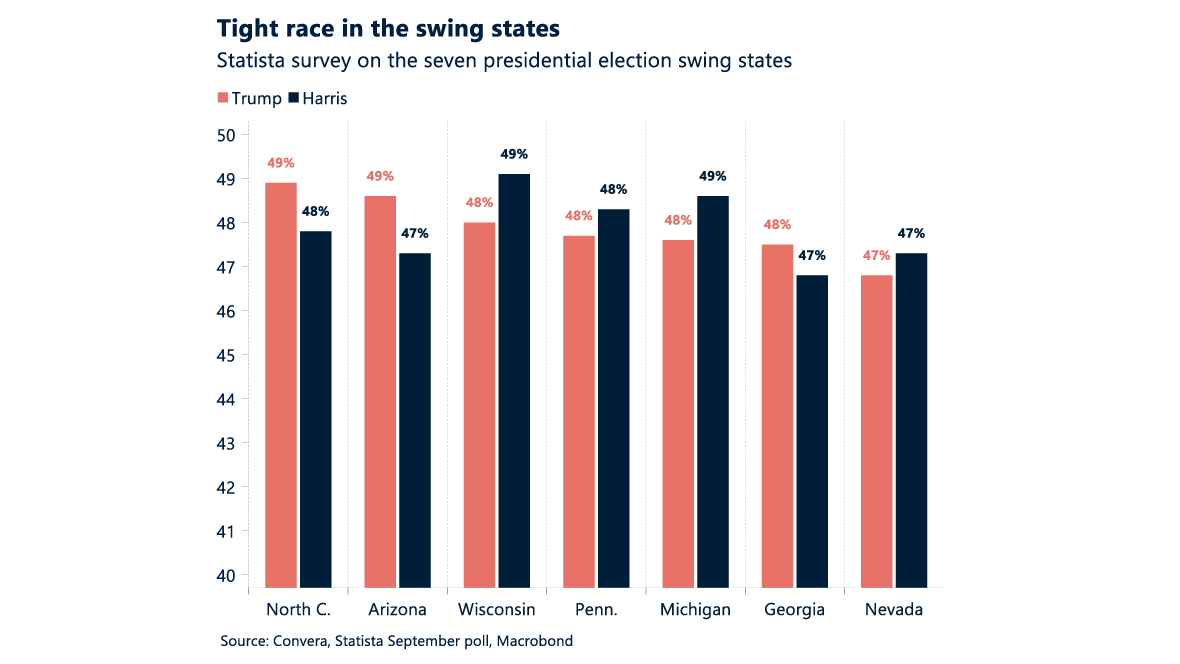

The outcome of the election will hinge on a few key battleground states that are too close to call. These swing states hold the key to the 270 electoral votes needed to secure the presidency. Even a small shift in voter turnout or sentiment could dramatically alter the electoral map and, by extension, influence the FX markets.

What history tells us

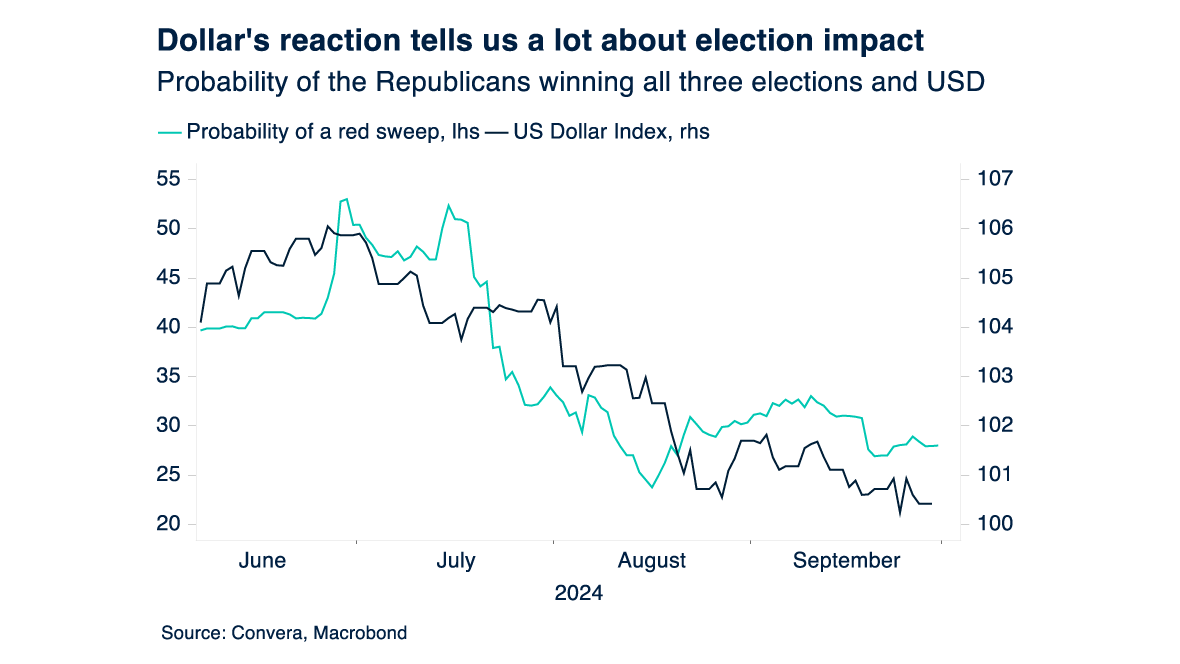

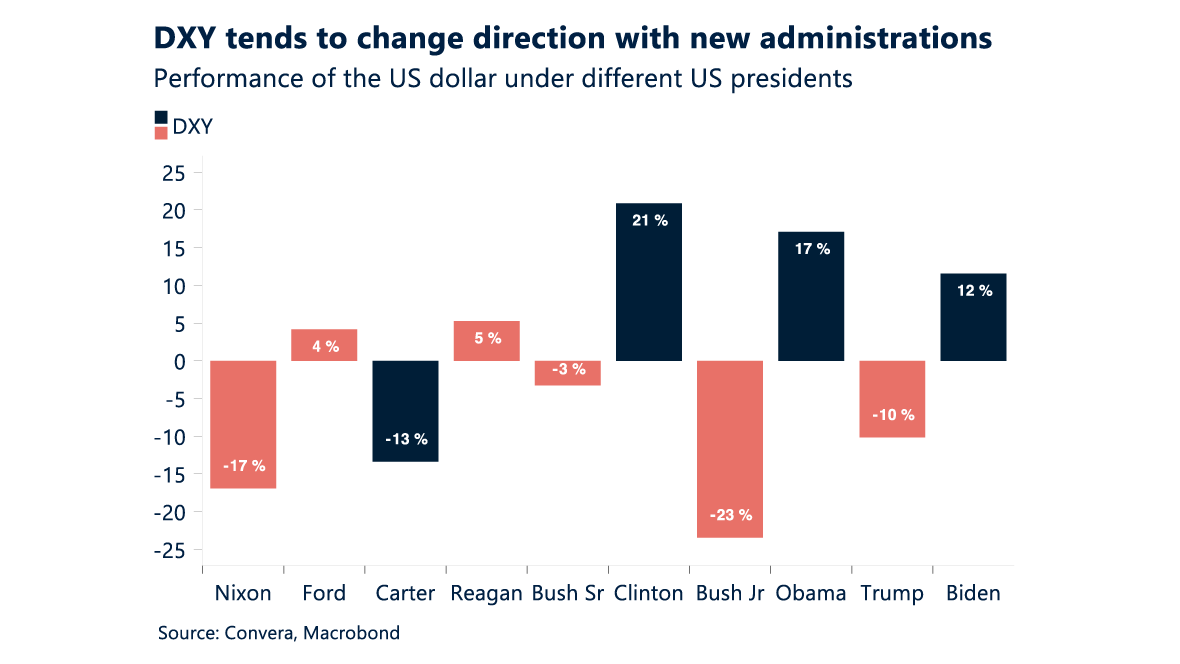

Historical patterns show that the US dollar’s reaction to presidential elections follows a predictable path. Typically, the greenback tends to appreciate immediately following a Republican win and weakens if a Democrat takes the White House. However, these initial movements are rarely sustained over the long term. Over the past 50 years, the dollar has generally performed better under Democratic administrations when considering the entire four-year cycle.

This nuanced behavior underscores the importance of a sophisticated approach to hedging and managing FX risk during election periods. A split Congress, which appears likely, could add further complexity. Legislative gridlock might lead to more subdued policy responses and less immediate market impact but could still set the stage for significant movements over the longer term.

Three key risks for FX markets

Our election guide identifies three primary risks that businesses need to consider as the election draws nearer. Recognizing these risks aids businesses in navigating heightened volatility and developing strategies to help manage FX risk.

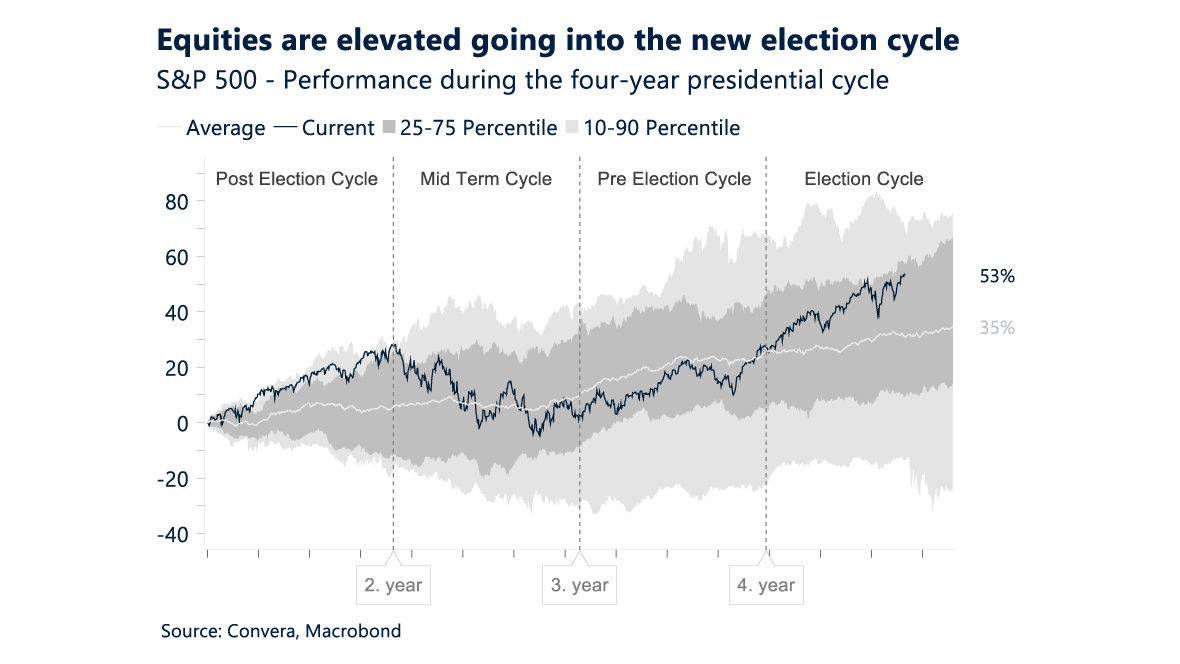

1. Elevated asset prices ahead of the election:

The S&P 500 and the US dollar are currently trading at elevated levels, a notable deviation from the historical trend of stabilization or decline during election years. Currently, the S&P 500 is up 52% since the start of President Biden’s term, far outpacing the typical 35% gain at the end of a presidential term.

Similarly, the US dollar has recorded impressive gains, outperforming the average return during recent Democratic presidencies.

“If Harris wins, these elevated valuations could be vulnerable to a sudden correction,” Kovacevic explains. “Especially if markets begin to price in the potential for increased regulatory scrutiny and higher taxes. Conversely, a Trump victory could reinforce the status quo, supporting equities and the dollar in the short term.”

2. Potential for a major dollar regime shift:

The US dollar’s performance often shifts dramatically when a new president takes office. Historically, Republican presidents have been associated with a weaker dollar, while Democratic administrations have seen stronger greenback performance.

If this pattern holds, a Harris win could signal a period of dollar strength, while a Trump victory might lead to a period of depreciation. The magnitude of these changes can be significant, resembling what some analysts describe as a regime shift.

Businesses exposed to the USD should be ready to adjust their hedging strategies. Recognizing the potential for such shifts is key to managing FX risk effectively.

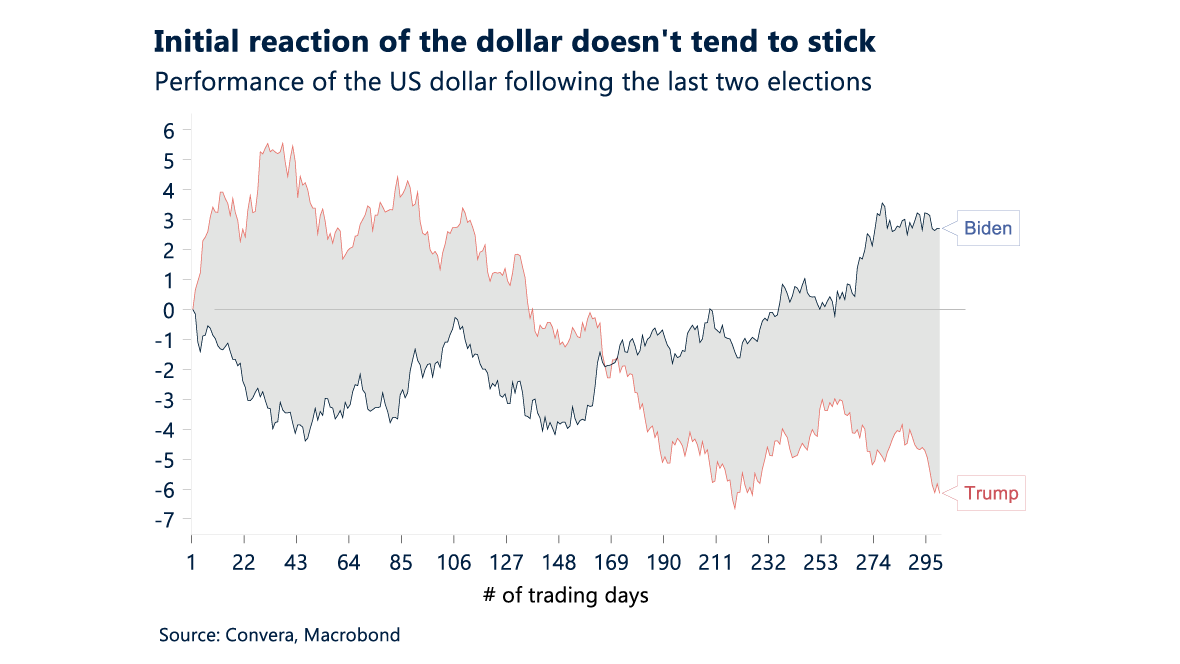

3. Initial market reactions may not stick:

While markets often respond quickly to election results, initial reactions are rarely a good predictor of long-term trends. For example, in the 2016 election, the dollar surged immediately following Trump’s victory, only to reverse course in the months that followed.

This phenomenon could repeat in 2024, with short-term spikes giving way to longer-term trends driven by macroeconomic fundamentals and policy changes.

Kovacevic says that businesses should be cautious of relying too heavily on initial market reactions, “Instead they should focus on the broader economic picture when developing strategies to manage their FX exposure in response to the election.”

Policy paths and market outcomes

The two leading candidates, Kamala Harris and Donald Trump, offer starkly different policy approaches, each with distinct market implications. A Harris administration is expected to continue the current focus on domestic investment and regionalism, with a particular emphasis on clean energy and infrastructure spending.

This approach could lead to a softer dollar in the short term, but looking towards the horizon, it could bolster economic growth and, by extension, the greenback.

“On the other hand,” says Kovacevic, “A return to a Trump-led White House would likely see a more aggressive stance on trade, particularly with China. This could heighten global risk sentiment, initially driving the dollar higher as a safe-haven currency.”

However, sustained trade tensions might weigh on the greenback over time, particularly if it undermines business confidence and investment.

Swing states: The deciding factor

The race is likely to be decided in a handful of battleground states, which are key to the 270 electoral votes needed to secure the presidency.

With both candidates polling closely, the outcome remains highly uncertain. Recent shifts in voter sentiment on issues like the economy, healthcare, and even recent assassination attempts on Trump have added to the complexity surrounding this election.

Steven Dooley, Head of Market Insights at Convera, highlighted that, “Polling data from key swing states shows Harris and Trump separated by just a few percentage points. Given the importance of these states, even a small shift in voter turnout or sentiment could dramatically alter the electoral map.”

Download the US Election Guide now

As we’ve explored, the 2024 US presidential election is set to bring significant volatility to FX markets. Political uncertainty, elevated asset prices, potential dollar regime shifts, and the Federal Reserve’s cautious stance all play crucial roles in shaping market movements.

It should also be noted that the Federal Reserve cut interest rates by 50 basis points on 18 September – less than two months out from the election. This is not unusual. The US Federal Reserve has made rate changes during election cycles more often than many assume. The Federal Reserve’s monetary policy decisions during election years can impact broader economic stability, market volatility and the direction of the dollar, suggesting that businesses must factor potential rate fluctuations into their risk management strategies as the 2024 election approaches.

To help you stay ahead of these potential shifts, download our comprehensive US Election Guide for FX Markets for in-depth analysis of key scenarios, historical market behavior, and actionable insights to help your business navigate the volatility surrounding the 2024 election.

Want more insights on the topics shaping the future of cross-border payments? Tune in to Converge, with new episodes every Wednesday.

Plus, register for the Daily Market Update to get the latest currency news and FX analysis from our experts directly to your inbox.