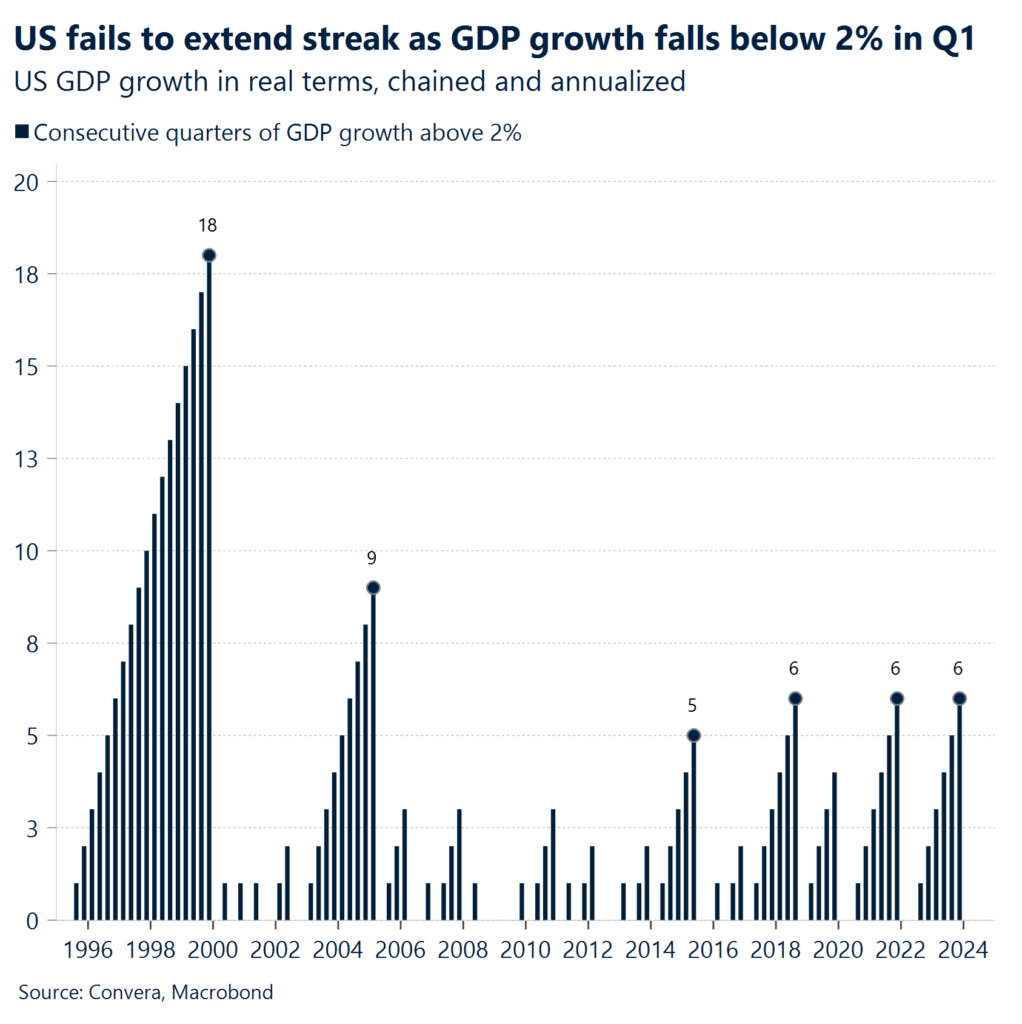

US activity expanded by a disappointing 1.6% in the three months ending in March. However, the price component (PCE) came in much hotter than expected, beating the 3.4% estimate with a 3.7% growth rate.

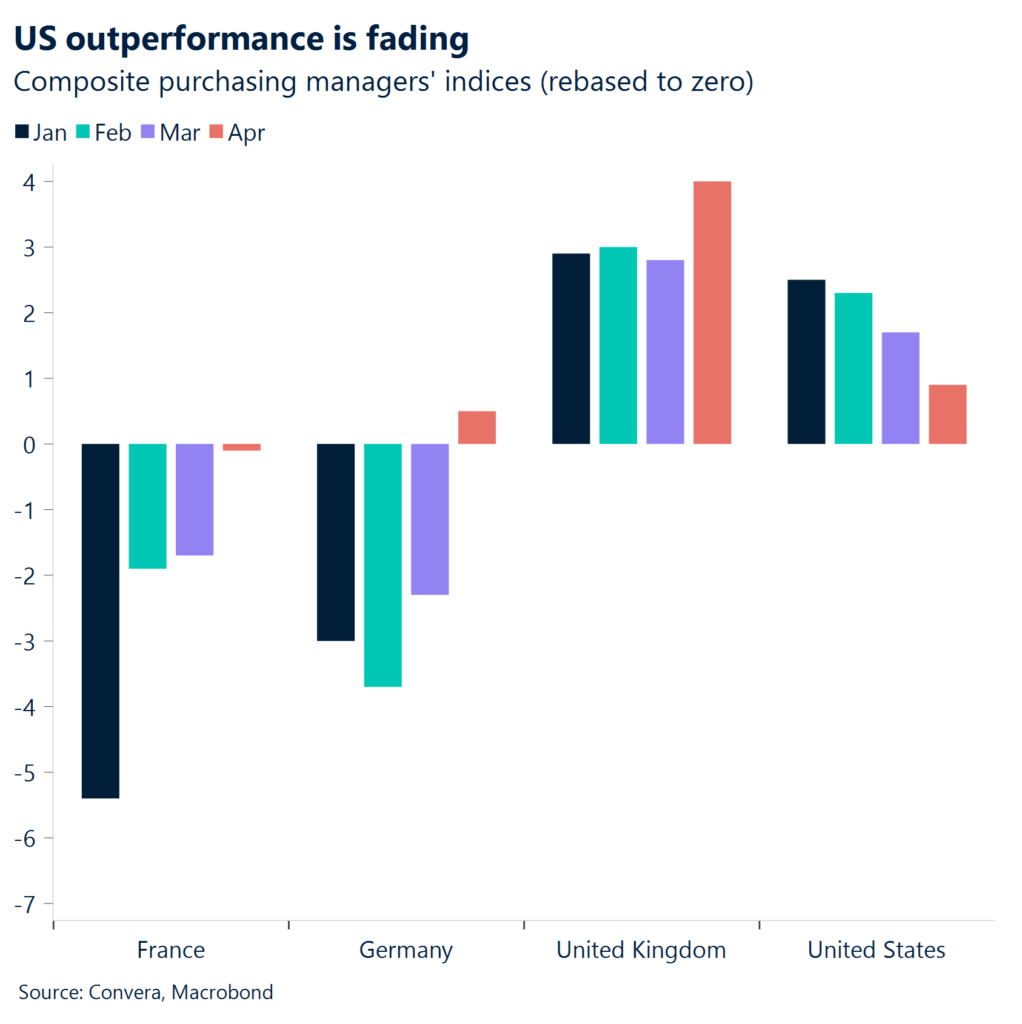

Flash US PMI slipped to 50.9, implying the US economy may not be as “exceptional” as other indicators suggest. The same index increased to 51.4 and 54.0 for the Eurozone and UK, suggesting a convergence.

Markets didn’t seem to care that much about the GDP-PCE story as weaker US PMIs and fading geopolitical risks set the tone. Global equity markets rose for the first time in four weeks as the dollar declined despite yields continuing to climb.

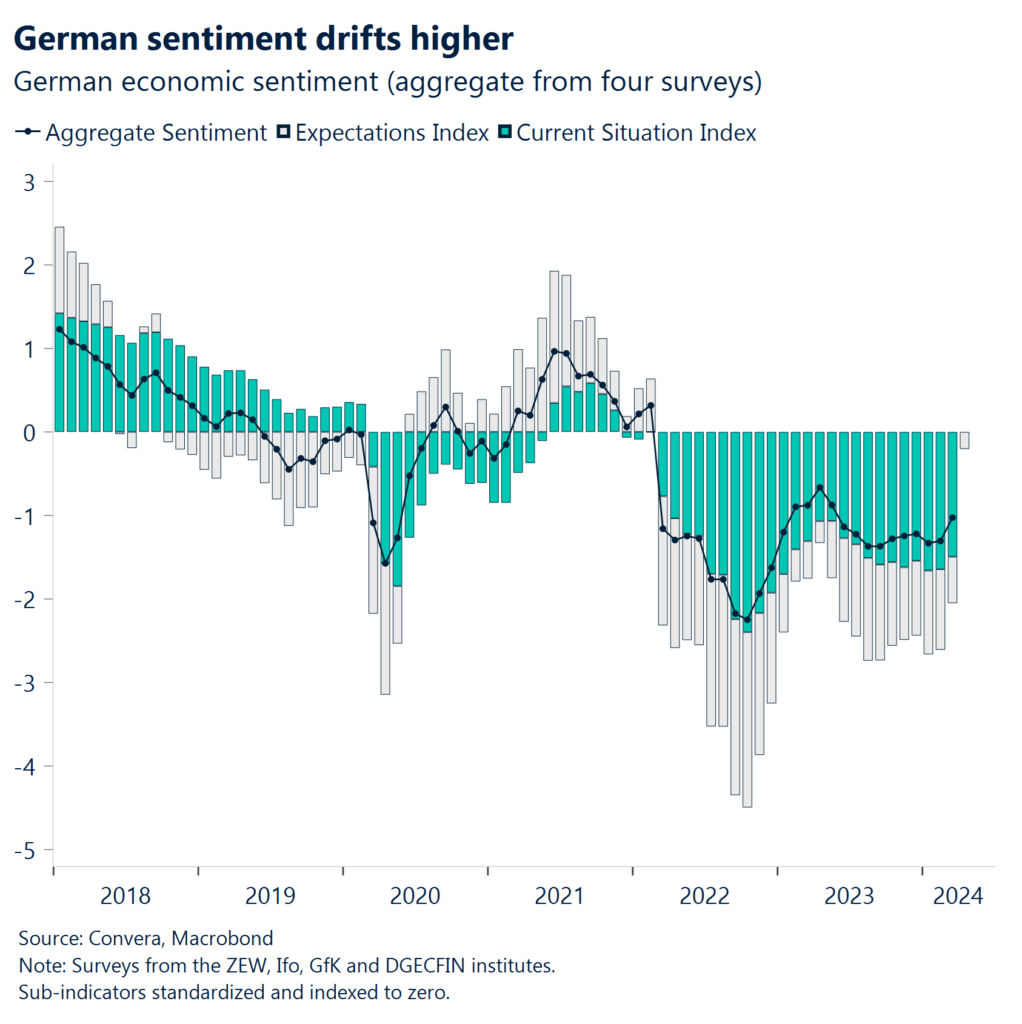

April has seen a broad-based sector wide improvement in the German growth outlook, confirmed by all major surveys. German macro has now finally stopped being a burden for the euro as economic momentum is starting to pick up.

Multiple Asian currencies are trading at or near multi-year lows vs. the dollar. Central banks in Japan, Taiwan and this week Indonesia have increased interest rates with pressures on Malaysia and the Philippines mounting to do the same.

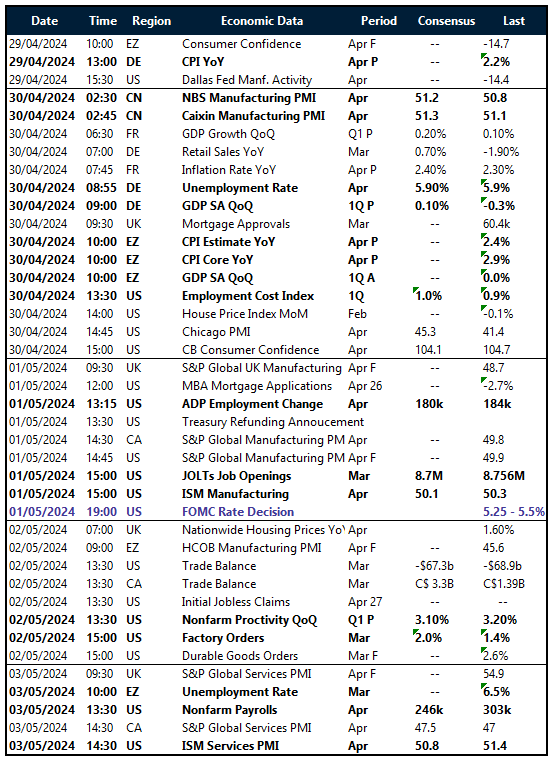

A big US macro week includes the Employment Cost Index, ISM manufacturing and services PMI, job openings, factory orders and the nonfarm payrolls report closing out the week on Friday. The Fed is expected to leave policy rates unchanged on Wednesday.

Global Macro

Investors at crossroads on three fronts

Growth vs. inflation. The conclusion of the week has been that US inflation remains sticky while US exceptionalism on the growth side is waning. The upside surprises on retail sales, industrial production, inflation and durable goods did not culminate into a strong GDP print closing out Q1. US activity expanded by an annualized 1.6% in the three months ending in March. However, the price component (PCE) came in much hotter than expected, beating the 3.4% estimate with a 3.7% growth rate. Going forward, it seems more likely that US growth will moderate and converge back down to the soft data. Fed cuts could still come few and far between as inflation remains above target.

Europe turning neutral. April has seen a broad-based sector wide improvement in the German growth outlook, confirmed by all major surveys. German macro has now finally stopped being a burden for the common currency as economic momentum is starting to pick up. One thing to note; the recent improvement in sentiment has been driven by the expectations component as export perspective brighten and hopes of rate cuts in the latter half of the year mount. German companies still assess their current situation as historically weak. However, markets have focused on the former as absent any shocks, expectations lead the business cycle (current situation) and markets (FX).

Intervention risks rising. Asia has a strong dollar problem that only the Fed can solve. Asian currencies have remained under pressure versus the Greenback as the divergence between the Fed and central banks in Asia continues to grow. The mean 10-year yield differential between the US and eight selected Asian countries rose from -0.1% at the beginning of the year to currently sitting +0.4%. This has resulted in currencies of countries like Japan, Korea, Malaysia, Indonesia and the Philippines trading at or near multi-year lows vs. the dollar. Central banks in Japan, Taiwan and this week Indonesia have increased interest rates with pressures on Malaysia and the Philippines mounting to do the same.

Regional outlook: US & UK

Is growth between the US and RoW converging?

Negative employment. The flash US composite Purchasing Managers Index (PMI), which tracks the manufacturing and services sectors, slipped to 50.9. A reading above 50 still indicates expansion in the private sector, but it was its slowest since December 2023, implying the US economy may not be as “exceptional” as other indicators suggest. The composite measure of orders also showed the first contraction in six months whilst employment decreased for the first time since June 2020 with the reduction focused on services. A cooling of the labour market fed through to lower prices pressures too, with both input costs and output charges rising at slower rates.

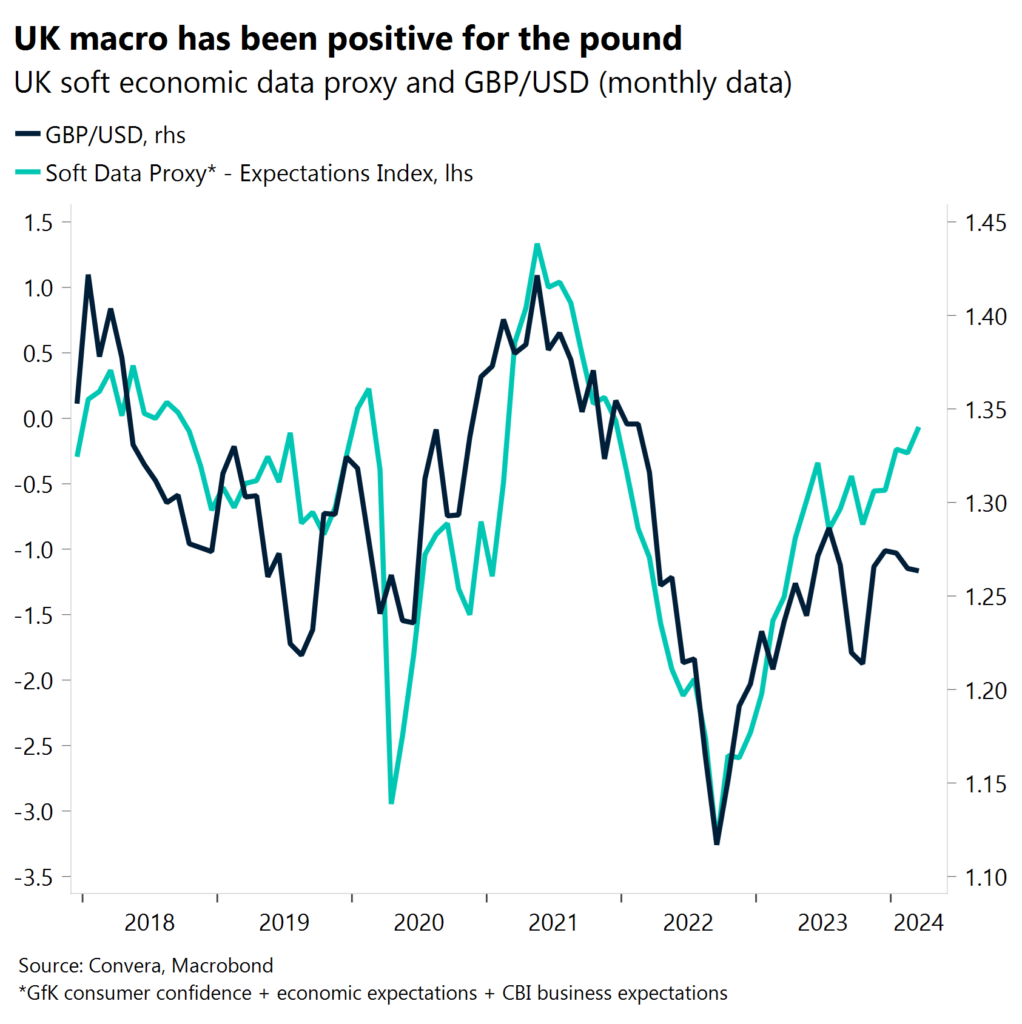

UK outperformance. The UK composite PMI rose to a stronger-than-expected 54.0 in April, from 52.8 in March. This marked the most robust growth in business activity since May 2023 and means the UK has outperformed even the US every month so far this year. The gain was led by a big rise in the services index to 54.9 from 53.1, offsetting the manufacturing slump to 49.1 from 50.9. Meanwhile, the prices charged by firms rose at the slowest pace in over three years, but they also reported the strongest cost pressures in 11 months.

British optimism. The Confederation of British Industry’s (CBI) quarterly Industrial Trends survey showed that business optimism rose to its highest level in nearly three years while sentiment within the manufacturing sector improved, with output expectations the strongest for six months. However, price pressures continued to build, with the corresponding index rising to the highest level since February 2023.

Regional outlook: Eurozone

Stars align for Eurozone recovery

Service led recovery gathers pace. The S&P Global Composite PMIs for the Eurozone climbed to 51.4 in April, well clear of the 50 threshold that separates expansion from contraction, and topping market consensus of 50.7. German private-sector activity grew for the first time in 10 months, driven by services as manufacturing continued to shrink, albeit at a slower pace than the month before. However, the recent improvement in sentiment has been driven by the expectations component as export perspective brighten and hopes of central bank rate cuts.

Germany is healing. A string of business surveys are suggesting that Germany may be tentatively bouncing back. The forward looking Gfk consumer confidence index rose to -24.2 – its highest level since May 2022, beating market expectations while business sentiment improved to its highest level in a year. While overall sentiment has improved, it remains at a subdued level, with a sustained economic recovery still some time away. Earlier this week, the German government published forecasts show the economy is expected to grow just 0.3% in 2024.

What awaits after June cut? Although a June rate cut is most likely a sealed deal, the rate path in H2 remains a highly contested topic across the Governing Council. The ECB’s Nagel said that services inflation remains high and until inflation falls in a sustainable manner, he could not pre-commit to a particular rate path. His views were echoed by other ECB officials, namely Schnabel and Muller, who said he was not comfortable committing to “back-to-back cuts”. Meanwhile ECB’s Stournaras and Simkus show openness to cut 3, potentially even 4, times by year end. Money markets trimmed cumulative rate cuts expectations to 66bps (-8bps w/w) by year end, while front end expectations remain largely stable.

Week ahead

Big week as GDP print spreads confusion

Searching for confirmation. The US GDP report on Thursday jolted markets as growth surprised to the downside, while inflation for Q1 came in much hotter than expected. While the contradiction won’t move the needle for the Fed on Wednesday, it does suggest that growth is starting to slow, while price growth remains sticky. Against this backdrop, both macro and inflation data will be closely watched before and after the FOMC meeting.

Big US macro week. The plethora of market moving releases includes the Employment Cost Index, ISM manufacturing and services PMI, job openings, factory orders and the nonfarm payrolls report closing out the week on Friday. Markets are expecting Jerome Powell to reiterate the neutral stance the central bank has recently adopted in response to higher-than-expected inflation in Q1. Investors have cut back their easing bets to just one rate cut this year, well down from six in January and below the Fed’s own projection of three. However, a consensus is building around the view that the Fed will revise its rate projection up in June so as to show only two cuts for 2024.

European inflation. The US will be the relevant market to watch. However, European investors will have more than enough data to digest as well. German and European inflation numbers will be key as both investors and policy makers are gearing up for a likely start of the easing cycle in June. Consumer confidence for the Eurozone and housing prices for the UK are coming up as well.

FX Views

Dollar pulls back; yen still on the ropes

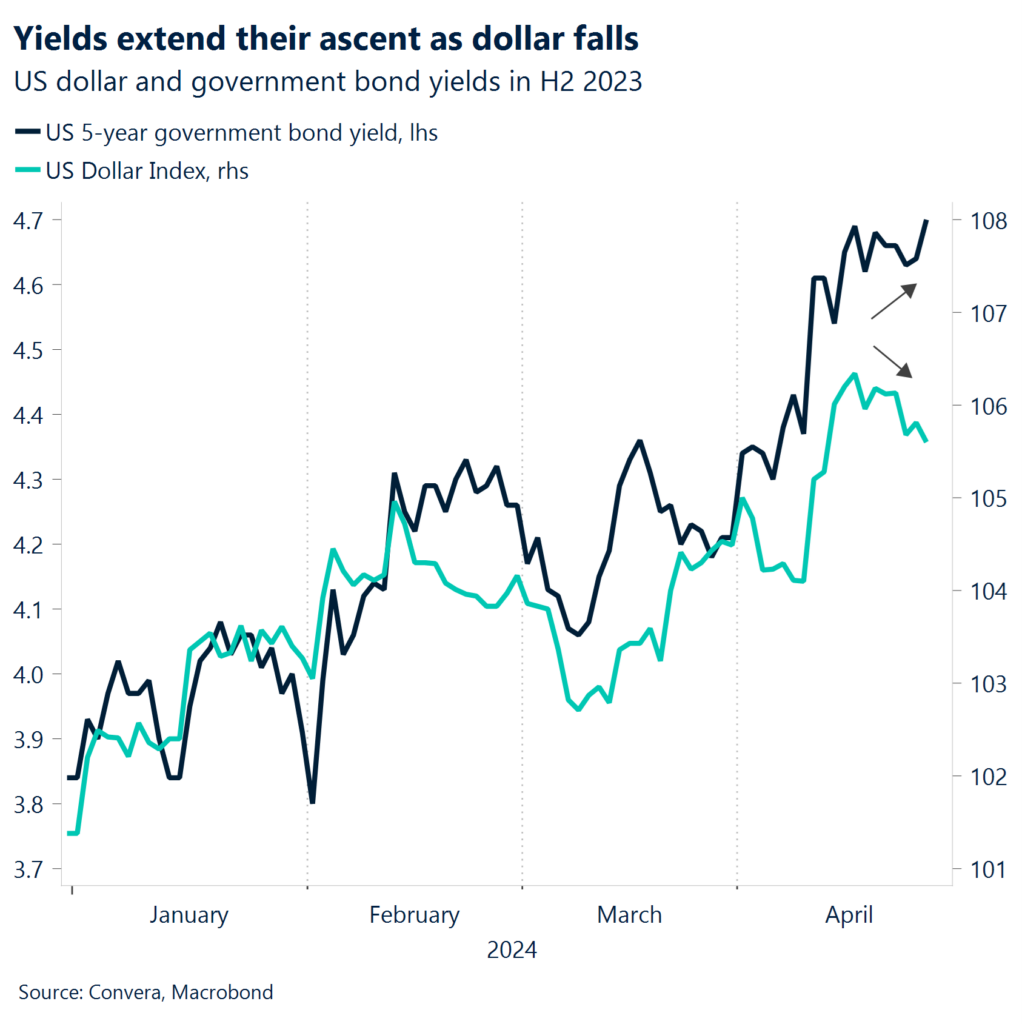

USD Decouples with yields (for now). The US dollar has recently suffered a further softening in its momentum due to a calmer risk setting, falling oil prices and weaker-than-expected US economic data. Diverging PMIs was the catalyst to send the US dollar index to 2-week lows, despite US yields consolidating at 5-month highs. The main drivers of FX still point to a stronger dollar in the very near term. Higher Treasury yields, widening swap differentials in favour of the USD, and stumbling equities this month are all constructive for the US currency. The markets continue to price in a higher-for-longer environment for the Fed amid solid underlying US economic growth and stickier inflation figures. The dollar’s volatile, but eventually negative, reaction to the softer GDP and hotter PCE prints for Q1 again reflects the buck’s asymmetric reaction function, responding more to negative news on US data compared to USD-positive news. The same can’t be said for fixed income though as the US 10-year yield rose to the highest since early November as traders pushed back the timing of the first Fed rate cut until December. We could see a lagged recoupling of US yields and the USD soon though with the DXY possibly stretching back above the 106 handle. The upcoming Fed meeting and non-farm payrolls will keep traders on their toes though.

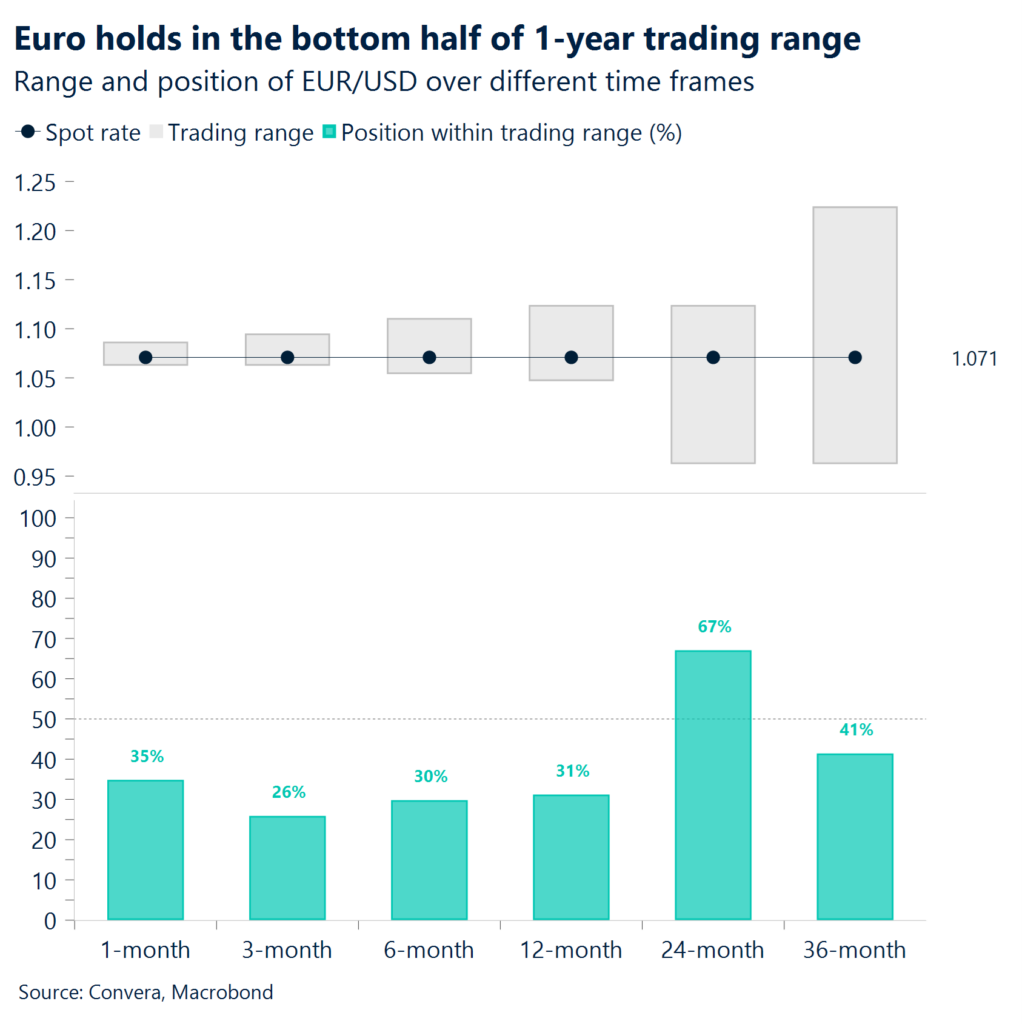

EUR Not out of the woods. As short-term bearish pressures ease a notch and EU-US 2-year government bond spread narrowed the most since Apr 10th, euro clinched a 2-week high around $1.0730 as US dollar strength waned on the back of an unexpected shortfall in US data. Upbeat domestic macro data acts as a support function, rather than a bullish catalyst, for the euro currency, as the focus remains firmly on US developments and subsequent adjustments to policy rate cut expectations. As it stands, the divergence between the Fed and the ECB outlooks for rate trajectories remains an overarching euro negative factor. EUR/USD 1-week 25 delta risk reversal rose to 0.23% in favour of euro puts, suggesting markets see further euro downside in the short term. If euro sellers drag the spot below $1.07 threshold, that would pave the way toward the 100-week SMA at $1.0630, with immediate support at $1.0601 (YTD low). For now, the 50-week SMA at $1.0820 sets a possible top, capping further near-term upside.

GBP Sharp rebound from 5-month low. The pound registered its biggest daily rise (0.8%) and its second biggest weekly rise (1.2%) year-to-date against the US dollar after hitting a fresh 5-month low recently. Improving risk sentiment, better-than-expected UK economic data and relatively hawkish comments from the BoE’s chief economist supported the UK currency. Money markets modestly reduced bets on the scope for BoE rate cuts as a result and August is no longer fully priced in as the starting point. The UK 10-year government bond yield surged towards 5-month peaks, supporting sterling’s strength across the board with GBP/JPY hitting highs last seen in 2015 and GBP/EUR jumping over 1%, back above key long-term daily moving averages. Meanwhile, GBP/USD has recovered over two cents in a week after finding support at its 100-week moving average, but remains over 3% below its 2024 high near $1.29. The pair has been caught in a steep downtrend since March and will need to close above its 200-day moving average at $1.2560 to give us more confidence in a recovery towards $1.30 later this year. However, the risk of further dovish repricing of the BoE rate outlook, given UK inflation dynamics, is likely to limit sterling’s gains, especially if the BoE delivers more rate cuts than the Fed this year.

CHF Easing geopolitical risks squeeze swissy lower. The Swiss franc has appreciated against less than 20% of global currencies so far this year. After strengthening against over 50% of its peers last week, due to a spike in safe haven demand on escalating geopolitical risks, the franc soon found itself back on the defensive. USD/CHF touched fresh 6-month highs close to its 100- and 200-week moving averages in the higher realms of 0.91, due to stark differences in expected monetary policy paths between the US and Switzerland. Meanwhile, EUR/CHF scored its second biggest weekly rise of 2024 amidst a cooling of geopolitical tensions and thus safe haven demand. Going forward, absent any external shocks, particularly geopolitical, driving CHF demand, we retain a bearish view on the swissy. Moreover, the SNB is unlikely to accept any sustained CHF strength given Swiss inflation already fell to an over-two-year low of 1% in March. Lower inflation has already allowed the SNB to cut interest rates and relax its support for the franc, with foreign currency reserves increasing for a third month in February, but the SNB may even be prepared to buy FX to curb any unwanted CHF strength. The latest Swiss inflation report for April is a key risk event for the franc over the coming days.

CNY FX markets testing PBOC’s “line in the sand”. The Chinese yuan remained pressured as the USD/CNH pair traded close to technical resistance at 7.3000. The economic outlook remains gloomy for China with the Conference Board’s leading index providing a negative reading for the ninth-straight month. Chinese authorities are likely to push back on recent weakness as the USD/CNH reached this major technical level. In the near term, the year’s highs near the key 7.3000 level look likely to cap gains and CNH buyers will be looking to target moves towards this level. However, with the ongoing US dollar strength, and the People’s Bank of China likely to keep policy loose, the USD/CNH might eventually test levels above 7.4000.

JPY New lows for yen as BoJ holds steady. The USD/JPY remains the most closely-watched pair in FX markets as the marked divergence between a hot US economy and a still-loose Japanese policy regime keeps upward pressure on the pair. The USD/JPY broke above 155.00 for the first time since 1990 mid-week. The JPY is weak in other markets too – at the lowest level versus the euro since 2008 and the Chinese yuan since 1992. On Friday, the Bank of Japan kept policy on hold after raising rates for the first time in 17 years in March and did little to dissuade markets to stop selling yen. The USD/JPY is clearly overheated. The relative strength index, a measure of momentum, is at the highest level since May last year, but does not show signs of reversal as yet. Markets remain alert for intervention from the Ministry of Finance, but with fundamentals driving the pair higher, Japanese authorities might struggle to have a lasting impact.

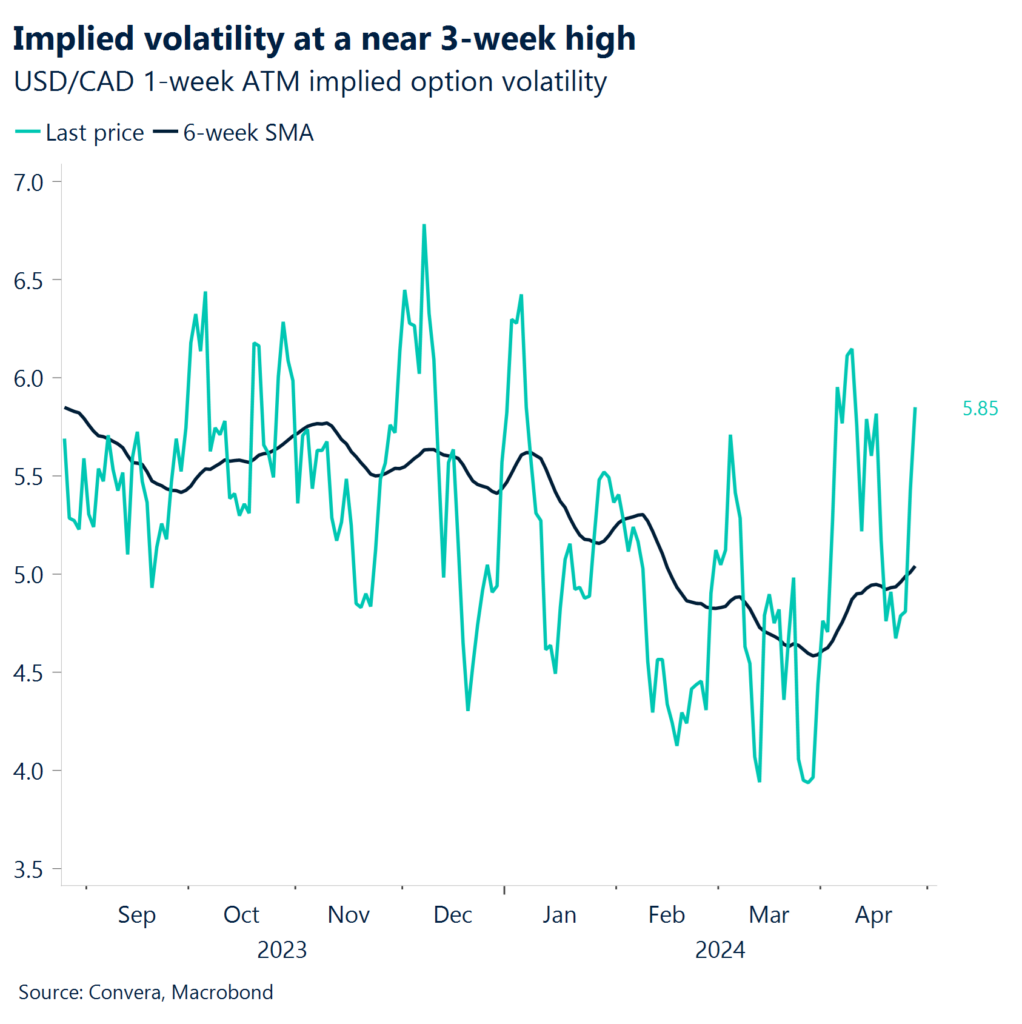

CAD Exposed to downside risk. The Canadian dollar retreated from a 5-month low, admittedly clawing back only 0.3% since a week ago, as diverging monetary policy outlooks between the BoC and the Fed continued to favor the greenback. While sluggish Canadian retail sales further reinforce the argument that the economy is slowing down, potentially prompting the BoC to consider interest rate cuts at its upcoming policy meeting in June, such hopes continue to fade. Markets have pulled back on near term cut expectations, with money markets pricing in barely above 50% probability of a rate cut in the upcoming meeting, down from 64% at the start of the week as producer and raw material prices along with wage growth pressures show signs of a possible reflation risk. Ahead of the May FOMC rate decision, the 1-week 25-delta risk reversals skews further widen in favour of calls, implying markets are positioning for further USD/CAD upside. Given the latest US macro developments, there is room for further USD/CAD gains on the back of FOMC rate decision. However, they are unlikely to stretch beyond the recent 5-month highs. We continue to target $1.36-$1.37 range over the upcoming weeks.

AUD Hot CPI boosts Aussie. The Australian dollar hit two-week highs after a higher-than-expected inflation number boosted the currency. The Aussie was stronger in most other markets. Wednesday’s CPI reading was hotter across the board but the acceleration over the quarter was likely to be most concerning for the Reserve Bank of Australia. In annual terms, the RBA’s preferred measure, the trimmed mean, came in at 4.0% (forecast at 3.8%). On a quarterly basis, the trimmed mean was at 1.0% versus the 0.8% expected. Australian money markets now don’t see a full 25-basis point rate cut until August 2025. The Aussie’s rally saw the AUD/USD move above the short-term 21-day EMA but the pair remains below the 200-day EMA so the longer-term bias remains negative. Key resistance is seen at 0.6620 and 0.6650.