Two opposing forces (fiscal- and monetary policy) are affecting fixed income and FX markets and are contributing to some volatile directional trading as of late. The latter has won this week with the US dollar sliding for the first week in five.

Expectations of a Trump presidency have been bolstered by last week’s debate. Biden is now likely to drop out of the race with Kamala Harris overtaking him in the betting probabilities on who is more likely to be the Democratic candidate.

The UK’s Labour party returns to government after 14 years in opposition, securing 412 seats in the House of Commons and the largest majority government in 25 years.

Signs are emerging that the US economy is beginning to feel the pain from the high interest rate regime. Business conditions are worsening, the labor market is coming back into balance and disinflation is back on track. Rate cutting bets are rising.

This week, Jerome Powell warned maintaining a restrictive stance for too long risks unnecessary economic pain but that cutting rates too soon risks undoing much of the progress made in bringing inflation toward the 2% target.

The first round of the French parliamentary election culminated in La Pen’s party in front of Macron’s centrist alliance, but with fewer votes than anticipated.

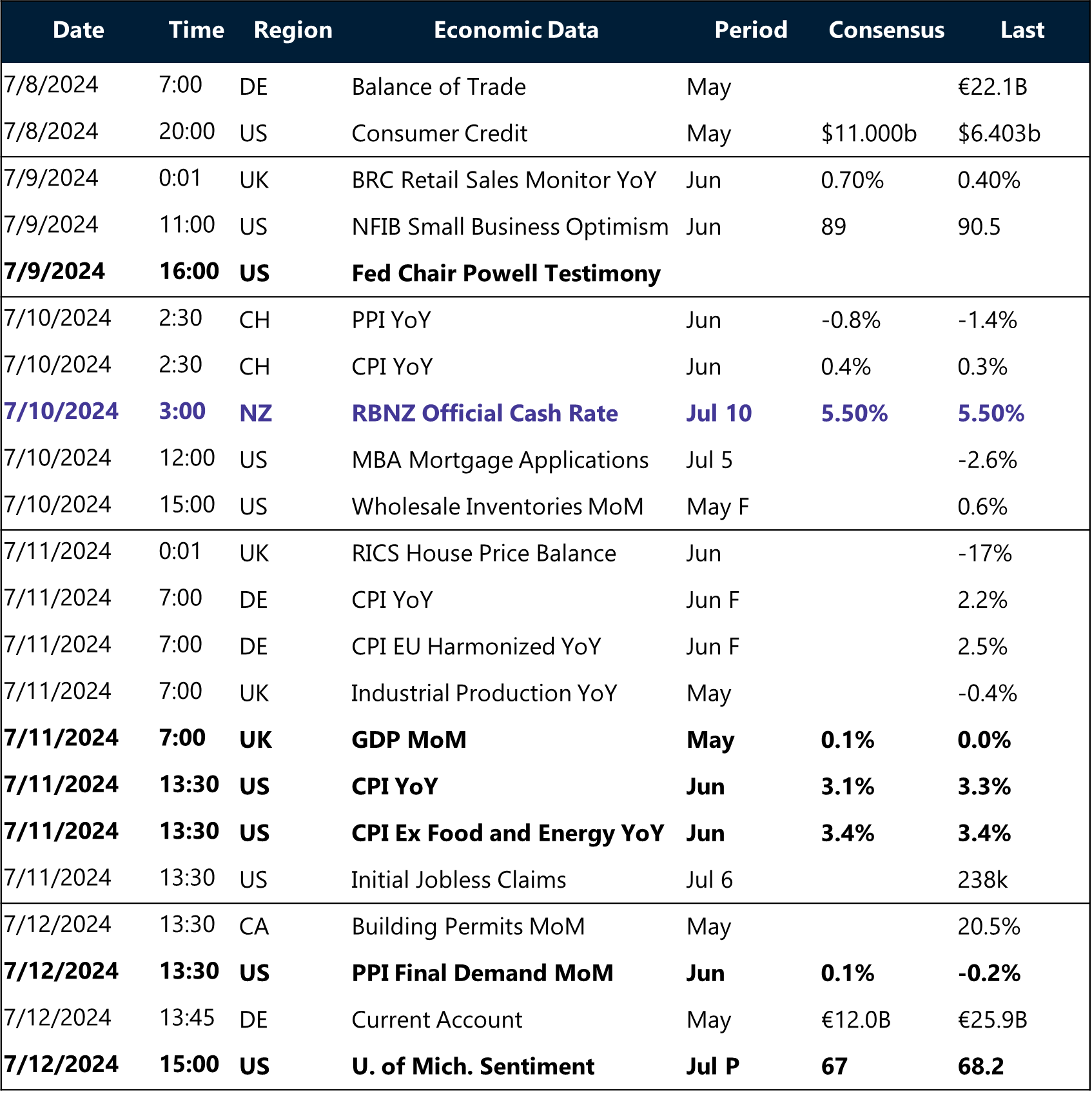

The week will once again begin on a Sunday with second round voting in France. The main macro events will be the US CPI report and Powell speaking twice next week.

Global Macro

Political focus to lessen following elections

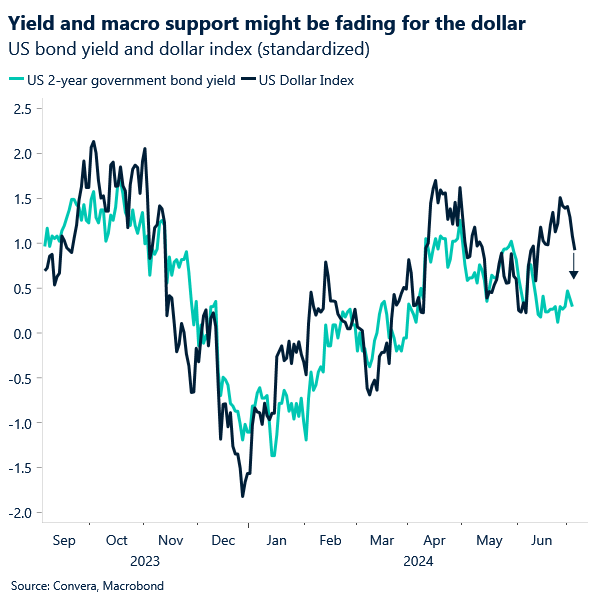

FX dichotomy. Two opposing forces (fiscal- and monetary policy) are affecting fixed income and FX markets at the moment and are contributing to some volatile directional trading as of late. 1. All US presidential candidates seem to be fiscally positive, and the budget deficit is not expected to significantly shrink any time soon. Government bond yields on the long end are therefore stuck between fiscal expansion (higher yields) and monetary contraction (lower yields) over the next quarters. 2. A similar dichotomy is dominating the outlook for the US dollar. Politics continues to put upward pressure on the currency while the expected easing cycle by the Federal Reserve might do the opposite. The latter has won this week with the US dollar suffering its worst week in nine.

Biden likely to drop out. Even before the presidential debate last week, the polls were moving against the Democrats. From around mid-April, there was just less than a 60% probability of Biden winning the election according to PredictIt poll. That probability has tailed off alongside US macro data, with the economic surprise index falling to its lowest since 2022. Accordingly, expectations of a Trump presidency have been bolstered by last week’s debate, and its resulting expansionary fiscal policy outlook. Biden is now likely to drop out of the race with Kamala Harris overtaking him in the betting probabilities on who is more likely to be the Democratic candidate.

Election over, back to macro? The UK’s Labour party returns to government after 14 years in opposition, securing 412 seats in the House of Commons and the largest majority government in 25 years. Some investors are betting UK assets, including GBP, will provide a refuge in the coming months from political chaos elsewhere, like in France and the US. But the focus also remains on the macroeconomic data and the monetary policy outlook, and we lean towards more BoE easing compared to market expectations (45bps) this year, starting with a cut in August.

Regional outlook: United States

US exceptionalism is shrinking

Weakening growth. Signs are emerging that the US economy is beginning to feel the pain from the high interest rate regime. Business conditions are worsening, the labor market is coming back into balance and disinflation is back on track. GDP growth moderated from an average of 3.75% in the second half of 2023 to 1.70% in Q1 this year and Q2 is expected to see GDP rise by less than 2% annualized.

Service sector cooling. Procyclical data has been underperforming for more than two years now. However, the beacon of hope and the driver of the US exceptionalism thesis, the consumer and labor market, have surprised to the downside as well in recent weeks. The most important data point this week was the ISM PMI, which showed the services sector contracting in the month of June with the index falling to a four-year low of 48.8. Seven out of the eight components declined in addition to the production sub-index recording its third largest fall on record, falling by 11 points to 49.6. This is the first negative reading since the pandemic and is usually not seen outside recessions.

Easing bias. This week, Jerome Powell warned maintaining a restrictive stance for too long risks unnecessary economic pain but that cutting rates too soon risks undoing much of the progress made in bringing inflation toward the 2% target. Although the Fed chair acknowledged the labour market is coming into better balance, the JOLTS job openings, released shortly afterwards, surprised to the upside. This halted a decline in the ratio of job openings versus unemployed persons, one of the Fed’s favoured labour market indicators. Still, the trend is softening with the US economy moving towards pre-pandemic levels and keeping the door open for rate cuts later this year. This was highlighted by the unemployment rate rising from 4.0% to 4.1% in June. Job growth came in at 206k, slightly above the expected 190k – 200k range.

Regional outlook: Eurozone

Investors eager to look past politics

Headline inflation moderates in June. The preliminary annual inflation rate in the Eurozone eased to 2.5% in June, having briefly accelerated to 2.6% in May, and largely in line with market consensus. Core inflation, a measure excluding volatile items such as food and energy, unexpectedly remained unchanged at 2.9%. The services inflation gauge was also stable at 4.1%.

Labour market remains robust. The unemployment rate in the Eurozone remained unchanged at an all-time low of 6.4% in May, matching expectations. On the regional basis, Spain continues to grapple with the highest unemployment rate at 11.7%, while the German labour market remains the tightest, with the unemployment rate at 3.3%.

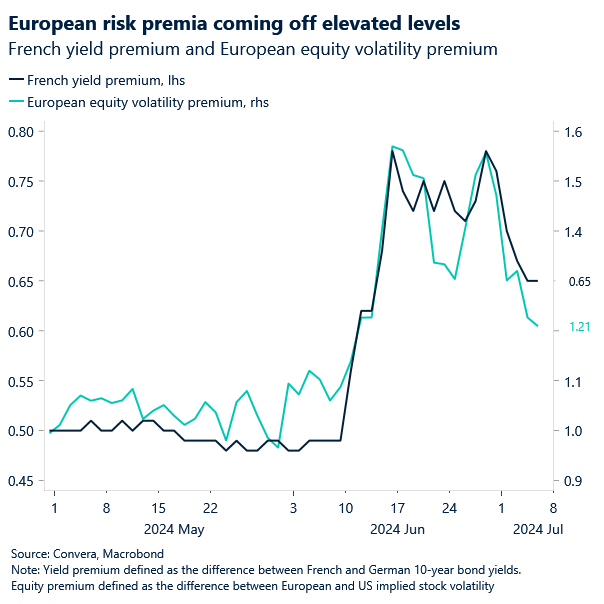

French election worries soothe. The first round of the French parliamentary election culminated in La Pen’s party in front of Macron’s centrist alliance, but with fewer votes than anticipated. Easing concerns of an extremist parliament composition saw the OAT-Bund 10-year spread narrow to 67bps, down from 83bps at the end of June. Meanwhile, the implied 3-month volatility on CAC 40 returned to a pre-election announcement level and the European equality volatility premium has also eased from the June peak.

ECB calls for patience on further easing. The ECB officials cautioned that the bank does not yet have sufficient evidence that inflation threats have passed, despite the recent June report. The reservations were also confirmed in the minutes from the recent monetary policy meeting. As there is no pressure to move with back-to-back cuts, the central bank’s preference remains in favour of a wait-and-watch approach, but some Governing Council members have given an implicit nod to the current market easing expectations (40bp by year-end).

Week ahead

Powell speaking before inflation numbers

Nudging us closer to a cut. Another week, another US CPI report. Inflation prints have turned market positive over the past months as the disinflationary trend that stopped in Q1 this year resumed in the second quarter. Headline inflation is expected to have fallen from 3.3% to 3.0% in June with the core figure having remained unchanged at 3.4%. The Federal Reserve has stressed the importance of a few good inflation reports to gain the confidence of cutting interest rates. The June numbers could bring us closer to that point and could continue the trend of rising easing bets seen after the Powell speech and weak PMI numbers this week.

Powell 2.0. Jerome Powell has struck a slightly dovish tone at the ECB’s conference in Sintra, Portugal. Investors are expecting the FOMC Chair to underline his bias towards easing policy next week at the semiannual monetary policy hearing to the Senate Banking Committee and the House Financial Services Committee on Tuesday and Wednesday.

Second-round voting. The week will once again begin on a Sunday with the first risk event coming in the form of second round voting in the French election. The first round and current projections don’t expect the far-right (RN) or left-wing coalition to come out of the election with an absolute majority. Such a hung parliament could limit the market implication, even if the medium-term fiscal outlook for France remains challenging.

Watching China. The Chinese data patch will be watched in Asia as well. PPI, exports and credit data could marginally be yuan supportive as loan demand and trade likely picked up in June. However, the producer price inflation is set to continue for a 21. straight month.

FX Views

A tug of war between politics and policy

USD Wincing under weight of weak data. The US dollar stomached its first weekly drop in five after a string of weaker-than-estimated US economic data, particularly from the services sector, reinforced the case for the Fed to start cutting rates in September. The US currency faces elevated volatility in either direction as traders tussle between the rising odds of a Trump presidency (USD bullish in the short-term) versus the Fed cutting rates (USD bearish). The latter could prove more meaningful if money markets start pricing in more easing assuming the disinflation trend persists, the economy cools, and labour market loosens. This should see US yields (currently near 1-month lows) slide further with the dollar. But until the Fed does start easing and political risks evaporate, the high yield and safe haven appeal of the US dollar might keep it strong for longer.

EUR Best 2024 performance. At the start of the week, the euro experienced a brief relief rally due to a partial reduction in the perceived risks associated with a left-wing win in the French elections and a smaller lead by Le Pen’s party (RN) following the first round of the French parliamentary elections. Narrowing OAT-Bund spreads and declining implied European stock market volatility propelled the Euro index to its best weekly performance since mid-November, driven by significant gains against safe haven currencies, namely the USD (+1.1%), CHF (+1.1%), and JPY (+1.0%). The EUR/USD pair had its best weekly performance of 2024, capitalising on US dollar weakness due to a series of disappointing economic data releases, which consequently narrowed the DE-US front end of the sovereign bond yield curve to a near four-week low. We expect the euro to strengthen further if the second-round results eliminate the remaining risk of an RN majority, but regardless of the second-round results, political uncertainty will remain elevated for some time, which could weigh on the Eurozone’s soft economic data that had shown signs of improvement.

GBP Takes election in its stride. In the first half the year, sterling was up against all G10 peers, including almost 12% vs. JPY, 5.6% vs. CHF, 2.3% vs. EUR, and marginally stronger against USD. The UK election hasn’t altered this picture. UK assets, including sterling, have barely flinched, implying investors are relatively sanguine about the UK economic and political outlook under a new ruling party. Labour’s victory was expected, as was the muted market reaction with GBP volatility gauges subdued. The long-term trajectory for sterling could be favourable if closer trade relations with the EU are established, thereby reducing the currency’s Brexit premium (GBP/USD is still down 15% from when the UK voted to leave the EU). But the hard-right Reform UK’s success could arguably curb the enthusiasm around this narrative. In the short-term, the interest rate story will ultimately determine the direction of the pound and we agree with markets that an August BoE rate cut looms. This may delay attempts for sterling to move back above $1.30, a key level it’s been below for 250 consecutive days.

CHF Opposing forces in motion. The Swiss franc hit a 1-month low versus the USD and EUR after domestic inflation data saw consumer prices rose 1.3% y/y in June, less than the median forecast of 1.4%. The surprise decline vindicates the Swiss National Bank’s (SNB) decision to cut rates at its last meeting. The central bank’s two rate cuts so far this year have already put its real policy rate in a negative territory, playing a major part in the franc’s circa 6% and 5% deterioration versus the dollar and euro respectively in H1. The franc did sharply recover last month though due to safe haven flows amid a spike in European political risk. Thus, two opposing forces are in motion: safe haven demand (CHF bullish) versus a dovish SNB (CHF bearish), though the former might actually be supporting the latter via its contribution to the moderation in inflation. In the short term, the franc’s fortunes may be dominated by the French election, though 1-month implied volatility is down an 11th day for EUR/CHF, its longest losing streak since November.

CNY Pressure mounts as China’s service sector loses steam. China’s service sector growth decelerated in June, with the Caixin PMI services index dropping more than expected. The slowdown, reaching an eight-month low, was accompanied by job market contraction and waning business optimism. This lackluster performance hints at persistent challenges in consumption recovery. Meanwhile, the People’s Bank of China has signaled its intent to maintain stability in yuan exchange rate expectations, potentially aiming to curb upward pressure on USD/CNH and USD/CNY. Chart shows the correlation which suggests that the path of least resistance is for USD/CNY to trade slightly higher, with key resistance at 7.30 handle. Traders should keep a close eye on forthcoming releases of official and Caixin manufacturing PMIs, as well as non-manufacturing PMIs, for a comprehensive view of China’s economic landscape.

JPY Outlook clouded as Japan’s service sector stumbles. Japan’s service sector experienced an unexpected contraction in June, marking its first decline in nearly two years. The au Jibun Bank services PMI fell below the expansion threshold, indicating stagnant new business growth. This sharp downturn represents the most significant drop in service sector activity since early 2022. While service providers maintain a cautiously optimistic outlook, concerns over labor shortages persist. The divergence between accelerating input costs and slowing output price increases suggests mounting pressure on profit margins. Next resistance is at 163.023 Dec 2023 channel trend line. As the yen navigates this challenging environment, market participants should closely monitor key economic indicators, including the Tankan Big manufacturing outlook index and household spending figures, for potential shifts in monetary policy stance.

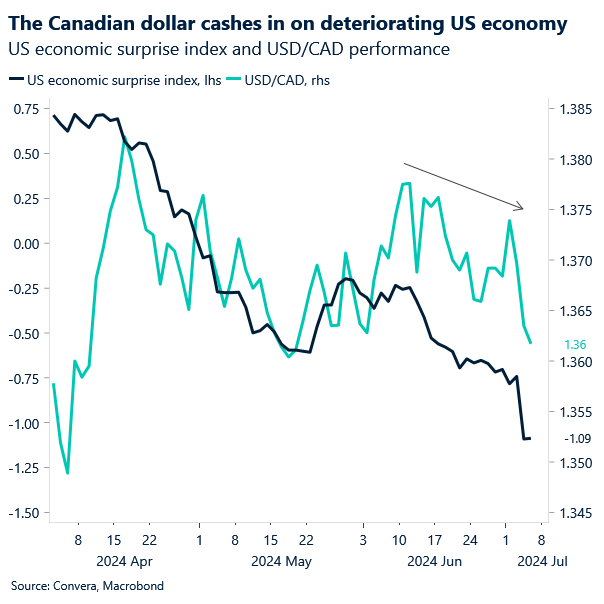

CAD Rallies to a 1-month high. The continued signs of a softening US economy prompted the narrowing of the CA-US 2-year bond spreads to a 5-week low of 66bps and a likely pullback in the net CAD short positions from the recent overstretched levels. Consequently, the Canadian dollar propelled to a 1-month high against the Greenback and is on track for its fourth consecutive weekly gain, the best performance in over a year. Despite CAD’s robust performance against the US dollar, its overall strength is less convincing when considering a broader set of currencies. On an unweighted basis, CAD has depreciated against a basket of G10 currencies for the first time in three weeks, most notably against high-beta currencies. The Canadian private sector activity shrank in June, reversing the growth seen in May, factory activity contracted for the 14th consecutive month and the economy posted its largest trade deficit in 10 months, due to a significant slump in exports, and the unemployment rate increased to a 2.5-year high. These weak fundamentals continue to undermine investors’ confidence in CAD, despite its recent gains against the US dollar. In the short term, further gains against the Greenback may be dampened at the 200-day SMA ($1.360) and the 35-week SMA ($1.3570) levels, unless we see additional signs of fading US exceptionalism.

AUD Treads water as RBA signals caution. The Reserve Bank of Australia’s recent minutes highlight the delicate balance between inflation concerns and labor market stability. The central bank noted that a steady cash rate might be warranted if employment risks tilt downward. They observed that falling vacancy rates could indicate weaker labor conditions than employment trends suggest. The June Judo Bank services PMI, while expanding for the fifth straight month, showed the slowest growth in the current sequence. This tepid expansion, coupled with easing new business growth, led to the slowest staffing level increase in nearly a year. AUD/USD has managed to breach significant resistance level and next resistance is at 0.6871. Market participants should monitor upcoming building approvals and retail sales data for further direction.

Theme in focus

Trump likely dollar-positive, but…

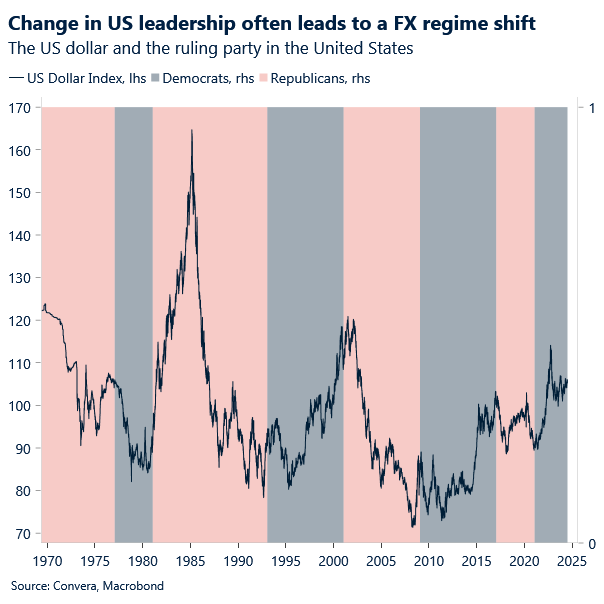

Most agree on the fact that the election is likely to impact financial markets and the US dollar. However, the directionality between Trump, Biden and the dollar seems to be less clear. With four months until the election, lets focus on three key points for now.

Trump as trade-negative. The pandemic and its effects on the economy make comparisons between the Trump and Biden presidencies difficult. We see the period between 2018 and 2019 as representative of how global trade was impacted by Trump’s tariff increases and trade unfriendly practices. World exports declined on a two-year rolling basis (’18-’19) for the first time since the Global Financial Crisis. US tariffs on Chinese exports increased from around 4% in 2018 to 19% at the end of Trump’s presidency. If reelected, Trump has pledged to impose a broad 10% levy on all products entering the United States from overseas. This should be trade-negative.

Three main channels for FX. An increase in tariffs is likely to be dollar positive via the 1. risk-sentiment and 2. trade slowdown channel. If it turns out to be significantly inflationary and impacts the Federal Reserves bias to ease policy, it would additionally be dollar-beneficial via the monetary policy channel. Keep in mind that the next president will nominate Fed Chair Jerome Powell’s successor.

Elections have led to regime shifts. There is a statistically significant relationship between currency markets and US presidential cycles. Against popular believe, the US dollar tends to do better when Democrats are in power. Still, a change in leadership has often led to a FX regime shift. DXY has risen by around 17% since 2021. If a regime shift (significant change in directionality) takes place after Trump is elected, it would likely be a negative one given potential exhaustion of the current upward trend.