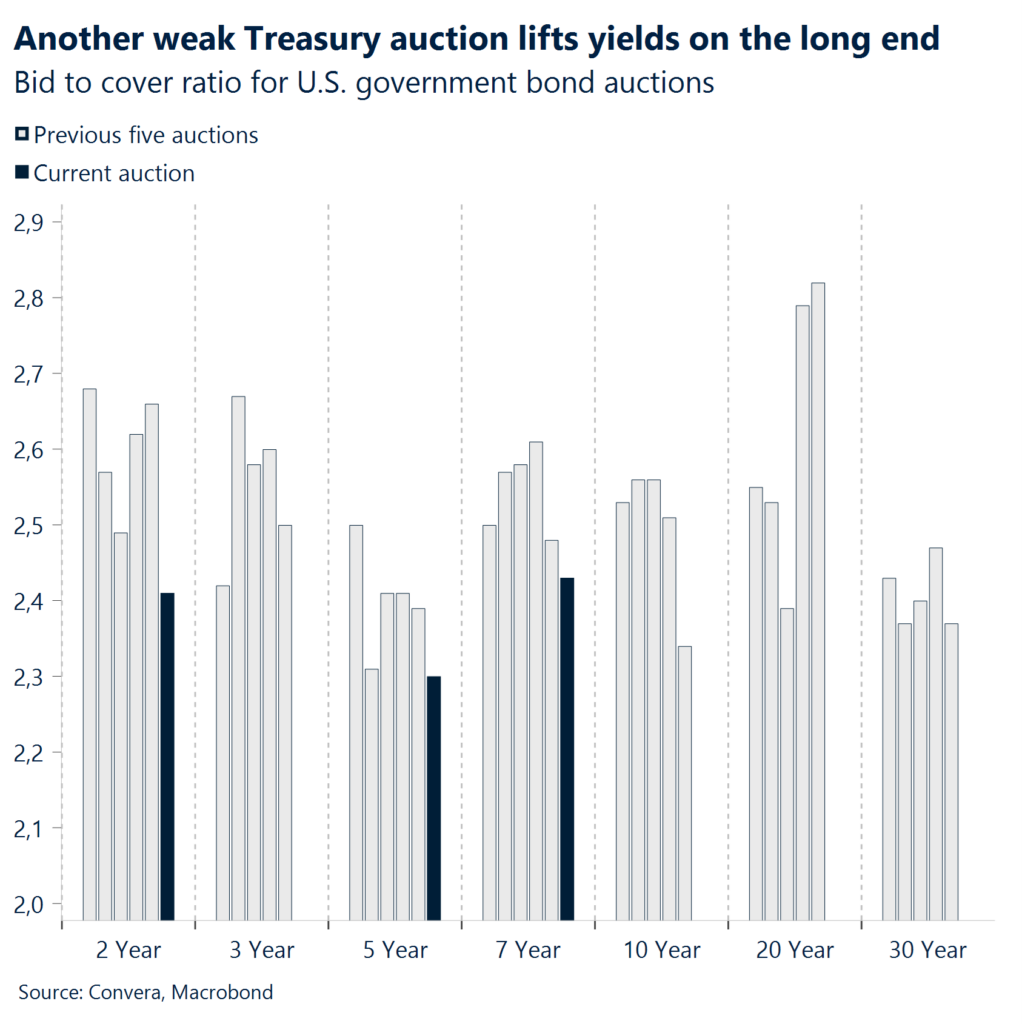

Fixed income continues to set the direction for global markets. US bond yields are on the rise again on weakening demand for Treasury auctions and recovering consumer confidence.

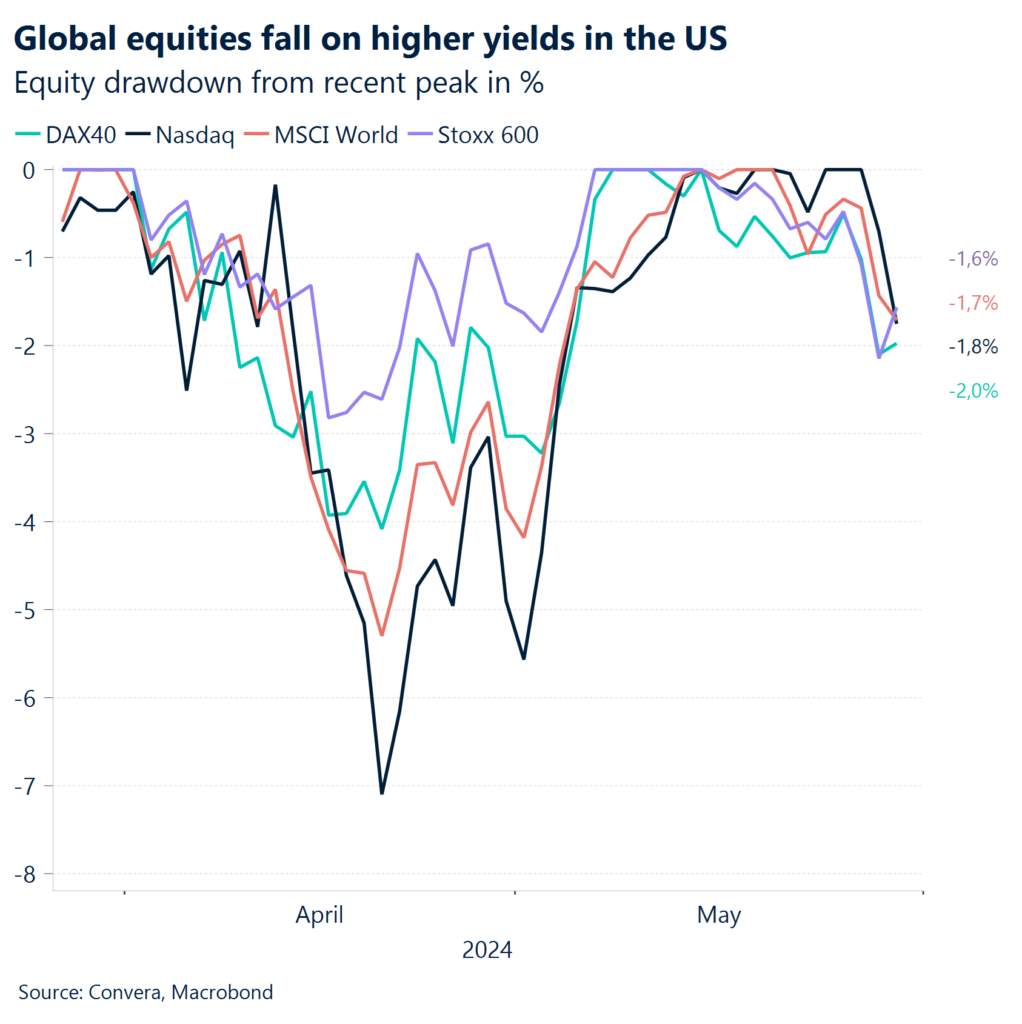

The rise in yields on the longer end pushed up the US equity volatility index for the first time in six weeks and weighed on stocks. The European equity benchmark Stoxx 600 fell for a second consecutive week. The US dollar was largely flat.

The European Union has until next week to inform companies on whether it will impose tariffs on Chinese electric vehicles and hence follow suit with the latest hikes from the United States.

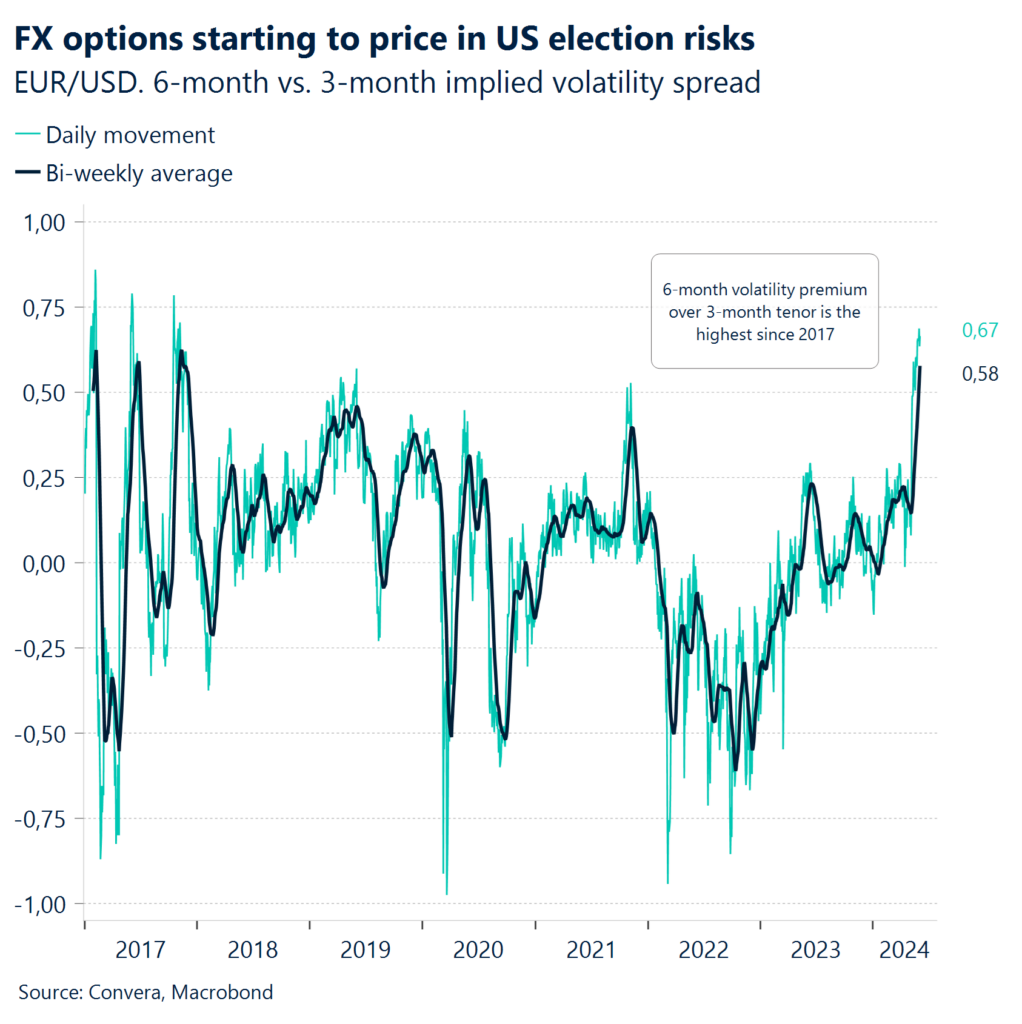

Investors are positioning for increased swings ahead. The 6-month implied volatility premium over the 3-month tenor has risen to the highest level since 2017 for EUR/USD due to the longer option contracts capturing the US election in November.

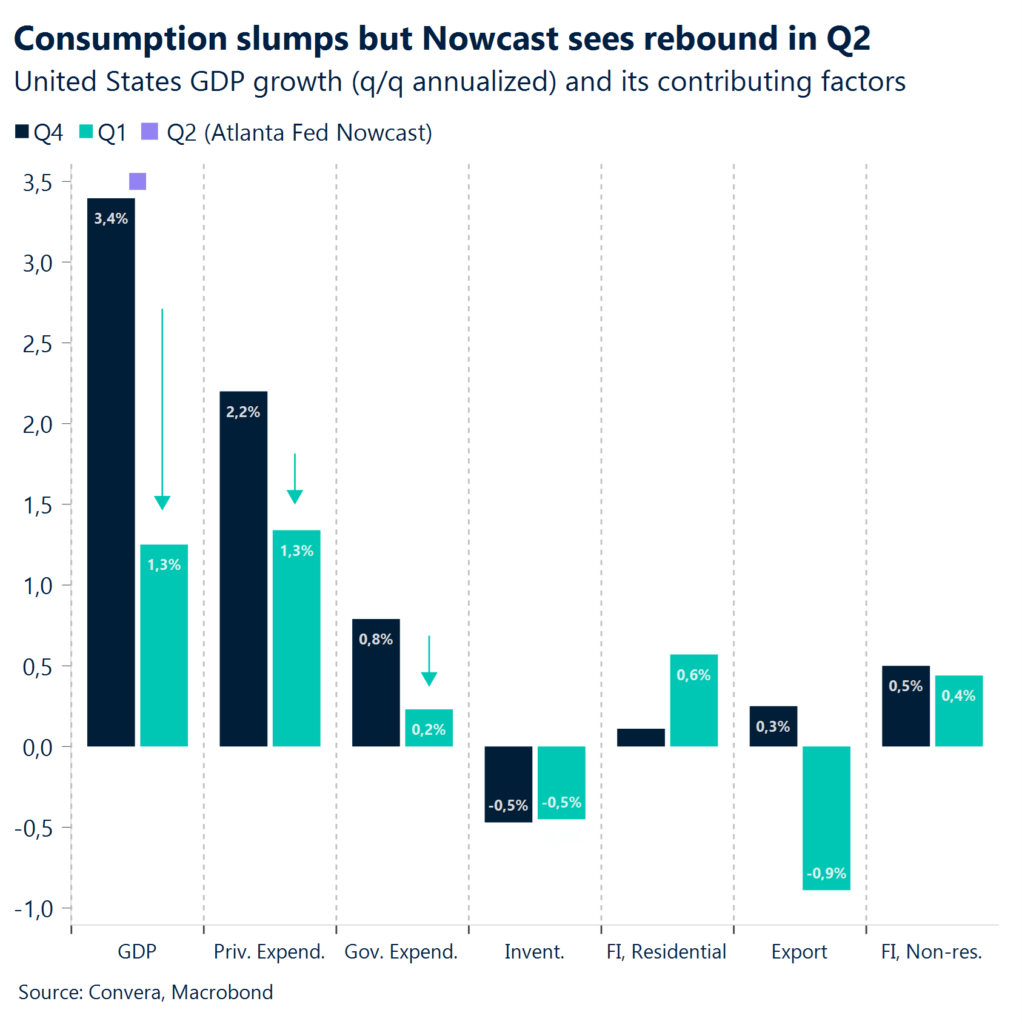

US consumer confidence increased for the first time in four months, topping all expectations in May. GDP growth for the US was revised lower to 1.3% in Q1, in line with expectations, mainly due to slower consumer spending.

Annual inflation rate in the Eurozone rose for the first time in five months to 2.6% in May, up from 2.4% in each of the previous two months, and above forecasts of 2.5%.

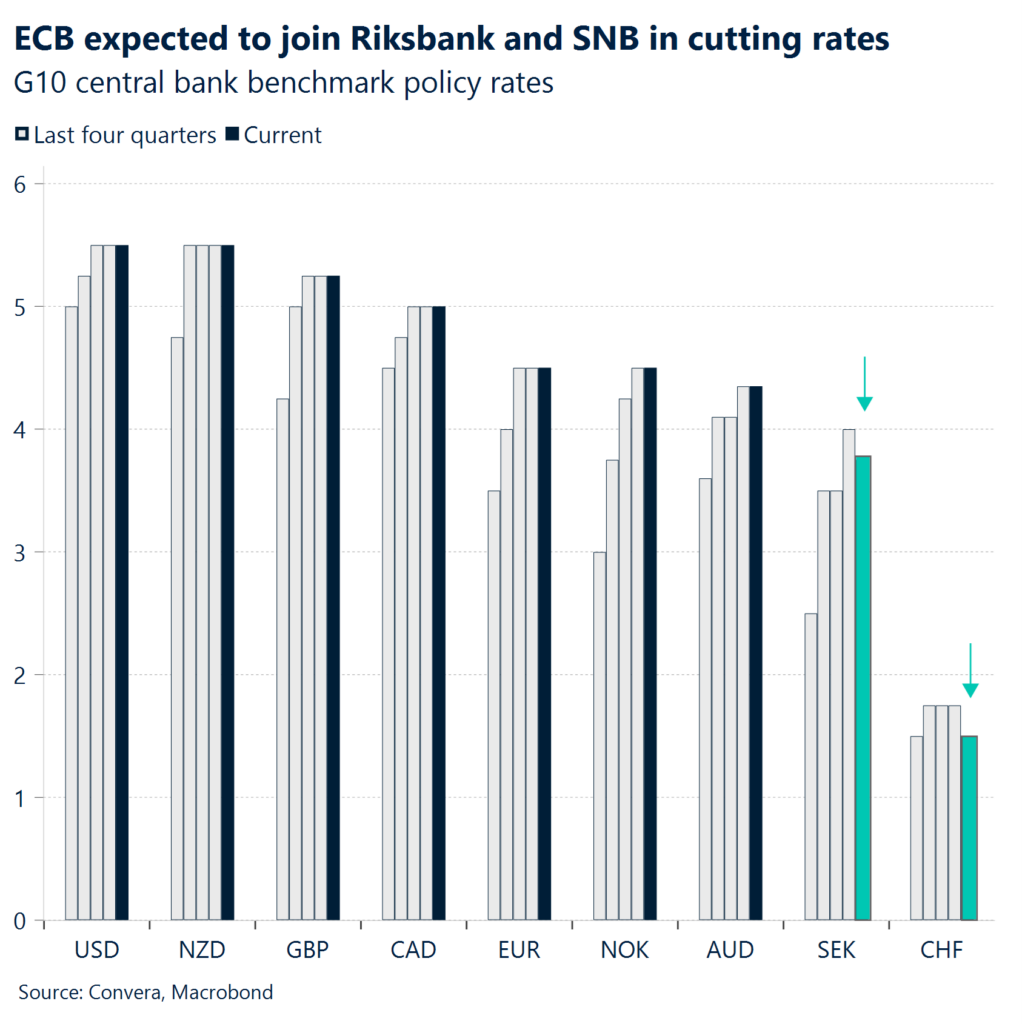

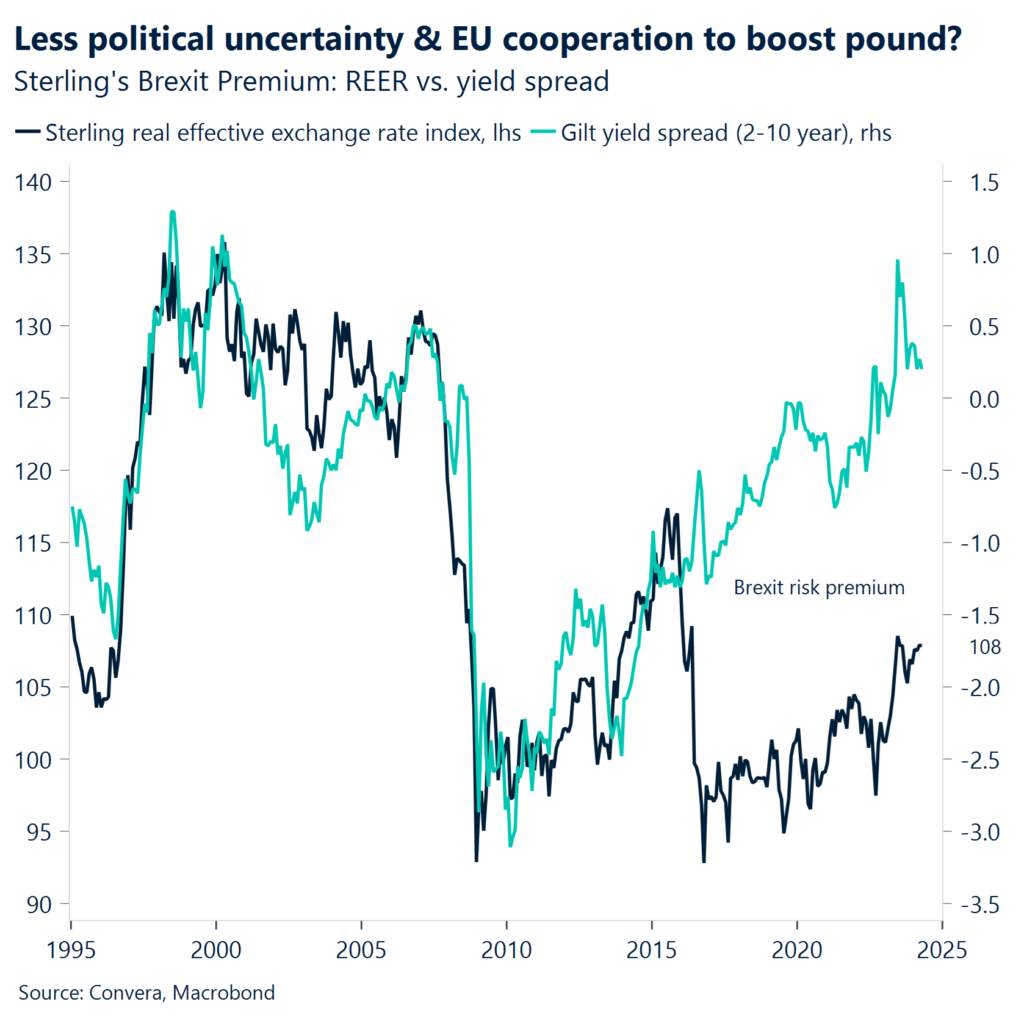

The ECB is expected to deliver a 25-basis point cut next week. In the US, various labor market indicators will be watched for any signs of continued cooling.

Global Macro

Equities fall on rising yields and volatility

Opposing bond forces. Fixed income continues to set the direction for global markets. US bond yields are on the rise again on weakening demand for Treasury auctions and recovering consumer confidence. The bid to cover ratio for the 2- 5- and 7-year government bonds fell short of expectation, setting multi-month lows. The large issuance of new debt and the quantitative tightening program of the US central bank continue to support higher yields under the conditions that economic momentum holds up in the coming quarters. Opposing the rising supply of bond is the weakening growth outlook for the US, which has limited the rise in yields this week. Disappointing pending home sales, the downward revision of GDP for Q1 and slightly higher initial jobless claims have pushed yields down again on Thursday.

Volatility up, equities down. The rise in yields on the longer end pushed up the US equity volatility index higher for the first time in six weeks and weighed on stock benchmarks. While the US dollar did not profit as much from the higher for longer environment due to it being mainly supply driven, both the S&P 500 and Nasdaq recorded losses on the week. The European equity benchmark Stoxx 600 fell for a second consecutive week.

Benign PCE report. The third factor influencing bond yields this week besides economic growth and the supply has had been inflation. The Fed preferred inflation gauge from the PCE report came in as expected with both the headline (2.7%) and core (2.8%) figures remaining unchanged on an annual basis in April. Bond yields declines somewhat following the benign report. Consumer spending slowed to 0.2%.

Politics in focus

China, Europe and the US election

China continues to struggle. Beijing’s rescue plan of the domestic real estate market in 2015 following the collapse of property sales by more than 30% the year prior had ignited a rally that lasted for six years. Since peaking around the middle of 2021, property transactions have fallen by 45%, dwarfing the crisis seen in 2014 in some areas. Beijing is once again stepping in with liquidity and policy measures to ensure that the worst is over for the Chinese real estate market. While conditions are still not met for a significant rebound, we see attention moving away from the property market to issues surrounding geopolitics and the oversupply debate. The longer-term implication remains, though. Real estate will not be the growth driver it once was going forward.

Awaiting Europe’s decision on tariffs. The European Union has until next week to inform companies on whether it will impose tariffs on Chinese electric vehicles and hence follow suit with the latest hikes from the United States. China already hinted at retaliatory measures against the Union in case of an increase, putting policy makers in a complicated situation. The continent stands to lose the most from the continued rise in trade disputes and tariffs. However, doing nothing is not an option either as Europe is losing in almost all new generation technologies to Asia and the United States. While not market moving, geo- and trade politics will continue to shape the global narrative.

FX pricing in election risks. Realised currency volatility has been well below its historic average this year despite the uncertainty about the path of both inflation and monetary policy. However, one-off events on the geopolitical front and elections (Europe, UK, US) might. Investors are positioning for increased swings ahead. The 6-month implied volatility premium over the 3-month tenor has risen to the highest level since 2017 for EUR/USD due to the longer option contracts capturing the US election in November. This makes sense. Historically, volatility, policy uncertainty and the US dollar rise going into a US presidential election.

Regional outlook: United States

US growth is weakening

Rising equities mask underlying problems. US consumer confidence increased for the first time in four months, topping all expectations in May. The index published by the Conference Board rose from 97.5 to 102 with the barometer of present conditions climbing for the first time since January. The surface level strength explained by rising stock markets was tainted by the weaker underlying details of the report. The likelihood of recession over the coming year rose for a second consecutive week. The consumers view on labor markets and inflation was somewhat stable.

Leaving Q1 behind. GDP growth for the US was revised lower to 1.3% in Q1, in line with expectations, mainly due to slower consumer spending, whilst PCE prices increased slightly less than initially anticipated. US jobless claims came in slightly higher than forecasts too, and above average for 2024. Market participants now see only one rate reduction by the Fed this year, with odds for a decrease in November at 65% and 83% for December, compared to 61% and 80% respectively prior to the US data dump.

Conviction without consequence? In other news, last night Donald Trump has been convicted on all 34 counts of falsifying business records in the historical criminal trial in New York. It is the first time a former or service US president has been convicted of a crime. The verdict comes as he campaigns to defeat Joe Biden in November’s election and return to the White House. He will be sentenced on 11 July – the ex-president could face prison, but legal experts say a fine is the more likely outcome. Nonetheless, Donald Trump can still run in the presidential election in November as the Constitution sets out three main requirements for being eligible to become president – and none of them reference being a convicted criminal. The outcome does however pose a significant political danger for Trump.

Regional outlook: Eurozone

ECB to cut policy rates from record highs

Sentiment to pick up in June. Heading into the summer, the GfK Consumer Climate Indicator for Germany rose to -20.9, beating market consensus of -22.5. It was the highest reading since April 2022, improving for the fourth straight month. Income and economic expectations edged higher, and the tendency to save fell sharpy. At the same time, the propensity to buy was little changed as German consumers lack security necessary to increasing buying power in larger purchases again.

Inflation accelerates more than expected ahead of ECB cut. The annual inflation rate in the Eurozone rose for the first time in five months to 2.6% in May, up from 2.4% in each of the previous two months, and above forecasts of 2.5%, preliminary estimates showed. The uptick was driven by a rebound in energy and services prices. The core rate, which excludes volatile energy and food components, also increased to 2.9% from 2.7%, higher than expectations of 2.8%.

How much will the ECB cut in H2? With a June rate cut fully priced in, the Governing Council appears to be conflicted on what to do thereafter. Most policymakers sound uncomfortable with a back-to-back cut in July, while France’s Villeroy said the ECB shouldn’t exclude such a policy move. Although not commenting on the timing of further easing, ECB’s Knot said Brussels’ most-recent forecasts merit either three or four interest rate cuts this year, marginally more than the latest market pricing. Credit data supports suggests less need for aggressive cuts. Monthly data published by the ECB showed that the drag on spending from credit provision continues to decline. The improvement reduces the need for the ECB to rapidly ease monetary policy and should provide the Governing Council to more flexibility.

Week ahead

Three things to watch: ECB, ISM and NFP

ECB to cut, BoC to stay put. We are heading into the last month of the first half of 2024 with expectations of the European Central Bank starting its easing cycle with a 25-basis point rate cut on Thursday. The Canadian central bank will likely stay put and wait out two additional CPI prints before easing policy at the July meeting. Economic projections from European policy makers will be watched as well for any revisions to the institutions inflation and growth outlook. The main question going into the meeting will be, if a back-to-back cut in July will be the right thing to do given the uptick in inflation in May.

Slight uptick in job growth. US job and wage growth came in weaker than expected last month at 175 thousand and 0.2% m/m. This has had significant implications for markets and the theme of waning US exceptionalism. The consensus is looking for a slight uptick in job creation at around 200k. This would be a solid print as the number would be neither too hot or too cool for the Federal Reserve. Deviation from this baseline could cause volatility across markets as the CPI and NFP reports remain by far the largest drivers of volatility in the data space. Before the print on Friday, job openings will be watched as well for signs of a cooling labor market.

Positive services growth? Regional Fed data is pointing to an improving US ISM PMI number for the manufacturing sector. This would be in line with the S&P’s PMI having increased significantly in last month. The services sector barometer is expected to move up into positive territory again, having slipped below 50 in April.

The overall data flow could turn the US dollar in either direction depending on the extent of the labor market weakness. A downside surprise on the JOLTS data and rise in the unemployment rate would outweigh the priced in rate cut from the ECB.

FX Views

Flip flopping risk sentiment

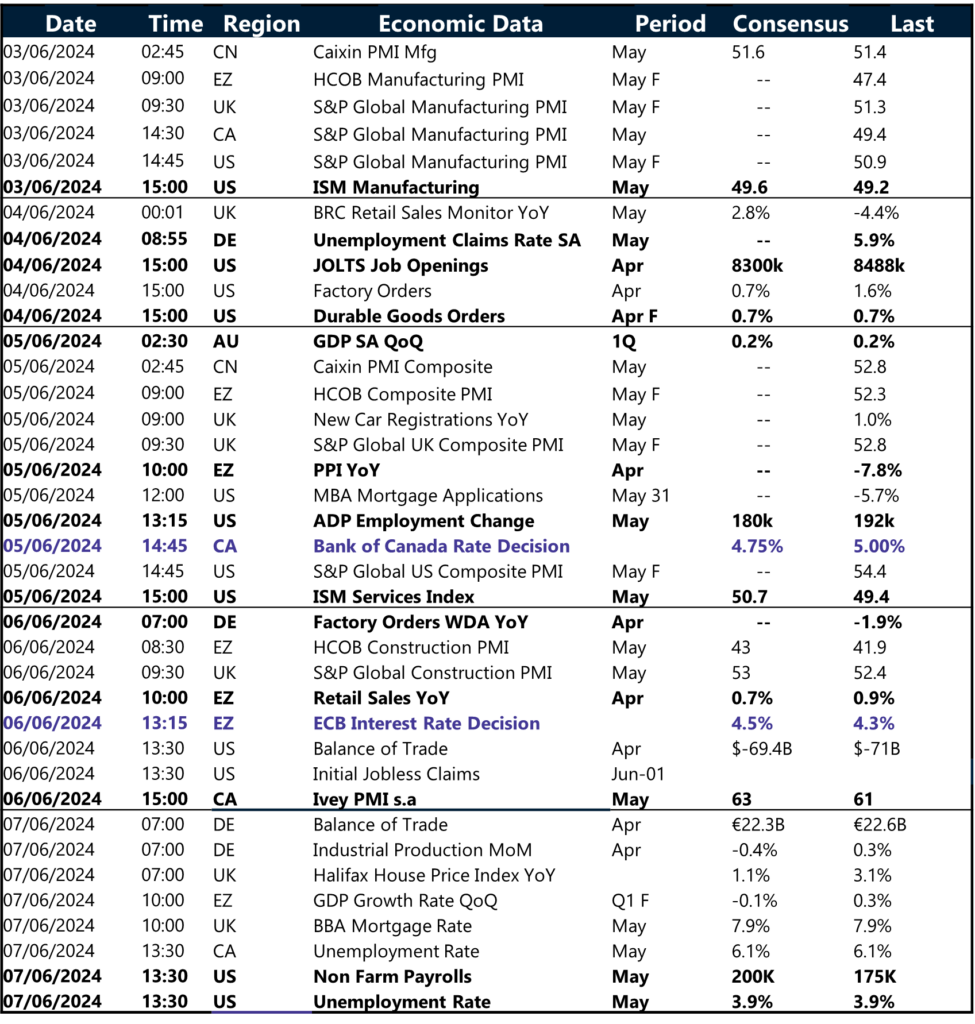

USD Lacking directional impetus. The US dollar had a rollercoaster week, dropping to a 2-week low on improved global risk appetite before surging to a 2-week high amid rising Treasury yields, driven by some strong economic data, hawkish talk from Fed policymakers, and a run of weak bond auctions. The Treasury market rout spurred a rush to safe havens – another dollar positive theme. US dollar strength in 2024 caught many off guard but can be easily explained. Growth differentials between the US and other G7 economies have been consistently positive for some time. Short- and long-term interest rate differentials are dollar supportive, and the US’s shift to a net energy exporter and strong FDI are also helpful. From January to April, the dollar had, on average, appreciated against 55% of its global peers, but in May, it rose against just 14%, despite the scaling back of Fed rate cut bets. This can be explained by the weaker macro data starting to emerge from the US, including this week’s Q1 GDP print revised lower, in a sign that investors have a preference to seek a reason to sell the buck. All eyes turn to the upcoming ISM PMI and jobs report.

EUR Euro bears awaken. The euro’s performance has been significantly impacted by rising global yields and souring risk sentiment, leading to its broad depreciation against G10 currencies. Notably, the EUR/CHF pair dropped over 1.0% week-on-week to a 2-week low, marking the largest decline in 2024, influenced by strong Swiss economic growth and reduced expectations for near-term rate cuts. Similarly, EUR/USD also briefly touched a 2-week low amid US Treasury rally, before recouping the losses. The ECB is anticipated to cut its key policy rates by 25bps at its 6th June meeting, which, juxtaposed with the divergence in Fed’s timing, is likely to exert further downward pressure on the euro. Reflecting these expectations, the 1-week implied option volatility for EUR/USD has spiked to a 2-week high, although it remains below its 6-month average. Market sentiment, as indicated by the 1-week EUR/USD risk reversal, is at its most bearish in nearly four weeks. However, the 10-delta flies for the same tenor, trading at 0.30 vol, imply that any significant movements in either direction are likely to encounter diminishing interest. This suggests that while volatility is expected, market participants may not sustain substantial directional bets.

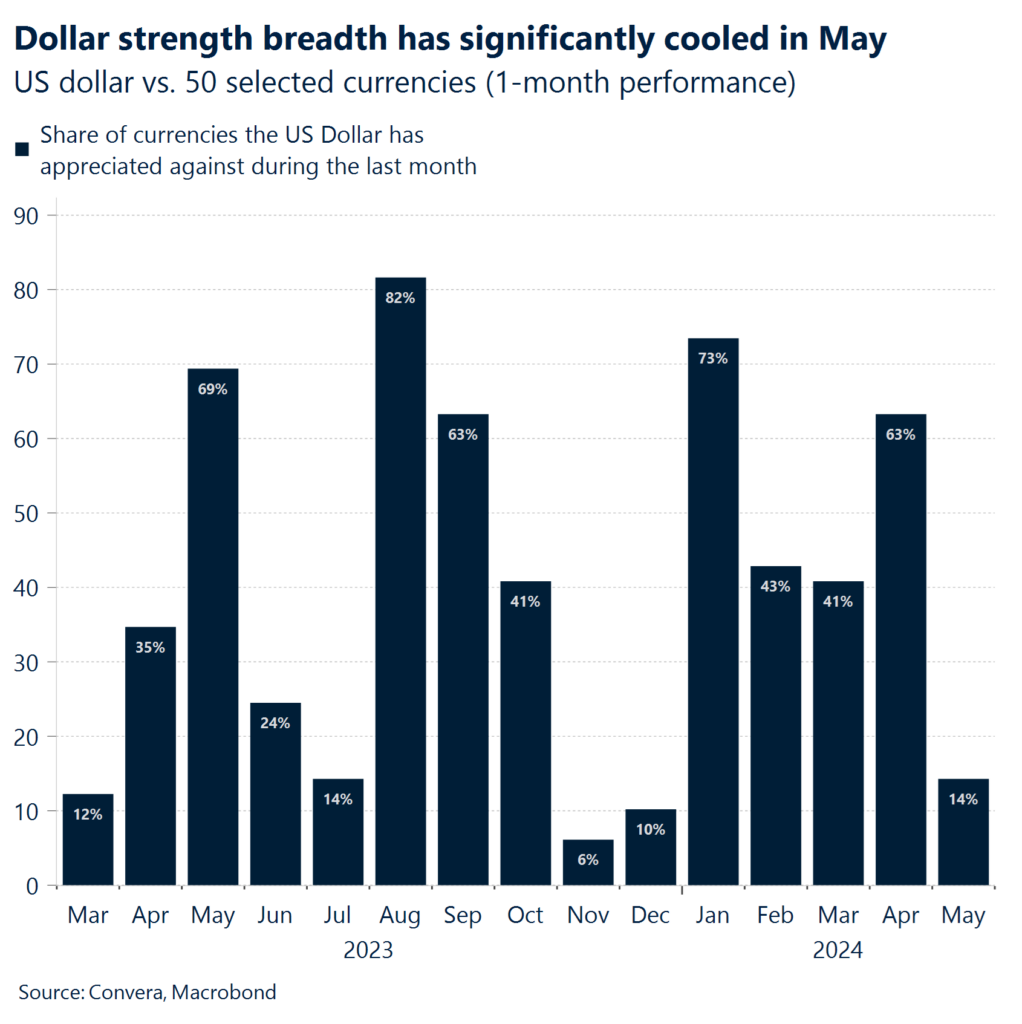

GBP Wounded by risk aversion. The upbeat risk tone across financial markets at the start of the week saw GBP/USD rally to almost 10-week highs beyond $1.28. GBP/EUR rose to its highest level since August 2022 and GBP/JPY to its highest since 2008. Sentiment soon soured though amid rising global inflation fears, sending risk assets like equities tumbling and the risk-sensitive pound reversing sharply against safe havens like USD, JPY and CHF. Looking ahead, the Bank of England’s (BoE) cancellation of public speeches for its policymakers until after the UK general election could been seen as constructive for GBP, as it lessens the already low risk of a BoE rate cut in June. Regarding the election, one narrative around a large Labour majority win is the potential for closer ties with the EU. This could help narrow the pound’s so-called Brexit risk premium and see GBP/USD trade above $1.30 and GBP/EUR to €1.20. The biggest downside tail risk to sterling is a hung parliament, a scenario which saw GBP/USD shed over 2% in a week back in 2010 and 2017. The key driver for sterling in the short run remains on the BoE policy outlook but expect volatility to pick up as the election draws nearer.

CHF Hawk talk and haven hoist. The Swiss franc ended May on a stronger note, clocking one of its best days of 2024 on Thursday amidst hawkish tones from the Swiss National Bank (SNB) and surging safe haven demand on fears of lingering inflationary pressures across major economies. Strong Swiss Q1 GDP data also provided support. USD/CHF snapped a 3-week winning streak, reversing sharply from its 200-week moving average at 0.9168 and breaking below its 50-day moving average, which had been supportive for most of the month. Against the euro, after hitting a 1-year low, the swissy rebounded to a new 2-week high. Still, the franc remains the second worst performer out of the G10 so far this year (-8% vs. USD) as the SNB stopped selling FX reserves and started cutting interest rates before its major peers due to inflation falling into its target range. However, SNB Chairman, Jordan, stated this week that there is an upward risk to its inflation forecasts due to the weaker franc, which could be counteracted by selling FX reserves.

CNY This year’s resistance holds fast. The USD/CNH climbed back to this year’s major resistance level at 7.28 over the last week before a rapid US dollar sell-off on Thursday saw this technical level again hold fast. Chinese data continues to weaken after a small improvement in the early part of the year caused some observers to hope for “green shoots”. Unfortunately, the most recent PMI numbers saw services activity slow and manufacturing activity fall back into contraction at 49.5 – any result below 50 is seen as a sign of slowdown. Some speculators believe recent moves from the People’s Bank of China are a sign it is prepared to let the CNY fall after allowing the USD/CNY fix to climb to the highest level since January. Looking forward, Caixin PMIs and trade balance will be the major events. CNH buyers continue to target moves back toward 7.28 in USD/CNH.

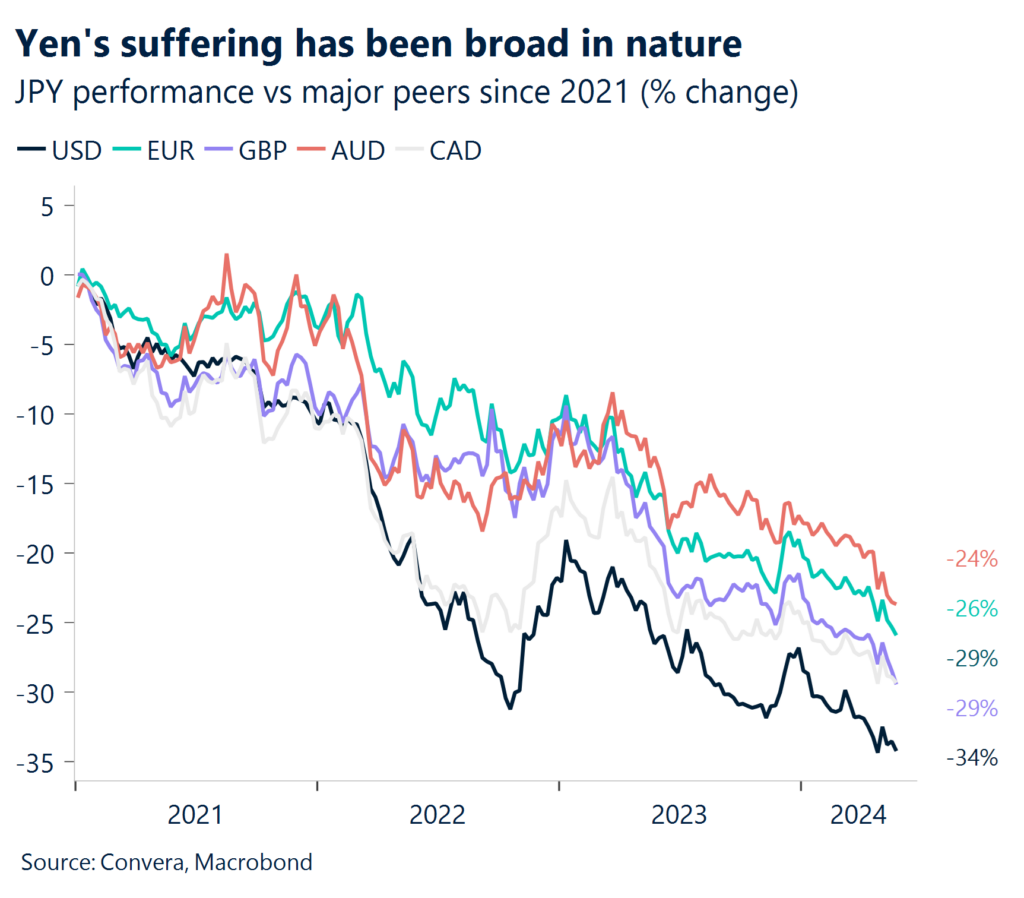

JPY Markets wary near 160. The USD/JPY inched higher for most of the week before turning sharply lower from one-month highs on Thursday – just below the levels that saw intervention from Japanese authorities last month. Activity in this market has cooled – USD/JPY one-month implied volatility fell to six-week lows after reaching ten-month highs after last month’s intervention. Japan’s inflation outlook will be key for the yen as Tokyo core CPI climbed from 1.6% on April to 1.9% in May. Higher inflation should make the Bank of Japan more likely to hike and provide some much-needed support to the yen – down more than 50% against the US dollar over the last decade. For now, USD/JPY remains in a clear uptrend with support seen at 156.20 and resistance seen at 158.00 and then 160.00. Cash earnings on Wednesday and household spending on Friday are the key upcoming events.

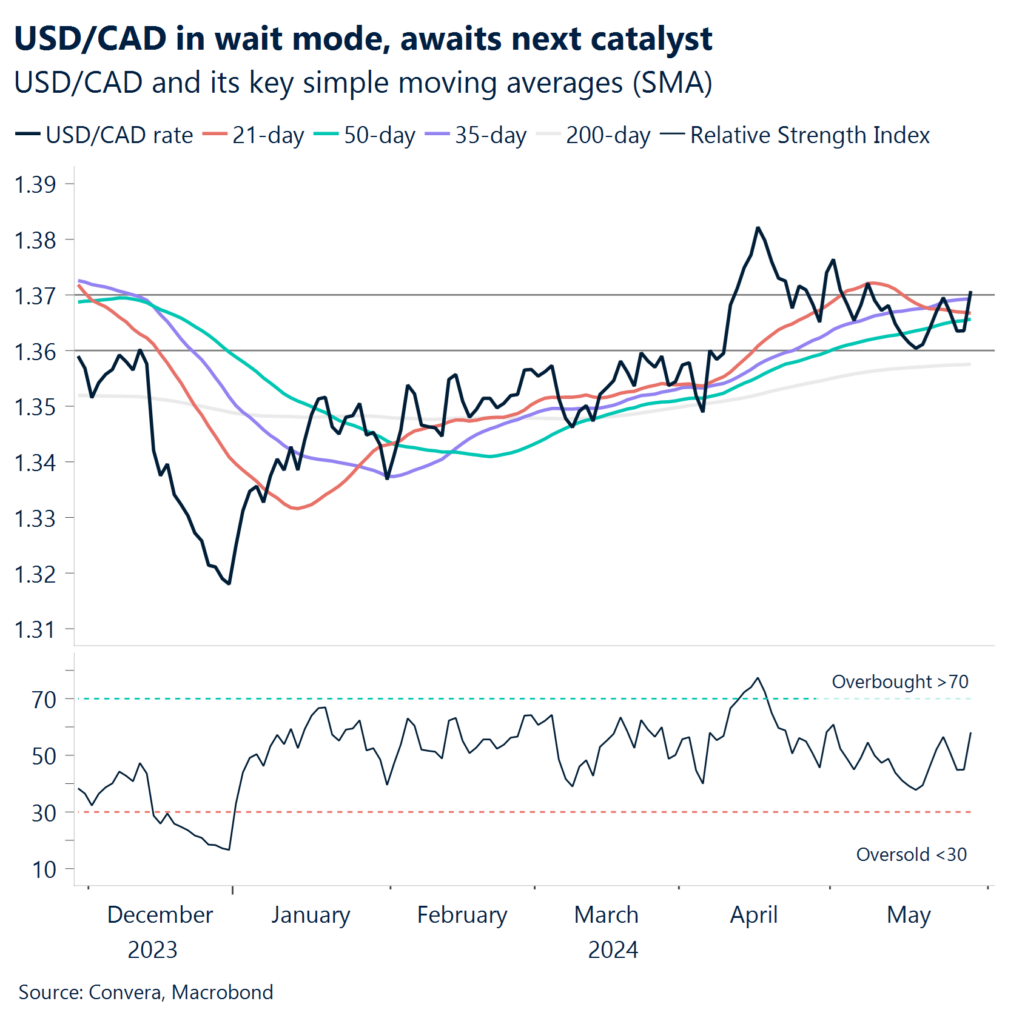

CAD BoC’s reluctance to cut could reinvigorate Loonie. The Canadian dollar had a woeful week, depreciating against most G10 currencies amid souring global sentiment. For the past 7-weeks USD/CAD has largely oscillated in the $1.36-$1.375 range as it awaits a fresh directional catalyst. The Bank of Canada is due to hold its rate decision on June 5, and the money markets favour a 25bps cut with a 65% probability after last week all inflation measures reportedly eased within the 1-3% tolerance band. The central bank is likely to opt to wait until its July meeting to confirm that lower core inflation will be sustained as it will have two more CPI releases to consider, especially as signs are emerging of inflationary pressures building down the pipeline. While near-term market sentiment remains CAD bearish, a delay in central bank cuts should see the market unwind recent CAD weakness.

AUD Aussie takes a break. The Aussie was broadly flat over the last five trading days with the currency mostly catching its breath near recent highs. The AUD/USD has been trapped under four-month highs at 0.6700 while AUD/EUR is just under five-month highs at 0.6170. The AUD wasn’t able to benefit from a hotter than expected monthly inflation report, with the annualised monthly inflation gauge up from 3.5% in March to 3.6% in April. Another poor retail sales number – local retail sales have missed in every report since November – suggests sluggish growth will keep the Reserve Bank of Australia from raising rates further. That said, financial markets don’t see a full 25bps cut priced in until June 2025 (source: ASX). Technically, the AUD/USD remains in a medium-term uptrend, above both the 21- and 200-day EMAs. Topside targets are to 0.6700 with downside targets towards 0.6590. Australian GDP, due Wednesday, is the next big release.

Have a question? [email protected]