Written by Convera’s Market Insights team

Safe haven injection boost for dollar

George Vessey – Lead FX Strategist

Although Treasury yields look to have lost their upward momentum, allowing benchmark 10-year notes to stabilize, the US dollar remains in high demand given its safe haven appeal. Meanwhile, the rise in energy prices as a result of the escalating conflict between Russia and the West, has helped currencies of commodity-exporting nations like CAD, AUD and NOK. With global and local political uncertainties plentiful, and a lack of key economic data catalysts to trigger a meaningful repricing, these trends will likely persist in the short term.

The dollar index is hovering close to two-year highs as traders await more details on Trump’s policies and continue to price in less aggressive interest rate cuts from the Fed. Comments made by Fed policymakers this week provided scant clarity on the Fed’s future course, but the odds for a 25bps reduction in the funds rate next month continue to fall, currently holding around 40%, well below 83% last week. Additionally, the ongoing escalation in the Russia-Ukraine conflict bolstered the dollar’s safe-haven appeal. The buck continues to strengthen against the euro and sterling but is battling against the safe haven Japanese yen.

On the macro front, applications for US unemployment benefits unexpectedly fell last week to the lowest level since April, illustrating a solid job market. However, continuing claims, a proxy for the number of people receiving benefits, climbed to 1.91 million in the previous week, a three-year high. Meanwhile, a recession indicator based on the Fed regional indexes continues to fall, alluding to the rising prospect of a soft or no landing scenario, keeping the US exceptionalism narrative intact.

Pound sinks further after retail sales miss

George Vessey – Lead FX Strategist

The British pound isn’t benefiting from elevated UK yields and the hawkish repricing of the Bank of England’s (BoE) policy outlook in the wake of the higher-than-expected UK inflation figures recently. We think it is therefore undervalued versus the USD. But the risk off tone amidst escalating geopolitical tensions is a major headwind for the risk-sensitive pound whilst poor UK retail sales numbers are an added drag.

GBP/USD broke below $1.26 on Thursday and in the process, below its 100-week moving average which has been a key support for 2024. A weekly close beneath this level opens the door to fresh downside risks, though the $1.25 is a key psychological barrier, whilst the pair looks oversold via the 14-day relative strength index breaching the 30 mark. Aside from the Trump trade gaining momentum, and the risk off market environment, sterling is also contending with weak UK retail sales figures published this morning.

Despite a surprise uptick in UK consumer confidence, retail sales data for October printed weaker than expected at 2.4% y/y versus 3.4%. The month-on-month number came in at -0.7%, the sharpest drop since June when sales fell by 1.0% from May.

Euro breaks below key support

George Vessey – Lead FX Strategist

The euro remains in a clear downtrend, with EUR/USD dropping seven out of the past eight weeks, breaking below its key $1.05 support level on Thursday. The pair is now on the verge on being oversold based on its 14-day relative strength index, but other technical indicators point to further euro losses ahead.

The 21-day moving average has capped any rebound since early October, while short-dated moving averages are below longer-dated ones, creating what’s known as a “death cross” pattern that points to further declines. A break through the October 2023 low at $1.0448 would leave the euro at a two-year bottom. Trump’s policy agenda and trade tariffs risks continue to weigh. Political headaches in France and Germany are headwinds, and the escalating war in Ukraine has spurred flight to safety. German bunds are in demand, with yields sliding across the curve. The underwhelming Eurozone cyclical context is likely to continue with today’s flash PMIs expected to disappoint, thus the dovish ECB adjustment is well warranted.

Amidst the plethora of macro and political risks denting the euro’s appeal, traders continue to pay more for put options that bet on a lower EUR/USD than for calls that look for the pair to rise. Implied volatility measures on the common currency have also climbed to their highest since the US election, amid an intensifying selloff in the spot market.

GBP and EUR slump, gold and oil jump

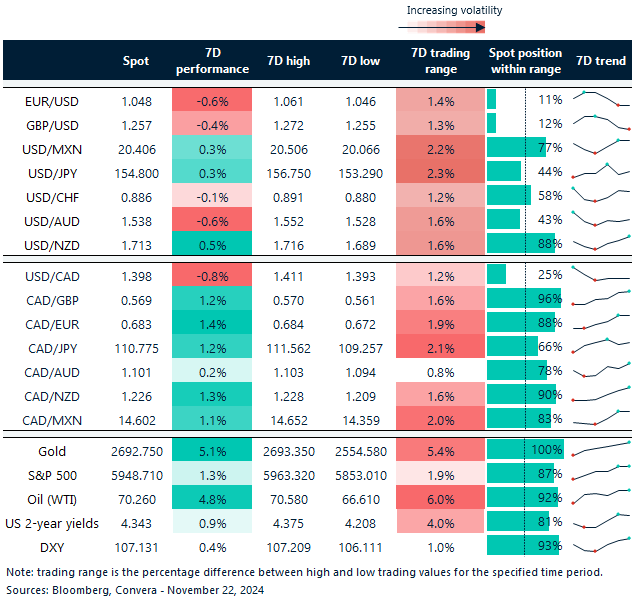

Table: 7-day currency trends and trading ranges

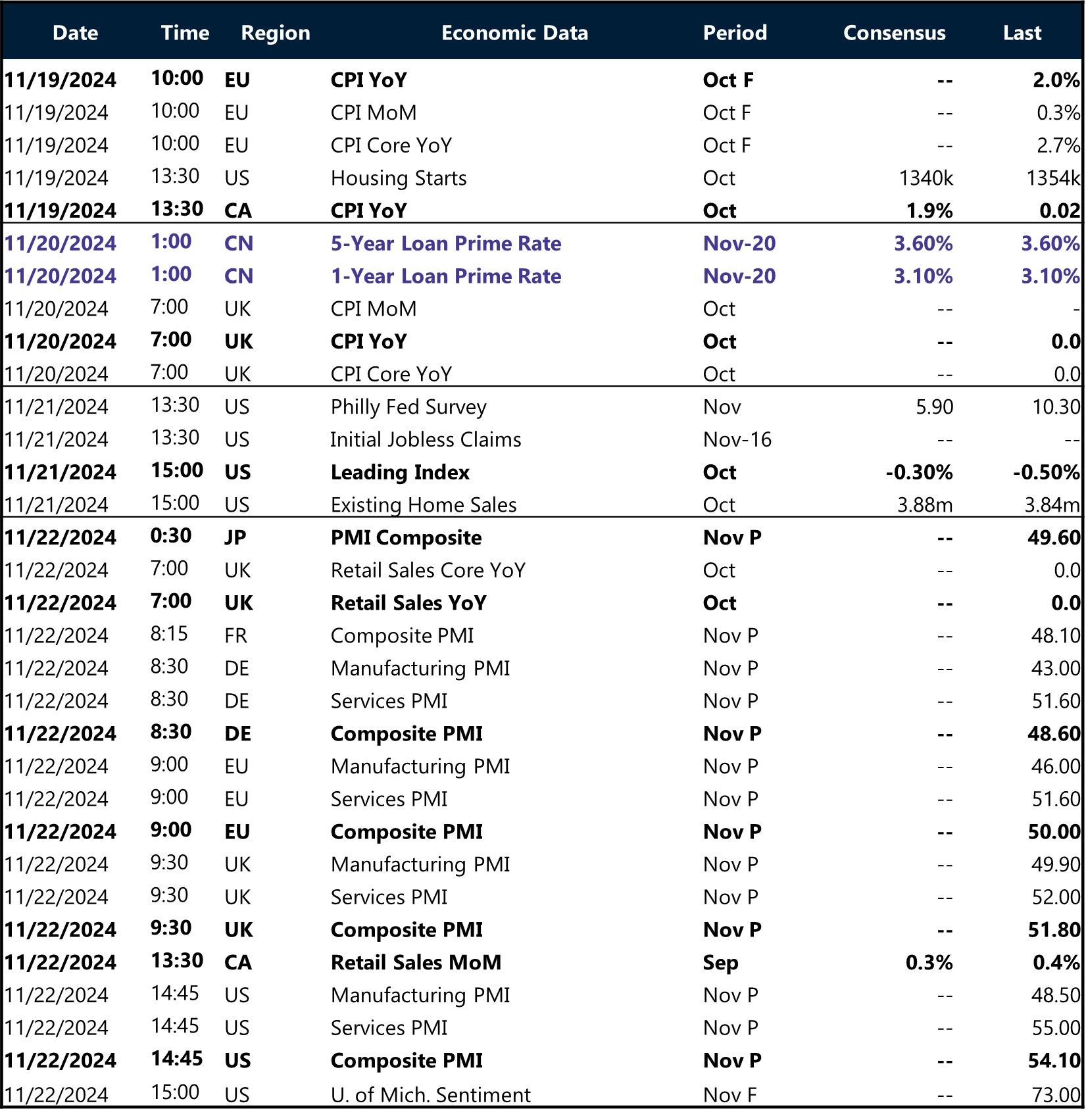

Key global risk events

Calendar: November 18-22

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.