Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

USD’s gains to be tested

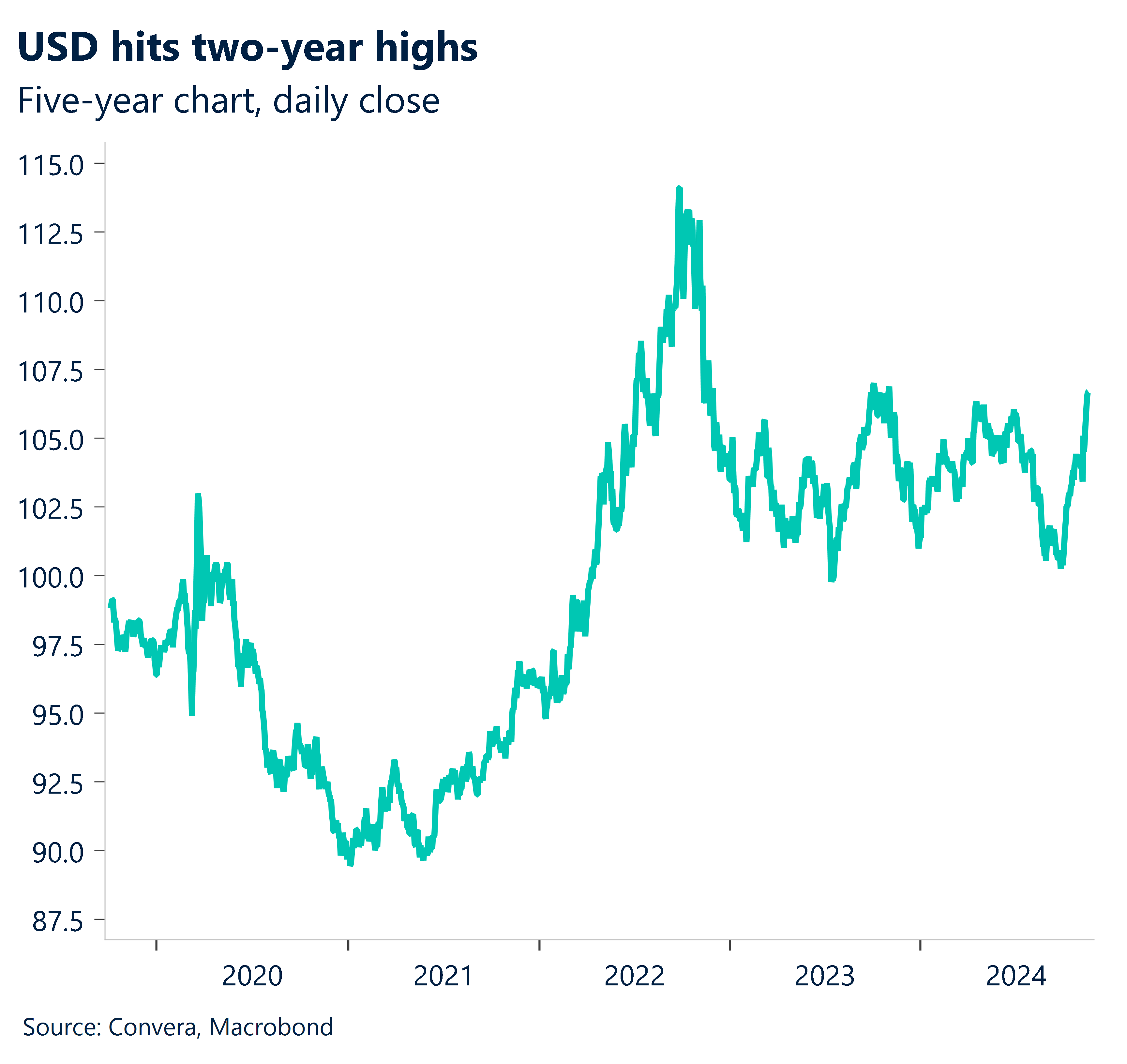

The US dollar’s monster run over the last seven weeks paused on Friday as the pair near major resistance at the two-year highs.

The USD index climbed as much at 6.2% over the December quarter so far, boosted by expectations that President-Elect Donald Trump’s policies of tariffs and tax cuts would be inflationary.

The greenback has also been boosted by a shift in expectations around the US Federal Reserve. On October 1, financial markets expected the Fed funds rate to be at 2.90% at the end of 2025. Now, financial markets expect the Fed funds rate to be at 3.83% at the end of 2025.

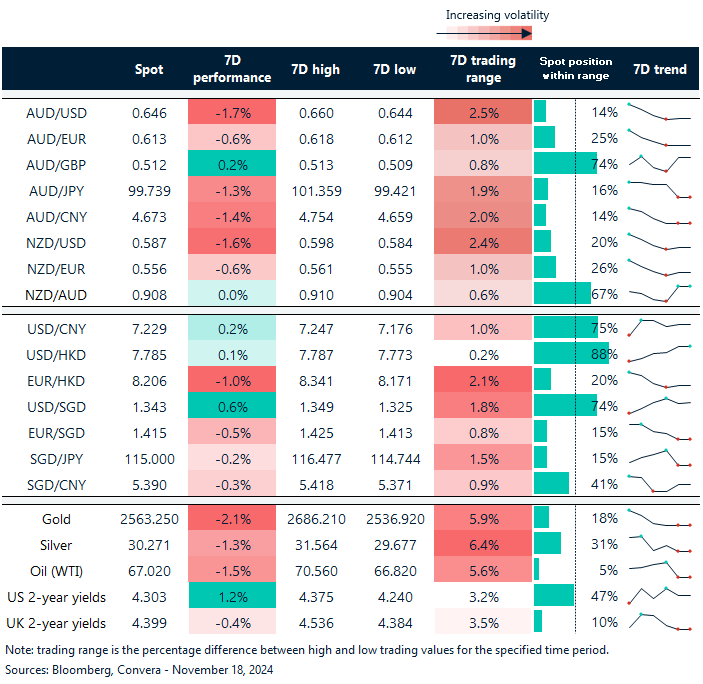

As the USD paused, key markets saw a small rebound.

The AUD/USD gained 0.1% on Friday while NZD/USD climbed 0.3%.

In Asia, the USD/JPY led losses, with a sharp 1.1% fall. The USD/CNH lost 0.3% while USD/SGD dropped 0.2%.

Euro losses near pause?

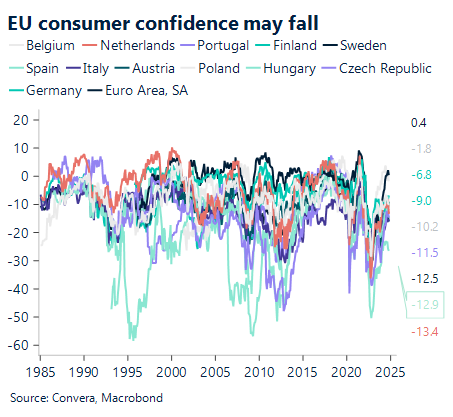

The euro has been the hardest hit in the developed FX markets this month with the EUR/USD down 2.7% month-to-date. This Thursday will see the release of EU consumer confidence data.

Eurozone consumer confidence in the euro area may fall in November due to increased policy uncertainty after Donald Trump’s election in the US and the anticipated negative policy spillovers.

Headline consumer confidence might drop from -12.5 in October to -13 in November. However, once negative mood subsides in December, we would anticipate a recovery; the negative effects of Trump’s initiatives won’t materialize until Q2 2025.

The price action in EUR/USD remains pressured with the 50-day EMA now below the 200-day EMA. Next support is seen at 1.0450.

PMI data in focus this week

FX markets will be driven by November flash PMI readings across major economies this week, with particular attention on European and US manufacturing data to gauge recession risks.

Tuesday sees Canada housing starts while Canadian CPI data on Wednesday will be closely monitored.

UK inflation data on Wednesday will be closely watched after recent signs of cooling price pressures.

Other notable releases include US jobless claims, US existing home sales, and Japanese nationwide core CPI.

The US dollar strengthened against most major currencies last week. Next week’s PMI data could drive further USD movement if it indicates diverging economic momentum between regions.

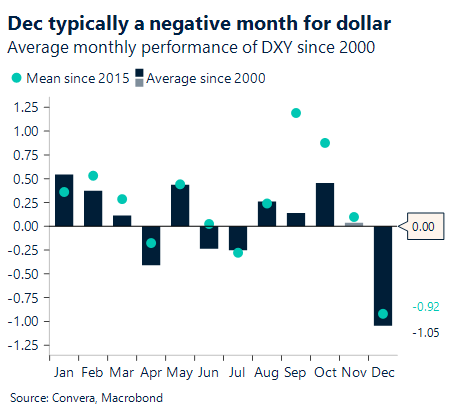

Looking forward, historically, December is a seasonally negative month for the dollar.

Trump trade dominates as USD surges in Asia

Table: seven-day rolling currency trends and trading ranges

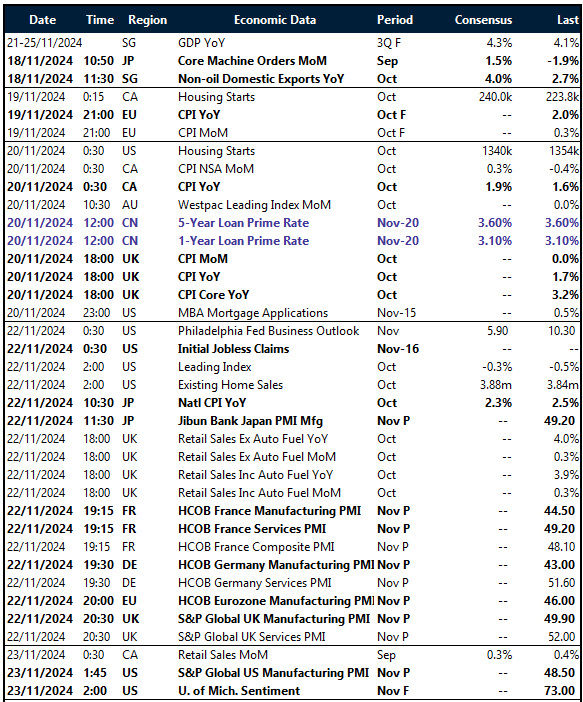

Key global risk events

Calendar: 18 – 23 November

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.