Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

US shares reverse

The US sharemarket’s recent run higher – the Dow Jones index was up as much as 8.1% since the end of May while the Nasdaq jumped as much as 13.8% – turned sharply overnight with the move lower driven by losses in smaller companies.

The S&P 500 fell 0.8% while the Dow Jones lost 1.3%. The Russell 2000, an index of smaller companies, fell 2.0%.

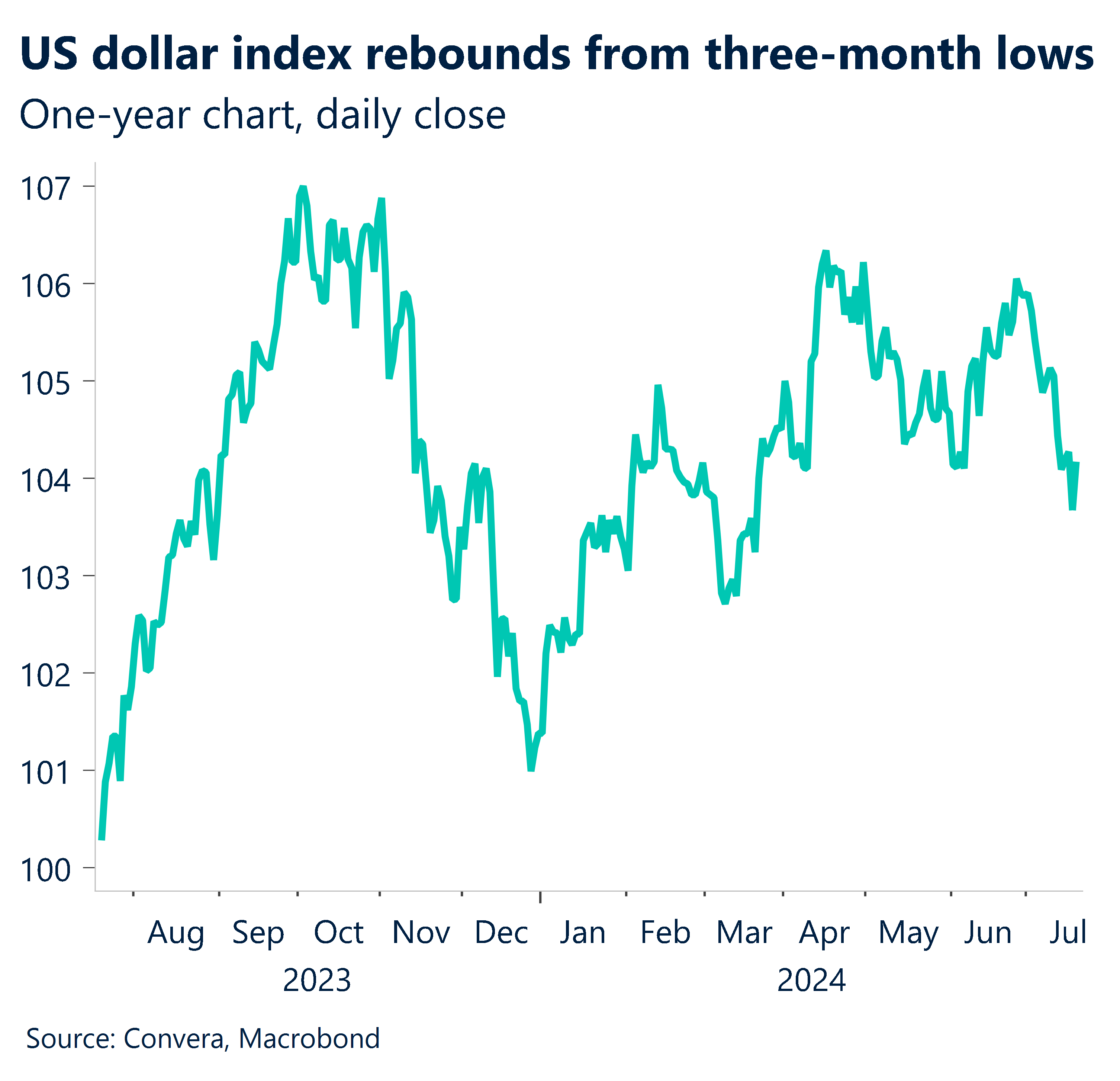

The US dollar rebounded from three-month lows as FX markets shifted into safe havens.

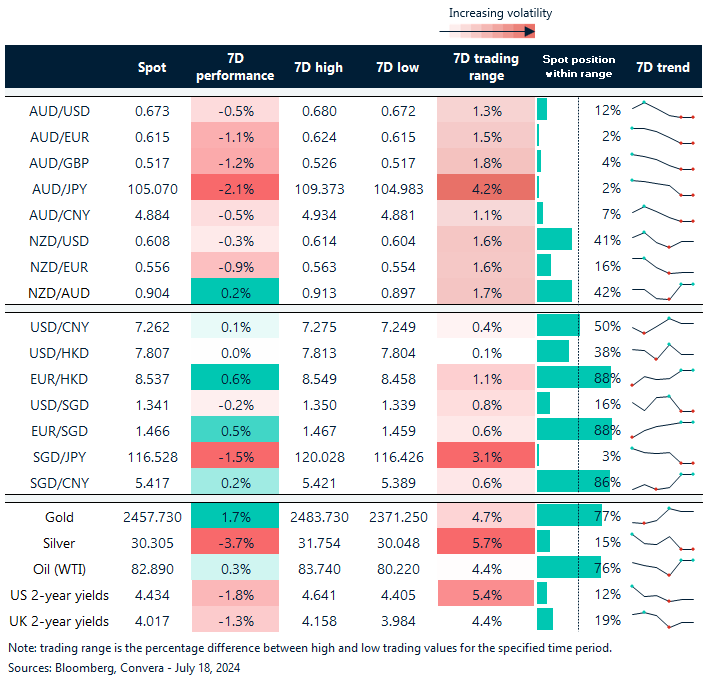

The AUD/USD fell 0.4% while NZD/USD fell 0.6%. The USD/JPY shook off recent losses and gained 0.7%.

European FX turns from highs

European FX markets have also benefited as US shares gained and last night’s broader reversal saw the euro and GBP weaken.

The EUR/USD fell 0.4% even after last night’s European Central Bank decision saw the ECB indicate it has no clarity over when it might next cut rates.

The British pound, recently one of the stronger currencies, reversed sharply, 0.5% as the pair turned from an “overbought” reading on the relative strength index.

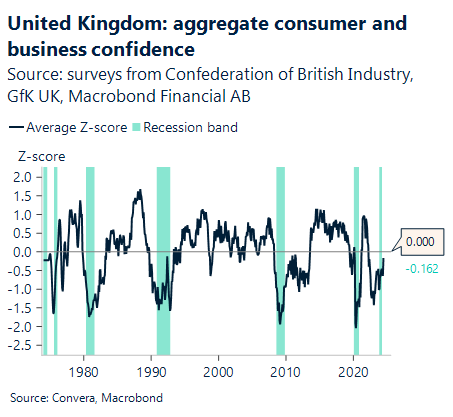

Looking ahead, UK consumer confidence is in focus. June saw an increase in consumer confidence to -14, the highest level since the end of 2021. The progress has been driven by the overall economy’s balances, both historical and prospective, as of the beginning of 2023.

Only 5–6 points separate the headline index currently from pre-pandemic historical norms.

Ringgit gains ground as Malaysian GDP growth accelerates

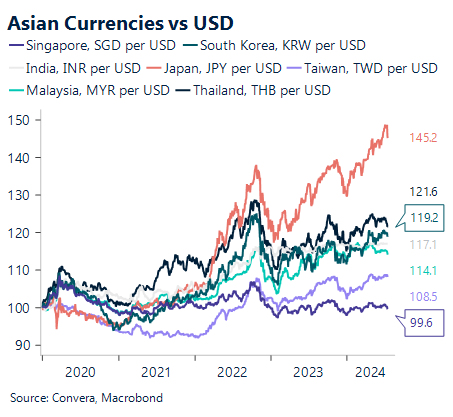

Even after last night’s US dollar gains, the Malaysian ringgit remains broadly near six-month highs.

We anticipate that the advance real GDP estimate will demonstrate a pick-up in growth to 4.6% y-o-y in Q2 from 4.2% in Q1, driven by a robust industrial production rebound, bolstered by supply chain diversification and the global tech upcycle.

USD index rebounds as shares turn lower

Table: seven-day rolling currency trends and trading ranges

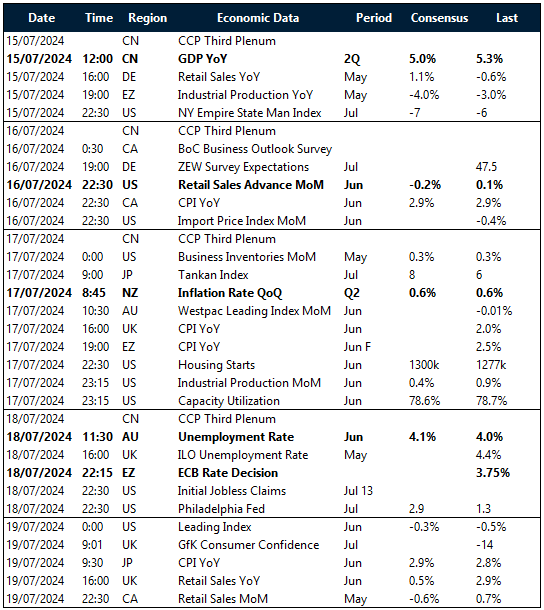

Key global risk events

Calendar: 15 – 19 July

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]