Written by Convera’s Market Insights team

Power sweep overshadows inflation

George Vessey – Lead FX Strategist

Shortly after US inflation data prompted a Treasury rally and US dollar weakness, comments from Dallas Federal Reserve (Fed) President Lorie Logan triggered a reversal, mainly in the US dollar. Although Logan doesn’t vote on monetary policy, she called for the Fed to cut at a cautious pace amidst risks to inflation from strong demand and geopolitics. Meanwhile, Republicans sweep the White House and both houses of Congress, giving President-elect Donald Trump unified control of the elected branches of government.

Headline US inflation was in line with economists’ expectations of a 2.6% rise and above September’s 2.4% pace. Core CPI held steady at 3.3% on an annual basis. Shelter prices prices in particular have been sticky, but new rent indices show a clear path to slowdown. Over the last three months it rose at a 3.6% annualized rate, marking the fastest pace since April. The data will be closely watched by the US central bank, which has already lowered its benchmark rate by 0.75 percentage points over two successive meetings to a new target range of 4.5-4.75%. Swaps traders boosted to about 75% the probability that the Fed will cuts rates again in December, up from around 56% earlier Wednesday. This underpinned demand for short-term bonds, sending yields lower. However, with the Republican Party clinching a majority in the House of Representatives, making executing Trump’s agenda of tariffs and tax cuts easier, the US dollar has rallied to an over one-year high against a basket of currencies. Thus, the dollar and short-term Treasury yields moved in opposite directions, as the Fed remains on a defined cutting path, whilst Trump embarks on fiscal expansion.

Having risen more 6% in six weeks, all eyes are on whether the dollar index can stretch beyond 107 and open the door to additional gains, with 110 a major psychological level to the upside. To the downside, big support levels reside around the 200-daying moving average nearer the 104 mark. Given the scale of the dollar’s rally since October, momentum might start to wane soon, increasing the chance of a correction under some profit taking.

Euro breaks below $1.06

Boris Kovacevic – Global Macro Strategist

The bearish narrative surrounding the euro doesn’t seem to go away as the currency broke decisively below the important $1.06 mark against the US dollar. Investors have made up their mind about which currencies are likely to suffer under the Republican trifecta lead by president-elect Donald Trump. The euro and yuan are topping that list with EUR/USD and CNY/USD now displaying the highest correlation (90-day rolling average) on record.

The common currency has shed around 5% of its value since the end of September, when markets started aggressively pricing in a Trump presidency. This has pushed EUR/USD into negative territory on the year. If this trend continues into the end of December, it would be the fifth out of the last seven years that the euro has fallen against the dollar. With less than two months to go, FX investors will look out for seasonality effects, the composition of Trump’s administration and the result of the vote of confidence in Germany to gauge how likely EUR/USD is to trade at parity.

European macro data will need to improve significantly to stop acting as a drag on the continent’s assets. The Council of Economic Experts, an independent panel of exports of the German Chancellor, has revised down its forecast for growth in Europe’s largest economy. Germany is set to contract for a second consecutive year for the first time since 2003.

Sterling’s rout deepens

George Vessey – Lead FX Strategist

The pound is on track for its worst weekly streak since 2014 against the US dollar. GBP/USD has tumbled six weeks in a row and is bracing for a seventh straight weekly loss, amounting to a fall of over 5%. Since taking out its key long-term moving averages near $1.28, the downtrend has accelerated below the $1.27 handle, with the 100-week moving average, located at $1.26, the next downside target.

Along with other currency peers, the pound is at the mercy of the dollar’s onslaught in the wake of the US election and Trump’s clean red sweep scenario, which we saw as the biggest downside tail risk to GBP/USD. Meanwhile, on the domestic front, UK inflation has slipped below the Bank of England (BoE) 2% target, though officials still remain wary over underlying pressures from the services sector and jobs market. Catherine Mann, the most hawkish BoE rate setter, hit the wires yesterday saying the central bank can afford to wait on rate cuts until there is concrete evidence of underlying inflationary pressures easing. Traders are pricing just a 16% chance of a BoE cut in December and are fully pricing in just two quarter-point rate cuts by the end of 2025, a pace that would see the BoE lag behind other major central banks.

This relative hawkish pricing has been a tailwind for the pound in 2024, and a key driver of GBP/EUR reaching over 2-year highs near €1.21 this week. However, we think risks remain skewed towards a dovish repricing and consequent negative impact on sterling should services inflation continue trending lower. Mann stated that she’s prepared to “move big” on interest rate cuts when the time is right, which would likely catch markets, and sterling bulls, off guard.

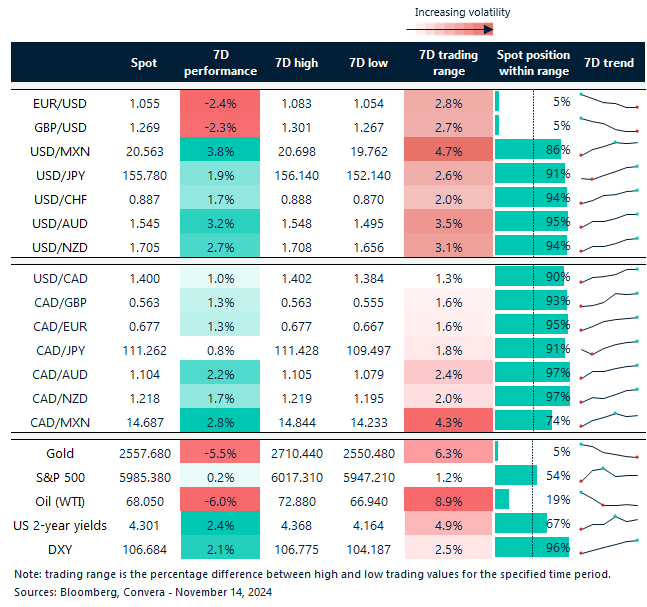

GBP and EUR down over 2% in a week

Table: 7-day currency trends and trading ranges

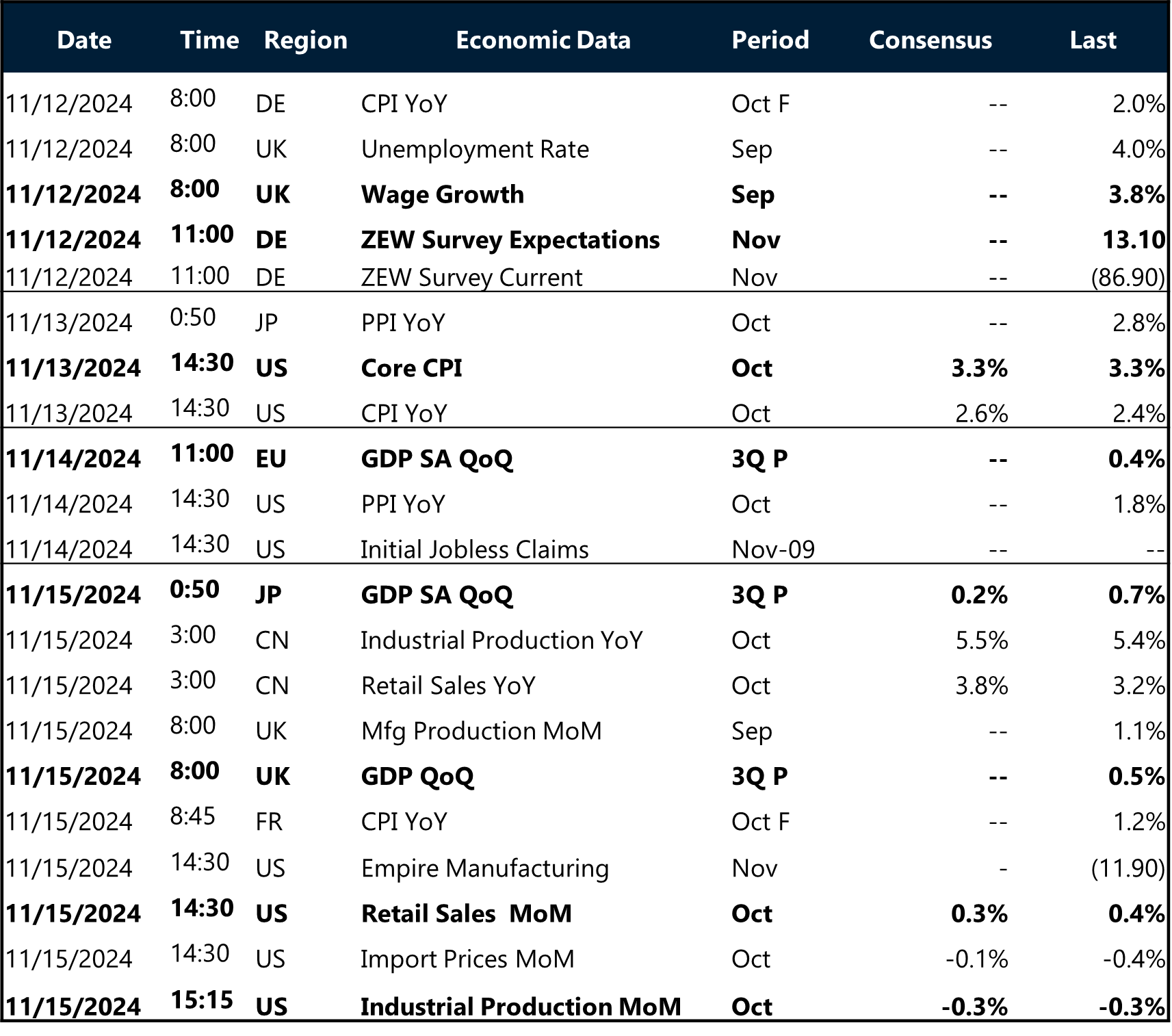

Key global risk events

Calendar: November 11-15

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.