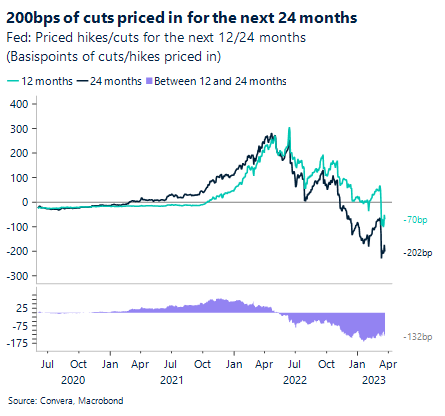

The Federal Reserve (Fed) raised its benchmark interest rate by 25 basis points to a range of 4.75% to 5%. The ninth consecutive increase has pushed the fed funds rate to the highest level since 2007. According to current market pricing, the most aggressive tightening cycle in over 40 years might have just come to an end with yesterday’s hike.

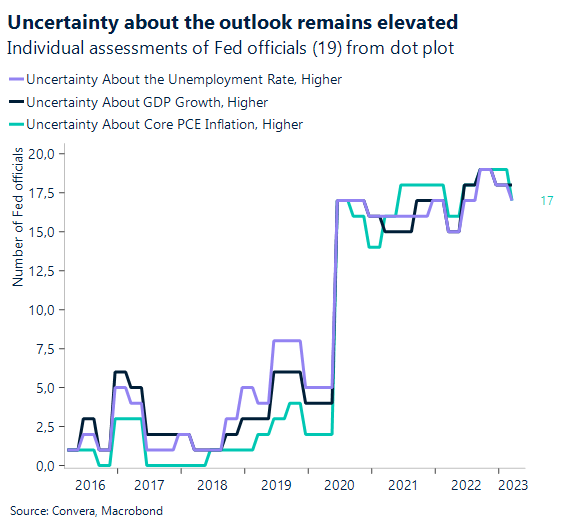

Investors have perceived the rate decision as a dovish hike, primarily because of three reasons. Firstly, The FOMC’s median estimate of the fed funds rate at the end of 2023 remained unchanged at 5.1%, signaling just one additional rate increase worth 25 basis points to follow. Additionally, the language within the statement following the rate decision was slightly amended, replacing the phrase: “…ongoing increases will be appropriate” with “…some additional policy firming may be appropriate”. Thirdly, Fed Chair Jerome Powell acknowledged that the FOMC did consider pausing rate increases in March due to the ongoing uncertainties surrounding the banking sector. In totality, markets perceived these factors as enough to decrease the expectations of another hike in May to less than 50%, effectively betting on the end of the tightening cycle.

Risk sensitive assets like equities rallied on the initial rate increase and continued to gain momentum during Powell’s speech. However, during this press conference, Treasury Secretary Janet Yellen’s comments about not considering or currently working on a unilateral expansion of deposit insurance led to a complete reversal of risk, with the S&P 500 falling by 2.6% from peak to trough. EUR/USD ($1.0910) held on to most of the gains and closed the day higher by 0.8% and is on track to record its sixth daily increase in a row.

Money markets are fully pricing a 25-basis point interest rate rise by the Bank of England (BoE) today, which would take rates in the UK to 4.25% – the highest since 2008. An unwelcome resurgence of UK inflation dashed hopes of a BoE pause, but the pound reacted positively, mostly against the US dollar, though this also reflects the dovish Fed hike yesterday. Against the euro, however, sterling has erased last week’s gains as capital flight from dollars to euros has sent EUR/USD to a 7-week high.

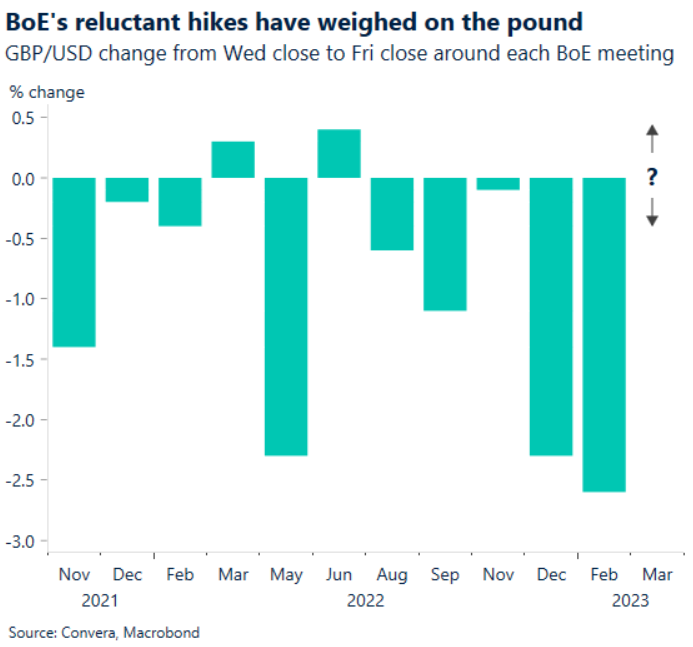

After the Fed dropped some hawkish language and shifted towards pausing its rate-hike cycle soon, attention now turns to the BoE’s decision at midday. Will the BoE follow the Fed with a dovish hike amidst the recent banking sector turmoil? Or will the hotter-than-expected inflation report force more hawkish guidance? Core CPI unexpectedly rose to 6.2% in February from 5.8% the month prior and more importantly, service-sector inflation, especially in hospitality, is proving particularly sticky. Before the CPI release, money markets had been roughly 50/50 between a pause and a quarter point rate increase and although the dial has shifted towards a hike today, it doesn’t guarantee more rate hikes in the future. Thus, the BoE may follow the Fed’s lead with a dovish hike, which could weigh on the pound’s value – a reaction that’s been typical during this tightening cycle. The average performance of GBP/USD from each Wednesday to Friday that has sandwiched a BoE meeting since December 2021 has been nearly -1%.

Ultimately, BoE policymakers must decide whether to continue hiking rates to tame inflation or add stress to nervous markets enduring the negative effects of tightening monetary policy. For GBP/USD, multiple technical indicators point to further upside with little in the way of resistance until the 2023 high of $1.2447. For GBP/EUR though, the path of least resistance appears to the downside, but this largely depends on the upward momentum of EUR/USD.

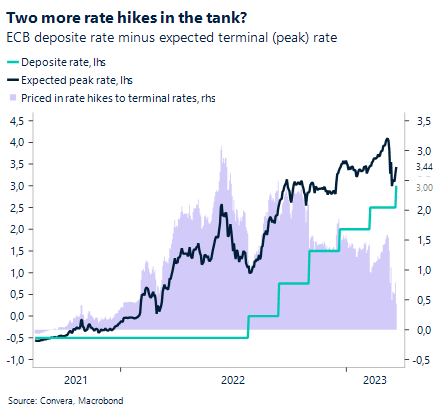

Raising interest rates further in light of elevated core inflation rates seems to be the consensus within the European Central Bank’s (ECB) Governing Council. However, while confidence is growing that the Eurozone has withstood the energy crisis and banking turmoil, a continued tightening of monetary policy going forward will be much harder to justify.

European policy makers decided to raise the benchmark interest rate by 50 basis points last week, in an attempt to quell inflationary pressures while committing to help the financial system in case of an emergency. The ECB justified the hike by separating the fight against inflation and stabilisation of financial markets into two distinguishable goals that must be achieved by using different instruments (rate policy vs. regulatory and liquidity measures). Markets leaned into this idea and are currently pricing in two more rate hikes of 25 basis points in May and June from the ECB, which is helping to lift the common currency across the board.

Policymakers continue to be data dependent, meaning that incoming economic data will make or break the assumption that the ECB will be done after two more hikes. Given the lack of relevant data releases in Europe, markets have been primarily driven by developments in the US. This changes with today’s rate decisions in England and Switzerland and the release of Eurozone consumer confidence.

Pound pops higher after UK CPI

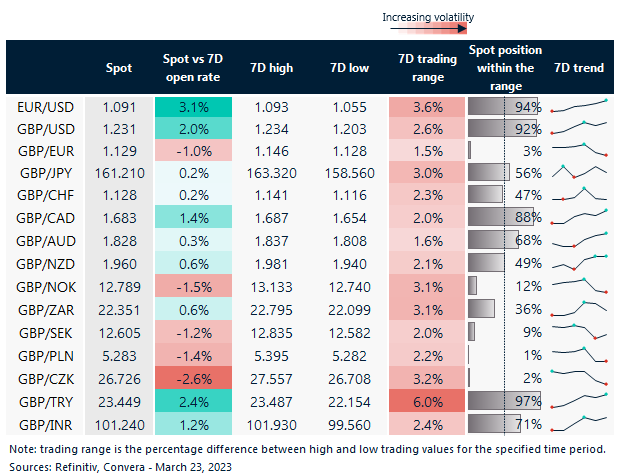

Table: 7-day currency trends and trading ranges

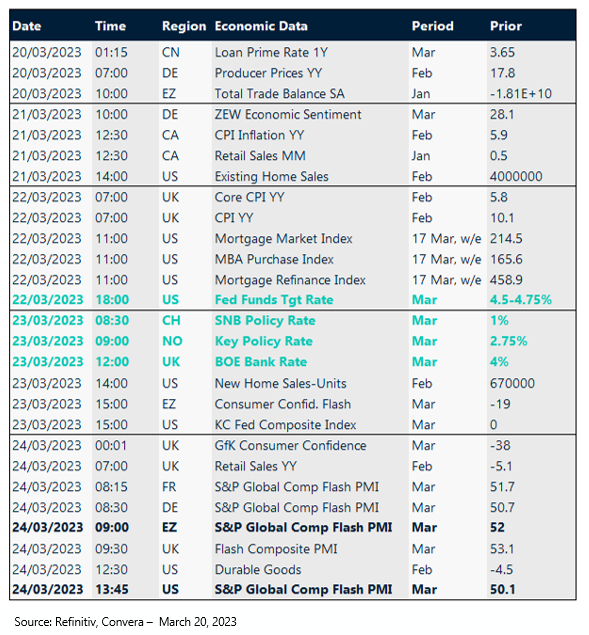

Key global risk events

Calendar: Mar 20 -Mar 24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.