Sterling struggles after BoE hike

Hot on the heels of an unexpected uplift in UK inflation, the Bank of England (BoE) raised interest rates by 25 basis points yesterday. Sterling was supported by the BoE joining the government in stating the UK is likely to avoid a recession this year, but the policy decision came with a dovish 7-2 vote split. The pound’s momentum stalled above the $1.23 mark versus the US dollar and GBP/EUR steadied around €1.13 despite this morning’s big UK retail sales beat.

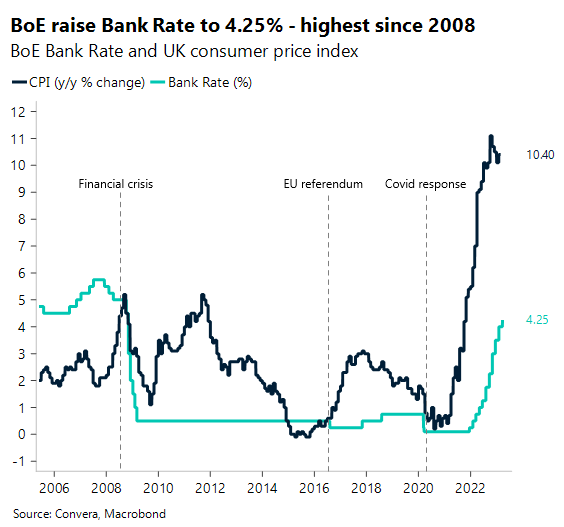

This was the 11th successive time that the BoE has increased interest rates and the Bank Rate now stands at 4.25% – the highest since 2008. Notably, policymaker Catherine Mann dropped her vote for a 50-basis point hike in February to 25-basis point hike at this meeting. The minutes from the meeting suggest that the BoE voted to increase interest rates despite forecasting inflation will decline considerably this year – a silver lining for UK households as real disposable incomes should remain flat in the near term, rather than falling significantly. Moreover, policymakers seemed relaxed about the recent banking crisis, saying the UK system is resilient, leaving the BoE free to focus on its main objective of bringing inflation back down to target. The pound’s initial uplift was undermined by rising speculation of a BoE pause though, and money markets are now evenly split between chances of a 25-basis point hike in May or a hold. That led two-year yields in the UK falling by the most in about a week, capping the pound’s gains.

In the short term, flash industry PMIs are in focus today. Will economic activity continue to surprise stronger and boost the pound? Looking further out, should the US inflation rate fall at a quicker pace than in the UK, resulting in a narrowing UK-US rate differential, GBP/USD could still soon test year-to-date highs in the mid-$1.24 region, though rising risk aversion today has seen the currency pair slip closer towards $1.22.

Two weeks of banking carnage

Small US banks continue to lose deposits to larger banks and money market funds, two weeks after the turmoil in the banking sector started. Swift action following the collapse of the Silicon Valley and Signature bank by the private sector and government, coupled with central bank support, have avoided a short-term crisis. However, the underlying problems are still a concern for investors.

Banks have been drawing on the Fed for emergency liquidity for a second consecutive week. The usage of the Fed’s discount window and newly established bank term funding program (BTFP) continues to be elevated, averaging around $150bn for the last two weeks, almost triple the usage during the height of the pandemic stress in 2020. The Fed’s role as the lender of last resort has been working against its plans to shrink its balance sheets via the selling of government bonds. During the last two weeks, the balance sheet increased by $40bn, reversing more than two-thirds of the reduction that had taken place since March 2022. At the same time, the inflows into money market funds during the same period have been the highest since April 2020, bringing the total amount to $5.1bn – a record high.

So, how much are investors positioning for a banking crisis? Recent flows do suggest that caution is warranted and that US regional banks will most likely continue to need support to avoid a continuation of deposits leaving big banks into money market funds. Treasury Secretary Janet Yellen said that additional deposit actions might be warranted, taking back her previous statements made two days ago. The US dollar is primed for its second biggest weekly loss of the year against a basket of currencies as flight to safety amid banking sector turmoil has mostly been overshadowed by rising hopes of an end to the global tightening cycle.

Euro’s winning streak comes to an end

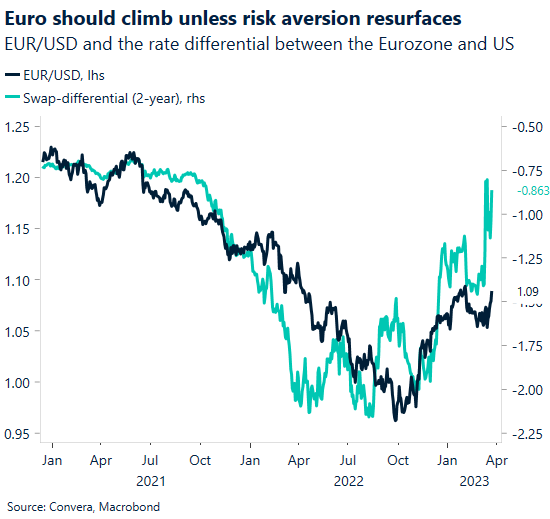

The euro’s circa 3.8% rally against the US dollar over the last five days came to an end yesterday. EUR/USD bumped into resistance just above the $1.09 handle, a 7-week high, and pulled back under $1.08 as US Treasury yields rebound – widening US-German rate differential and increasing the dollar’s yield advantage over the euro.

In general, market conditions have improved somewhat relative to last week, but the situation in the banking sector remains fragile and the extent and scale of the financial vulnerability remains unclear. Interestingly, Deutsche Bank’s George Saravelos argues the negative impact from financial stresses on broader credit conditions will be much greater in the US than in Europe and this is why the European Central Bank (ECB) is sounding a lot more hawkish than the Fed at the moment. Ironically, costs of insuring against Deutsche Bank default (CDS prices) have soared higher this week. Is a repeat of the Credit Suisse crisis lurking in the shadows and will this deter the ECB from hiking in May and June as money markets currently expect? Aside from further stress in the banking sector, policymakers continue to be data dependent, meaning that incoming economic data will make or break the assumption that the ECB will be done after two more hikes.

Uncertainty about financial stability and monetary policy is driving FX volatility, and the latter often increases during the start and end of tightening cycles. However, rate uncertainty related to rate cuts is often less turbulent for markets than rate uncertainty related to rate hikes, and the former should benefit risk assets like stocks and pro-cyclical currencies like the euro over the US dollar. As witnessed, EUR/USD may struggle to climb beyond $1.10, but further out, narrowing US-German yield spreads could help EUR/USD move towards $1.15 by year-end.

Pound pops higher after UK CPI

Table: 7-day currency trends and trading ranges

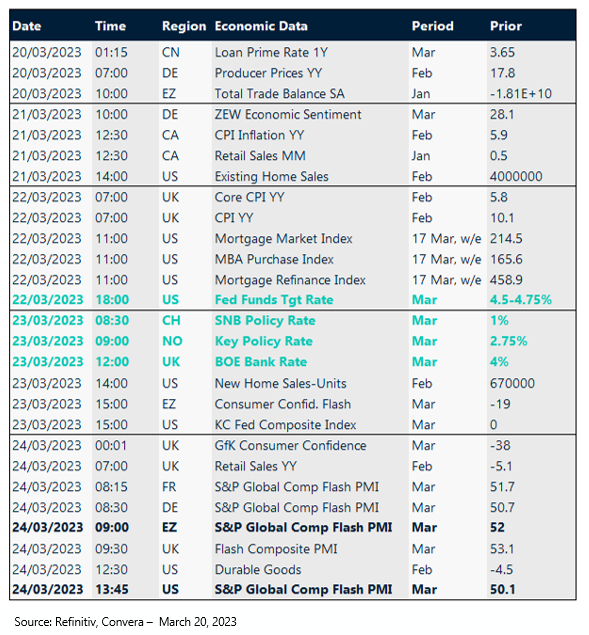

Key global risk events

Calendar: Mar 20 -Mar 24

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.