It’s a short week for many financial markets, but there will be a steady flow of statistics and events such as final industry PMI numbers from major advanced economies, rate decisions in Australia and New Zealand and the highly anticipated US jobs report on Friday. Markets remain relatively calm as the dust from the banking crisis continues to settle, though a surprise oil output cut has spurred renewed risk aversion this morning.

Risk aversion hurts pound as oil prices jump

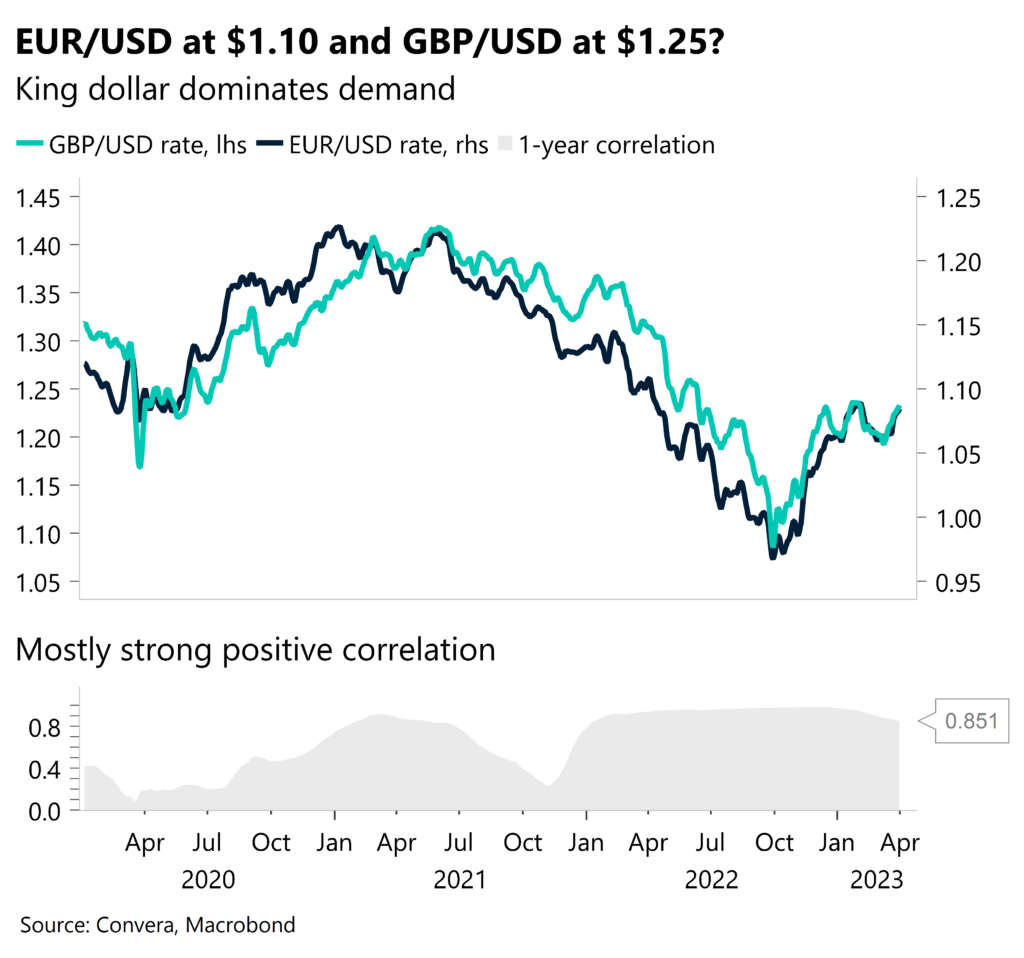

The British pound clinched its biggest monthly rise since November last year versus the US dollar as narrowing US-UK rate differentials and better-than-expected UK economic data fuelled demand for the UK currency. With banking sector fears easing, attention has shifted once again to economic data in gauging monetary policy decisions going forward.

The turbulence in financial markets last month has cast fresh doubts about how much more central banks need to hike rates and has introduced new negative risk scenarios for the economy. Deeper recession concerns are growing amidst fears of tighter lending conditions by banks, although due to sticky inflation (particularly in the UK), we think central banks still have more work to do to tame rising price pressures. Surging oil prices doesn’t help the situation. A 4% rise in oil prices already today, following an unexpected output cut by OPEC+ of more than 1mln barrels per day, has sparked more inflation woes. Safe haven demand has given the dollar a boost, with both GBP/USD and EUR/USD recoiling from near 9-week peaks. Still, the pound was crowned the best-performing currency of the first quarter of 2023, rising an average of 3% against its G10 peers.

This week, several Bank of England (BoE) policymakers are speaking, with chief economist Huw Pill giving a speech on inflation and monetary policy on Tuesday and Silvana Tenreyro discussing monetary, fiscal and financial policy on Wednesday. Absent more risk aversion, we think that falling US interest rate expectations could allow EUR/USD to test $1.10 this month, which should give GBP/USD a better chance of testing $1.25.

Sticky inflation keeps pressure on ECB

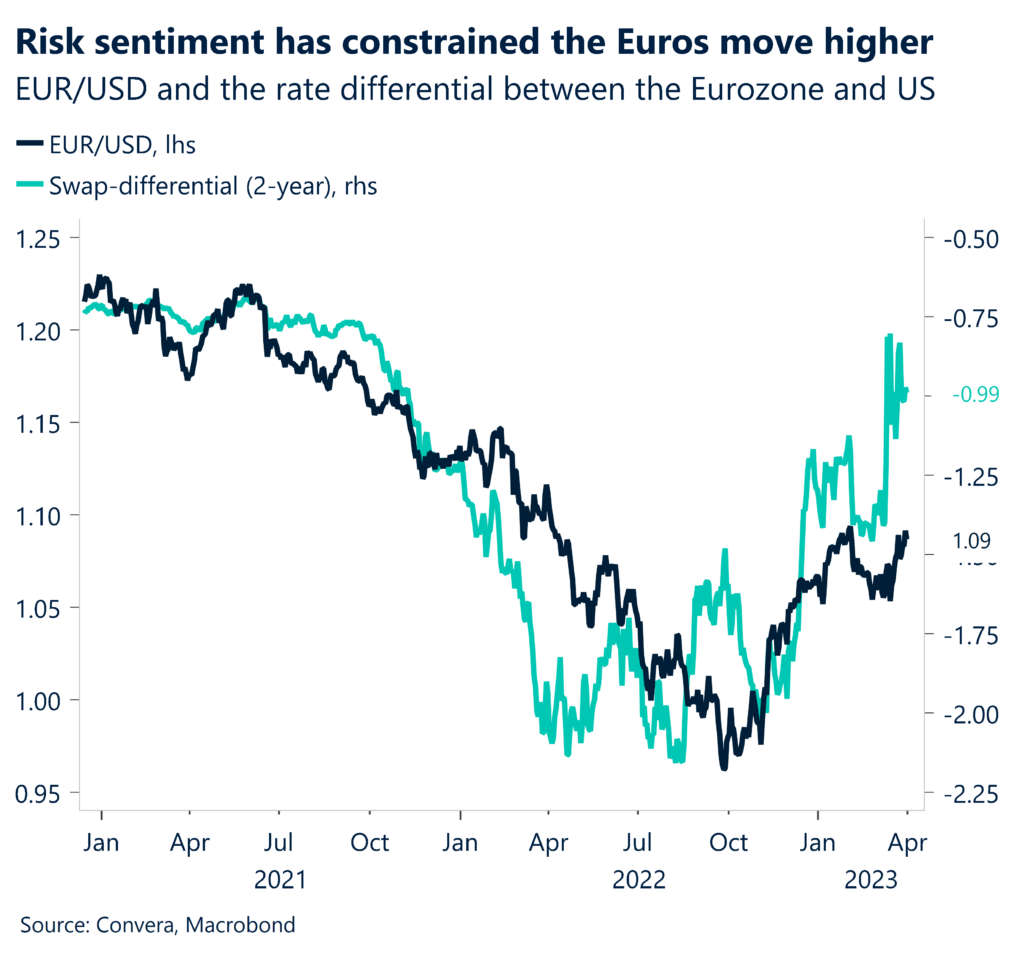

The euro fell short of its 100-week moving average ($1.0958) against the US dollar last week and is sliding closer to the $1.08 mark this morning amidst renewed risk aversion from soaring oil prices. However, despite headline inflation falling in the Eurozone, evidence of sticky inflation in certain areas will keep the European Central Bank’s (ECB) rate hiking cycle in focus, which should support the euro over the medium term.

European consumer inflation increased by 6.9% in March, less than expected, recording the weakest yearly growth rate since February 2022. Given the normalisation of energy prices and base effects kicking in, policymaker’s focus has shifted to the development of core and services vs. headline and goods inflation. There, price pressures remain clearly visible, with inflation excluding food and energy (core) rising to an all-time high and services inflation topping 5% for the first time on record. Under the assumption of no banking crisis materialising in Europe, further hikes seem like the base case scenario for the ECB in the short-term. Until there are convincing signs that inflation is firmly on the way towards the target of 2%, the ECB is expected to press for at least two more hikes of 25-basis points this year. In the short term, the focus this week will be on Eurozone data including final PMIs, German industrial orders and production and producer prices.

For EUR/USD, four factors will be important going forward – developments in the banking sector, interest rate differentials, risk indicators and economic data. The euro’s correlation with the banking sector and economic data has somewhat broken down, leaving overall risk sentiment and interest rate differentials as the two most important factors for the currency. Against the pound, there are few clear short-term drivers, but a more hawkish ECB relative to the BoE could keep the downside pressure alive on GBP/EUR, which has struggled to close above its 100-day moving average just under €1.14.

Bank’s stress borrowing eases significantly

Financial markets are prone to (1) overreact to major shocks and to then (2) correct any excess movement once the dust has settled. This two-step framework can be applied to the current banking turmoil in the US as well. The collapse of three major commercial banks over recent weeks has increased market volatility and led investors to rotate capital from risk assets (stocks) into safe havens (bonds).

However, the support programs from the Federal Reserve (Fed), the Swiss government wagered acquisition of Credit Suisse by UBS, and the 15% rally in the stock price of Deutsche Bank have convinced markets into believing that the crisis has been more idiosyncratic than systemic. Now, investors are correcting their initial reaction by buying stocks and selling bonds. The Nasdaq has risen three consecutive weeks (12%) to the highest level since late August, while 2-year bond yields have topped 4% once again. The absence of negative news on the banking front has helped calm the waters. Deposits continue to leave banks but at a much smaller pace than two weeks prior and weekly borrowing by US institutions has fallen from $534 billion to just $26 billion last week. This data flow supports the thesis that while we are not out of the woods yet, the Fed’s emergency lending facilities have done a good job at containing the crisis so far.

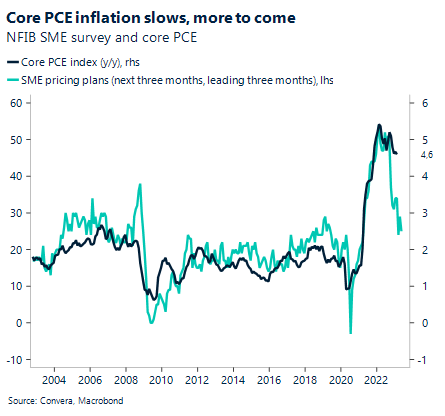

Friday’s release of PCE inflation did not disturb the peace on markets. Headline US inflation continued to trend lower, rising by just 5% y/y, with core inflation remaining relatively stable at 4.6%. The data print did not change the market consensus for the Fed’s May meeting (no hike expected), which explains why the US dollar index fell for the third week in a row. Attention shifts to ISM manufacturing and non-manufacturing data this week, wrapping up with the critical non-farm payrolls print on Friday.

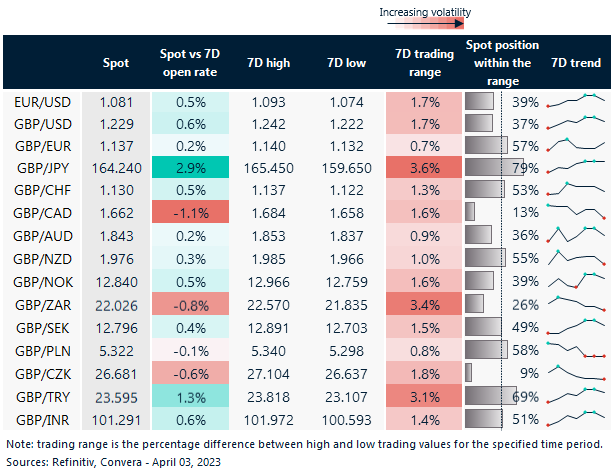

GBP/JPY swings 3.6% in a week

Table: 7-day currency trends and trading ranges

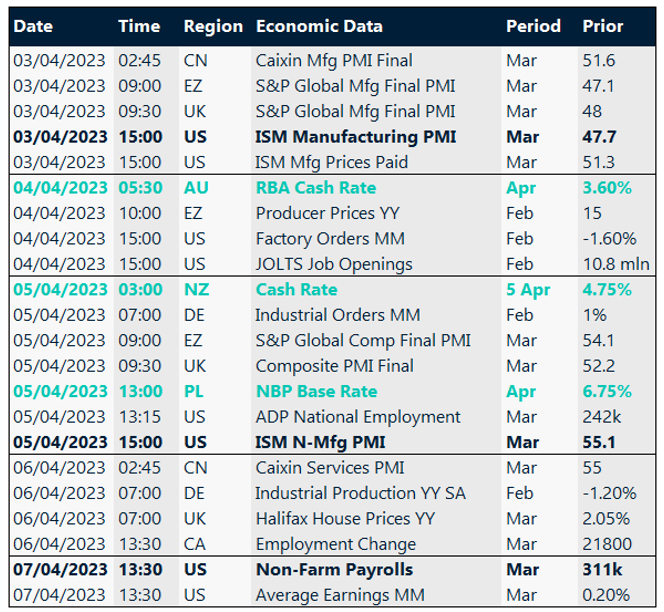

Key global risk events

Calendar: Apr 03 -07

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.