Written by Convera’s Market Insights team

US yields marching higher

George Vessey – Lead FX Strategist

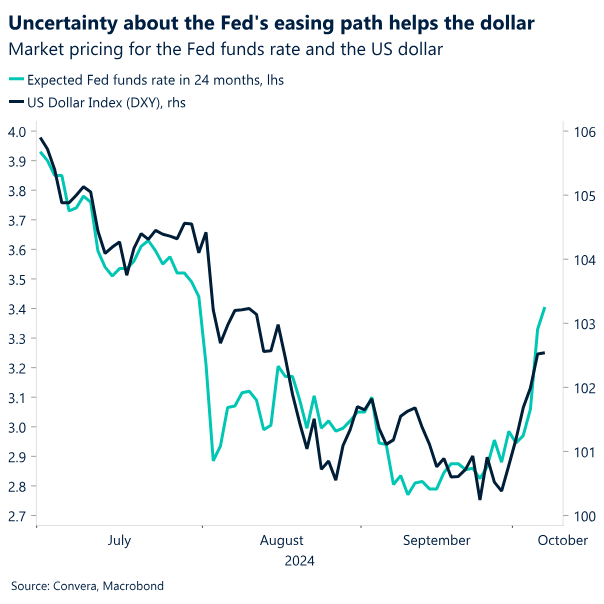

After its best week in over two years, the US dollar index snapped a five-day winning streak on Monday. The dollar’s greatest losses were seen against its safe haven peers like the Swiss franc and Japanese yen. However, risk-sensitive currencies like GBP, AUD and NZD still underperformed against USD, falling in line with equities as traders trim their bets on Federal Reserve (Fed) rate cuts.

The yield on the benchmark 10-year US Treasury is back at 4%, a level not seen since August, after the stronger-than-expected jobs report on Friday prompted traders to reassess the outlook for US monetary policy. A “no landing” scenario – a situation where the US economy keeps growing, inflation starts to resurface, and the Fed therefore has little room to cut interest rates – is once again in the spotlight. Markets have now priced out any chance of another 50-basis point rate cut from the Fed in November, while assigning an 85% probability of a more modest 25 basis point reduction. Although this explains most of the dollar’s recent strength, the dovish shift from other major central banks has also made their respective currencies less appealing. An extended dollar bounce is increasingly feasible if incoming US data supports further hawkish Fed repricing.

Importantly for the dollar, where yield differentials have been a key factor driving the USD outperformance, if US Treasury yields continue to rise sharply on a relative basis to G10 peers, this is another positive factor for the US currency. Moreover, a lack of fiscal stimulus announcements from China, causing a stir in equity markets could provide the dollar a safe haven tailwind too. The Hang Seng index, for example, is tumbling toward its worst day since 2008, down more than 7%. But China’s CSI300 index is heading for a gain of 5%.

Pound looks for support after hitting 4-week low

George Vessey – Lead FX Strategist

The British pound remains on the defensive this week, falling to its lowest level in almost a month against the US dollar on Monday. GBP/USD broke below $1.31, whilst GBP/EUR slumped closer to €1.19 despite the fact UK yields are on the rise. The somewhat risk-off mood during the Asian session due to the lack of Chinese stimulus announcements hasn’t helped the risk-sensitive pound.

Data published yesterday showed UK salaries increased at the slowest pace in three-and-a half years in September in a fresh sign that the labour market is loosening. The increased number of candidates and reduced demand for staff limited pay growth for permanent hires to the weakest since February 2021. This supports growing expectations of more aggressive rate cuts by the Bank of England (BoE). However, in line with US yields rising after the strong US jobs report, UK gilt yields have spiked to multi-month highs across the curve, offering the pound some support. Meanwhile, data this morning showed retail sales in the UK rose 1.7% on a like-for-like basis in September from a year ago, the fastest pace of growth in six months amid higher spending on clothes in an early indication of a busy festive season.

With the pound still the best-performing currency year-to-date and, up over 3% against the dollar, and with speculative traders still net-bullish GBP, this may give traders reason to take profit into year-end, especially as the upcoming UK Budget and the US presidential election bring an element of near-term uncertainty.

Euro trading sub $1.10

Boris Kovacevic – Global Macro Strategist

The euro continues to trade below the $1.10 mark this morning as European equities are expected to open the trading session lower. Chinese markets lost some momentum as well and underperformed their peers since Friday. Oil prices are on the rise as brent oil topped the $80 a barrel mark for the first time in six weeks. Geopolitical uncertainty surrounding the tensions between Iran and Israel have weighed somewhat on pro cyclical currencies.

However, the main drag on the euro remains the downside revision of Fed cuts this year and the continued weakness of the German economy. German factory orders declined by 5.8% in August, the largest fall since January 2024. Inflation in most large economies of the Eurozone has fallen below 2% as well. This has raised the prospects of the European Central Bank (ECB) cutting interest rates by 25 basis points next week.

Recent speeches from policy makers have tried to prepare the markets for this shift, which should have pushed down yields on the short end. However, the repricing of US Treasury yield higher in reaction to better economic data has stopped the fall in Bund yields. The convergence between the ECB and Fed has naturally put pressure on EUR/USD as the currency pair fell from $1.12 to sub $1.10 last week.

Risk off as high beta FX slump

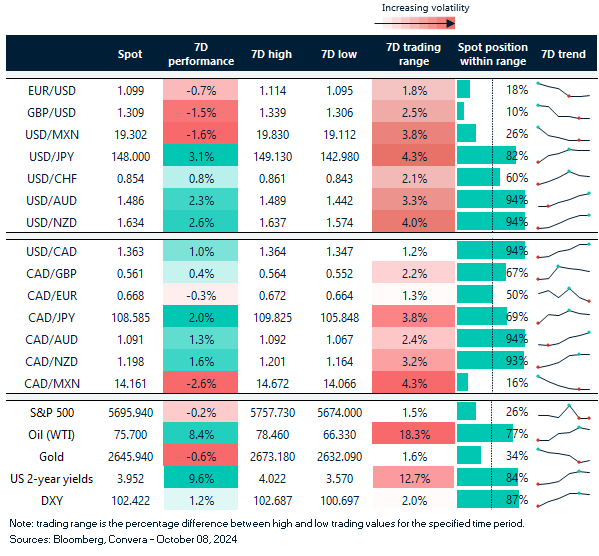

Table: 7-day currency trends and trading ranges

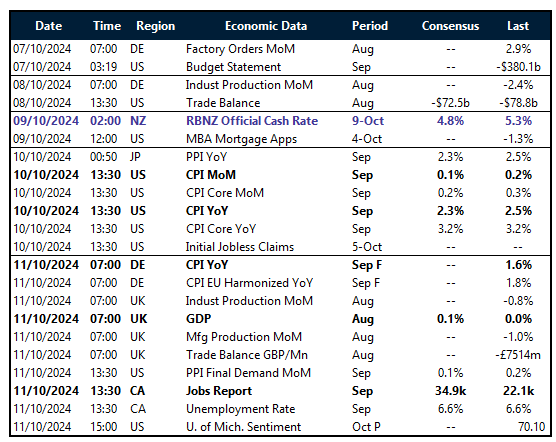

Key global risk events

Calendar: October 07-11

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.