Written by Convera’s Market Insights team

Dollar rebounds but set for weekly loss

George Vessey – Lead FX Strategist

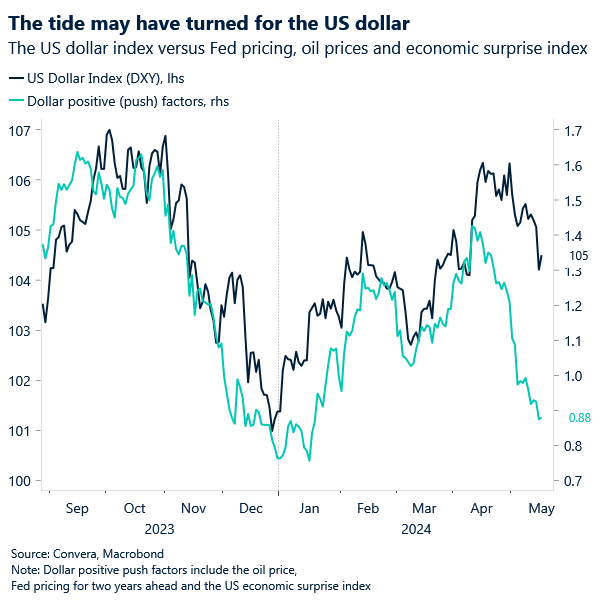

The US dollar index rebounded from 5-week lows yesterday helped by data that showed US import prices increased 0.9% last month, erasing some of the optimism this week around the US disinflation narrative and Federal Reserve’s (Fed) rate cuts. Still, following the slightly softer CPI print the day earlier and signs of a cooling US economy and jobs market, the US dollar is on track for a weekly loss and is suffering its worst month of 2024.

The slowing of consumer prices prompted markets to price in the likelihood that the Fed would cut rates twice this year, with the first coming as early as September. However, concerns are resurfacing given import and export prices rose more than anticipated in addition to producer prices surprising higher as we saw earlier in the week, The reality is growing that inflation is moderating above the Fed’s 2% target, which could therefore delay plans for policymakers to cut interest rates and thus keep the dollar stronger for longer.

The aggressive sell-off in the US dollar of late does highlight our ongoing theory of its asymmetric reaction function to incoming data – falling more on data misses than rising on data beats. However, we do think the market overreacted this week and that’s reflected in the way that the dollar bounced back yesterday, albeit modestly.

Pound set for 2nd biggest weekly rise of 2024

George Vessey – Lead FX Strategist

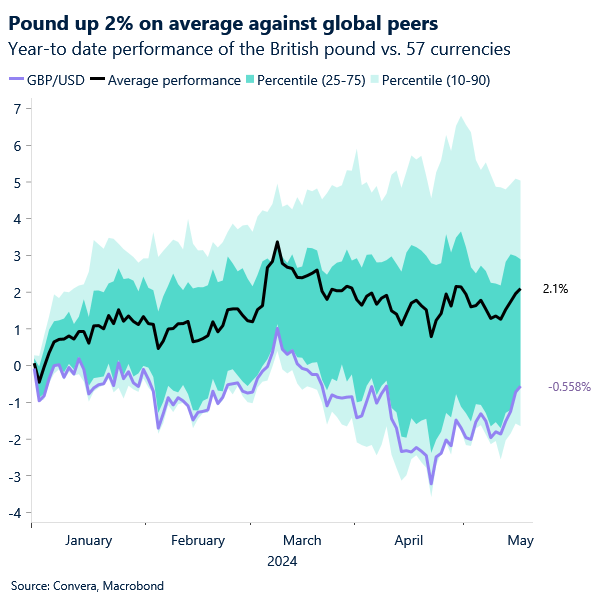

Sterling is primed for its second biggest weekly rise against the US dollar so far this year. The UK currency is also on track to a snap a 2-week losing streak against the euro. As the pound is deemed a more pro-cyclical currency – supported by improving global growth prospects – the increase in global easing bets of late, which is constructive for economic growth, has been the main driver of sterling’s strength.

Although its correlation with equities has weakened somewhat in 2024, sterling still holds one of the strongest positive correlations with risk assets. This has also been reflected by sterling’s performance this week alongside global stock indices hitting fresh all-time highs. Against high beta commodity-linked currencies though, sterling has struggled somewhat. GBP/AUD and GBP/NOK for example have both declined this week as commodity prices continue to rally, also helped by global growth prospects as well as supply constraints. Still, so far this year, GBP is trading, on average, 2% higher against global peers. Looking ahead, all signs point to 2024 being better than 2023 for the UK economy. Easing inflation pressures are set to open the door to Bank of England (BoE) rate cuts, potentially as soon as next month. Markets are pricing over a 50% probability of such a move.

The risk to this outlook is of course inflation. We expect the disinflation trend in the UK to continue and believe the BoE’s 2% target will be reached in the next couple of months, but given the rebound in global goods price pressures and commodity prices of late, we cannot rule out this feeding into UK consumer prices. UK CPI data will be released next week and is a key risk event for the pound due to its impact on the BoE’s policy path.

Bearish euro signals creep in

Ruta Prieskienyte – FX Strategist

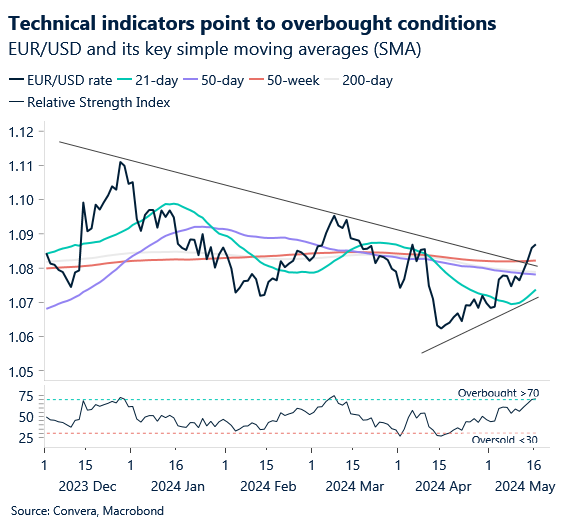

The euro trended lower in Thursday’s session after striking a fresh multi-week high, as post US CPI price action consolidates. EUR/USD erased nearly half of Wednesday’s induced gains, allowing some short-term bearish tech signals to creep in. Despite that, the pair remains on track to post its fifth consecutive weekly gain, the best week-on-week performance in over a year, and its largest weekly gain (+0.9%) since March 8th.

In the absence of data releases, the markets steered their attention to central bank speeches. The markets are almost certain (with a 97% conviction) that the ECB will cut rates in June, opting for a 25bps reduction, with the latest data as well as central bank communication supporting that positioning. However, the trajectory thereafter remains anything but opaque. Wage growth is one of the key metrics weighed by the central bank when deciding how much to ease monetary policy following an initial reduction in rates. ECB’s Vice President Luis de Guindos sees wage growth moderating to around 4%, down from above 5% observed some months ago, but remains wary of upside surprises. Overall, an overarching Governing Council consensus leans towards a gradual and data dependant cutting cycle. As of late, swaps are pricing in over 70bps of easing by year end – close to three 25bps cuts.

Looking at today’s calendar, final eurozone inflation figures for April are due shortly. With only Italy’s print released yesterday coming in lower than expected, we are not expecting downward surprises to the bloc’s aggregate print and thus the report is likely to be largely benign. With the agendas on both sides of the Atlantic largely absent of data prints, only central bank speeches could sway the currency trends. In the absence of further market moving occurrences, EUR/USD is expected to trend lower as the pair is currently trading above its key short and long-term moving averages, signalling an overstretched position.

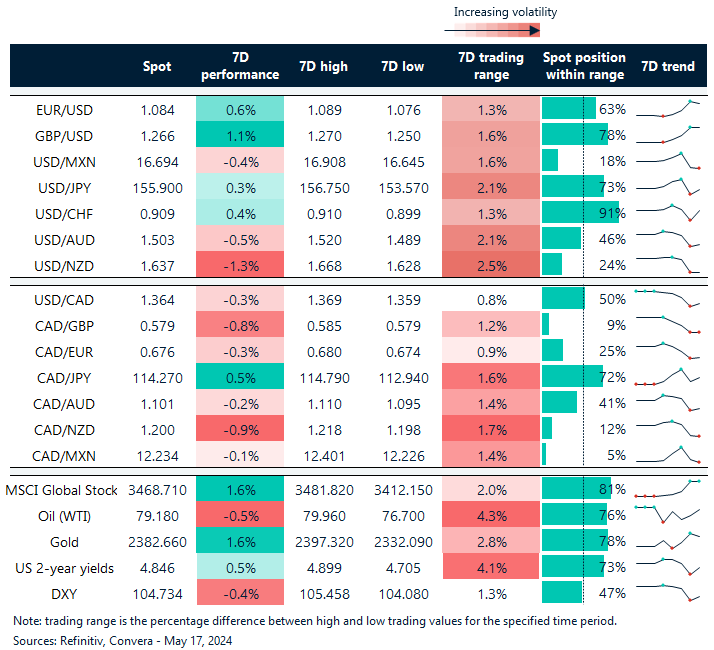

USD loses out to high beta currencies

Table: 7-day currency trends and trading ranges

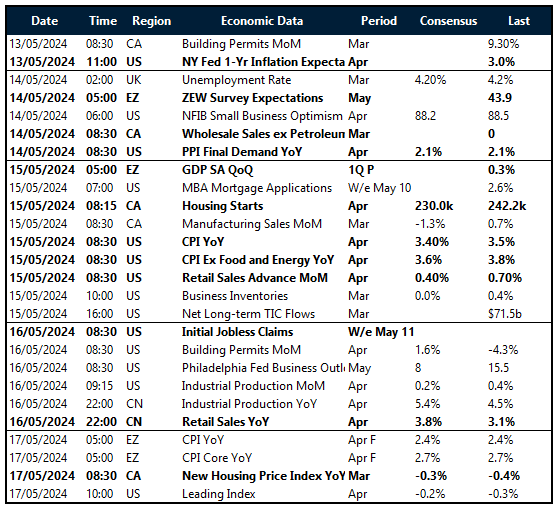

Key global risk events

Calendar: May 13-17

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.