Written by Convera’s Market Insights team

Dollar snaps losing streak

George Vessey – Lead FX Strategist

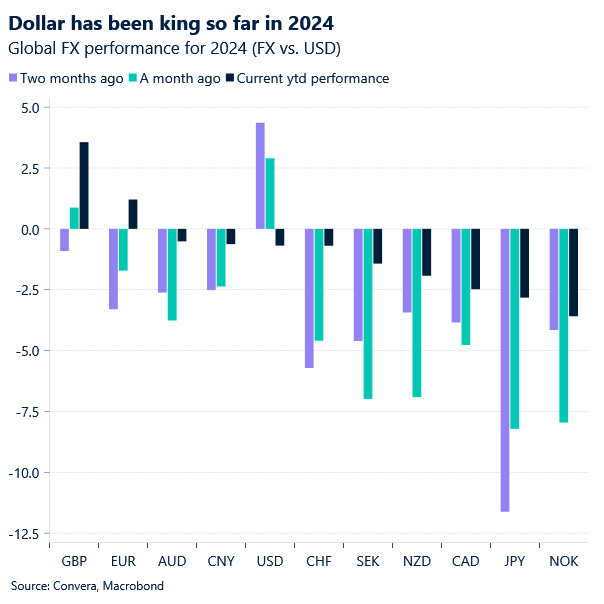

The US dollar index has bounced off 1-year lows and tech megacaps have declined just days ahead of Nvidia Corp.’s results as traders reassessed the extent the Federal Reserve (Fed) is likely to cut interest rates next month. After Jackson Hole last week, the potential for a 50-basis point cut had risen, dragging yields and the dollar lower, but a more sober market is now seeing greater odds of 25-basis point cut instead.

Optimism over looming US interest rate cuts have been tempered by nervousness over what economic data will show in the coming weeks. Durable goods orders numbers, released yesterday, came in at a strong 9.9% for July which was more than double the 4% increase from the 6.7% plunge seen a month earlier. The US personal consumption expenditure price index – the Fed’s preferred gauge of inflation – is due on Friday and will be closely scrutinised. In the meantime, though, market participants will keep an on the sky-high expectations from earnings of AI darling Nvidia, whilst the market mood has also soured due to rising geopolitical tensions amidst wavering hopes of a ceasefire in Gaza. As a result, and aggravated by a production halt in Libya, oil prices have surged more than 7% in the previous three sessions on supply concerns, further denting risk appetite.

The dollar has reduced its post-pandemic gain to around 3%, while being down 12% from its peak reached in September 2022. However, recent geopolitical tensions rising, oil price volatility, and frothy valuations in tech stocks have investors on edge and safe haven flows are propping up the US currency this week.

Pound holding firm on UK rate outlook

George Vessey – Lead FX Strategist

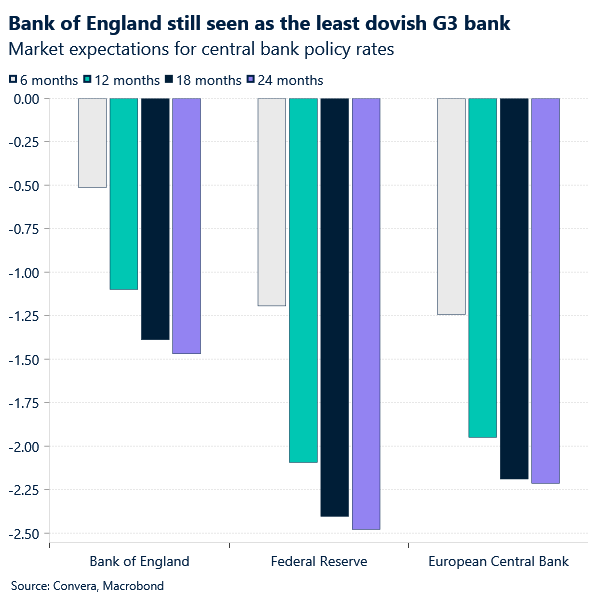

Sterling performed strongly against its major peers at the start of the week, helped by the fact the Bank of England (BoE) is reluctant to offer much guidance on the rate-cut path given that the victory over inflation in the UK is supposedly far from over. GBP/USD jumped above $1.32 to its highest level in more than two years whilst GBP/EUR reclaimed €1.18.

BoE Governor Andrew Bailey signalled in his speech at Jackson Hole that the second-round effects of inflationary pressures could be smaller than expected but added that the central bank should not rush for more interest rate cuts. Bailey also ruled out the risks of a potential UK recession and assured that the steady disinflation in the UK is aligned with the aim of achieving a soft landing for the economy. This week, the pound will be partly guided by global risk sentiment. Hence it has softened slightly on renewed geopolitical risks. But sterling will also be driven by the market speculation for BoE interest rate cuts amid an absence of top-tier economic data in the UK. Currently, market participants expect that the BoE will deliver 41 basis points of cuts this year, in other words, only one quarter point cut is priced in.

A slew of upbeat economic data, including stronger-than-expected flash PMIs for August, has weighed on expectations for another rate cut in September, with markets pricing just a 24% chance of one. Rate differentials and an improving UK growth outlook keep sterling’s outlook brighter for the remainder of the year. But it also sets the bar high on the data front, and any dovish recalibration of rate expectations could see the pound weaken sharply.

Euro slips from $1.12 handle

Ruta Prieskienyte – Lead FX Strategist

The euro pared back some of its recent gains on Monday, slipping from the $1.12 mark as traders eased off the gas pedal in broad market Dollar-negative flows following yet another better-than-expected US macroeconomic print. European equity markets are set for a higher open on Tuesday, with Euro Stoxx 50 and Stoxx 600 futures up about 0.2% in premarket trade, as the prospect of interest rate cuts in both the US and Europe lifted market sentiment.

On the macroeconomic front, the GfK Consumer Climate Indicator for Germany dropped to -22.0 heading into September, missing market estimates of -18.0. This was the lowest reading since May, driven by concerns over job security, rising insolvencies, and a weakening economy. The income expectations index deteriorated sharply to 3.5, down from 19.7 in the previous month, reaching its lowest level in nearly two years. Additionally, economic expectations plunged, and the propensity to buy slipped further, while the tendency to save increased. Meanwhile, Germany’s final GDP was confirmed to have contracted by 0.1% quarter-on-quarter. This contraction included a 2.2% decline in capital investment and a 0.2% drop in private consumption, according to the country’s statistics office. Government expenditure, however, rose by 1%. Although Europe’s largest economy started the year on solid footing, it has struggled to maintain that momentum. Recent indicators suggest a deteriorating outlook among businesses, with the latest surveys painting a stark picture of rising risks for Europe’s largest economy, which could be heading towards a crisis after years of stagflation.

Having peaked at a one-year high, the euro’s momentum is now showing signs of fatigue. Risk reversals in the options market remain euro bullish for tenures up to one month, which includes the Fed and ECB rate decisions in September, but the outlook beyond that is less supportive of the euro. Should we see further dovish signals from the Fed, EUR/USD might test the 30-month ceiling around mid-$1.12 (July 2023 high). However, given the still-stretched momentum indicators and the lurking political risks in both Europe and the US as September approaches, such a move is likely to be short-lived.

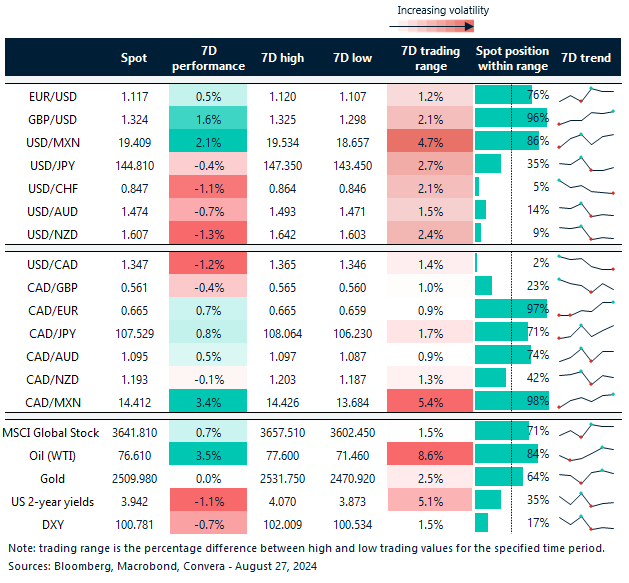

Almost 9% swing in oil prices recently

Table: 7-day currency trends and trading ranges

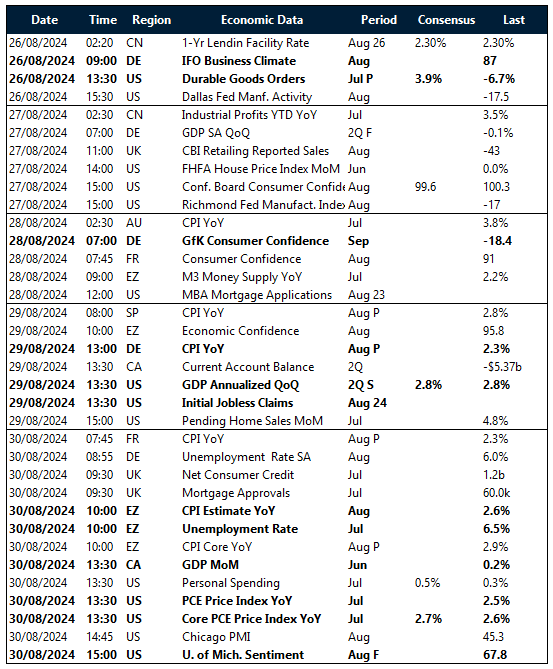

Key global risk events

Calendar: August 26-30

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.