Written by Convera’s Market Insights team

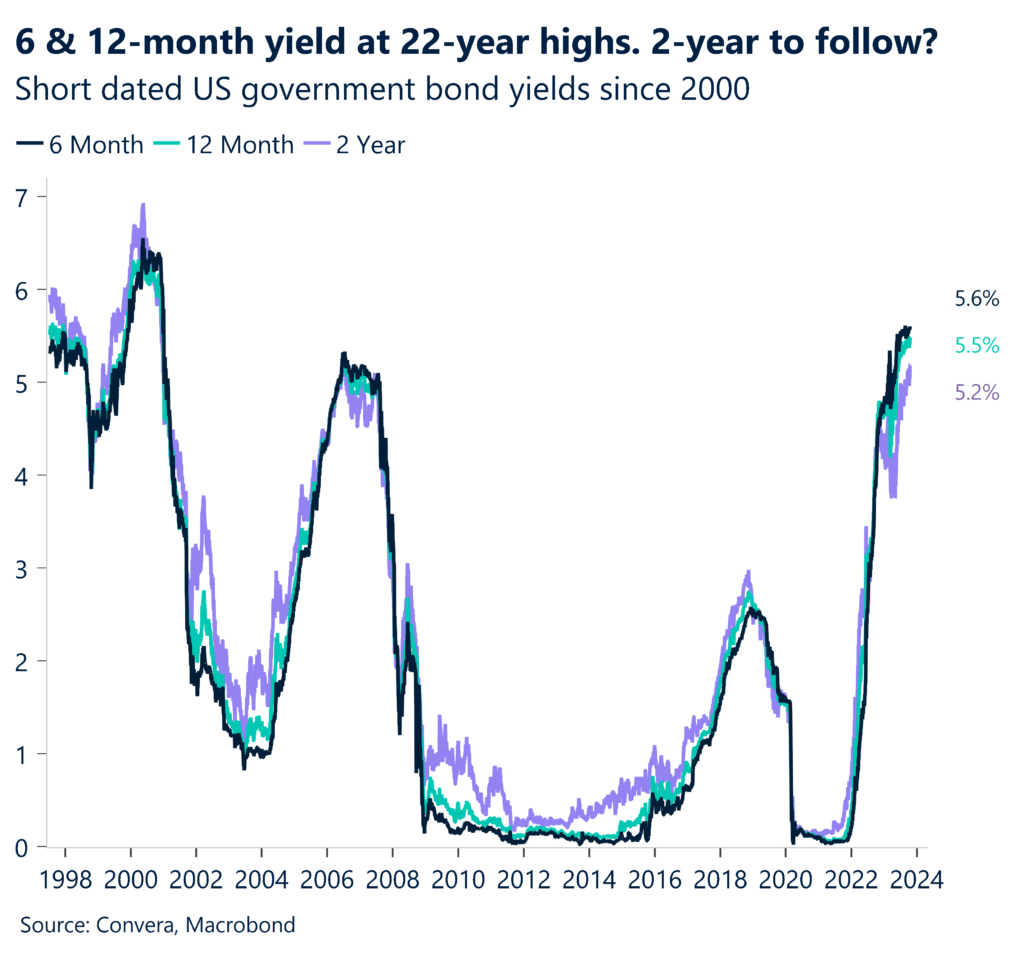

US 2-year yield closing in on 22-year high

Boris Kovacevic – Global Macro Strategist

Financial markets have been preoccupied with the daily news flow coming from the Middle East and the Federal Reserve (Fed) as investors have been trying to answer two pressing questions going into this week. Is the conflict between Hamas and Israel spilling over into the broader region and can US interest rates rise much further from here on? Unfortunately for both the general public and global investors, the answer to both questions has been yes, at least so far this week.

Global equity markets retreated in yesterday’s session following the intensified rhetoric against Israel coming from Iran after the explosion of a hospital in Gaza killed hundreds of people. US president Joe Biden showed support for Israel in a meeting with prime minister Benjamin Netanyahu, saying that early evidence does not point to Israeli forces having launched the rocket into the hospital. However, following the incident earlier this week, Arab leaders cancelled their planned meeting with the Biden and have shut down diplomatic channels. At the same time in the US, the persistence of Fed officials to keep interest rates high for longer has weighed on sentiment across the board. The S&P500 and Stoxx 600 were both down around a percent intra-day and are now 6.3% and 5.2% away from their respective highs reached in July.

The main consensus emerging out of Fed speak this week has been (1) that the increase of bond yields has done some of the tightening for the Fed, (2) that policy makers can remain patient and wait to see how things in the Middle East play out and (3) that rates will be in restrictive territory for quite some time. The treasury market saw the biggest reaction to this week’s stronger than expected economic data and hawkish Fed speak. US 10-year bond yields pushed beyond 4.9% for the first time since 2007 while the 2-year yield remains only a few basis points away from reaching the highest level since 2001 at 5.25%. The US dollar has benefited from both higher yields and the risk-off environment and has mostly made up its earlier weekly losses, trading (DXY) at 106.50, only 0.7% away from its yearly high.

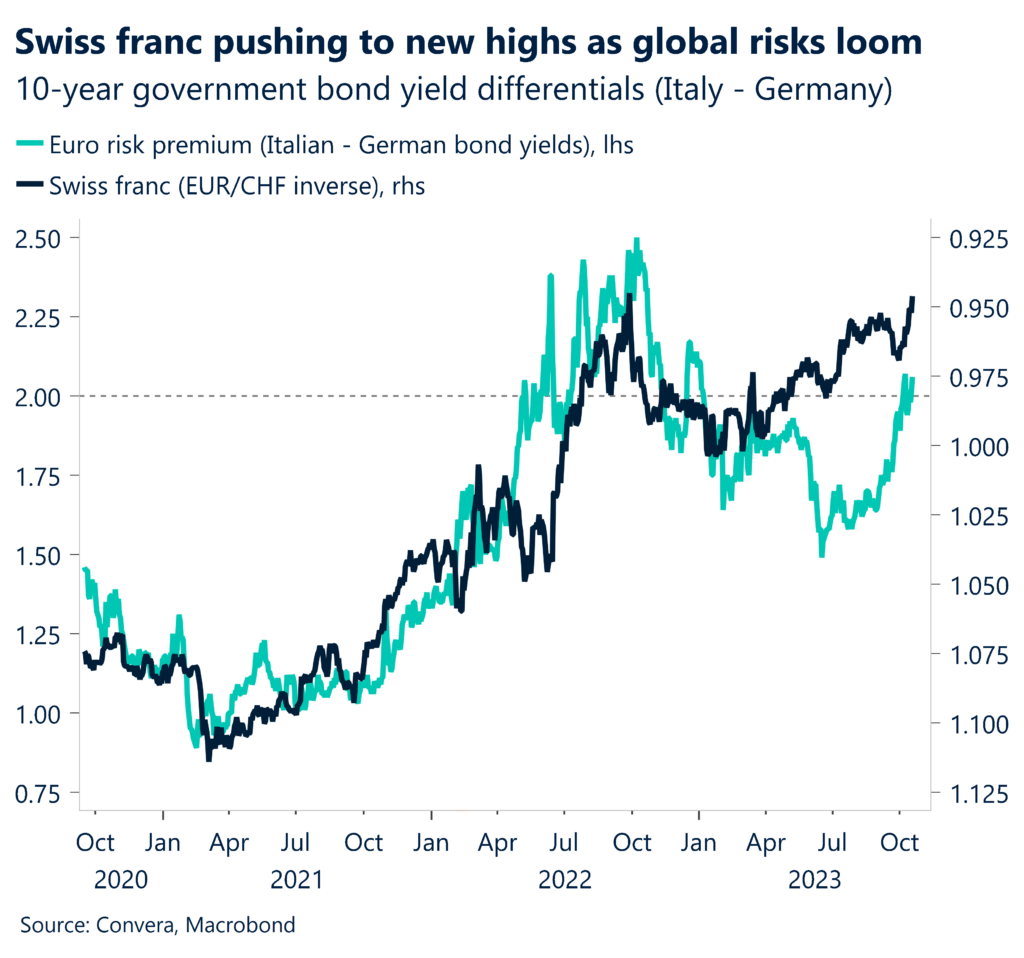

EUR/CHF eyeing lowest weekly close on record

Boris Kovacevic – Global Macro Strategist

Concern about the implication of Iran getting involved in the war between Israel and Hamas on the gas and oil supply to Europe have been front and centre this week and have mostly led to a flight to safety away from the euro. The US dollar has benefited from its trifecta status as a high yielder, safe haven and high growth currency and has pushed the common currency to the lower $1.05 realm once again this week. However, the main proxy trade for the rise in geopolitical tensions and gas prices has been EUR/CHF.

With the dollar and yen garnering most of the attention, the Swiss franc getting close to a new all-time high against the euro has mostly gone unnoticed. If the franc manages to remain at current levels (0.9470) until the end of Friday, it would be the lowest weekly close on record for EUR/CHF. This would come at a time when oil and gas prices have risen by 28% and 106% respectively since the lows in July. As we noted last week, the franc has historically been highly reactive to political turmoil in Italy. With the euro risk premium, defined as the yield difference between Italy and Germany, remaining at the elevated 200 basis point level, euro demand has been weak.

Without any major releases on the calendar to surprise markets positively this week, the euro has been a collateral damage to the global developments. We continue to see EUR/USD at current levels as justified by the real interest rate and leading economic indicators. However, the currency pair will remain tied to the dual news flow (the Middle East and the Fed) and is therefore prone to swings in both directions in the short term.

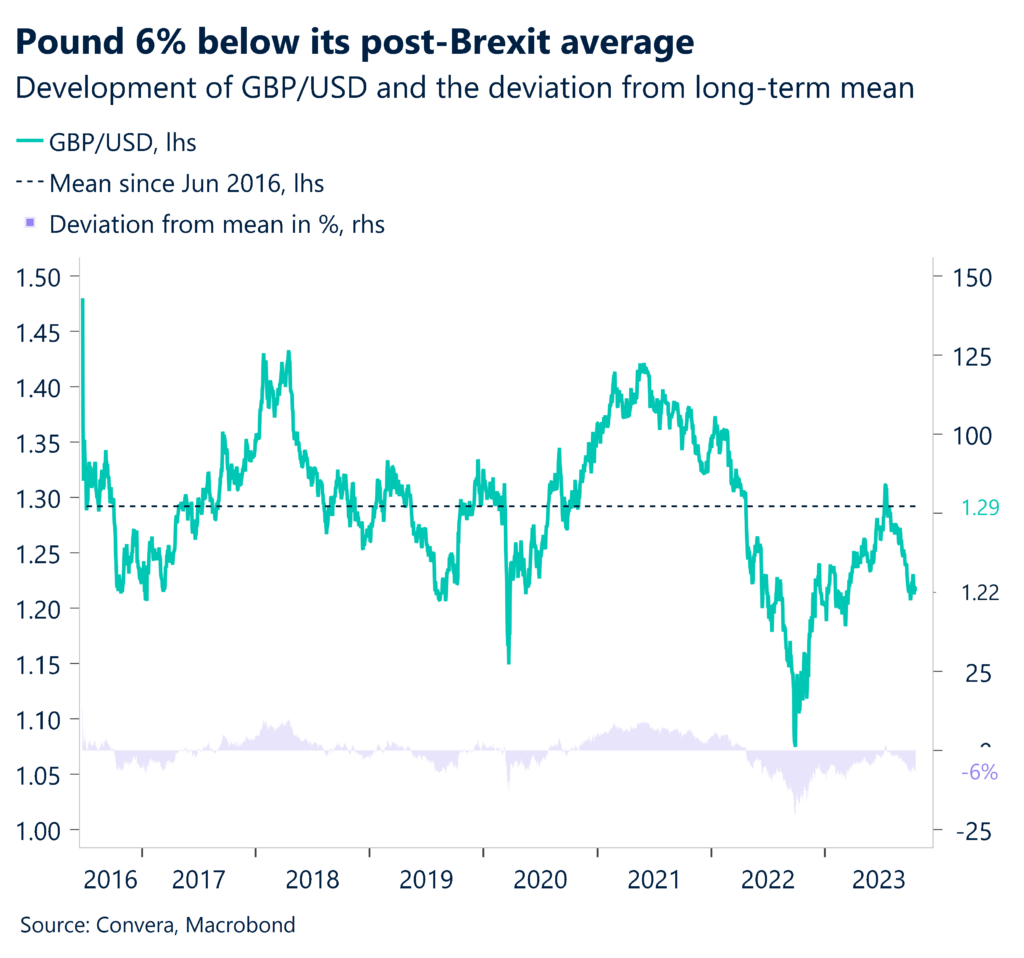

Pound buckles under global risk aversion

George Vessey – Lead FX Strategist

With growing geopolitical headwinds and surging bond yields spurring risk off flows, the risk-sensitive British pound has also come under selling pressure this week. GBP/USD has slipped back towards $1.21 after briefly reclaiming $1.22 following the UK inflation surprise yesterday. GBP/EUR is clinging onto €1.15 – just above its year-to-date and 5-year average – and is set to record its first weekly drop in four.

This week, the pound’s price action has also been influenced by domestic data showing UK wage growth is easing from record highs and inflation, despite beating expectations, should continue falling through year-end. Although the Bank of England’s (BoE) chiefly watched services inflation inched higher, it was put down to volatile package holidays, whilst other more stable categories edged lower. Thus, markets are still pricing a 50-50 chance of another BoE rate hike, which may be influenced by next week’s release of the delayed unemployment and inactivity rates. Meanwhile, the Resolution Foundation, a leading think tank, has advised the BoE to raise its inflation target to 3% once it completes its task of reaching its current 2% target. This should allow the BoE to provide more interest-rate stimulus during a crisis, reducing the need for government borrowing and for bond-buying. If the BoE was to implement this change without coordination from other advanced economies, there would be a negative impact on sterling’s long-term fair value.

In the short-term, with UK stagflation risks rising and ongoing global risk aversion, the pound is finding it difficult to build on any attempted recoveries. The $1.2350 mark is a key resistance barrier for GBP/USD, but although near-term risks appear skewed to the downside, we still expect a rebound going into 2024, helped by the fact that GBP/USD is currently positioned 6% below its post-Brexit average and 27% below its 21st century average.

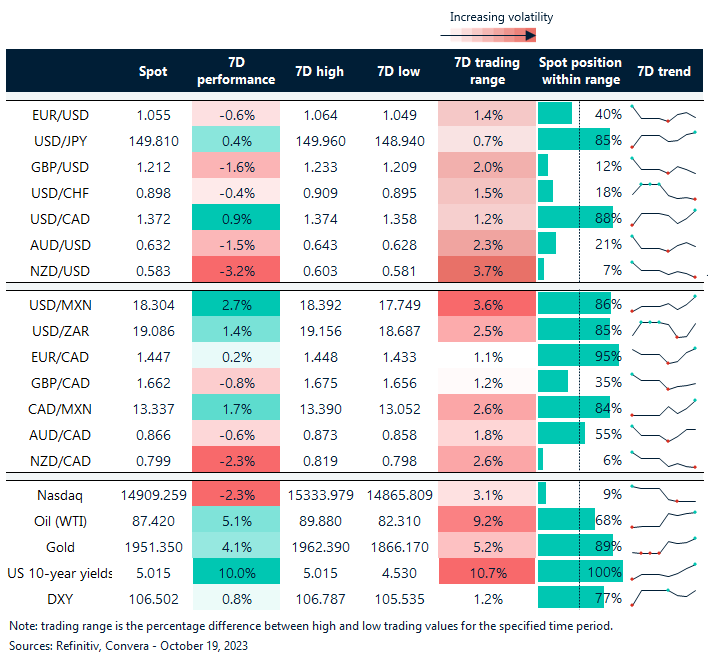

Safe havens USD, JPY, CHF & Gold in high demand

Table: 7-day currency trends and trading ranges

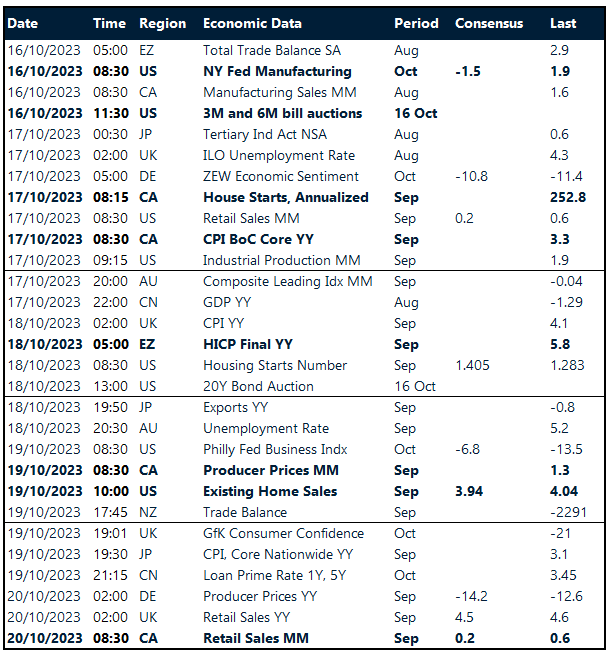

Key global risk events

Calendar: October 16-20

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Check out our latest Converge Podcast episode: Are You Ready for 2024? Convera’s annual macroeconomic outlook