Written by Convera’s Market Insights team

The end of complacency?

George Vessey – Lead FX Strategist

The US dollar index is bumping into resistance at its 200-day moving average at 104.36, weighed down mostly by the ongoing strength of the Japanese yen. Investors continue to unwind carry trades as volatility creeps higher amid the rise in geopolitical and trade uncertainty and ahead of the illiquid summer period. The yield curve is also steepening, driven by lower front-end yields as investors brace for rate cuts by the Federal Reserve (Fed).

Political developments in the US remain in the spotlight after President Joe Biden’s decision to drop out of the election. It appears Vice President Kamala Harris has enough pledged delegates to secure the Democratic presidential nomination, although delegate support will not be official until August. As of now, former President Donald Trump is still the favourite to win, but Biden’s withdrawal adds considerable uncertainty and arguably makes it a closer competition. Indeed, the equity volatility index, the VIX, jumped 32.6% last week, the biggest weekly increase since March 2023. But at 16.5, the VIX level is still below the long-term average of 19.8. For all the market volatility generated by the election, the main driver of yields and FX remains investors’ speculation over how much the US economy is slowing and to what degree that compels the Fed to begin its easing cycle.

Key economic releases later this week, include second-quarter GDP data on Thursday and the Fed’s preferred underlying inflation measure, the personal consumption expenditures price index, on Friday. Those figures will come ahead of the Fed’s next policy meeting a week tomorrow.

Pound appears vulnerable to a correction

George Vessey – Lead FX Strategist

In parallel with GBP/USD stretching to a fresh 1-year high above $1.30 last week, bullish bets in the British currency climbed to a record high last week. Already we’ve seen a minor correction lower in sterling, but amid the overcrowded GBP speculative positioning leading into the Bank of England’s (BoE) rate decision next week, sterling appears vulnerable at these levels.

Non-commercial traders, i.e. hedge funds, asset managers and other speculative market players, increased their net long position on the pound to an all-time high last week, according to Commodity Futures Trading Commission data. The positioning reflects the optimism around the UK’s better-than-expected economic performance so far this year, relative political stability with a majority Labour government and the currency’s appeal to carry traders as the BoE has delayed cutting interest rates. It’s the latter – carry trades – based on the pound’s high yields relative to other currencies, that could be set to uncoil as a period of ambiguous monetary policy beckons in conjunction with the eagerly-watched US presidential election. FX volatility has been in the doldrums for some time, promoting the carry trade strategy, but if the risk of bigger price swings starts unnerving investors, high yielding currencies with greater sensitivity to risk sentiment – like GBP – will likely feel the pain. Indeed, with the Fed and BoE meetings due next week, the 2-week implied volatility gauge has jumped to its highest in a month.

Meanwhile, money markets assign a 40% probability of a BoE quarter-point interest rate cut in August, which is another reason for bullish GBP traders to be wary. Because if the BoE does catch markets off guard with a cut, sterling could weaken sharply. The 200-week moving average at $1.2850 is our first key support level in focus.

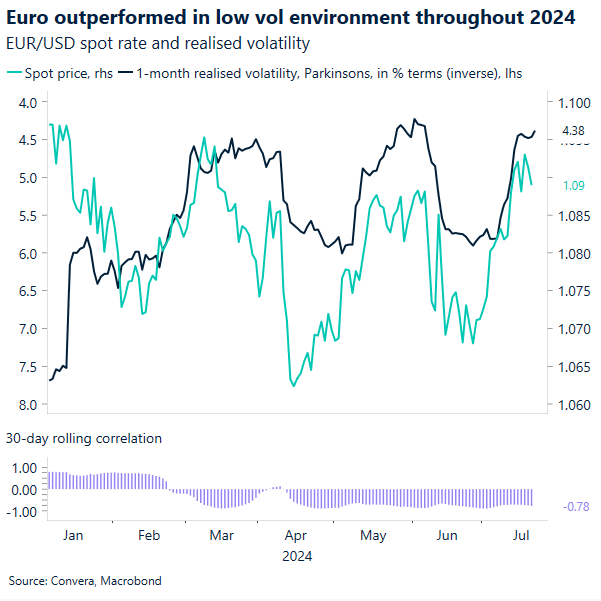

Low FX cadence favours euro

Ruta Prieskienyte – Lead FX Strategist

The common currency’s gains against its commodity-backed G10 peers were precisely balanced against outflows versus the yen, leaving the broad euro index flat at the start of the week. European bonds edged lower, slightly underperforming US Treasuries, while equities continued to climb after US President Joe Biden ended his re-election campaign and endorsed Vice President Kamala Harris.

Breaking down the FX performance, EUR/AUD climbed to a fresh monthly high, extending the month-to-date gain to 1.7%, amid lower Aussie demand due to China’s unexpected short-term rate cut. In fact, the pair is on track for its first monthly appreciation since February and the largest such gain since August 2023. EUR/USD benefited in a low-volatility environment, a feature prevalent for the pair throughout most of 2024, edging marginally higher to the top of $1.08. Money markets are pricing in around 60 basis points of rate cuts by the Fed through year-end, compared with 45 basis points by the ECB. As long as the markets remain calm, we foresee the euro benefiting from the relative rate differential advantage. If volatility picks up, however, the euro is one of those currencies at risk of depreciating.

On the calendar today, the flash Eurozone consumer confidence is expected to improve for a seventh consecutive month. However, there is a risk of a downside surprise as the Eurozone soft economic data may be impacted by the fallout of the French parliamentary elections. Also on the docket today is the ECB’s Lane speech due shortly this morning. Given an eight-week gap between the July and the next ECB policy rate decision meeting, we are not expecting guidance from the Bank’s Chief Economist beyond the official communication from last week as the Governing Council waits further evidence of easing inflationary pressures.

Japanese yen up well over 1% vs. peers

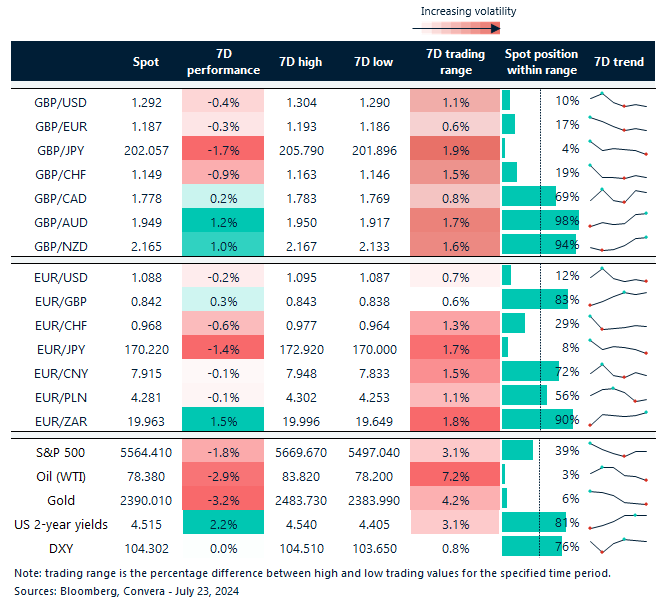

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 22-26

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.